Strategi DCA RSI+CCI+Bollinger Bands multi-kerangka waktu

Tanggal Pembuatan:

2023-11-21 16:17:34

Akhirnya memodifikasi:

2023-11-21 16:17:34

menyalin:

2

Jumlah klik:

895

1

fokus pada

1664

Pengikut

Ringkasan

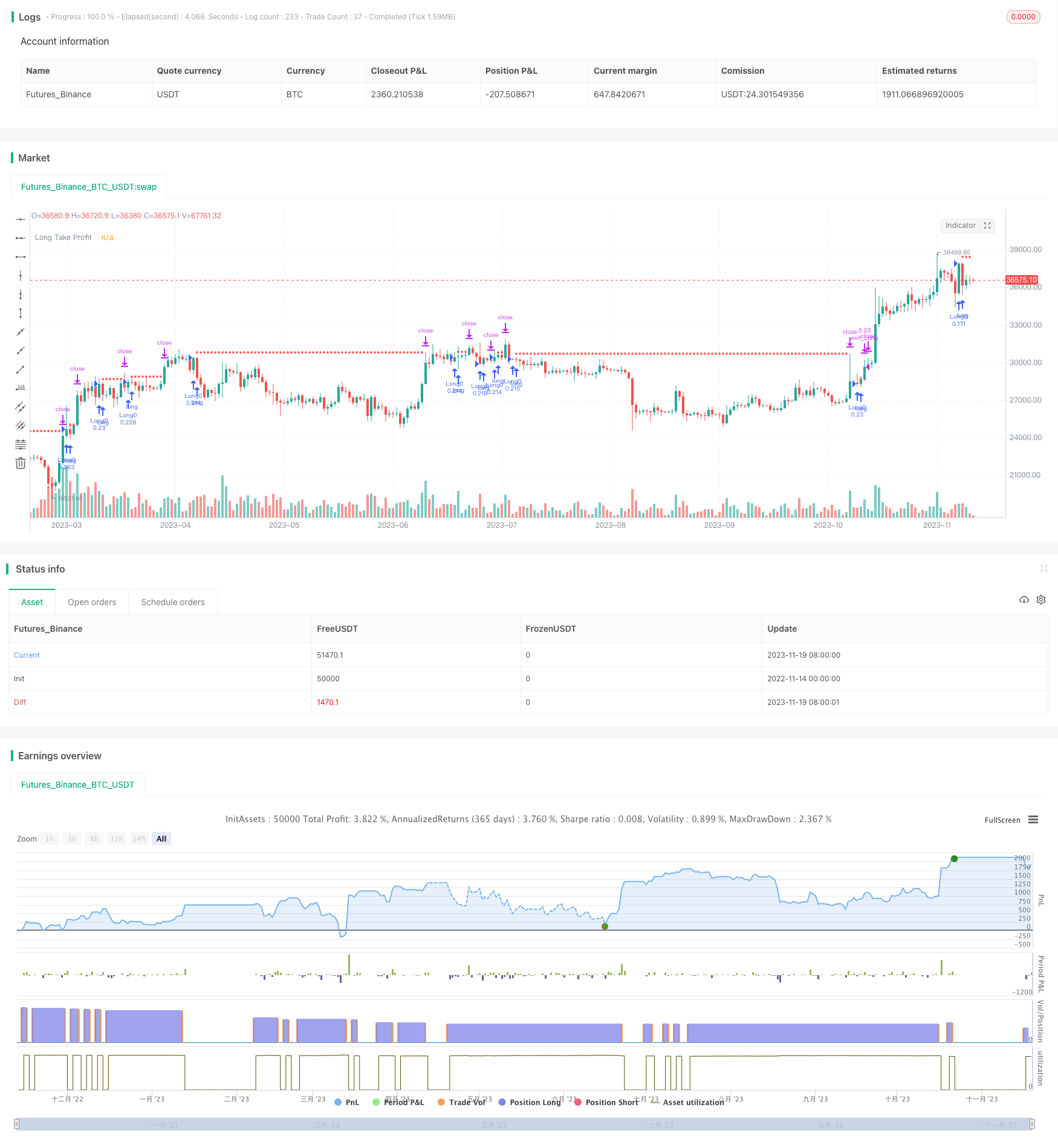

Strategi ini adalah strategi pelacakan tren yang menilai arah tren pada berbagai kerangka waktu melalui beberapa indikator seperti RSI, CCI, dan Bollinger Bands, dan mengimplementasikan DCA untuk mengejar keuntungan tren.

Prinsip Strategi

- RSI dan CCI dihitung secara terpisah pada 5 menit, 15 menit, dan 30 menit.

- Ketika RSI periode yang lebih pendek lebih rendah dari suatu nilai, RSI periode yang lebih panjang juga lebih rendah dari suatu nilai yang dinilai sebagai overbought, ketika RSI periode yang lebih pendek lebih tinggi dari suatu nilai, dan RSI periode yang lebih panjang lebih tinggi dari suatu nilai yang dinilai sebagai oversold.

- Brinet menilai apakah harga terlalu jauh dari orbit tengah, sebagai indikator penilaian tambahan.

- Untuk mencapai efek DCA, Anda harus melakukan over entry secara bertahap saat over buy, dan over entry secara bertahap saat over sell.

Analisis Keunggulan

- Pertimbangan yang lebih akurat dalam kombinasi indikator multi-framework

- Strategi DCA untuk Mengurangi Biaya Pembelian

- Anda dapat menyesuaikan persentase masing-masing dari total modal, mengendalikan risiko

Analisis risiko

- Risiko Melewatkan Titik Masuk Terbaik

- Risiko pembalikan tren

- Parameter yang salah menyebabkan risiko overtrading

Solusi:

- Optimalkan parameter, pastikan parameter indikator cocok

- Tergabung dengan lebih banyak indikator untuk menilai tren

- Persentase yang disesuaikan per unit

Arah optimasi

- Mencoba kombinasi indikator yang lebih banyak untuk menemukan kombinasi yang optimal

- Mengoptimalkan proporsi per unit

- Meningkatkan strategi stop loss

Meringkaskan

Strategi ini menilai arah tren melalui RSI dan CCI dalam beberapa kerangka waktu, melakukan masukan DCA secara berurutan saat overbought dan oversold, dan melacak tren yang menguntungkan ketika terjadi orientasi yang lebih besar. Namun, pengaturan parameter yang tidak tepat juga dapat menyebabkan perdagangan yang berlebihan. Secara keseluruhan, strategi ini memiliki ruang untuk mengoptimalkan parameter dan stop loss yang lebih besar, dan setelah dioptimalkan, dapat memperoleh efek yang lebih baik.

Kode Sumber Strategi

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rrolik66

//@version=5

strategy(title="3RSI 3CCI BB 5orders DCA strategy+", overlay=true )

start_time = input(defval=timestamp('01 January 2021 00:00'), title='Start Time')

end_time = input(defval=timestamp('01 January 2022 00:00'), title='End Time')

src_bot = input.source(close, 'Source Bot')

tradeDirection = input.string(title='Trade Direction', options=['Long Bot', 'Short Bot'], defval='Long Bot')

weight_order0 = input.float(13.03, title='1 order (%)', group='weight of orders in %', inline='Input 0') * 0.01

weight_order1 = input.float(14.29, title='2 order (%)', group='weight of orders in %', inline='Input 0') * 0.01

weight_order2 = input.float(17.19, title='3 order (%)', group='weight of orders in %', inline='Input 1') * 0.01

weight_order3 = input.float(22.67, title='4 order (%)', group='weight of orders in %', inline='Input 1') * 0.01

weight_order4 = input.float(32.80, title='5 order (%)', group='weight of orders in %', inline='Input 2') * 0.01

st_long_orders = input.float(title='Rate cover (%)', minval=1, defval=80, group='Long Bot', inline='Input 1') / 4 * 0.01

longTakeProfit = input.float(1.4, step=0.05, title='Take Profit (%)', group='Long Bot', inline='Input 1') * 0.01

entry_long_SL = input.bool(defval=false, title='StopLoss', group='Long Bot', inline='Input 2')

longStopLoss = input.float(80, step=0.1, title='for Long Bot (%)', group='Long Bot', inline='Input 2') * 0.01

st_short_orders = input.float(title='Rate cover (%)', minval=1, defval=500, group='Short Bot', inline='Input 1') / 4 * 0.01

shortTakeProfit = input.float(1.4, step=0.05, title='Take Profit (%)', group='Short Bot', inline='Input 1') * 0.01

entry_short_SL = input.bool(defval=false, title='StopLoss', group='Short Bot', inline='Input 2')

shortStopLoss = input.float(500, step=0.1, title='for Short Bot (%)', group='Short Bot', inline='Input 2') * 0.01

//inputs for indicators

src = input.source(close, 'Source', group='indicators')

rsi1_input = input.bool(defval=true, title='RSI-1', group='RSI-1', inline='Input 0')

rsi1_res = input.timeframe(title='resolution', defval='5', group='RSI-1', inline='Input 0')

rsi1_low = input.int(65, minval=0, maxval=100, title='long <', group='RSI-1', inline='Input 1')

rsi1_len_long = input.int(14, minval=1, title='Length', group='RSI-1', inline='Input 1')

rsi1_up = input.int(37, minval=0, maxval=100, title='short >', group='RSI-1', inline='Input 2')

rsi1_len_short = input.int(14, minval=1, title='Length', group='RSI-1', inline='Input 2')

rsi2_input = input.bool(defval=true, title='RSI-2', group='RSI-2', inline='Input 0')

rsi2_res = input.timeframe(title='resolution', defval='15', group='RSI-2', inline='Input 0')

rsi2_low = input.int(72, minval=0, maxval=100, title='long <', group='RSI-2', inline='Input 1')

rsi2_len_long = input.int(14, minval=1, title='Length', group='RSI-2', inline='Input 1')

rsi2_up = input.int(37, minval=0, maxval=100, title='short >', group='RSI-2', inline='Input 2')

rsi2_len_short = input.int(14, minval=1, title='Length', group='RSI-2', inline='Input 2')

rsi3_input = input.bool(defval=true, title='RSI-3', group='RSI-3', inline='Input 0')

rsi3_res = input.timeframe(title='resolution', defval='30', group='RSI-3', inline='Input 0')

rsi3_low = input.int(74, minval=0, maxval=100, title='long <', group='RSI-3', inline='Input 1')

rsi3_len_long = input.int(14, minval=1, title='Length', group='RSI-3', inline='Input 1')

rsi3_up = input.int(34, minval=0, maxval=100, title='short >', group='RSI-3', inline='Input 2')

rsi3_len_short = input.int(14, minval=1, title='Length', group='RSI-3', inline='Input 2')

cci1_input = input.bool(defval=true, title='CCI-1', group='CCI-1', inline='Input 0')

cci1_res = input.timeframe(title='resolution', defval='5', group='CCI-1', inline='Input 0')

cci1_low = input.int(190, step=5, title='long <', group='CCI-1', inline='Input 1')

cci1_len_long = input.int(20, minval=1, title='Length', group='CCI-1', inline='Input 1')

cci1_up = input.int(-175, step=5, title='short >', group='CCI-1', inline='Input 2')

cci1_len_short = input.int(20, minval=1, title='Length', group='CCI-1', inline='Input 2')

cci2_input = input.bool(defval=true, title='CCI-2', group='CCI-2', inline='Input 0')

cci2_res = input.timeframe(title='resolution', defval='15', group='CCI-2', inline='Input 0')

cci2_low = input.int(195, step=5, title='long <', group='CCI-2', inline='Input 1')

cci2_len_long = input.int(20, minval=1, title='Length', group='CCI-2', inline='Input 1')

cci2_up = input.int(-205, step=5, title='short >', group='CCI-2', inline='Input 2')

cci2_len_short = input.int(20, minval=1, title='Length', group='CCI-2', inline='Input 2')

cci3_input = input.bool(defval=true, title='CCI-3', group='CCI-3', inline='Input 0')

cci3_res = input.timeframe(title='resolution', defval='30', group='CCI-3', inline='Input 0')

cci3_low = input.int(200, step=5, title='long <', group='CCI-3', inline='Input 1')

cci3_len_long = input.int(20, minval=1, title='Length', group='CCI-3', inline='Input 1')

cci3_up = input.int(-220, step=5, title='short >', group='CCI-3', inline='Input 2')

cci3_len_short = input.int(20, minval=1, title='Length', group='CCI-3', inline='Input 2')

bb_input = input.bool(defval=false, title='BB', group='Bollinger Bands', tooltip='(for long trading) the price is below the lower band, (for short trading) the price is abowe the upper band, для лонга цена под нижней линией, для шорта цена над верхней линией', inline='Input 0')

bb_res = input.timeframe(title='resolution', defval='5', group='Bollinger Bands', inline='Input 0')

bb_dev = input.float(2.0, minval=0.1, maxval=50, step=0.1, title='Deviation', group='Bollinger Bands', inline='Input 2')

bb_len = input.int(20, minval=1, title='Length', group='Bollinger Bands', inline='Input 2')

cci_input = input.bool(defval=false, title='band CCI', group='band CCI', tooltip='this setting sets the trading range by the level of the "CCI" indicator, эта настройка задает диапазон торговли по уровню индикатора "CCI" (я не использую)', inline='Input 0')

cci_res = input.timeframe(title='resolution', defval='60', group='band CCI', inline='Input 0')

cci_len = input.int(20, minval=1, title='CCI Length', group='band CCI', inline='Input 1')

cci_low = input.int(-110, step=10, title='CCI >', group='band CCI', inline='Input 2')

cci_up = input.int(110, step=10, title='CCI <', group='band CCI', inline='Input 2')

show_signals = input.bool(defval=false, title='Show signals', inline='Input')

//Input to trading conditions

longOK = tradeDirection == 'Long Bot'

shortOK = tradeDirection == 'Short Bot'

within_window() => true

// get indicators

rsi1_sec_long = request.security(syminfo.tickerid, rsi1_res, ta.rsi(src, rsi1_len_long))

rsi1_sec_short = request.security(syminfo.tickerid, rsi1_res, ta.rsi(src, rsi1_len_short))

rsi2_sec_long = request.security(syminfo.tickerid, rsi2_res, ta.rsi(src, rsi2_len_long))

rsi2_sec_short = request.security(syminfo.tickerid, rsi2_res, ta.rsi(src, rsi2_len_short))

rsi3_sec_long = request.security(syminfo.tickerid, rsi3_res, ta.rsi(src, rsi3_len_long))

rsi3_sec_short = request.security(syminfo.tickerid, rsi3_res, ta.rsi(src, rsi3_len_short))

cci1_sec_long = request.security(syminfo.tickerid, cci1_res, ta.cci(src, cci1_len_long))

cci1_sec_short = request.security(syminfo.tickerid, cci1_res, ta.cci(src, cci1_len_short))

cci2_sec_long = request.security(syminfo.tickerid, cci2_res, ta.cci(src, cci2_len_long))

cci2_sec_short = request.security(syminfo.tickerid, cci2_res, ta.cci(src, cci2_len_short))

cci3_sec_long = request.security(syminfo.tickerid, cci3_res, ta.cci(src, cci3_len_long))

cci3_sec_short = request.security(syminfo.tickerid, cci3_res, ta.cci(src, cci3_len_short))

[basis, upper_bb, lower_bb] = request.security(syminfo.tickerid, bb_res, ta.bb(src, bb_len, bb_dev))

cci_sec = request.security(syminfo.tickerid, cci_res, ta.cci(src, cci_len))

// calculate indicators

float rating_long = 0

float rating_long_num = 0

float rating_short = 0

float rating_short_num = 0

float rsi1_long = na

float rsi1_short = na

if not na(rsi1_sec_long) and rsi1_input and longOK

rsi1_long := rsi1_sec_long < rsi1_low ? 1 : 0

if not na(rsi1_sec_short) and rsi1_input and shortOK

rsi1_short := rsi1_sec_short > rsi1_up ? 1 : 0

if not na(rsi1_long)

rating_long += rsi1_long

rating_long_num += 1

if not na(rsi1_short)

rating_short += rsi1_short

rating_short_num += 1

float rsi2_long = na

float rsi2_short = na

if not na(rsi2_sec_long) and rsi2_input and longOK

rsi2_long := rsi2_sec_long < rsi2_low ? 1 : 0

if not na(rsi2_sec_short) and rsi2_input and shortOK

rsi2_short := rsi2_sec_short > rsi2_up ? 1 : 0

if not na(rsi2_long)

rating_long += rsi2_long

rating_long_num += 1

if not na(rsi2_short)

rating_short += rsi2_short

rating_short_num += 1

float rsi3_long = na

float rsi3_short = na

if not na(rsi3_sec_long) and rsi3_input and longOK

rsi3_long := rsi3_sec_long < rsi3_low ? 1 : 0

if not na(rsi3_sec_short) and rsi3_input and shortOK

rsi3_short := rsi3_sec_short > rsi3_up ? 1 : 0

if not na(rsi3_long)

rating_long += rsi3_long

rating_long_num += 1

if not na(rsi3_short)

rating_short += rsi3_short

rating_short_num += 1

float cci1_long = na

float cci1_short = na

if not na(cci1_sec_long) and cci1_input and longOK

cci1_long := cci1_sec_long < cci1_low ? 1 : 0

if not na(cci1_sec_short) and cci1_input and shortOK

cci1_short := cci1_sec_short > cci1_up ? 1 : 0

if not na(cci1_long)

rating_long += cci1_long

rating_long_num += 1

if not na(cci1_short)

rating_short += cci1_short

rating_short_num += 1

float cci2_long = na

float cci2_short = na

if not na(cci2_sec_long) and cci2_input and longOK

cci2_long := cci2_sec_long < cci2_low ? 1 : 0

if not na(cci2_sec_short) and cci2_input and shortOK

cci2_short := cci2_sec_short > cci2_up ? 1 : 0

if not na(cci2_long)

rating_long += cci2_long

rating_long_num += 1

if not na(cci2_short)

rating_short += cci2_short

rating_short_num += 1

float cci3_long = na

float cci3_short = na

if not na(cci3_sec_long) and cci3_input and longOK

cci3_long := cci3_sec_long < cci3_low ? 1 : 0

if not na(cci3_sec_short) and cci3_input and shortOK

cci3_short := cci3_sec_short > cci3_up ? 1 : 0

if not na(cci3_long)

rating_long += cci3_long

rating_long_num += 1

if not na(cci3_short)

rating_short += cci3_short

rating_short_num += 1

float bb_long = na

float bb_short = na

if not(na(lower_bb) or na(src) or na(src[1])) and bb_input and longOK

bb_long := src < lower_bb ? 1 : 0

if not(na(upper_bb) or na(src) or na(src[1])) and bb_input and shortOK

bb_short := src > upper_bb ? 1 : 0

if not na(bb_long)

rating_long += bb_long

rating_long_num += 1

if not na(bb_short)

rating_short += bb_short

rating_short_num += 1

float cci_band = na

if not na(cci_sec) and cci_input

cci_band := cci_sec < cci_up and cci_sec > cci_low ? 1 : 0

if not na(cci_band)

rating_long += cci_band

rating_long_num += 1

rating_short += cci_band

rating_short_num += 1

//Buy Sell

Buy_ok = rating_long_num != 0 and longOK ? rating_long == rating_long_num : true

Sell_ok = rating_short_num != 0 and shortOK ? rating_short == rating_short_num : true

// Plotting

plotshape(Buy_ok and show_signals and longOK, title='Buy', text='Long', textcolor=color.new(color.white, 0), style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny)

plotshape(Sell_ok and show_signals and shortOK, title='Sell', text='Short', textcolor=color.new(color.white, 0), style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

strategy.initial_capital =50000

//Figure in entry orders price

longEntryPrice0 = src_bot

longEntryPrice1 = longEntryPrice0 * (1 - st_long_orders)

longEntryPrice2 = longEntryPrice0 * (1 - st_long_orders * 2)

longEntryPrice3 = longEntryPrice0 * (1 - st_long_orders * 3)

longEntryPrice4 = longEntryPrice0 * (1 - st_long_orders * 4)

longEntryqty0 = strategy.initial_capital * weight_order0 / longEntryPrice0

longEntryqty1 = strategy.initial_capital * weight_order1 / longEntryPrice1

longEntryqty2 = strategy.initial_capital * weight_order2 / longEntryPrice2

longEntryqty3 = strategy.initial_capital * weight_order3 / longEntryPrice3

longEntryqty4 = strategy.initial_capital * weight_order4 / longEntryPrice4

shortEntryPrice0 = src_bot

shortEntryPrice1 = shortEntryPrice0 * (1 + st_short_orders)

shortEntryPrice2 = shortEntryPrice0 * (1 + st_short_orders * 2)

shortEntryPrice3 = shortEntryPrice0 * (1 + st_short_orders * 3)

shortEntryPrice4 = shortEntryPrice0 * (1 + st_short_orders * 4)

shortcontracts = strategy.initial_capital / shortEntryPrice0

shortEntryqty0 = shortcontracts * weight_order0

shortEntryqty1 = shortcontracts * weight_order1

shortEntryqty2 = shortcontracts * weight_order2

shortEntryqty3 = shortcontracts * weight_order3

shortEntryqty4 = shortcontracts * weight_order4

long_entry_price = strategy.opentrades.entry_price (0)

short_entry_price = strategy.opentrades.entry_price (0)

longTP = strategy.position_avg_price * (1 + longTakeProfit)

longSL = long_entry_price * (1 - longStopLoss)

shortTP = strategy.position_avg_price * (1 - shortTakeProfit)

shortSL = short_entry_price * (1 + shortStopLoss)

plot(series=strategy.position_size > 0 and longOK ? longTP : na, color=color.new(color.red, 0), style=plot.style_circles, linewidth=3, title='Long Take Profit')

plot(series=strategy.position_size > 0 and entry_long_SL and longOK ? longSL : na, color=color.new(color.black, 0), style=plot.style_circles, linewidth=1, title='Long Stop Loss')

plot(series=strategy.position_size < 0 and shortOK ? shortTP : na, color=color.new(color.green, 0), style=plot.style_circles, linewidth=3, title='Long Take Profit')

plot(series=strategy.position_size < 0 and entry_short_SL and shortOK ? shortSL : na, color=color.new(color.black, 0), style=plot.style_circles, linewidth=1, title='Long Stop Loss')

// Submit entry orders

if strategy.opentrades == 0 and longOK and within_window()

strategy.order(id='Long0', direction=strategy.long, qty=longEntryqty0, limit=longEntryPrice0, when=Buy_ok)

strategy.order(id='Long1', direction=strategy.long, qty=longEntryqty1, limit=longEntryPrice1, when=Buy_ok)

strategy.order(id='Long2', direction=strategy.long, qty=longEntryqty2, limit=longEntryPrice2, when=Buy_ok)

strategy.order(id='Long3', direction=strategy.long, qty=longEntryqty3, limit=longEntryPrice3, when=Buy_ok)

strategy.order(id='Long4', direction=strategy.long, qty=longEntryqty4, limit=longEntryPrice4, when=Buy_ok)

if strategy.opentrades == 0 and shortOK and within_window()

strategy.order(id='Short0', direction=strategy.short, qty=shortEntryqty0, limit=shortEntryPrice0, when=Sell_ok)

strategy.order(id='Short1', direction=strategy.short, qty=shortEntryqty1, limit=shortEntryPrice1, when=Sell_ok)

strategy.order(id='Short2', direction=strategy.short, qty=shortEntryqty2, limit=shortEntryPrice2, when=Sell_ok)

strategy.order(id='Short3', direction=strategy.short, qty=shortEntryqty3, limit=shortEntryPrice3, when=Sell_ok)

strategy.order(id='Short4', direction=strategy.short, qty=shortEntryqty4, limit=shortEntryPrice4, when=Sell_ok)

// exit position

if (strategy.position_size > 0) and not entry_long_SL and longOK

strategy.exit(id='exit_Long', limit=longTP, qty=strategy.position_size, when=strategy.position_size[1] > 0)

if (strategy.position_size > 0) and entry_long_SL and longOK

strategy.exit(id='exit_Long', limit=longTP, stop=longSL, qty=strategy.position_size, when=strategy.position_size[1] > 0)

if (strategy.position_size < 0) and not entry_short_SL and shortOK

strategy.exit(id='exit_Short', limit=shortTP, qty=math.abs(strategy.position_size), when=strategy.position_size[1] < 0)

if (strategy.position_size < 0) and entry_short_SL and shortOK

strategy.exit(id='exit_Short', limit=shortTP, stop=shortSL, qty=math.abs(strategy.position_size), when=strategy.position_size[1] < 0)

// Cleanup

if ta.crossunder(strategy.opentrades, 0.5)

strategy.close_all()

strategy.cancel_all()