Strategi Indikator Momentum RSI/MFI Berdasarkan Teori Dow

Tanggal Pembuatan:

2023-12-12 17:54:58

Akhirnya memodifikasi:

2023-12-12 17:54:58

menyalin:

0

Jumlah klik:

793

1

fokus pada

1628

Pengikut

Ringkasan

Strategi ini menggunakan indikator relatif kuat lemah (RSI) atau indikator aliran dana (MFI) untuk menentukan apakah pasar bull atau bear, dan menggabungkan koefisien bull-bear dari teori Dow untuk menghitung distribusi probabilitas yang disesuaikan. Bergantung pada jenis pasar yang berbeda, masuk dan keluar logika yang berbeda digunakan.

Prinsip Strategi

- Perhitungan RSI atau MFI untuk menentukan kondisi pasar saat ini (bull atau bear)

- Menghitung koefisien bull/bear dalam teori Dow, yang mencerminkan hubungan antara harga dan volume transaksi saat ini

- Menyesuaikan distribusi probabilitas RSI/MFI untuk menentukan distribusi polygon yang tepat

- Berdasarkan SessionId dan Probabilitas saat ini

- Stop loss ketika keuntungan ditarik kembali atau pasar diselesaikan

Analisis Keunggulan

- Teori Dow lebih akurat dalam menentukan jenis pasar

- Mengingat Faktor Penyusunan, Hindari Masuk Tanpa Pandang

- Rasio laba rugi tinggi, penarikan rendah

Analisis risiko

- Parameter yang tidak tepat waktu, akan menghasilkan banyak kesalahan penilaian

- Perlu dukungan data sejarah yang cukup

- Logika stop loss sederhana, tidak dapat dioptimalkan untuk situasi khusus

Arah optimasi

- Ada beberapa indikator yang dapat dipertimbangkan untuk menilai market session.

- Menambahkan logika stop loss yang lebih ketat berdasarkan volatilitas, data historis, dan lainnya

- Anda dapat mencoba pembelajaran mesin untuk menentukan parameter yang lebih baik.

Meringkaskan

Strategi ini secara keseluruhan memiliki hasil yang baik dan memiliki beberapa nilai nyata. Namun, masih perlu pengujian dan penyesuaian lebih lanjut, terutama logika stop-loss.

Kode Sumber Strategi

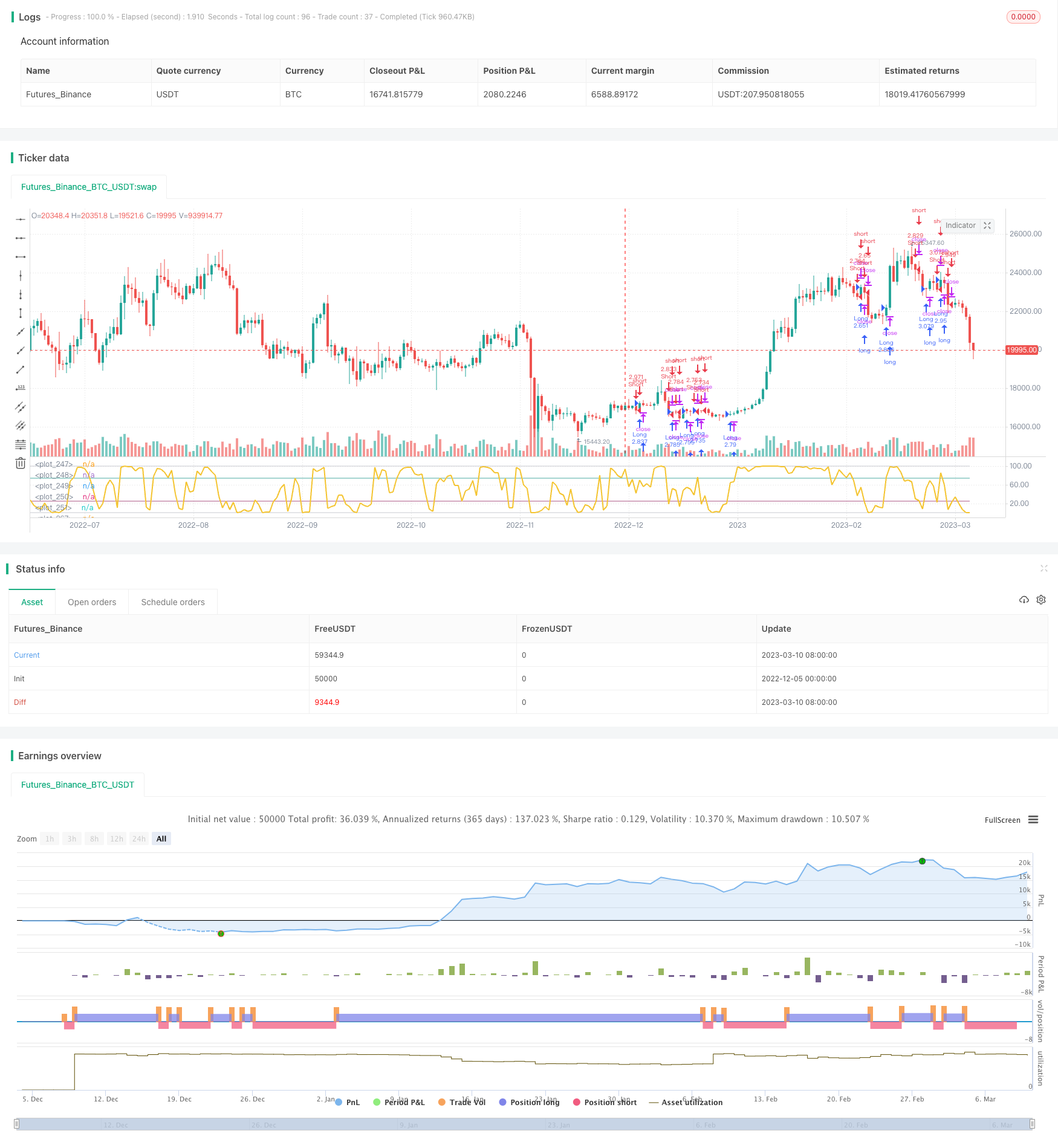

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//MIT License

//Copyright (c) 2019 user-Noldo

//Permission is hereby granted, free of charge, to any person obtaining a copy

//of this software and associated documentation files (the "Software"), to deal

//in the Software without restriction, including without limitation the rights

//to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

//copies of the Software, and to permit persons to whom the Software is

//furnished to do so, subject to the following conditions:

//The above copyright notice and this permission notice shall be included in all

//copies or substantial portions of the Software.

//THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

//IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

//FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

//AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

//LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

//OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE

//SOFTWARE.

strategy("Dow Factor RSI/MFI and Dependent Variable Odd Generator Strategy",shorttitle = "Dow_Factor RSI/MFI & DVOG Strategy", overlay = false, default_qty_type=strategy.percent_of_equity,commission_type=strategy.commission.percent, commission_value=0.125, default_qty_value=100 )

src = close

lights = input(title="Barcolor I / 0 ? ", options=["ON", "OFF"], defval="OFF")

method = input(title="METHOD", options=["MFI", "RSI"], defval="RSI")

length = input(5, minval=2,maxval = 14, title = "Strategy Period")

// Essential Functions

// Function Sum

f_sum(_src , _length) =>

_output = 0.00

_length_adjusted = _length < 1 ? 1 : _length

for i = 0 to _length_adjusted-1

_output := _output + _src[i]

f_sma(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

float _sum = 0

for _i = 0 to (_length_adjusted - 1)

_sum := _sum + _src[_i]

_return = _sum / _length_adjusted

// Unlocked Exponential Moving Average Function

f_ema(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

_multiplier = 2 / (_length_adjusted + 1)

_return = 0.00

_return := na(_return[1]) ? _src : ((_src - _return[1]) * _multiplier) + _return[1]

// Function Standard Deviation

f_stdev(_src,_length) =>

float _output = na

_length_adjusted = _length < 2 ? 2 : _length

_avg = f_ema(_src , _length_adjusted)

evar = (_src - _avg) * (_src - _avg)

evar2 = ((f_sum(evar,_length_adjusted))/_length_adjusted)

_output := sqrt(evar2)

// Linear Regression Channels :

f_pearson_corr(_src1, _src2, _length) =>

_length_adjusted = _length < 2 ? 2 : _length

_ema1 = f_ema(_src1, _length_adjusted)

_ema2 = f_ema(_src2, _length_adjusted)

isum = 0.0

for i = 0 to _length_adjusted - 1

isum := isum + (_src1[i] - _ema1) * (_src2[i] - _ema2)

isumsq1 = 0.0

for i = 0 to _length_adjusted - 1

isumsq1 := isumsq1 + pow(_src1[i] - _ema1, 2)

isumsq2 = 0.0

for i = 0 to _length_adjusted - 1

isumsq2 := isumsq2 + pow(_src2[i] - _ema2, 2)

pcc = isum/(sqrt(isumsq1*isumsq2))

pcc

// Dow Theory Cycles

dow_coeff = f_pearson_corr(src,volume,length)

dow_bull_factor = (1 + dow_coeff)

dow_bear_factor = (1 - dow_coeff)

// MONEY FLOW INDEX =====> FOR BULL OR BEAR MARKET (CLOSE)

upper_s = f_sum(volume * (change(src) <= 0 ? 0 : src), length)

lower_s = f_sum(volume * (change(src) >= 0 ? 0 : src), length)

_market_index = rsi(upper_s, lower_s)

// RSI (Close)

// Function RMA

f_rma(_src, _length) =>

_length_adjusted = _length < 1 ? 1 : _length

alpha = _length_adjusted

sum = 0.0

sum := (_src + (alpha - 1) * nz(sum[1])) / alpha

// Function Relative Strength Index (RSI)

f_rsi(_src, _length) =>

_output = 0.00

_length_adjusted = _length < 0 ? 0 : _length

u = _length_adjusted < 1 ? max(_src - _src[_length_adjusted], 0) : max(_src - _src[1] , 0) // upward change

d = _length_adjusted < 1 ? max(_src[_length_adjusted] - _src, 0) : max(_src[1] - _src , 0) // downward change

rs = f_rma(u, _length) / f_rma(d, _length)

res = 100 - 100 / (1 + rs)

res

_rsi = f_rsi(src, length)

// Switchable Method Codes

_method = 0.00

if (method=="MFI")

_method:= _market_index

if (method=="RSI")

_method:= _rsi

// Conditions

_bull_gross = (_method )

_bear_gross = (100 - _method )

_price_stagnant = ((_bull_gross * _bear_gross ) / 100)

_price_bull = (_bull_gross - _price_stagnant)

_price_bear = (_bear_gross - _price_stagnant)

_coeff_price = (_price_stagnant + _price_bull + _price_bear) / 100

_bull = _price_bull / _coeff_price

_bear = _price_bear / _coeff_price

_stagnant = _price_stagnant / _coeff_price

// Market Types with Dow Factor

_temp_bull_gross = _bull * dow_bull_factor

_temp_bear_gross = _bear * dow_bear_factor

// Addition : Odds with Stagnant Market

_coeff_normal = (_temp_bull_gross + _temp_bear_gross) / 100

// ********* OUR RSI / MFI VALUE ***********

_value = _temp_bull_gross / _coeff_normal

// Temporary Pure Odds

_temp_stagnant = ((_temp_bull_gross * _temp_bear_gross) / 100)

_temp_bull = _temp_bull_gross - _temp_stagnant

_temp_bear = _temp_bear_gross - _temp_stagnant

// Now we ll do venn scheme (Probability Cluster)

// Pure Bull + Pure Bear + Pure Stagnant = 100

// Markets will get their share in the Probability Cluster

_coeff = (_temp_stagnant + _temp_bull + _temp_bear) / 100

_odd_bull = _temp_bull / _coeff

_odd_bear = _temp_bear / _coeff

_odd_stagnant = _temp_stagnant / _coeff

_positive_condition = crossover (_value,50)

_negative_condition = crossunder(_value,50)

_stationary_condition = ((_odd_stagnant > _odd_bull ) and (_odd_stagnant > _odd_bear))

// Strategy

closePosition = _stationary_condition

if (_positive_condition)

strategy.entry("Long", strategy.long, comment="Long")

strategy.close(id = "Long", when = closePosition )

if (_negative_condition)

strategy.entry("Short", strategy.short, comment="Short")

strategy.close(id = "Short", when = closePosition )

// Plot Data

// Plotage

oversold = input(25 , type = input.integer , title = "Oversold")

overbought = input(75 , type = input.integer , title = "Overbought")

zero = 0

hundred = 100

limit = 50

// Plot Data

stagline = hline(limit , color=color.new(color.white,0) , linewidth=1, editable=false)

zeroline = hline(zero , color=color.new(color.silver,100), linewidth=0, editable=false)

hundredline = hline(hundred , color=color.new(color.silver,100), linewidth=0, editable=false)

oversoldline = hline(oversold , color=color.new(color.silver,100), linewidth=0, editable=false)

overboughtline = hline(overbought , color=color.new(color.silver,100), linewidth=0, editable=false)

// Filling Borders

fill(zeroline , oversoldline , color=color.maroon , transp=88 , title = "Oversold Area")

fill(oversoldline , stagline , color=color.red , transp=80 , title = "Bear Market")

fill(stagline , overboughtline , color=color.green , transp=80 , title = "Bull Market")

fill(overboughtline , hundredline , color=color.teal , transp=88 , title = "Overbought Market")

// Plot DOW Factor Methods

plot(_value, color = #F4C430 , linewidth = 2 , title = "DOW F-RSI" , transp = 0)

// Plot border lines

plot(oversold ,style = plot.style_line,color = color.new(color.maroon,30),linewidth = 1)

plot(overbought,style = plot.style_line,color = color.new(color.teal,30) ,linewidth = 1)

plot(zero ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

plot(hundred ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

// Switchable Barcolor ( On / Off)

_lights = 0.00

if (lights=="ON")

_lights:= 1.00

if (lights=="OFF")

_lights:= -1.00

bcolor_on = _lights == 1.00

bcolor_off = _lights == -1.00

barcolor((_positive_condition and bcolor_on) ? color.green : (_negative_condition and bcolor_on) ? color.red :

(_stationary_condition and bcolor_on) ? color.yellow : na)

// Alerts

alertcondition(_positive_condition , title='Strong Buy !', message='Strong Buy Signal ')

alertcondition(crossover(_value,overbought) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossover(_value,oversold) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossunder(_value,overbought) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(crossunder(_value,oversold) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(_negative_condition , title='Strong Sell !', message='Strong Sell Signal ')