Strategi perdagangan kuantitatif MACD terbalik jalur ganda

Ringkasan

Strategi ini adalah strategi perdagangan kuantitatif MACD reverse biner. Strategi ini mengambil dari indikator teknis yang dijelaskan oleh William Blau dalam bukunya, Momentum, Direction and Divergence, dan dikembangkan berdasarkannya. Strategi ini juga memiliki fungsi feedback, yang dapat ditambahkan dengan fungsi tambahan seperti alarm, filter, dan tracking stop loss.

Prinsip Strategi

Indikator inti dari strategi ini adalah MACD. Strategi ini menghitung EMA bergerak cepat ® dan EMA bergerak lambat (slowMALen) dan kemudian menghitung diferensial mereka xmacd. Di samping itu, menghitung EMA (signalLength) dari xmacd mendapatkan xMA_MACD.

Selain itu, strategi ini juga memperkenalkan filter tren. Jika ada filter tren bullish yang dikonfigurasi, harga akan terdeteksi jika ada kenaikan saat sinyal berganda; Demikian pula, sinyal shorting akan mendeteksi tren harga turun. Indikator RSI dan indikator MFI juga dapat digunakan untuk memfilter konfigurasi sinyal.

Analisis Keunggulan

Keuntungan terbesar dari strategi ini adalah fitur pengembalian yang kuat. Anda dapat memilih varietas perdagangan yang berbeda, mengatur rentang waktu pengembalian, dan mengoptimalkan strategi untuk data varietas tertentu. Dibandingkan dengan strategi MACD sederhana, ini meningkatkan penilaian tren, overbought dan oversold, dan dapat menyaring beberapa sinyal thunderbolt.

Analisis risiko

Risiko dari strategi ini terutama berasal dari pemikiran tentang perdagangan terbalik. Meskipun sinyal terbalik dapat memperoleh beberapa peluang, itu juga berarti mengorbankan beberapa titik jual beli MACD tradisional, yang perlu dinilai dengan hati-hati. Selain itu, MACD sendiri rentan terhadap masalah sinyal palsu bertingkat.

Untuk mengurangi risiko, parameter dapat disesuaikan dengan tepat, mengoptimalkan panjang rata-rata bergerak; Kombinasi dengan filter tren dan indikator, untuk menghindari sinyal di pasar yang bergoyang; Tingkatkan jarak stop loss dengan tepat, untuk memastikan kendali kerugian perdagangan individu.

Arah optimasi

Strategi ini dapat dioptimalkan dalam beberapa hal:

- Menyesuaikan parameter tren cepat dan lambat, mengoptimalkan panjang rata-rata bergerak, menguji data varietas tertentu untuk menemukan kombinasi parameter yang optimal

- Menambahkan atau menyesuaikan filter tren untuk menilai apakah ada peningkatan dalam tingkat pengembalian strategi berdasarkan hasil pengembalian

- Uji coba mekanisme stop loss yang berbeda, apakah stop loss tetap atau stop loss tracking

- Cobalah untuk mengkombinasikan indikator lain seperti KD, Brinband, dan lain-lain untuk mengatur kondisi penyaringan yang lebih baik untuk memastikan kualitas sinyal.

Meringkaskan

Strategi kuantitatif MACD inverse dual track mengambil ide dari indikator MACD klasik, dan dikembangkan dan ditingkatkan berdasarkan itu. Strategi ini memiliki konfigurasi parameter yang fleksibel, pilihan mekanisme penyaringan yang kaya, dan fitur pengembalian yang kuat. Ini memungkinkan pengoptimalan yang dipersonalisasi untuk varietas perdagangan yang berbeda, dan merupakan strategi perdagangan kuantitatif yang berpotensi untuk dieksplorasi.

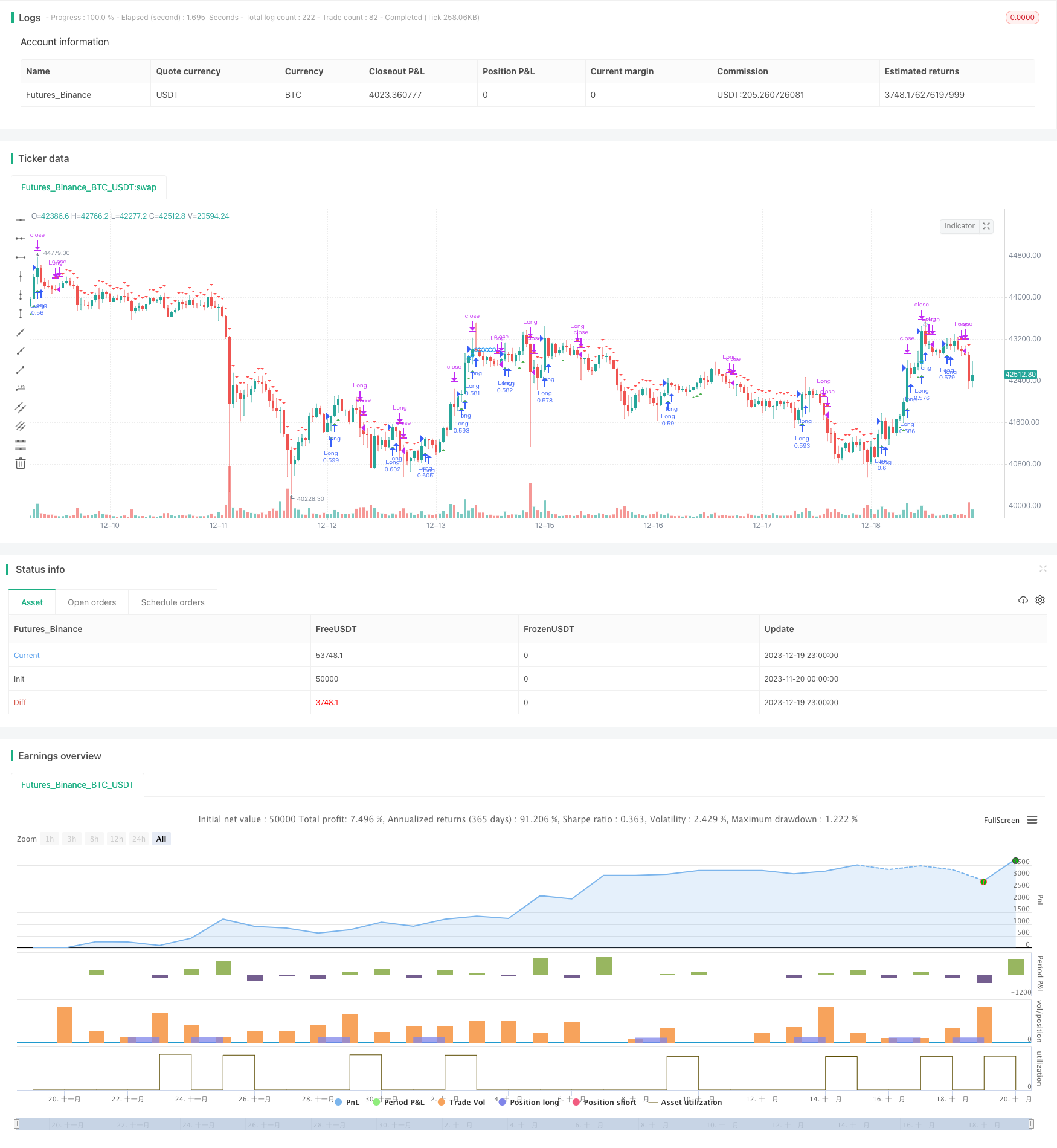

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 09/12/2016

// This is one of the techniques described by William Blau in his book

// "Momentum, Direction and Divergence" (1995). If you like to learn more,

// we advise you to read this book. His book focuses on three key aspects

// of trading: momentum, direction and divergence. Blau, who was an electrical

// engineer before becoming a trader, thoroughly examines the relationship

// between price and momentum in step-by-step examples. From this grounding,

// he then looks at the deficiencies in other oscillators and introduces some

// innovative techniques, including a fresh twist on Stochastics. On directional

// issues, he analyzes the intricacies of ADX and offers a unique approach to help

// define trending and non-trending periods.

// Blau`s indicator is like usual MACD, but it plots opposite of meaningof

// stndard MACD indicator.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

//

//

// 2018-09 forked by Khalid Salomão

// - Backtesting

// - Added filters: RSI, MFI, Price trend

// - Trailing Stop Loss

// - Other minor adjustments

//

////////////////////////////////////////////////////////////

strategy(title="Ergotic MACD Backtester [forked from HPotter]", shorttitle="Ergotic MACD Backtester", overlay=true, pyramiding=0, default_qty_type=strategy.cash, default_qty_value=25000, initial_capital=50000, commission_type=strategy.commission.percent, commission_value=0.15, slippage=3)

// === BACKTESTING: INPUT BACKTEST RANGE ===

source = input(close)

strategyType = input(defval="Long Only", options=["Long & Short", "Long Only", "Short Only"])

FromMonth = input(defval = 7, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2030, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => true // window of time verification

// === STRATEGY ===

r = input(144, minval=1, title="R (32,55,89,100,144,200)") // default 32

slowMALen = input(6, minval=1) // default 32

signalLength = input(6, minval=1)

reverse = input(false, title="Trade reverse (long/short switch)")

//hline(0, color=blue, linestyle=line)

fastMA = ema(source, r)

slowMA = ema(source, slowMALen)

xmacd = fastMA - slowMA

xMA_MACD = ema(xmacd, signalLength)

pos = 0

pos := iff(xmacd < xMA_MACD, 1,

iff(xmacd > xMA_MACD, -1, nz(pos[1], 0)))

possig = 0

possig := iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

// === FILTER: price trend ====

trending_price_long = input(true, title="Long only if price has increased" )

trending_price_short = input(false, title="Short only if price has decreased" )

trending_price_length = input( 2, minval=1 )

trending_price_with_ema = input( false )

trending_price_ema = input( 3, minval=1 )

price_trend = trending_price_with_ema ? ema(source, trending_price_ema) : source

priceLongTrend() => (trending_price_long ? rising(price_trend, trending_price_length) : true)

priceShortTrend() => (trending_price_short ? falling(price_trend, trending_price_length) : true)

// === FILTER: RSI ===

rsi_length = input( 14, minval=1 )

rsi_overSold = input( 14, minval=0, title="RSI Sell Cutoff (Sell only if >= #)" )

rsi_overBought = input( 82, minval=0, title="RSI Buy Cutoff (Buy only if <= #)" )

vrsi = rsi(source, rsi_length)

rsiOverbought() => vrsi > rsi_overBought

rsiOversold() => vrsi < rsi_overSold

trending_rsi_long = input(false, title="Long only if RSI has increased" )

trending_rsi_length = input( 2 )

rsiLongTrend() => trending_rsi_long ? rising(vrsi, trending_rsi_length) : true

// === FILTER: MFI ===

mfi_length = input(14, minval=1)

mfi_lower = input(14, minval=0, maxval=50)

mfi_upper = input(82, minval=50, maxval=100)

upper_s = sum(volume * (change(source) <= 0 ? 0 : source), mfi_length)

lower_s = sum(volume * (change(source) >= 0 ? 0 : source), mfi_length)

mf = rsi(upper_s, lower_s)

mfiOverbought() => (mf > mfi_upper)

mfiOversold() => (mf < mfi_lower)

trending_mfi_long = input(false, title="Long only if MFI has increased" )

trending_mfi_length = input( 2 )

mfiLongTrend() => trending_mfi_long ? rising(mf, trending_mfi_length) : true

// === SIGNAL CALCULATION ===

long = window() and possig == 1 and rsiLongTrend() and mfiLongTrend() and not rsiOverbought() and not mfiOverbought() and priceLongTrend()

short = window() and possig == -1 and not rsiOversold() and not mfiOversold() and priceShortTrend()

// === trailing stop

tslSource=input(hlc3,title="TSL source")

//suseCurrentRes = input(true, title="Use current chart resolution for stop trigger?")

tslResolution = input(title="Use different timeframe for stop trigger? Uncheck box above.", defval="5")

tslTrigger = input(3.0) / 100

tslStop = input(0.6) / 100

currentPrice = request.security(syminfo.tickerid, tslResolution, tslSource, barmerge.gaps_off, barmerge.lookahead_off)

isLongOpen = false

isLongOpen := nz(isLongOpen[1], false)

entryPrice=0.0

entryPrice:= nz(entryPrice[1], 0.0)

trailPrice=0.0

trailPrice:=nz(trailPrice[1], 0.0)

// update TSL high mark

if (isLongOpen )

if (not trailPrice and currentPrice >= entryPrice * (1 + tslTrigger))

trailPrice := currentPrice

else

if (trailPrice and currentPrice > trailPrice)

trailPrice := currentPrice

if (trailPrice and currentPrice <= trailPrice * (1 - tslStop))

// FIRE TSL SIGNAL

short:=true // <===

long := false

// if short clean up

if (short)

isLongOpen := false

entryPrice := 0.0

trailPrice := 0.0

if (long)

isLongOpen := true

if (not entryPrice)

entryPrice := currentPrice

// === BACKTESTING: ENTRIES ===

if long

if (strategyType == "Short Only")

strategy.close("Short")

else

strategy.entry("Long", strategy.long, comment="Long")

if short

if (strategyType == "Long Only")

strategy.close("Long")

else

strategy.entry("Short", strategy.short, comment="Short")

//barcolor(possig == -1 ? red: possig == 1 ? green : blue )

//plot(xmacd, color=green, title="Ergotic MACD")

//plot(xMA_MACD, color=red, title="SigLin")

plotshape(trailPrice ? trailPrice : na, style=shape.circle, location=location.absolute, color=blue, size=size.tiny)

plotshape(long, style=shape.triangleup, location=location.belowbar, color=green, size=size.tiny)

plotshape(short, style=shape.triangledown, location=location.abovebar, color=red, size=size.tiny)

// === Strategy Alert ===

alertcondition(long, title='BUY - Ergotic MACD Long Entry', message='Go Long!')

alertcondition(short, title='SELL - Ergotic MACD Long Entry', message='Go Short!')

// === BACKTESTING: EXIT strategy ===

sl_inp = input(7, title='Stop Loss %', type=float)/100

tp_inp = input(1.8, title='Take Profit %', type=float)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

strategy.exit("Stop Loss/Profit", "Long", stop=stop_level, limit=take_level)