Strategi Stop Loss Super Trend Following

Ringkasan

Strategi ini didasarkan pada indikator overtrend dan tracking stop loss untuk membuka posisi damai. Ini menggunakan 4 alarm untuk membuka posisi damai, dan menggunakan strategi overtrend. Strategi ini dirancang khusus untuk robot dan memiliki fungsi tracking stop loss.

Prinsip Strategi

Strategi ini menggunakan indikator ATR untuk menghitung uptrend dan downtrend. Strategi ini menghasilkan sinyal beli ketika harga penutupan menembus uptrend dan menghasilkan sinyal jual ketika harga penutupan menembus downtrend. Strategi ini juga menggunakan garis tren super untuk menilai arah tren.

Analisis Keunggulan

Strategi ini menggabungkan keuntungan dari indikator hypertrend untuk menentukan arah tren dan indikator ATR untuk menetapkan stop loss, yang dapat secara efektif menyaring false breakout. Tracking stop loss dapat dengan baik mengunci keuntungan dan mengurangi penarikan balik. Selain itu, strategi ini dirancang khusus untuk robot dan dapat mengotomatiskan perdagangan.

Analisis risiko

Indikator supertrend mudah menghasilkan lebih banyak sinyal palsu. Jika penyesuaian harga stop loss lebih besar, kemungkinan stop loss akan lebih tinggi. Selain itu, perdagangan robot juga menghadapi risiko teknis seperti server crash, gangguan jaringan.

Untuk mengurangi kemungkinan sinyal palsu, Anda dapat menyesuaikan parameter ATR atau menambahkan indikator lain untuk memfilter. Mengatur stop loss tracking amplitudo perlu menyeimbangkan keuntungan dan risiko. Bersiaplah untuk server dan jaringan cadangan untuk mencegah risiko kegagalan teknis.

Arah optimasi

Strategi ini dapat dioptimalkan dalam beberapa hal:

Tambahkan indikator atau kondisi untuk memfilter sinyal masuk, menghindari sinyal palsu. Misalnya, indikator MACD dapat ditambahkan.

Kombinasi parameter ATR yang berbeda dapat diuji untuk menemukan parameter yang optimal.

Anda dapat mengoptimalkan stop loss tracking untuk menemukan titik keseimbangan yang optimal.

Anda dapat menambahkan harga stop loss lebih banyak untuk stop loss batch.

Bisa membangun arsitektur dual server cadangan utama, dengan cepat beralih jika server utama gagal.

Meringkaskan

Strategi ini mengintegrasikan keuntungan dari indikator overtrend dan tracking stop loss, yang dapat mengotomatiskan pembukaan posisi dan stop loss. Pengembangan strategi ini digabungkan dengan pengoptimalan arah dalam real time, yang dapat menjadi strategi perdagangan kuantitatif yang sangat praktis.

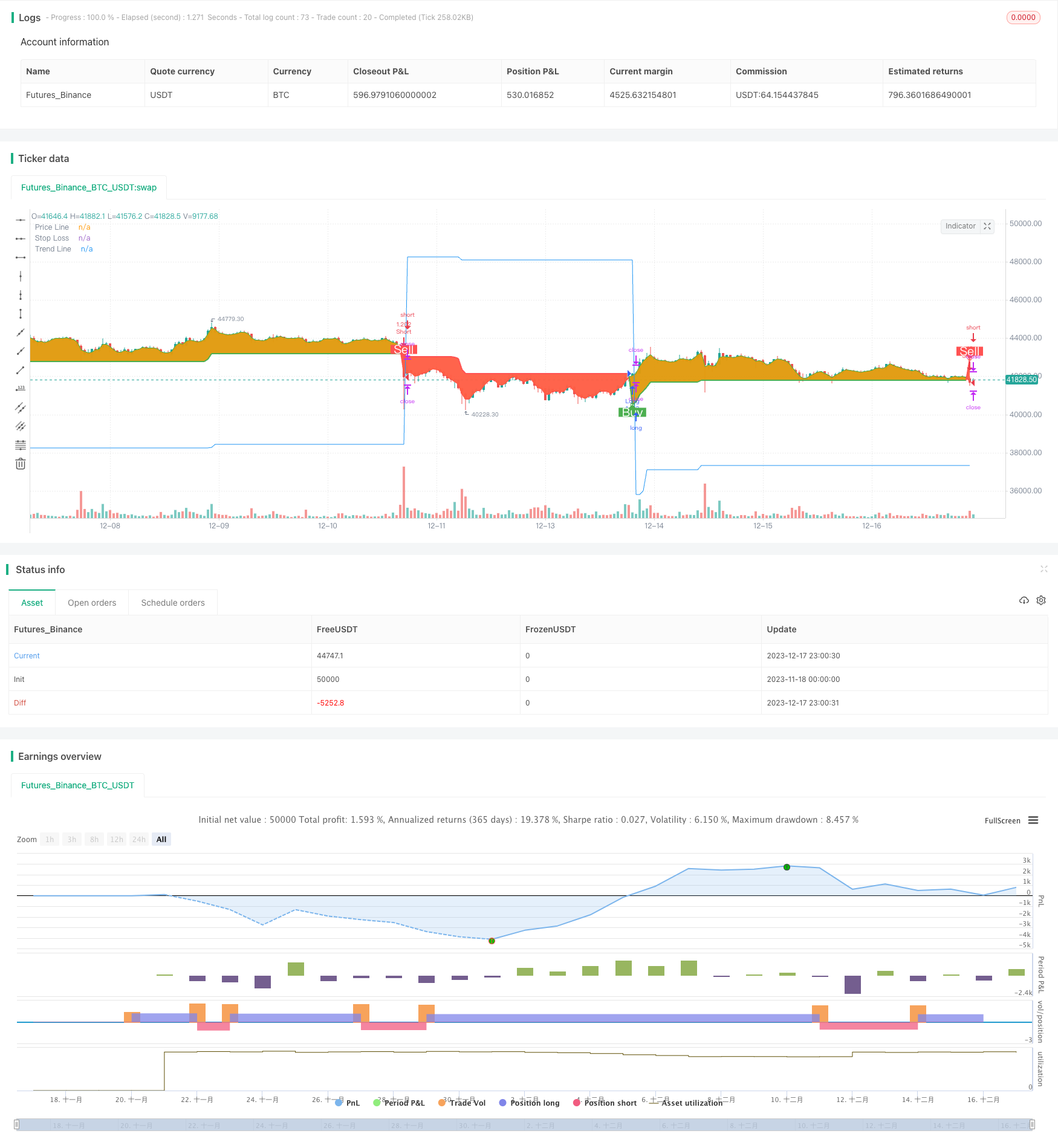

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © arminomid1375

//@version=5

strategy('Mizar_BOT_super trend', overlay=true, default_qty_value=100, currency=currency.USD, default_qty_type=strategy.percent_of_equity, initial_capital=100, max_bars_back=4000)

//===== INPUTS ==========================================================================//

factor = input.float(4.5, title='ATR Factor', step=0.1,group = 'ATR')

period = input.int(59, minval=1, maxval=100, title='ATR Period',group = 'ATR')

up = (high + low) / 2 - factor * ta.atr(period)

down = (high + low) / 2 + factor * ta.atr(period)

trend_up = 0.0

trend_up := close[1] > trend_up[1] ? math.max(up, trend_up[1]) : up

trend_down = 0.0

trend_down := close[1] < trend_down[1] ? math.min(down, trend_down[1]) : down

trend = 0.0

trend := close > trend_down[1] ? 1 : close < trend_up[1] ? -1 : nz(trend[1], 1)

tsl = trend == 1 ? trend_up : trend_down

line_color = trend == 1 ? 'green' : 'red'

long_signal = trend == 1 and trend[1] == -1

short_signal = trend == -1 and trend[1] == 1

background = true

//ss = input.float(defval=15.0, minval=0.0, title=' stop loss %',group = 'stop loss')

use_sl = input(title='trailing stop ?', defval=true,group = 'stop loss')

initial_sl_pct = input.float(defval=15.0, minval=0.0, title='trailing stop %',group = 'stop loss')

Tpactive1 = input(title='Take profit1 On/Off ?', defval=true, group='take profit')

tp1percent = input.float(5.0, title='TP1 %', group='take profit') *100

tp1amt = input.int(10, title='TP1 Amount %', group='take profit')

Tpactive2 = input(title='Take profit2 On/Off ?', defval=true, group='take profit')

tp2percent = input.float(10, title='TP2 %', group='take profit') *100

tp2amt = input.int(15, title='TP2 Amount %', group='take profit')

Tpactive3 = input(title='Take profit3 On/Off ?', defval=true, group='take profit')

tp3percent = input.float(15, title='TP3 %', group='take profit')*100

tp3amt = input.int(20, title='TP3 Amount %', group='take profit')

//===== TIMEFRAME ==========================================================================//

from_month = input.int(defval=1, title='From Month', minval=1, maxval=12)

from_day = input.int(defval=1, title='From Day', minval=1, maxval=31)

from_year = input.int(defval=2019, title='From Year', minval=2017)

to_month = input.int(defval=1, title='To Month', minval=1, maxval=12)

to_day = input.int(defval=1, title='To Day', minval=1, maxval=31)

to_year = input.int(defval=9999, title='To Year', minval=2017)

start = timestamp(from_year, from_month, from_day, 00, 00)

finish = timestamp(to_year, to_month, to_day, 23, 59)

window() =>

time >= start and time <= finish ? true : false

//===== PLOTS ==========================================================================//

// Line

line_plot = plot(tsl, color=trend == 1 ? color.green : color.red, linewidth=2, title='Trend Line')

// Labels

plotshape(long_signal and window() ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.normal, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

plotshape(short_signal and window() ? down : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.normal, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// Circles

plotshape(long_signal and window() ? up : na, title='Uptrend starts', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(short_signal and window() ? down : na, title='Downtrend starts', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// Background

long_fill = background ? trend == 1 ? color.green : na : na

short_fill = background ? trend == -1 ? color.red : na : na

candle_plot = plot(ohlc4, title='Price Line', color=trend == 1 ? long_fill : short_fill, linewidth=2, transp=90)

fill(candle_plot, line_plot, title='Long Background', color=long_fill, transp=90)

fill(candle_plot, line_plot, title='Short Background', color=short_fill, transp=90)

//===== GLOBAL ==========================================================================//

var entry_price = 0.0

var updated_entry_price = 0.0

var sl_price = 0.0

longString = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

longclose = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

shortString = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

shortclose = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

longAlertMessage = input(title="Long Alert Message", defval="long", group="Alert Messages", tooltip=longString)

longcloseAlertMessage = input(title="Long close Alert Message", defval="long", group="Alert Messages", tooltip=longclose)

shortAlertMessage = input(title="Short Alert Message", defval="short", group="Alert Messages", tooltip=shortString)

shortcloseAlertMessage = input(title="Short close Alert Message", defval="short", group="Alert Messages", tooltip=shortclose)

has_open_trade() =>

strategy.position_size != 0

has_no_open_trade() =>

strategy.position_size == 0

is_long() =>

strategy.position_size > 0 ? true : false

is_short() =>

strategy.position_size < 0 ? true : false

plot(use_sl ? has_no_open_trade() ? close : sl_price : na, color=has_no_open_trade() ? na : color.blue, title='Stop Loss')

strategy_close() =>

if is_long()

strategy.close('Long')

alert(longcloseAlertMessage)

if is_short()

strategy.close('Short')

alert(shortcloseAlertMessage)

strategy_long() =>

strategy.entry('Long', strategy.long)

strategy_short() =>

strategy.entry('Short', strategy.short)

sl_pct = initial_sl_pct

if long_signal or is_long() and not(short_signal or is_short())

sl_pct := initial_sl_pct * -1

sl_pct

//===== STRATEGY ==========================================================================//

crossed_sl = false

if is_long() and use_sl

crossed_sl := close <= sl_price

crossed_sl

if is_short() and use_sl

crossed_sl := close >= sl_price

crossed_sl

terminate_operation = window() and has_open_trade() and crossed_sl

if terminate_operation and not(long_signal or short_signal) // Do not close position if trend is flipping anyways.

entry_price := 0.0

updated_entry_price := entry_price

sl_price := 0.0

strategy_close()

start_operation = window() and (long_signal or short_signal)

if start_operation

entry_price := close

updated_entry_price := entry_price

sl_price := entry_price + entry_price * sl_pct / 100

if long_signal

strategy_long()

if Tpactive1==true

strategy.exit('TPL1','Long', qty_percent=tp1amt,profit =tp1percent)

alert(shortcloseAlertMessage)

alert(longAlertMessage)

if short_signal

strategy_short()

if Tpactive1==true

strategy.exit('TPL1','Short', qty_percent=tp1amt,profit =tp1percent)

alert(longcloseAlertMessage)

alert(shortAlertMessage)

//===== TRAILING ==========================================================================//

if is_long() and use_sl

strategy_pct = (close - updated_entry_price) / updated_entry_price * 100.00

if strategy_pct > 1

sl_pct += strategy_pct - 1.0

new_sl_price = updated_entry_price + updated_entry_price * sl_pct / 100

sl_price := math.max(sl_price, new_sl_price)

updated_entry_price := sl_price

updated_entry_price

if is_short() and use_sl

strategy_pct = (close - updated_entry_price) / updated_entry_price * 100.00

if strategy_pct < -1

sl_pct += strategy_pct + 1.0

new_sl_price = updated_entry_price + updated_entry_price * sl_pct / 100

sl_price := math.min(sl_price, new_sl_price)

updated_entry_price := sl_price

updated_entry_price