Momentum dikombinasikan dengan penilaian tren strategi perdagangan kuantitatif multi-faktor

Ringkasan

Strategi ini adalah strategi perdagangan kuantitatif multi-faktor yang menggabungkan indikator momentum dan indikator tren. Strategi ini menghasilkan sinyal perdagangan sesuai dengan kondisi penurunan nilai dengan menghitung kombinasi matematika dari berbagai rata-rata untuk menilai tren dan arah momentum keseluruhan pasar.

Prinsip Strategi

- Menghitung rata-rata kelompok dan indikator momentum

- Menghitung rata-rata dari beberapa kelompok, seperti rata-rata Harmonics, rata-rata jangka pendek, rata-rata jangka menengah, dan rata-rata jangka panjang

- Perhitungan perbedaan antara rata-rata untuk mencerminkan tren perubahan harga

- Perhitungan derivatif pertama dari setiap rata-rata yang mencerminkan dinamika perubahan harga

- Perhitungan indikator sinusoidal untuk menentukan arah tren

- Perhitungan Sinyal Perdagangan

- Menggunakan beberapa faktor seperti indikator momentum, indikator tren, dan lain-lain untuk melakukan operasi berat.

- Berdasarkan hasil yang jauh dari titik terendah, menilai kondisi pasar saat ini

- Sinyal untuk melakukan perdagangan short term

Analisis Keunggulan

- Multi-factor Judgment, meningkatkan akurasi sinyal

- Mempertimbangkan harga, tren, dan momentum secara keseluruhan

- Faktor yang berbeda dapat dikonfigurasi dengan berat yang berbeda

- Parameter yang dapat disesuaikan dengan pasar yang berbeda

- Parameter rata-rata, batas antara zona transaksi dapat disesuaikan

- Beradaptasi dengan siklus dan kondisi pasar yang berbeda

- Struktur kodenya jelas dan mudah dipahami.

- Kode Nama, Komentar Lengkap

- Mudah untuk digunakan kembali dan dioptimalkan

Analisis risiko

- Parameter yang sulit untuk dioptimalkan

- Perlu banyak data historis untuk mencari parameter optimal

- Frekuensi transaksi mungkin terlalu tinggi

- Ada beberapa faktor yang dapat menyebabkan terlalu banyak transaksi.

- Efek Terkait Pasar

- Strategi penilaian tren, mudah dipengaruhi oleh perilaku tidak rasional

Arah optimasi

- Menambahkan Stop Loss Logic

- Mencegah kerugian yang lebih besar dari perilaku tidak rasional

- Pengaturan Parameter Optimasi

- Mencari kombinasi optimal untuk meningkatkan stabilitas strategi

- Menambahkan elemen pembelajaran mesin

- Menggunakan pembelajaran mendalam untuk menilai kondisi pasar saat ini dan membantu pengambilan keputusan strategis

Meringkaskan

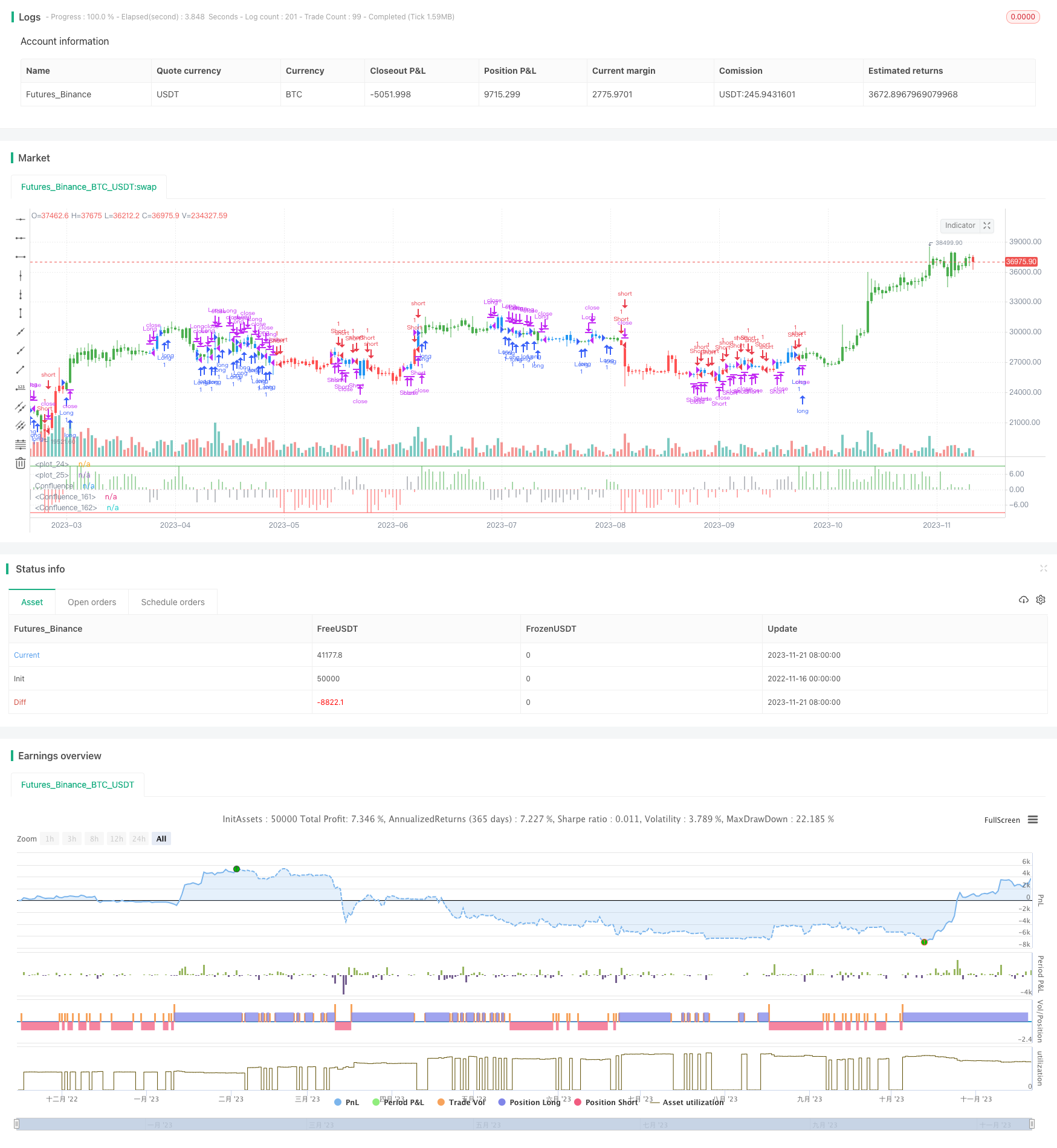

Strategi ini menilai kondisi pasar melalui kombinasi multi-faktor dari indikator momentum dan indikator tren, dan mengirimkan sinyal perdagangan sesuai dengan nilai ambang yang ditetapkan. Keunggulan strategi adalah konfigurasi yang kuat, sesuai dengan lingkungan pasar yang berbeda, dan mudah dimengerti. Kelemahannya adalah parameter yang sulit untuk dioptimalkan, frekuensi perdagangan mungkin terlalu tinggi, dan efeknya sangat relevan dengan pasar.

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 14/03/2017

// This is modified version of Dale Legan's "Confluence" indicator written by Gary Fritz.

// ================================================================

// Here is Gary`s commentary:

// Since the Confluence indicator returned several "states" (bull, bear, grey, and zero),

// he modified the return value a bit:

// -9 to -1 = Bearish

// -0.9 to 0.9 = "grey" (and zero)

// 1 to 9 = Bullish

// The "grey" range corresponds to the "grey" values plotted by Dale's indicator, but

// they're divided by 10.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Confluence", shorttitle="Confluence")

Harmonic = input(10, minval=1)

BuyBand = input(9)

SellBand = input(-9)

reverse = input(false, title="Trade reverse")

hline(SellBand, color=red, linestyle=line)

hline(BuyBand, color=green, linestyle=line)

Price = close

STL = round((Harmonic * 2) - 1 - 0.5)

ITL = round((STL * 2) - 1 - 0.5)

LTL = round((ITL * 2) - 1 - 0.5)

HOFF = round(Harmonic / 2 - 0.5)

SOFF = round(STL / 2 - 0.5)

IOFF = round(ITL / 2 - 0.5)

xHavg = sma(Price, Harmonic)

xSavg = sma(Price, STL)

xIavg = sma(Price, ITL)

xLavg = sma(Price, LTL)

xvalue2 = xSavg - xHavg[HOFF]

xvalue3 = xIavg - xSavg[SOFF]

xvalue12 = xLavg - xIavg[IOFF]

xmomsig = xvalue2 + xvalue3 + xvalue12

xLavgOHLC = sma(ohlc4, LTL - 1)

xH2 = sma(Price, Harmonic - 1)

xS2 = sma(Price, STL - 1)

xI2 = sma(Price, ITL - 1)

xL2 = sma(Price, LTL - 1)

DerivH = (xHavg * 2) - xHavg[1]

DerivS = (xSavg * 2) - xSavg[1]

DerivI = (xIavg * 2) - xIavg[1]

DerivL = (xLavg * 2) - xLavg[1]

SumDH = Harmonic * DerivH

SumDS = STL * DerivS

SumDI = ITL * DerivI

SumDL = LTL * DerivL

LengH = Harmonic - 1

LengS = STL - 1

LengI = ITL - 1

LengL = LTL - 1

N1H = xH2 * LengH

N1S = xS2 * LengS

N1I = xI2 * LengI

N1L = xL2 * LengL

DRH = SumDH - N1H

DRS = SumDS - N1S

DRI = SumDI - N1I

DRL = SumDL - N1L

SumH = xH2 * (Harmonic - 1)

SumS = xS2 * (STL - 1)

SumI = xI2 * (ITL - 1)

SumL = xLavgOHLC * (LTL - 1)

xvalue5 = (SumH + DRH) / Harmonic

xvalue6 = (SumS + DRS) / STL

xvalue7 = (SumI + DRI) / ITL

xvalue13 = (SumL + DRL) / LTL

value9 = xvalue6 - xvalue5[HOFF]

value10 = xvalue7 - xvalue6[SOFF]

value14 = xvalue13 - xvalue7[IOFF]

xmom = value9 + value10 + value14

HT = sin(xvalue5 * 2 * 3.14 / 360) + cos(xvalue5 * 2 * 3.14 / 360)

HTA = sin(xHavg * 2 * 3.14 / 360) + cos(xHavg * 2 * 3.14 / 360)

ST = sin(xvalue6 * 2 * 3.14 / 360) + cos(xvalue6 * 2 * 3.14 / 360)

STA = sin(xSavg * 2 * 3.14 / 360) + cos(xSavg * 2 * 3.14 / 360)

IT = sin(xvalue7 * 2 * 3.14 / 360) + cos(xvalue7 * 2 * 3.14 / 360)

ITA = sin(xIavg * 2 * 3.14 / 360) + cos(xIavg * 2 * 3.14 / 360)

xSum = HT + ST + IT

xErr = HTA + STA + ITA

Condition2 = (((xSum > xSum[SOFF]) and (xHavg < xHavg[SOFF])) or ((xSum < xSum[SOFF]) and (xHavg > xHavg[SOFF])))

Phase = iff(Condition2 , -1 , 1)

xErrSum = (xSum - xErr) * Phase

xErrSig = sma(xErrSum, SOFF)

xvalue70 = xvalue5 - xvalue13

xvalue71 = sma(xvalue70, Harmonic)

ErrNum = iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, 1,

iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, 3,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, -1,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, -2,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, -2,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, -3, 0))))))))

momNum = iff (xmom > 0 and xmom < xmom[1] and xmom < xmomsig , 1,

iff (xmom > 0 and xmom < xmom[1] and xmom > xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom < xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom > xmomsig, 3,

iff (xmom < 0 and xmom > xmom[1] and xmom > xmomsig, -1,

iff (xmom < 0 and xmom < xmom[1] and xmom > xmomsig, -2,

iff (xmom < 0 and xmom > xmom[1] and xmom < xmomsig, -2,

iff (xmom < 0 and xmom < xmom[1] and xmom < xmomsig, -3, 0))))))))

TCNum = iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, 1,

iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, 3,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, -1,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, -3,0))))))))

value42 = ErrNum + momNum + TCNum

Confluence = iff (value42 > 0 and xvalue70 > 0, value42,

iff (value42 < 0 and xvalue70 < 0, value42,

iff ((value42 > 0 and xvalue70 < 0) or (value42 < 0 and xvalue70 > 0), value42 / 10, 0)))

Res1 = iff (Confluence >= 1, Confluence, 0)

Res2 = iff (Confluence <= -1, Confluence, 0)

Res3 = iff (Confluence == 0, 0, iff (Confluence > -1 and Confluence < 1, 10 * Confluence, 0))

pos = iff(Res2 >= SellBand and Res2 != 0, -1,

iff(Res1 <= BuyBand and Res1 != 0, 1,

iff(Res3 != 0, 0, nz(pos[1], 0))))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close("Long", when = possig == 0)

strategy.close("Short", when = possig == 0)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(Res1, color=green, title="Confluence", linewidth=3, style = histogram)

plot(Res2, color=red, title="Confluence", linewidth=3, style = histogram)

plot(Res3, color=gray, title="Confluence", linewidth=3, style = histogram)