Strategi terobosan kejutan tren super lintas kerangka waktu

Ringkasan

Strategi ini menggabungkan indikator supertrend dengan indikator Brin Belt dalam beberapa frame waktu, mengidentifikasi arah tren dan titik-titik resistensi pendukung utama, melakukan Entries pada saat terjatuh, dan berdasarkan posisi keluar silang. Strategi ini terutama berlaku untuk varietas komoditas berjangka yang berfluktuasi tinggi, seperti emas, perak, minyak mentah, dll.

Prinsip Strategi

Fungsi supertrend multi-timeframe khusus yang ditulis berdasarkan Pine Scriptpine_supertrend(), supertrend yang menggabungkan periode yang berbeda (misalnya 1 menit dan 5 menit), untuk menentukan arah tren siklus besar.

Pada saat yang sama, menghitung Bollinger Bands di bawah rel, untuk melakukan penilaian terobosan saluran. Ketika harga menembus Bollinger Bands di atas rel, dianggap berada di posisi bullish; Ketika harga jatuh di bawah Bollinger Bands di bawah rel, dianggap sebagai terobosan bearish.

Sinyal strategis:

Sinyal multihead: harga close > Brin berlari ke jalur dan close > indikator super trend multi-frame Sinyal kosong: harga penutupan < Brin band downtrack dan harga penutupan < Multi-time frame super trend indicator

Stop loss:

Stop loss multihead: harga penutupan < 5 menit indikator supertrend Stop loss kosong: harga penutupan > 5 menit indikator tren super

Oleh karena itu, strategi untuk menangkap terobosan resonansi antara indikator supertrend dan indikator BRI, untuk memproses transaksi dalam situasi yang sangat berfluktuasi.

Analisis Keunggulan

- Menggunakan indikator supertrend multi-frame waktu untuk menentukan arah tren siklus besar, meningkatkan kualitas sinyal

- Brin yang berada di atas dan di bawah rel sebagai titik resistensi pendukung utama, dapat mengurangi false breaks

- Indikator Supertrend sebagai Stop Loss, Mengurangi Kerugian, Mengontrol Risiko

Analisis risiko

- Indikator supertrend mengalami keterlambatan dan mungkin melewatkan titik baliknya.

- Setelan parameter Brin-band yang tidak tepat dapat menyebabkan terlalu sering atau terlalu banyak kehilangan perdagangan

- Komoditas berjangka harga berfluktuasi tajam, mudah terhalang pada malam hari atau saat terjadi peristiwa besar

Solusi untuk Mengatasi Risiko:

- Kombinasi sinyal konfirmasi dengan berbagai indikator bantu untuk menghindari penembusan palsu

- Optimalkan parameter Brin untuk mencari titik keseimbangan yang optimal

- Sesuaikan posisi stop loss dan perpanjang jarak stop loss

Arah optimasi

- Cobalah indikator tren lainnya seperti KDJ, MACD dan lain-lain sebagai penilaian tambahan.

- Meningkatkan probabilitas penilaian model pembelajaran mesin sebagai bantuan

- Optimalkan parameter untuk menemukan kombinasi superparameter yang optimal

Meringkaskan

Strategi ini mengintegrasikan supertrend dengan dua indikator yang sangat efisien di Brin Belt, untuk mencapai operasi probabilitas tinggi melalui analisis kerangka waktu dan penilaian terobosan saluran. Strategi ini secara efektif mengendalikan risiko dana, dan telah terbukti dapat menghasilkan keuntungan yang lebih baik di varietas yang sangat berfluktuasi. Efektivitas strategi dapat ditingkatkan dengan lebih lanjut mengoptimalkan dan menggabungkan INDICATORS.

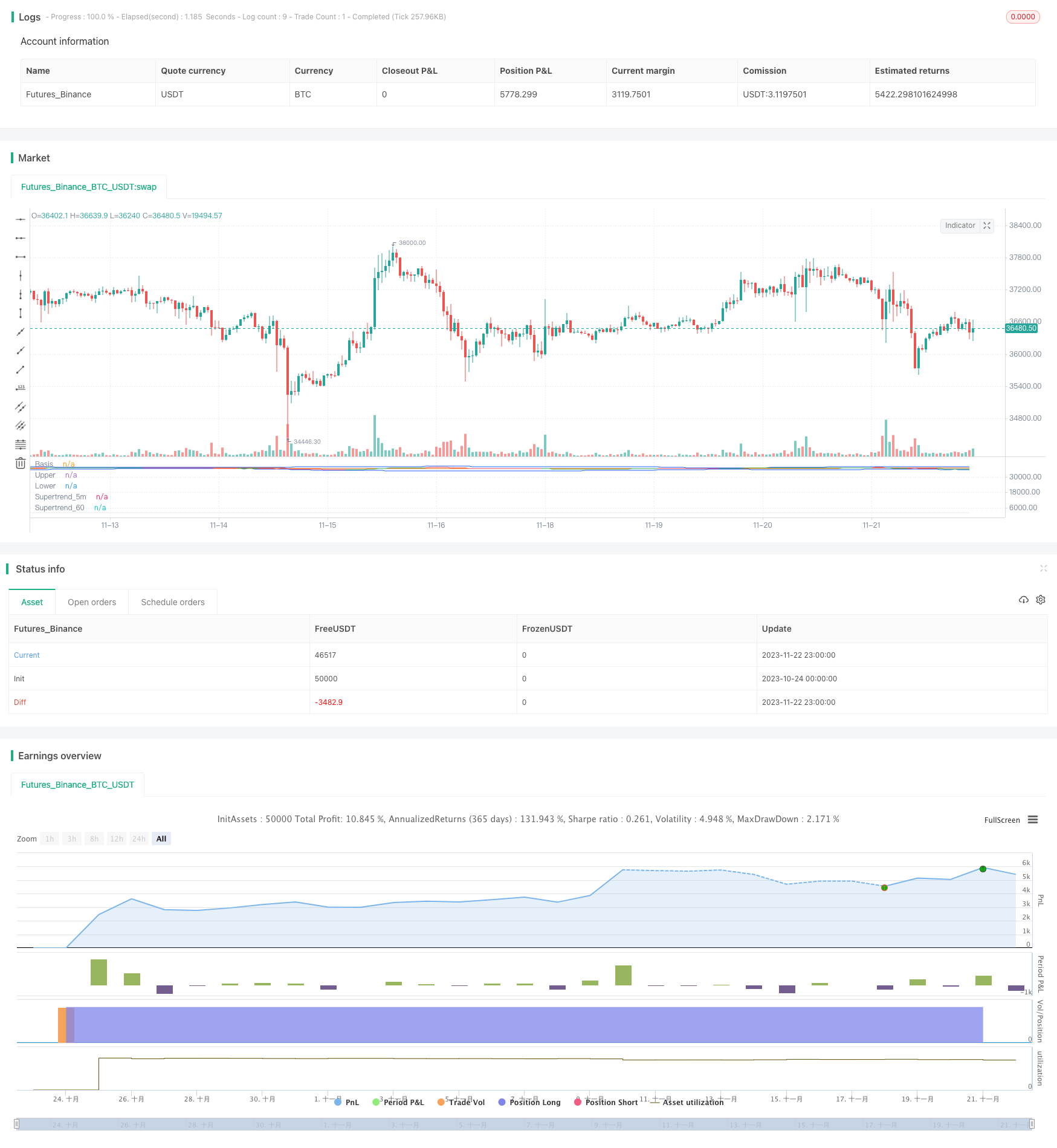

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ambreshc95

//@version=5

strategy("Comodity_SPL_Strategy_01", overlay=false)

// function of st

// [supertrend, direction] = ta.supertrend(3, 10)

// plot(direction < 0 ? supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(direction > 0 ? supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

// VWAP

// src_vwap = input(title = "Source", defval = hlc3, group="VWAP Settings")

// [_Vwap,stdv,_] = ta.vwap(src_vwap,false,1)

// plot(_Vwap, title="VWAP", color = color.rgb(0, 0, 0))

// The same on Pine Script®

pine_supertrend(factor, atrPeriod,len_ma) =>

h= ta.sma(high,len_ma)

l= ta.sma(low,len_ma)

hlc_3 = (h+l)/2

src = hlc_3

atr = ta.atr(atrPeriod)

upperBand = src + factor * atr

lowerBand = src - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

lowerBand := lowerBand > prevLowerBand or close[1] < prevLowerBand ? lowerBand : prevLowerBand

upperBand := upperBand < prevUpperBand or close[1] > prevUpperBand ? upperBand : prevUpperBand

int direction = na

float superTrend = na

prevSuperTrend = superTrend[1]

if na(atr[1])

direction := 1

else if prevSuperTrend == prevUpperBand

direction := close > upperBand ? -1 : 1

else

direction := close < lowerBand ? 1 : -1

superTrend := direction == -1 ? lowerBand : upperBand

[superTrend, direction]

len_ma_given = input(75, title="MA_SMA_ST")

[Pine_Supertrend, pineDirection] = pine_supertrend(3, 10,len_ma_given)

// plot(pineDirection < 0 ? Pine_Supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(pineDirection > 0 ? Pine_Supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

//

// Define Supertrend parameters

atrLength = input(10, title="ATR Length")

factor = input(3.0, title="Factor")

// // Calculate Supertrend

[supertrend, direction] = ta.supertrend(factor, atrLength)

st_color = supertrend > close ? color.red : color.green

// // Plot Supertrend

// plot(supertrend, "Supertrend", st_color)

//

// BB Ploting

length = input.int(75, minval=1)

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(2.5, minval=0.001, maxval=50, title="StdDev")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// h= ta.sma(high,60)

// l= ta.sma(low,60)

// c= sma(close,60)

// hlc_3 = (h+l)/2

// supertrend60 = request.security(syminfo.tickerid, supertrend)

// // Define timeframes for signals

tf1 = input(title="Timeframe 1", defval="1")

tf2 = input(title="Timeframe 2",defval="5")

// tf3 = input(title="Timeframe 3",defval="30")

// // // Calculate Supertrend on multiple timeframes

supertrend_60 = request.security(syminfo.tickerid, tf1, Pine_Supertrend)

supertrend_5m = request.security(syminfo.tickerid, tf2, supertrend)

// supertrend3 = request.security(syminfo.tickerid, tf3, supertrend)

// // Plot Supertrend_60

st_color_60 = supertrend_60 > close ? color.rgb(210, 202, 202, 69) : color.rgb(203, 211, 203, 52)

plot(supertrend_60, "Supertrend_60", st_color_60)

// // Plot Supertrend_5m

st_color_5m = supertrend_5m > close ? color.red : color.green

plot(supertrend_5m, "Supertrend_5m", st_color_5m)

ma21 = ta.sma(close,21)

// rsi = ta.rsi(close,14)

// rsima = ta.sma(rsi,14)

// Define the Indian Standard Time (IST) offset from GMT

ist_offset = 5.5 // IST is GMT+5:30

// Define the start and end times of the trading session in IST

// start_time = timestamp("GMT", year, month, dayofmonth, 10, 0) + ist_offset * 60 * 60

// end_time = timestamp("GMT", year, month, dayofmonth, 14, 0) + ist_offset * 60 * 60

// Check if the current time is within the trading session

// in_trading_session = timenow >= start_time and timenow <= end_time

in_trading_session = not na(time(timeframe.period, "0945-1430"))

// bgcolor(inSession ? color.silver : na)

out_trading_session = not na(time(timeframe.period, "1515-1530"))

// // // Define buy and sell signals

buySignal = close>upper and close > supertrend_5m and close > supertrend_60 and close > ma21 and in_trading_session //close > supertrend and

sellSignal = close<lower and close < supertrend_5m and close < supertrend_60 and close < ma21 and in_trading_session //close < supertrend and

var bool long_position = false

var bool long_exit = false

var float long_entry_price = 0

var float short_entry_price = 0

if buySignal and not long_position

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_label_up, color = color.green, size = size.small)

long_position := true

strategy.entry("Buy",strategy.long)

long_exit := (close < supertrend_5m)

if long_position and long_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.green, size = size.tiny)

long_position := false

strategy.exit("Exit","Buy",stop = close)

var bool short_position = false

var bool short_exit = false

if sellSignal and not short_position

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_label_down, color = color.red, size = size.small)

short_position := true

strategy.entry("Sell",strategy.short)

short_exit := (close > supertrend_5m)

if short_position and short_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.red, size = size.tiny)

short_position := false

strategy.exit("Exit","Sell", stop = close)

if out_trading_session

long_position := false

strategy.exit("Exit","Buy",stop = close)

short_position := false

strategy.exit("Exit","Sell", stop = close)

// if long_position

// long_entry_price := close[1] + 50//bar_index

// if short_position

// short_entry_price := close[1] - 50//bar_index

// if (long_position and high[1] > long_entry_price)

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_triangledown, color = color.yellow, size = size.tiny)

// if (short_position and low[1] < short_entry_price)

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_triangleup, color = color.yellow, size = size.tiny)