Strategi Breakout Fluktuasi Volume Beli/Jual Dinamis

Tanggal Pembuatan:

2023-12-26 11:15:31

Akhirnya memodifikasi:

2023-12-26 11:15:31

menyalin:

0

Jumlah klik:

686

1

fokus pada

1664

Pengikut

Ringkasan

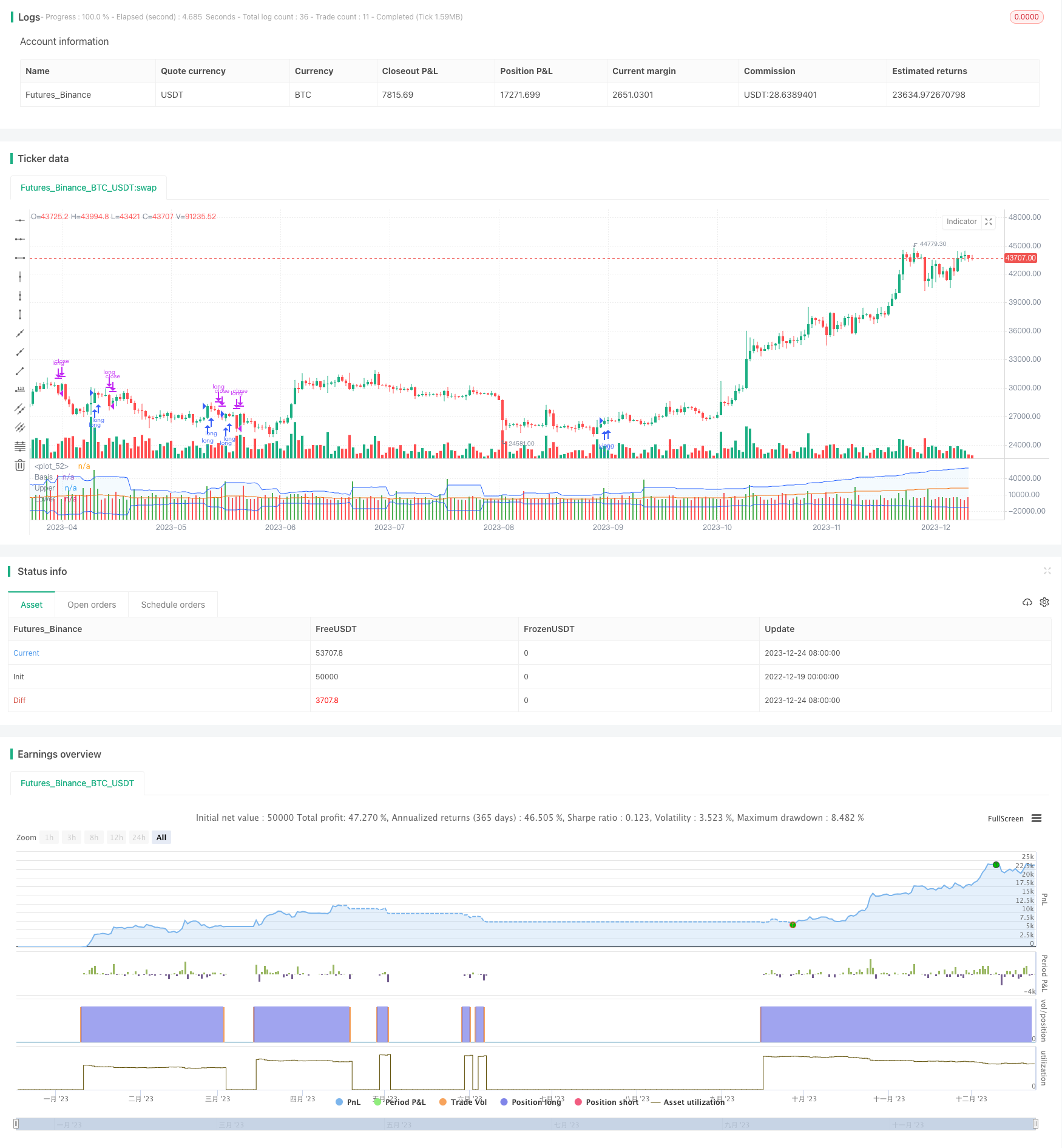

Strategi ini melakukan penilaian overhead dengan volume jual beli yang disesuaikan dengan periode waktu, digabungkan dengan VWAP lingkar, Brinband untuk memfilter, dan memungkinkan pelacakan tren probabilitas tinggi. Selain itu, mekanisme stop loss stop loss yang dinamis dapat secara efektif mengendalikan risiko unilateral.

Prinsip Strategi

- Perhitungan indikator volume jual beli dalam periode waktu yang disesuaikan

- BV: Volume pembelian, volume yang dihasilkan dari pembelian titik rendah

- SV: Volume penjualan, jumlah yang dihasilkan dari penjualan puncak

- Pengolahan volume

- Menggunakan 20 siklus EMA untuk meluruskan

- Untuk melakukan pemisahan positif negatif dari volume jual beli setelah ditangani.

- Menentukan arah indikator

- Indikator lebih besar dari 0 adalah bullish, kurang dari 0 adalah bearish

- VWAP, Blinken dan Pertimbangan Perpindahan

- Harga berada di atas VWAP dan indikator melihat kenaikan sebagai sinyal lebih

- Harga di bawah VWAP dan indikator turun sebagai sinyal shorting

- Stop loss dinamis

- Persentase Stop Loss Set ATR per Hari

Keunggulan Strategis

- Volume jual beli dapat mencerminkan dinamika pasar yang sebenarnya, menangkap potensi energi tren

- Garis lingkar VWAP menentukan arah tren siklus besar, pita Brin menentukan sinyal terobosan

- ATR Dinamis dengan Stop Loss Setup, Memaksimalkan Penguncian Keuntungan dan Menghindari Over-Tuning

Risiko Strategis

- Data penjualan dan pembelian memiliki beberapa kesalahan yang dapat menyebabkan kesalahan penilaian.

- Indikator tunggal yang dikombinasikan dengan penilaian, mudah menghasilkan sinyal yang salah

- Parameter Brinstrand yang tidak tepat akan mengurangi penembusan yang efektif

Arah optimasi strategi

- Optimalisasi Indeks Volume Pembelian dan Penjualan Periode Berkali-kali

- Menyaring indikator tambahan seperti peningkatan volume transaksi

- Dinamiskan Brinstrand Parameter untuk meningkatkan efisiensi penembusan

Meringkaskan

Strategi ini memanfaatkan sepenuhnya prediktivitas volume jual beli, ditambah dengan VWAP dan Brin band untuk menghasilkan sinyal probabilitas tinggi, dengan stop loss dinamis untuk mengontrol risiko secara efektif, merupakan strategi perdagangan kuantitatif yang efisien dan stabil. Dengan terus-menerus mengoptimalkan parameter dan aturan, efeknya diharapkan akan lebih jelas.

Kode Sumber Strategi

/*backtest

start: 2022-12-19 00:00:00

end: 2023-12-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © original author ceyhun

//@ exlux99 update

//@version=5

strategy('Buying Selling Volume Strategy', format=format.volume, precision=0, overlay=false)

weekly_vwap = request.security(syminfo.tickerid, "W", ta.vwap(hlc3))

vi = false

customTimeframe = input.timeframe("60", group="Entry Settings")

allow_long = input.bool(true, group="Entry Settings")

allow_short = input.bool(false, group="Entry Settings")

xVolume = request.security(syminfo.tickerid, customTimeframe, volume)

xHigh = request.security(syminfo.tickerid, customTimeframe, high)

xLow = request.security(syminfo.tickerid, customTimeframe, low)

xClose = request.security(syminfo.tickerid, customTimeframe, close)

BV = xHigh == xLow ? 0 : xVolume * (xClose - xLow) / (xHigh - xLow)

SV = xHigh == xLow ? 0 : xVolume * (xHigh - xClose) / (xHigh - xLow)

vol = xVolume > 0 ? xVolume : 1

TP = BV + SV

BPV = BV / TP * vol

SPV = SV / TP * vol

TPV = BPV + SPV

tavol20 = request.security(syminfo.tickerid, customTimeframe, ta.ema(vol, 20))

tabv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(BV, 20))

tasv20= request.security(syminfo.tickerid, customTimeframe, ta.ema(SV, 20))

VN = vol / tavol20

BPN = BV / tabv20 * VN * 100

SPN = SV / tasv20 * VN * 100

TPN = BPN + SPN

xbvp = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPV))

xbpn = request.security(syminfo.tickerid, customTimeframe,-math.abs(BPN))

xspv = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPV))

xspn = request.security(syminfo.tickerid, customTimeframe,-math.abs(SPN))

BPc1 = BPV > SPV ? BPV : xbvp

BPc2 = BPN > SPN ? BPN : xbpn

SPc1 = SPV > BPV ? SPV : xspv

SPc2 = SPN > BPN ? SPN : xspn

BPcon = vi ? BPc2 : BPc1

SPcon = vi ? SPc2 : SPc1

minus = BPcon + SPcon

plot(minus, color = BPcon > SPcon ? color.green : color.red , style=plot.style_columns)

length = input.int(20, minval=1, group="Volatility Settings")

src = minus//input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group="Volatility Settings")

xtasma = request.security(syminfo.tickerid, customTimeframe, ta.sma(src, length))

xstdev = request.security(syminfo.tickerid, customTimeframe, ta.stdev(src, length))

basis = xtasma

dev = mult * xstdev

upper = basis + dev

lower = basis - dev

plot(basis, "Basis", color=#FF6D00, offset = 0)

p1 = plot(upper, "Upper", color=#2962FF, offset = 0)

p2 = plot(lower, "Lower", color=#2962FF, offset = 0)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// Original a

longOriginal = minus > upper and BPcon > SPcon and close > weekly_vwap

shortOriginal = minus > upper and BPcon < SPcon and close< weekly_vwap

high_daily = request.security(syminfo.tickerid, "D", high)

low_daily = request.security(syminfo.tickerid, "D", low)

close_daily = request.security(syminfo.tickerid, "D", close)

true_range = math.max(high_daily - low_daily, math.abs(high_daily - close_daily[1]), math.abs(low_daily - close_daily[1]))

atr_range = ta.sma(true_range*100/request.security(syminfo.tickerid, "D", close), 14)

ProfitTarget_Percent_long = input.float(100.0, title='TP Multiplier for Long entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_long = close + (close * (atr_range * ProfitTarget_Percent_long))/100

LossTarget_Percent_long = input.float(1.0, title='SL Multiplier for Long entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_long = close - (close * (atr_range * LossTarget_Percent_long ))/100

ProfitTarget_Percent_short = input.float(100.0, title='TP Multiplier for Short entries ', step=0.5, step=0.5, group='Dynamic Risk Management')

Profit_Ticks_short = close - (close * (atr_range*ProfitTarget_Percent_short))/100

LossTarget_Percent_short = input.float(5.0, title='SL Multiplier for Short entries', step=0.5, group='Dynamic Risk Management')

Loss_Ticks_short = close + (close * (atr_range*LossTarget_Percent_short))/100

var longOpened_original = false

var int timeOfBuyLong = na

var float tpLong_long_original = na

var float slLong_long_original = na

long_entryx = longOriginal

longEntry_original = long_entryx and not longOpened_original

if longEntry_original

longOpened_original := true

tpLong_long_original := Profit_Ticks_long

slLong_long_original := Loss_Ticks_long

timeOfBuyLong := time

//lowest_low_var_sl := lowest_low

tpLong_trigger = longOpened_original[1] and ((close > tpLong_long_original) or (high > tpLong_long_original)) //or high > lowest_low_var_tp

slLong_Trigger = longOpened_original[1] and ((close < slLong_long_original) or (low < slLong_long_original)) //or low < lowest_low_var_sl

longExitSignal_original = shortOriginal or tpLong_trigger or slLong_Trigger

if(longExitSignal_original)

longOpened_original := false

tpLong_long_original := na

slLong_long_original := na

if(allow_long)

strategy.entry("long", strategy.long, when=longOriginal)

strategy.close("long", when= longExitSignal_original) //or shortNew

if(allow_short)

strategy.entry("short", strategy.short, when=shortOriginal )

strategy.close("short", when= longOriginal) //or shortNew