Strategi Rata-rata Pergerakan Stokastik Momentum yang Dihaluskan

Ringkasan

Strategi ini menggabungkan indeks moving average (EMA) dengan stochastic oscillator (Oscillator Stochastic) untuk mengikuti dan melanjutkan tren, dan memiliki beberapa fitur yang sangat keren. Saya membuat strategi ini khusus untuk perdagangan alternatif, tetapi ini juga berlaku untuk Bitcoin sendiri dan beberapa pasangan mata uang asing.

Prinsip Strategi

Strategi ini memiliki 4 persyaratan untuk membuka sinyal perdagangan. Berikut adalah persyaratan untuk membuka beberapa perdagangan (sinyal posisi kosong adalah kebalikannya):

- EMA cepat lebih tinggi dari EMA lambat

- Garis K acak berada di zona overbought

- Garis K acak melewati garis D acak ke atas

- Harga ditutup di antara EMA lambat dan EMA cepat

Setelah semua kondisi benar, maka K baris berikutnya akan dibuka.

Analisis Keunggulan

Strategi ini menggabungkan keunggulan dari EMA dan indikator acak, mampu secara efektif menangkap awal dan kelanjutan dari tren, cocok untuk operasi garis panjang tengah. Strategi ini juga menyediakan berbagai parameter yang dapat disesuaikan, yang dapat disesuaikan oleh pengguna sesuai dengan gaya perdagangan dan karakteristik pasar mereka sendiri.

Secara khusus, keuntungan dari strategi ini adalah:

- EMA menyeberang arah tren, meningkatkan stabilitas dan keandalan sinyal

- Indikator acak untuk melihat apakah ada overbought atau oversold, dan mencari peluang untuk membalikkannya

- Kombinasi dari dua indikator, trend following dan countertrading

- ATR secara otomatis menghitung jarak stop loss, stop loss disesuaikan dengan volatilitas pasar

- Rasio RR yang dapat disesuaikan untuk memenuhi kebutuhan pengguna yang berbeda

- Berbagai parameter yang dapat disesuaikan dengan pasar

Analisis risiko

Risiko utama dari strategi ini berasal dari:

- Sinyal yang terbentuk pada EMA silang dapat mengalami false breakout, sehingga menghasilkan sinyal yang salah

- Indikator acak sendiri tertunda, mungkin kehilangan titik waktu terbaik untuk membalikkan harga

- Strategi tunggal tidak dapat sepenuhnya beradaptasi dengan lingkungan pasar yang berubah

Untuk mengurangi risiko tersebut, langkah-langkah berikut dapat diambil:

- Sesuai menyesuaikan parameter siklus EMA untuk menghindari terlalu banyak sinyal palsu

- Menggabungkan lebih banyak indikator untuk menilai tren dan dukungan, untuk memastikan sinyal perdagangan yang dapat diandalkan

- Membuat strategi manajemen dana yang jelas dan mengendalikan risiko setiap transaksi

- Strategi komposit yang digunakan untuk saling memverifikasi sinyal dan meningkatkan stabilitas

Arah optimasi

Strategi ini dapat dioptimalkan lebih lanjut dalam beberapa hal:

- Tambahkan modul penyesuaian posisi berdasarkan volatilitas. Kurangi posisi dengan tepat ketika pasar berfluktuasi; Bila volatilitas melemah, posisi dapat ditingkatkan.

- Meningkatkan penilaian terhadap tren tingkat besar, menghindari operasi berlawanan. Misalnya, kombinasi garis K harian atau mingguan untuk menilai arah tren.

- Menambahkan model pembelajaran mesin untuk menilai sinyal jual beli. Dapat melatih model klasifikasi berdasarkan data historis untuk membantu menghasilkan sinyal perdagangan.

- Optimalkan modul strategi manajemen dana untuk membuat Stop Loss dan Position Size lebih cerdas.

Meringkaskan

Strategi ini mengintegrasikan keuntungan dari mengikuti tren dan perdagangan reversal, baik mempertimbangkan lingkungan pasar tingkat besar, dan memperhatikan perilaku harga saat ini, adalah strategi yang efektif yang layak untuk melacak real-time jangka panjang. Dengan terus mengoptimalkan parameter pengaturan, meningkatkan modul penilaian tren, dan lain-lain, kinerja strategi ini juga memiliki ruang untuk peningkatan yang besar, layak untuk menginvestasikan lebih banyak energi penelitian dan pengembangan.

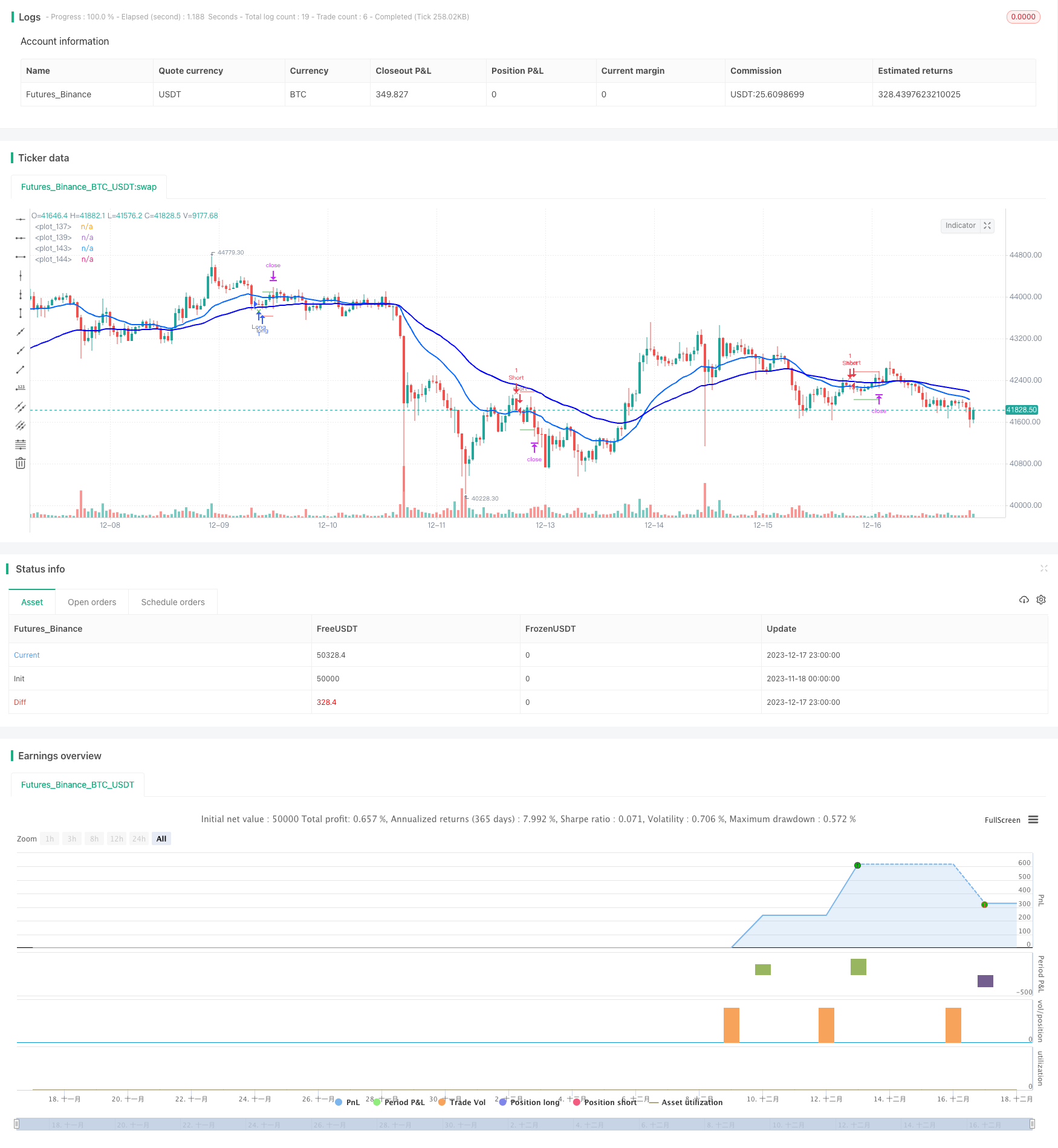

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LucasVivien

// Since this Strategy may have its stop loss hit within the opening candle, consider turning on 'Recalculate : After Order is filled' in the strategy settings, in the "Properties" tabs

//@version=5

strategy("Stochastic Moving Average", shorttitle="Stoch. EMA", overlay=true, default_qty_type= strategy.cash, initial_capital=10000, default_qty_value=100)

//==============================================================================

//============================== USER INPUT ================================

//==============================================================================

var g_tradeSetup = " Trade Setup"

activateLongs = input.bool (title="Long Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

activateShorts = input.bool (title="Short Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

rr = input.float(title="Risk : Reward" , defval=1 , minval=0, maxval=100 , step=0.1, inline="" , group=g_tradeSetup, tooltip="")

RiskEquity = input.bool (title="Risk = % Equity ", defval=false , inline="A2", group=g_tradeSetup, tooltip="Set stop loss size as a percentage of 'Initial Capital' -> Strategy Parameter -> Properties tab (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskPrctEqui = input.float(title="" , defval=1 , minval=0, maxval=100 , step=0.1, inline="A2", group=g_tradeSetup, tooltip="")

RiskUSD = input.bool (title="Risk = $ Amount " , defval=false , inline="A3", group=g_tradeSetup, tooltip="Set stop loss size as a fixed Base currency amount (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskUSD = input.float(title="" , defval=1000, minval=0, maxval=1000000000, step=100, inline="A3", group=g_tradeSetup, tooltip="")

var g_stopLoss = " Stop Loss"

atrMult = input.float(title="ATR Multiplier", defval=1 , minval=0, maxval=100 , step=0.1, tooltip="", inline="", group=g_stopLoss)

atrLen = input.int (title="ATR Lookback" , defval=14, minval=0, maxval=1000, step=1 , tooltip="", inline="", group=g_stopLoss)

var g_stochastic = " Stochastic"

Klen = input.int (title="K%" , defval=14, minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

Dlen = input.int (title=" D%" , defval=3 , minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

OBstochLvl = input.int (title="OB" , defval=80, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OSstochLvl = input.int (title=" OS" , defval=20, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OBOSlookback = input.int (title="Stoch. OB/OS lookback", defval=0 , minval=0, maxval=100 , step=1, inline="" , group=g_stochastic, tooltip="This option allow to look 'x' bars back for a value of the Stochastic K line to be overbought or oversold when detecting an entry signal (if 0, looks only at current bar. if 1, looks at current and previous and so on)")

OBOSlookbackAll = input.bool (title="All must be OB/OS" , defval=false , inline="" , group=g_stochastic, tooltip="If turned on, all bars within the Stochastic K line lookback period must be overbought or oversold to return a true signal")

entryColor = input.color(title=" " , defval=#00ffff , inline="S3", group=g_stochastic, tooltip="")

baseColor = input.color(title=" " , defval=#333333 , inline="S3", group=g_stochastic, tooltip="Will trun to designated color when stochastic gets to opposite extrem zone of current trend / Number = transparency")

transp = input.int (title=" " , defval=50, minval=0, maxval=100, step=10, inline="S3", group=g_stochastic, tooltip="")

var g_ema = " Exp. Moving Average"

ema1len = input.int (title="Fast EMA ", defval=21, minval=0, maxval=1000, step=1, inline="E1", group=g_ema, tooltip="")

ema2len = input.int (title="Slow EMA ", defval=50, minval=0, maxval=1000, step=1, inline="E2", group=g_ema, tooltip="")

ema1col = input.color(title=" " , defval=#0066ff , inline="E1", group=g_ema, tooltip="")

ema2col = input.color(title=" " , defval=#0000ff , inline="E2", group=g_ema, tooltip="")

var g_referenceMarket =" Reference Market"

refMfilter = input.bool (title="Reference Market Filter", defval=false , inline="", group=g_referenceMarket)

market = input (title="Market" , defval="BTC_USDT:swap", inline="", group=g_referenceMarket)

res = input.timeframe(title="Timeframe" , defval="30" , inline="", group=g_referenceMarket)

len = input.int (title="EMA Length" , defval=50 , inline="", group=g_referenceMarket)

//==============================================================================

//========================== FILTERS & SIGNALS =============================

//==============================================================================

//------------------------------ Stochastic --------------------------------

K = ta.stoch(close, high, low, Klen)

D = ta.sma(K, Dlen)

stochBullCross = ta.crossover(K, D)

stochBearCross = ta.crossover(D, K)

OSstoch = false

OBstoch = false

for i = 0 to OBOSlookback

if K[i] < OSstochLvl

OSstoch := true

else

if OBOSlookbackAll

OSstoch := false

for i = 0 to OBOSlookback

if K[i] > OBstochLvl

OBstoch := true

else

if OBOSlookbackAll

OBstoch := false

//---------------------------- Moving Averages -----------------------------

ema1 = ta.ema(close, ema1len)

ema2 = ta.ema(close, ema2len)

emaBull = ema1 > ema2

emaBear = ema1 < ema2

//---------------------------- Price source --------------------------------

bullRetraceZone = (close < ema1 and close >= ema2)

bearRetraceZone = (close > ema1 and close <= ema2)

//--------------------------- Reference market -----------------------------

ema = ta.ema(close, len)

emaHTF = request.security(market, res, ema [barstate.isconfirmed ? 0 : 1])

closeHTF = request.security(market, res, close[barstate.isconfirmed ? 0 : 1])

bullRefMarket = (closeHTF > emaHTF or closeHTF[1] > emaHTF[1])

bearRefMarket = (closeHTF < emaHTF or closeHTF[1] < emaHTF[1])

//-------------------------- SIGNAL VALIDATION -----------------------------

validLong = stochBullCross and OSstoch and emaBull and bullRetraceZone

and activateLongs and (refMfilter ? bullRefMarket : true) and strategy.position_size == 0

validShort = stochBearCross and OBstoch and emaBear and bearRetraceZone

and activateShorts and (refMfilter ? bearRefMarket : true) and strategy.position_size == 0

//==============================================================================

//=========================== STOPS & TARGETS ==============================

//==============================================================================

SLdist = ta.atr(atrLen) * atrMult

longSL = close - SLdist

longSLDist = close - longSL

longTP = close + (longSLDist * rr)

shortSL = close + SLdist

shortSLDist = shortSL - close

shortTP = close - (shortSLDist * rr)

var SLsaved = 0.0

var TPsaved = 0.0

if validLong or validShort

SLsaved := validLong ? longSL : validShort ? shortSL : na

TPsaved := validLong ? longTP : validShort ? shortTP : na

//==============================================================================

//========================== STRATEGY COMMANDS =============================

//==============================================================================

if validLong

strategy.entry("Long", strategy.long,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/longSLDist : RiskUSD ? riskUSD/longSLDist : na)

if validShort

strategy.entry("Short", strategy.short,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/shortSLDist : RiskUSD ? riskUSD/shortSLDist : na)

strategy.exit(id="Long Exit" , from_entry="Long" , limit=TPsaved, stop=SLsaved, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=TPsaved, stop=SLsaved, when=strategy.position_size < 0)

//==============================================================================

//============================= CHART PLOTS ================================

//==============================================================================

//---------------------------- Stops & Targets -----------------------------

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? SLsaved : na,

color=color.red , style=plot.style_linebr)

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? TPsaved : na,

color=color.green, style=plot.style_linebr)

//--------------------------------- EMAs -----------------------------------

l1 = plot(ema1, color=#0066ff, linewidth=2)

l2 = plot(ema2, color=#0000ff, linewidth=2)

//-------------------------- Stochastic gradient ---------------------------

// fill(l1, l2, color.new(color.from_gradient(K, OSstochLvl, OBstochLvl,

// emaBull ? entryColor : emaBear ? baseColor : na,

// emaBull ? baseColor : emaBear ? entryColor : na), transp))

//---------------------------- Trading Signals -----------------------------

plotshape(validLong, color=color.green, location=location.belowbar, style=shape.xcross, size=size.small)

plotshape(validShort, color=color.red , location=location.abovebar, style=shape.xcross, size=size.small)

//---------------------------- Reference Market ----------------------------

bgcolor(bullRefMarket and refMfilter ? color.new(color.green,90) : na)

bgcolor(bearRefMarket and refMfilter ? color.new(color.red ,90) : na)