Strategi Robot HTF MACD MFI Skalabel Non-Pengecatan Ulang Kustom

Ringkasan

Strategi ini adalah strategi kombinasi dari indikator MACD dan MFI yang sangat disesuaikan yang tidak digambar ulang untuk robot perdagangan algoritmik. Ini menggabungkan indikator tren dan indikator momentum untuk menghasilkan sinyal perdagangan melalui beberapa filter.

Prinsip Strategi

Strategi ini menggunakan indikator MACD untuk menentukan arah tren pasar. MACD adalah indikator momentum yang mengikuti tren, yang diperoleh dari garis rata-rata bergerak cepat dikurangi dengan garis rata-rata bergerak lambat.

Selain itu, strategi ini juga menggunakan indikator MFI untuk menilai kondisi overbought dan oversold di pasar. Indikator MFI menggabungkan informasi harga dan volume transaksi, dengan nilai berfluktuasi antara 0 dan 100. MFI di bawah 20 adalah zona oversold, di atas 80 adalah zona oversold.

Untuk memfilter sinyal palsu, strategi ini juga menambahkan filter tren dan filter RSI. Sinyal beli dihasilkan ketika harga berada di bawah tren naik dan RSI lebih kecil dari batas yang ditetapkan.

Keunggulan Strategis

- Menggabungkan beberapa indikator untuk menilai kondisi pasar secara menyeluruh, meningkatkan tingkat kemenangan

- Menambahkan mekanisme filter untuk menghindari sinyal palsu dan mengurangi transaksi yang tidak perlu

- Berbagai parameter dan filter dapat dikonfigurasi sesuai dengan varietas dan preferensi perdagangan

- Dapat digunakan untuk transaksi manual, atau dapat menghubungkan robot algoritma untuk transaksi terprogram

Risiko Strategis dan Solusi

Pengaturan parameter indikator yang tidak tepat dapat menghasilkan sinyal palsu

Dapat menguji berbagai parameter, memilih kombinasi parameter optimal

Parameter multi-varietas tidak berlaku, perlu pengujian dan optimasi secara terpisah

Frekuensi transaksi mungkin terlalu tinggi, meningkatkan biaya transaksi dan risiko slippage

Filter yang dapat disesuaikan untuk mengurangi frekuensi transaksi

Perhatikan pengendalian biaya saat bertransaksi secara langsung

Arah optimasi strategi

- Uji siklus data yang lebih lama untuk menilai stabilitas parameter

- Mencoba kombinasi parameter indikator yang berbeda

- Optimalkan Berat Indikator dan Meningkatkan Stabilitas Strategi

- Menambahkan lebih banyak filter untuk mengurangi transaksi yang tidak perlu

Meringkaskan

Strategi ini adalah strategi jenis trend tracking yang sangat disesuaikan, yang menggabungkan indikator tren dan dinamika untuk menilai kondisi pasar, dan secara efektif menggunakan mekanisme filter untuk mengendalikan risiko. Ini dapat digunakan untuk perdagangan manual, tetapi juga dapat menghubungkan robot algoritma untuk mencapai tingkat otomatisasi yang tinggi dalam perdagangan terprogram, dan merupakan sistem strategi yang layak untuk dipantau dan dioptimalkan untuk jangka panjang.

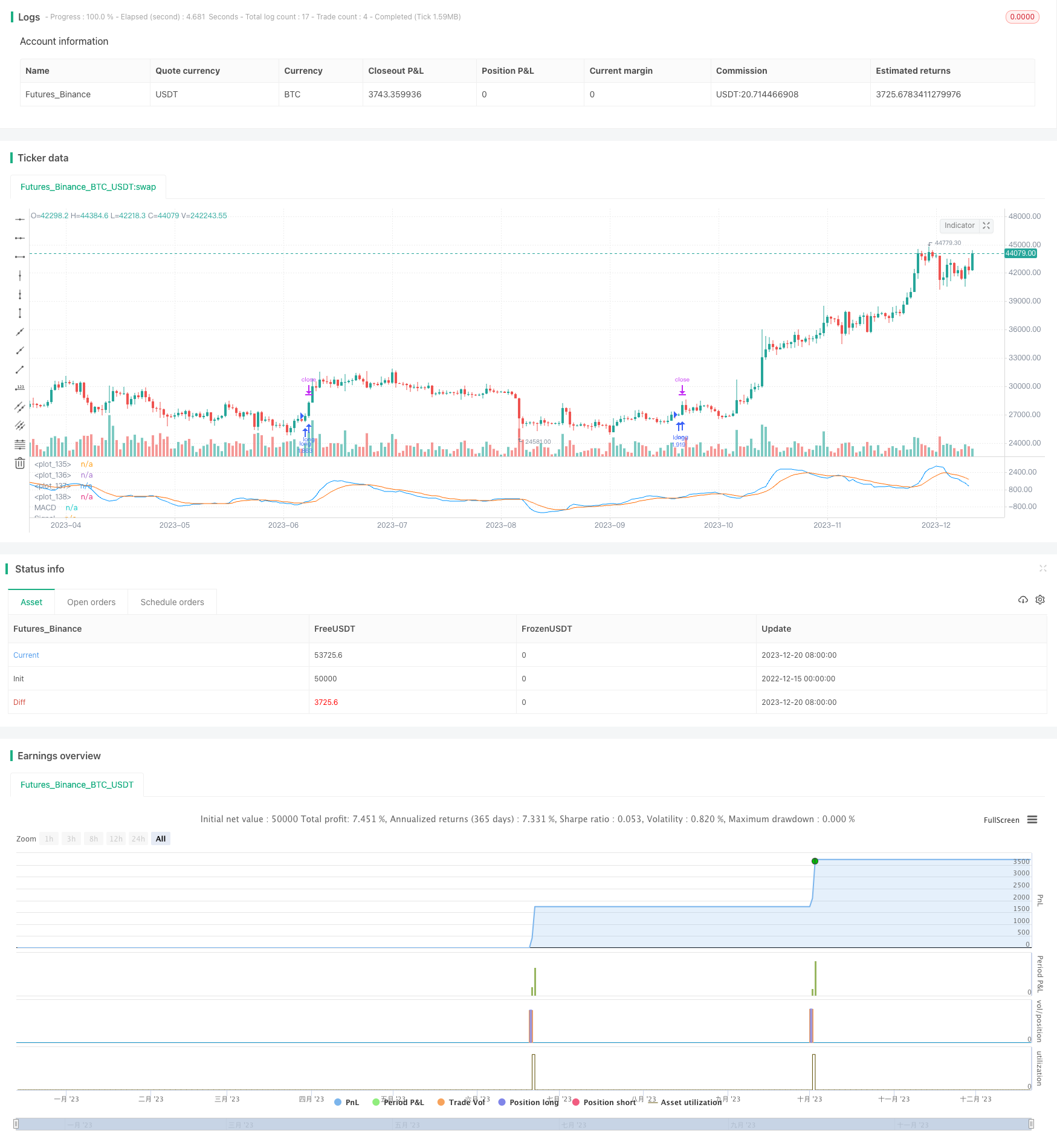

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//(c) Wunderbit Trading

//Modified by Mauricio Zuniga - Trade at your own risk

//This script was originally shared on Wunderbit website as a free open source script for the community. (https://help.wundertrading.com/en/articles/5246468-macd-mfi-trading-bot-for-ftx)

//

//WHAT THIS SCRIPT DOES:

// This is a scalping script originally intended to be used on altorightmic bot trading.

// This strategy is based on the trend-following momentum indicator. It includes the Money Flow index as an additional point for entry.

//HOW IT DOES IT:

// It uses a combination of MACD and MFI indicators to create entry signals. Parameters for each indicator have been surfaced for user configurability.

// Take profits are fixed, but stop loss uses ATR configuration to minimize losses and close profitably.

//HOW IS MY VERSION ORIGINAL:

// I started trying to deploy this script myself in my algorithmic tradingg but ran into some issues which I have tried to address in this version.

// Delayed Signals : The script has been refactored to use a time frame drop down. The higher time frame can be run on a faster chart (recommended on one minute chart for fastest signal confirmation and relay to algotrading platform.

// Repainting Issues : All indicators have been recoded to use the security function that checks to see if the current calculation is in realtime, if it is, then it uses the previous bar for calculation.

// If you are still experiencing repainting issues based on intended (or non intended use), please provide a report with screenshot and explanation so I can try to address.

// Filtering : I have added to additional filters an ABOVE EMA Filter and a BELOW RSI Filter (both can be turned on and off)

// Customizable Long and Clos Messages : This allows someone to use the script for algorithmic trading without having to alter code. It also means you can use one indicator for all of your different alterts required for your bots.

//HOW TO USE IT:

// Find a pair with high volatility - I have found it works particularly well with 3L and 3S tokens for crypto. although it the limitation is that confrigurations I have found to work typically have low R/R ratio, but very high win rate and profit factor.

// Ieally set one minute chart for bots, but you can use other charts for manual trading. The signal will be delayed by one bar but I have found configurations that still test well.

// Select a time frame in configuration for your indicator calculations.

// I like ot use 5 and 15 minutes for scalping scenarios, but I am interested in hearing back from other community memebers.

// Optimize your indicator without filters (trendFilter and RSI Filter)

// Use the TrendFilter and RSI Filter to further refine your signals for entry.

//@version=4

strategy("Customizable HTF MACD Strategy v1.2", overlay=false, pyramiding=0, commission_type=strategy.commission.percent, commission_value=0.07, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, currency = currency.USD)

openlongcomment = "Comment In Here"

closelongcomment = ""

openshortcomment = ""

closeshortcommment = ""

//RES

res = input(title="Resolution", type=input.resolution, defval="5", group="Strategy", inline="1")

comment = input(title="Open Long Comment", type=input.string, defval="",group="Strategy", inline="1")

if not(comment == "")

openlongcomment := comment

// FUNCTIONS

Ema(src,p) =>

ema = 0.

sf = 2/(p+1)

ema := nz(ema[1] + sf*(src - ema[1]),src)

Sma(src,p) => a = cum(src), (a - a[max(p,0)])/max(p,0)

Atr(p, res) =>

atr = 0.

highHTF = security(syminfo.tickerid, res, high[barstate.isrealtime ? 1 : 0])

lowHTF = security(syminfo.tickerid, res, low[barstate.isrealtime ? 1 : 0])

closeHTF = security(syminfo.tickerid, res, close[barstate.isrealtime ? 1 : 0])

Tr = max(highHTF - lowHTF, max(abs(highHTF - closeHTF[1]), abs(lowHTF - closeHTF[1])))

atr := nz(atr[1] + (Tr - atr[1])/p,Tr)

ribbon_period = input(39, "Period", step=1)

htfClose = security(syminfo.tickerid, res, close[barstate.isrealtime ? 1 : 0])

leadLine1 = ema(htfClose, ribbon_period)

leadLine2 = sma(htfClose, ribbon_period)

// p3 = plot(leadLine1, color= #53b987, title="EMA", transp = 50, linewidth = 1)

// p4 = plot(leadLine2, color= #eb4d5c, title="SMA", transp = 50, linewidth = 1)

// fill(p3, p4, transp = 60, color = leadLine1 > leadLine2 ? #53b987 : #eb4d5c)

//Upward Trend

UT=leadLine2 < leadLine1

DT=leadLine2>leadLine1

//FILTER LOGIC

aboveTrend = input(true, title="Use Trend", group="Filters", inline='1', type=input.bool)

TrendLength = input(3, minval=1, title="Trend MA", group="Filters", inline='1', type=input.integer)

aboveTrendFilter = sma(htfClose,TrendLength)

useRSI = input(true, title="Use RSI", group="Filters", inline='2', type=input.bool)

RSILength = input(34, minval=1, title="RSI Length", group="Filters", inline='2') // used to calculate RSI

belowRSIFilter = input(50, minval=1, title="Buy Below RSI Filter", group="Filters", inline='2') // only buy if its below this RSI - doesn't seem to work as expected

rsi = rsi(htfClose,RSILength)

if not(useRSI)

belowRSIFilter = 100

if not(aboveTrend)

aboveTrendFilter = -1

// MACD

fast_length = input(title="Fast Length", type=input.integer, defval=7)

slow_length = input(title="Slow Length", type=input.integer, defval=23)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 10)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

srcHTF = security(syminfo.tickerid, res, src[barstate.isrealtime ? 1 : 0])

// Calculating

fast_ma = sma_source ? Sma(srcHTF, fast_length) : Ema(srcHTF, fast_length)

slow_ma = sma_source ? Sma(srcHTF, slow_length) : Ema(srcHTF, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? Sma(macd, signal_length) : Ema(macd, signal_length)

hist = macd - signal

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

plot(macd, title="MACD", color=col_macd, transp=0)

plot(signal, title="Signal", color=col_signal, transp=0)

/// MFI

MFIsource = hlc3

sourceHTF = security(syminfo.tickerid, res, MFIsource[barstate.isrealtime ? 1 : 0])

length = input(15, minval=1)

lower = input(12, minval=0, maxval=50)

upper = input(80, minval=50, maxval=100)

// DrawMFI_f=input(true, title="Draw MFI?", type=bool)

HighlightBreaches=input(true, title="Highlight Oversold/Overbought?")

volumeHTF = security(syminfo.tickerid, res, volume[barstate.isrealtime ? 1 : 0])

// MFI

upper_s = sum(volumeHTF * (change(sourceHTF) <= 0 ? 0 : sourceHTF), length)

lower_s = sum(volumeHTF * (change(sourceHTF) >= 0 ? 0 : sourceHTF), length)

mf = rsi(upper_s, lower_s)

mfp = plot(mf, color=color.new(color.gray,0), linewidth=1)

top = hline(upper, color=color.new(color.gray, 100), linewidth=1, editable=false)

bottom = hline(lower, color=color.new(color.gray,100), linewidth=1, editable=false)

hline(0, color=color.new(color.black,100), editable=false)

hline(100, color=color.new(color.black,100), editable=false)

// Breaches

b_color = (mf > upper) ? color.new(color.red,70) : (mf < lower) ? color.new(color.green,60) : na

bgcolor(HighlightBreaches ? b_color : na)

fill(top, bottom, color=color.gray, transp=75)

// TAKE PROFIT AND STOP LOSS

long_tp1_inp = input(1, title='Long Take Profit 1 %', step=0.1)/100

long_tp1_qty = input(20, title="Long Take Profit 1 Qty", step=1)

long_trailing = input(1.3, title='Trailing Stop Long', step=0.1) / 100

long_take_level_1 = strategy.position_avg_price * (1 + long_tp1_inp)

// Stop Loss

multiplier = input(2, "SL Mutiplier", minval=1, step=0.1)

ATR_period=input(40,"ATR period", minval=1, step=1)

// Strategy

entry_long=(crossover(macd,signal) or (crossover(mf,lower) and leadLine2 < leadLine1)) and rsi < belowRSIFilter and close > aboveTrendFilter

entry_price_long=valuewhen(entry_long,close,0)

//SL_floating_long = entry_price_long -( (entry_price_long)*multiplier/100)//*Atr(ATR_period,res)

//SL_floating_long = entry_price_long - multiplier*Atr(ATR_period,res)

SL_floating_long = entry_price_long - multiplier*Atr(ATR_period,res)

exit_long= close < SL_floating_long

///// BACKTEST PERIOD ///////

testStartYear = input(2018, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, 0, 0)

testStopYear = input(9999, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

if testPeriod()

if UT

strategy.entry("long", strategy.long, when=entry_long == true, comment=openlongcomment)

strategy.exit("TP1","long", qty_percent=long_tp1_qty, limit=long_take_level_1)

strategy.exit("Trail stop","long", comment=closelongcomment, trail_points=entry_price_long * long_trailing / syminfo.mintick, trail_offset=entry_price_long * long_trailing / syminfo.mintick)

strategy.close("long", exit_long == true, comment=closelongcomment )