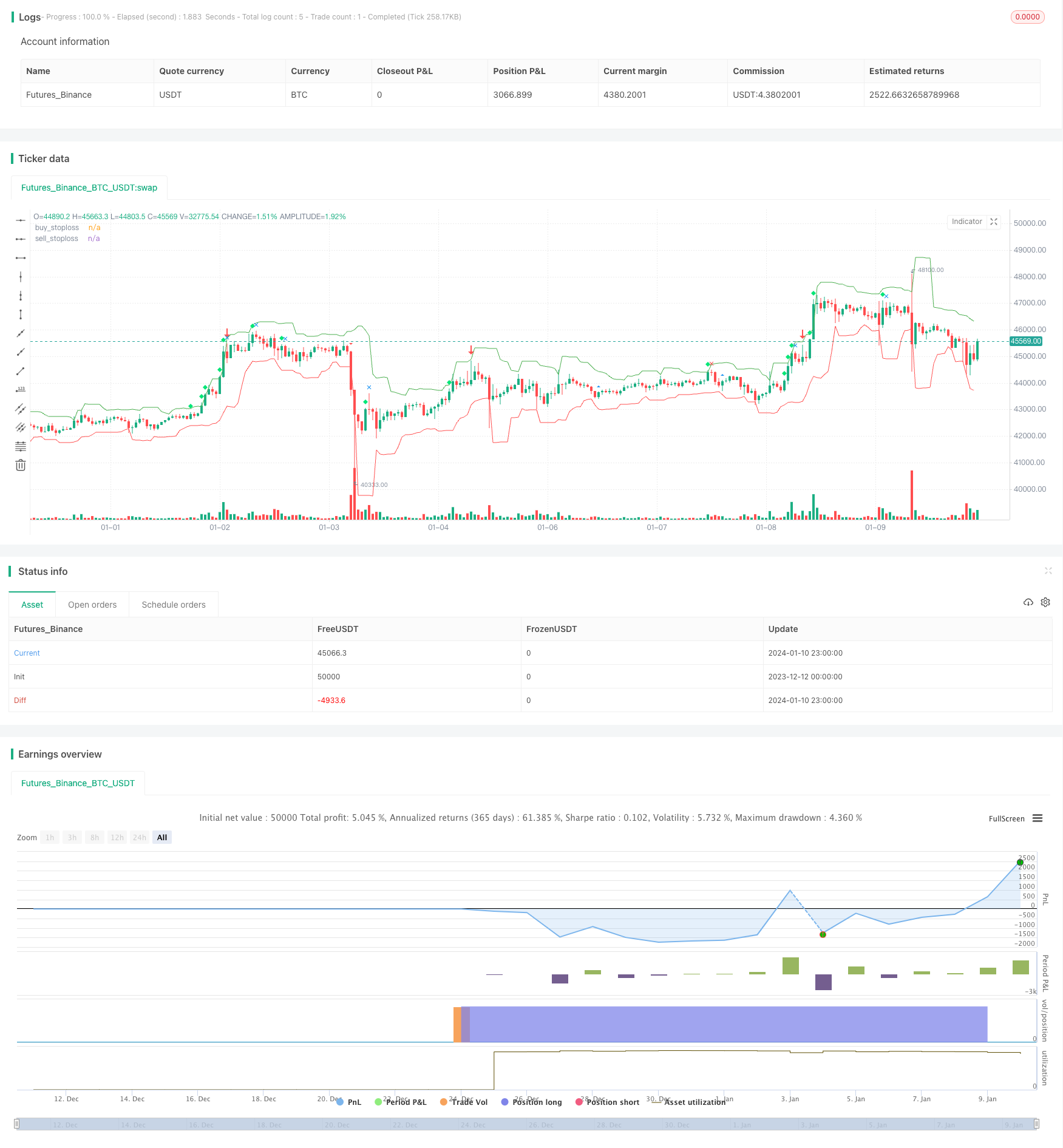

Strategi tren kuantitatif yang menggabungkan beberapa faktor

Ringkasan

Strategi ini mengintegrasikan beberapa faktor seperti volume transaksi, volatilitas, posisi penutupan, tren, dan lain-lain untuk mengidentifikasi peluang perdagangan, yang merupakan strategi kuantitatif multi-faktor yang khas.

Prinsip Strategi

Gagasan inti dari strategi ini adalah menggabungkan beberapa faktor, seperti penembusan yang tidak biasa dalam volume, posisi penutupan, dan amplitudo fluktuasi untuk mengidentifikasi titik jual beli.

Secara khusus, strategi ini menghitung volume transaksi rata-rata selama beberapa waktu terakhir, dan ketika volume transaksi dalam siklus saat ini terjadi, mungkin ada perubahan yang jelas. Selain itu, jika harga penutupan mendekati batas atas atau bawah dari amplitudo fluktuasi, itu berarti bahwa tren saat ini mungkin berbalik.

Untuk memverifikasi titik jual beli, strategi ini juga akan digabungkan dengan indikator amplitudo fluktuasi untuk menilai. Jika fluktuasi menembus rata-rata selama beberapa waktu terakhir, maka akan terbentuk kondisi pertama dari sinyal jual beli. Kemudian, jika harga penutupan siklus naik berada di bagian bawah dari amplitudo fluktuasi, dan volume transaksi meningkat, maka akan dihasilkan sinyal jual. Sebaliknya, jika harga penutupan siklus turun berada di bagian atas dari amplitudo fluktuasi, dan volume transaksi berkurang, maka akan dihasilkan sinyal beli.

Selain itu, strategi ini juga akan dikombinasikan dengan indikator garis rata untuk menilai tren keseluruhan, dan jika terjadi perubahan tren pada garis tengah dan panjang, ini juga akan berfungsi sebagai kondisi untuk menghasilkan sinyal beli dan jual.

Dengan menggabungkan berbagai indikator yang disebutkan di atas, strategi ini dapat memberikan penilaian yang komprehensif tentang waktu jual beli di pasar.

Keunggulan Strategis

Keuntungan utama dari strategi ini adalah mempertimbangkan berbagai faktor untuk membuat keputusan secara menyeluruh, sehingga hasilnya lebih dapat diandalkan. Secara khusus, ada beberapa keuntungan utama:

- Pertimbangannya adalah bahwa jika terjadi lonjakan lalu lintas yang tidak biasa, maka akan lebih awal untuk mendeteksi perubahan tren.

- Untuk mengevaluasi tren yang sebenarnya, perhatikan besarnya pergerakan dan posisi penutupan, dan jangan tertipu oleh kebisingan pasar jangka pendek.

- Strategi ini dapat digabungkan dengan garis rata-rata jangka menengah dan panjang untuk menentukan arah tren secara keseluruhan dan memastikan bahwa strategi tersebut berjalan sesuai dengan tren pasar utama.

- Keputusan komprehensif multi-faktor membuat strategi lebih stabil dan dapat diandalkan, menghindari kerugian besar.

Risiko Strategis

Strategi ini juga memiliki beberapa risiko yang perlu diperhatikan:

- Pertimbangan kombinasi multi faktor lebih rumit, dan parameter tuning lebih sulit.

- Tidak bisa sepenuhnya menghindari terjadinya transaksi yang tidak perlu karena tertipu oleh peretasan palsu.

- Jika salah menilai tren utama, efek operasional secara keseluruhan akan dikurangi.

- Pengaturan parameter volatilitas perlu disesuaikan dengan kondisi pasar yang berbeda.

Arah optimasi

Strategi ini juga memiliki beberapa optimasi utama:

- Mengoptimalkan parameter secara otomatis menggunakan metode seperti pembelajaran mesin.

- Bergabunglah dengan strategi manajemen risiko Stop Loss.

- Selain itu, ada beberapa faktor lain seperti aliran dana dan lain-lain yang dapat digunakan untuk menentukan tren utama.

- Desain beradaptasi dengan parameter fluktuasi.

Meringkaskan

Strategi ini mempertimbangkan berbagai faktor untuk mengidentifikasi peluang perdagangan. Keunggulan strategi adalah penilaian yang komprehensif, stabil dan dapat diandalkan. Risiko utama adalah kesalahan dalam menentukan parameter dan menilai tren utama. Di masa depan, parameter dapat dioptimalkan melalui pembelajaran mesin dan lain-lain.

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("volume spread analysis ", overlay=true)

volavg = sma(volume,40)

c= close

l=low

h=high

v=volume

volmean = stdev(volavg,30)

volupband3 = volavg + 3*volmean

volupband2 = volavg + 2*volmean

volupband1 = volavg + 1*volmean

voldnband1 = volavg -1*volmean

voldnband2 = volavg -2*volmean

midprice = (high+low)/2

spread = (high-low)

avgspread = sma(spread,80)

avgspreadbar = spread > avgspread

widerangebar = spread>(1.5*avgspread)

narrowrangebar = spread<(0.7*avgspread)

lowvolume = volume<volume[1] and volume<volume[2]

upbar = close>close[1]

downbar = close<close[1]

highvolume = volume>volume[1] and volume[1]>volume[2]

closefactor = close-low

clsposition = spread/closefactor

closeposition = iff(closefactor==0,avgspread,clsposition)

vb = volume>volavg or volume>volume[1]

upclose = close>=((spread*0.7)+low)// close is above 70% of the bar

downclose = close<=((spread*0.3)+low)// close is below the 30% of the bar

aboveclose = close>((spread*0.5)+low)// close is between 50% and 70% of the bar

belowclose = close<((spread*0.5)+low)// close is between 50% and 30% of the bar

midclose = close>((spread*0.3)+low) and c<((spread*0.7)+l)// close is between 30% and 70% of the bar

verylowclose = closeposition>4//close is below 25% of the bar

veryhighclose = closeposition<1.35// close is above 80% of the bar

closepos = iff(close<=((spread*0.2)+low),1,iff(close<=((spread*0.4)+low),2,iff(close<=((spread*0.6)+low),3,iff(close<=((spread*0.8)+low),4,5))))

// 1 = downclose, 2 = belowclose, 3 = midclose, 4 = aboveclose, 5 = upclose

volpos = iff(volume>volavg*2,1,iff(volume>volavg*1.3,2,iff(volume>volavg,3,iff(volume<volavg and volume>volavg*0.7,4,5))))

//// 1 = very high, 2 = high, 3 = above average, 4 = less than average, 5 = low

freshgndhi = close > highestbars(h,5)

freshgndlo = close < lowestbars(l,5)

//========================trend estimation =========================

//jtrend=sma(close,5)

//trendlongterm = linreg(jtrend,40)

//trendmediumterm = linreg(jtrend,10)

//trendshortterm = linreg(jtrend,3)

//tls=linreg(jtrend,3)

minperiodsrwist = input(title="short term min periods", defval=2, minval=1)

maxperiodsrwist = input(title="short term max periods", defval=8, minval=1)

minperiodsrwilt = input(title="long term min periods", defval=10, minval=1)

maxperiodsrwilt = input(title="long term max periods", defval=40, minval=1)

rwhmins = (high - nz(low[minperiodsrwist])) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwhmaxs = (high - nz(low[maxperiodsrwist])) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwhs = max( rwhmins, rwhmaxs )

rwlmins = (nz(high[minperiodsrwist]) - low) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwlmaxs = (nz(high[maxperiodsrwist]) - low) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwls = max( rwlmins, rwlmaxs )

rwhminl = (high - nz(low[minperiodsrwilt])) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwhmaxl = (high - nz(low[maxperiodsrwilt])) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwhl = max( rwhminl, rwhmaxl )

rwlminl = (nz(high[minperiodsrwilt]) - low) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwlmaxl = (nz(high[maxperiodsrwilt]) - low) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwll = max( rwlminl, rwlmaxl )

ground = rwhs

sky = rwls

j = rwhs-rwls

k = rwhl-rwll

j2 = rwhl

k2 = rwll

ja = cross(j,1)

jb = cross(1,j)

jc = cross(-1,j)

jd = cross(j,-1)

j2a = cross(j2,1)

j2b = cross(1,j2)

k2a = cross(k2,1)

k2b = cross(1,k2)

upmajoron = j > 1 and ja[1]

upmajoroff = j < 1 and jb[1]

upminoron = j2 > 1 and j2a[1]

upminoroff = j2 < 1 and j2b[1]

dnmajoron = j < -1 and jc[1]

dnmajoroff = j > -1 and jd[1]

dnminoron = k2 > 1 and k2a[1]

dnminoroff = k2 < 1 and k2b[1]

upimd = iff(ground > 1, 1,0)

dnimd = iff(sky > 1, 1, 0)

upmajor = iff(j>1,1,iff(j<(-1),-1,0))

upminor = iff(j2>1,1,-1)

dnminor = iff(k2>1,1,-1)

//======================================================================|

Buy_stop = lowest(low[1],5) - atr(20)[1]

plot(Buy_stop, color=red, title="buy_stoploss")

Sell_stop = highest(high[1],5) + atr(20)[1]

plot(Sell_stop, color=green, title="sell_stoploss")

//======================================================================|

//upthrustbar = widerangebar and downclose and upimd==1 and high>high[1] //wrb and uhs and fresh ground

nut = widerangebar and downclose and freshgndhi and highvolume // new signal

bc = widerangebar and aboveclose and volume == highest(volume,60) and upmajor==1 // new signal

upthrustbar = widerangebar and (closepos==1 or closepos==2) and upminor>0 and high>high[1] and (upimd>0or upmajor>0) and volpos <4// after minor up trend

upthrustbartrue = widerangebar and closepos==1 and upmajor>0 and high>high[1] and volpos <4//occurs after a major uptrend

upthrustcond1 = upthrustbar[1] and downbar and not narrowrangebar

upthrustcond2 = upthrustbar[1] and downbar and volpos == 2

upthrustcond3 = upthrustbar and volpos ==1

toprevbar = volume[1]>volavg and upbar[1] and widerangebar[1] and downbar and downclose and widerangebar and upmajor>0 and high==highest(high,10)

pseudoupthrust = upbar[1] and high>high[1] and volume[1]>1.5*volavg and downbar and downclose and not upthrustbar

pseudoutcond = pseudoupthrust[1] and downbar and downclose and not upthrustbar

trendchange = upbar[1] and high==highest(high,5) and downbar and (downclose or midclose) and volume>volavg and upmajor>0 and upimd>0 and not widerangebar and not pseudoupthrust

nodemandbarut = upbar and narrowrangebar and lowvolume and closepos> 3 and ((upminor>0 and upimd>0)or (upminor<0 and upminor>0))//in a up market

nodemandbardt = upbar and narrowrangebar and lowvolume and closepos> 3 and (upminor<=0or upimd<=0)// in a down or sidewayss market

nosupplybar = downbar and narrowrangebar and lowvolume and closepos<3 and ((upminor<1 and upimd<1)or (upminor>0 and upimd<1))

lowvoltest = low==lowest(low,5) and upclose and lowvolume//lowvolume and l<low[1] and upclose

lowvoltest1 = low==lowest(low,5) and volume<volavg and low<low[1] and upclose and upminor>0 and upmajor>0// and widerangebar

lowvoltest2 = lowvoltest[1] and upbar and upclose

sellcond1 = (upthrustcond1 or upthrustcond2 or upthrustcond3)

sellcond2 = sellcond1[1]==0

sellcond = sellcond1 and sellcond2

strengthdown0 = upmajor<0 and volpos<4 and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0// strength after a long down trend

strengthdown = volpos<4 and downbar[1] and upbar and closepos>3 and upimd<=00 and upminor<0// strength after a down trend

strengthdown1 = upmajor<0 and volume>(volavg*1.5) and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0//strength after downtrend . high volume

strengthdown2 = upimd<=0 and volume[1]<volavg and upbar and veryhighclose and volpos<4

buycond1 = strengthdown or strengthdown1

buycond = upbar and buycond1[1]

stopvolume = low==lowest(low,5) and (upclose or midclose) and v>1.5*volavg and upmajor<0

revupthrust = upmajor<0 and upbar and upclose and volume>volume[1] and volume>volavg and widerangebar and downbar[1] and downclose[1] and upminor<0

effortup = high>high[1] and low>low[1] and close>close[1] and close>=((high-low)*0.7+low) and spread>avgspread and volpos<4//and open<=((high-low)*0.3+low)

effortupfail = effortup[1] and (upthrustbar or upthrustcond1 or upthrustcond2 or upthrustcond3 or (downbar and avgspreadbar))

effortdown = high<high[1] and low<low[1] and close<close[1] and close<=((high-low)*0.25+low) and widerangebar and volume>volume[1]//o>=((high-low)*0.75+

effortdownfail = effortdown[1] and ((upbar and avgspreadbar)or revupthrust or buycond1)

upflag = (sellcond or buycond or effortup or effortupfail or stopvolume or effortdown or effortdownfail or revupthrust or nodemandbardt or nodemandbarut or nosupplybar or lowvoltest or lowvoltest1 or lowvoltest2 or bc)

bullbar = (volume>volavg or volume>volume[1]) and closeposition <2 and upbar and not upflag

bearbar = vb and downclose and downbar and spread>avgspread and not upflag

buy = (upbar and revupthrust[1])or lowvoltest2

burely = strengthdown1 and stopvolume[1]or (upbar and revupthrust[1])or lowvoltest2

//buy = effortup and lowvoltest2[1]

//sell = upthrustbartrue

sell = effortup[1] and effortupfail and upthrustcond3 and upthrustbartrue and toprevbar

strategy.entry("simpleBuy", strategy.long, when= (upbar and revupthrust[1])or lowvoltest2 )

strategy.close("simpleBuy",when=upthrustbartrue )

//strategy.entry("simpleSell", strategy.short,when= upthrustbartrue )

//strategy.close("simpleSell",when= (upbar and revupthrust[1])or lowvoltest2)

//|============================================================================================|

//data = close >= open

//plotshape(true, style=shape.flag, color=data ? green : red)

plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.arrowdown ,size=size.huge,color=red )

//plotshape(toprevbar ,title="toprevbar" ,style=shape.flag ,size=size.small,color=blue )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.circle ,size=size.small,color=blue )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangleup ,size=size.small,color=red )

plotshape(trendchange ,title="trendchange" ,style=shape.xcross ,size=size.small,color=red )

//plotshape((nodemandbardt) ,title="(nodemandbardt" ,style=shape.square ,size=size.small,color=orange )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.cross ,size=size.small,color=blue)

plotshape(revupthrust ,title="revupthrust" ,style=shape.arrowup ,size=size.huge,color=green )

//plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.cross ,size=size.small,color=red )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangledown ,size=size.small,color=white )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.arrowup ,size=size.small,color=blue )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labelup ,size=size.small,color=orange )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labeldown ,size=size.small,color=yellow )

//plotshape(nodemandbardt ,title="nodemandbardt" ,style=shape.diamond ,size=size.small,color=yellow )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.xcross ,size=size.small,color=blue )

plotshape(lowvoltest ,title="lowvoltest" ,style=shape.triangleup ,size=size.small,color=blue )

//plotshape(lowvoltest2 ,title="lowvoltest2" ,style=shape.triangledown ,size=size.small,color=yellow )

//plotshape(strengthdown ,title="strengthdown" ,style=shape.flag ,size=size.small,color=green)

//plotshape(strengthdown ,title="strengthdown" ,style=shape.circle ,size=size.small,color=lime )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowup ,size=size.small,color=silver )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowdown ,size=size.small,color=red )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labelup ,size=size.small,color=green )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labeldown ,size=size.small,color=yellow )

plotshape(effortup ,title="effortup" ,style=shape.diamond ,size=size.small,color=lime )

plotshape(effortupfail ,title="effortupfail" ,style=shape.xcross ,size=size.small,color=blue )

//plotshape(effortupfail ,title="effortupfail" ,style=shape.cross ,size=size.small,color=white )

plotshape(effortdown ,title="effortdown" ,style=shape.triangledown ,size=size.small,color=red )

plotshape(effortdownfail ,title="effortdownfail" ,style=shape.xcross ,size=size.small,color=green )

//plotshape(effortdownfail ,title="effortdownfail" ,style=shape.flag ,size=size.small,color=white )

//plotshape(buycond ,title="buycond" ,style=shape.circle ,size=size.small,color=green )

//plotshape(sellcond ,title="sellcond" ,style=shape.arrowup ,size=size.small,color=orange )

//plotshape((nut) ,title="(nut)" ,style=shape.arrowdown ,size=size.small,color=lime )

//plotshape((bc ) ,title="(bc" ,style=shape.labelup ,size=size.small,color=red )

//plotshape(buy ,title="buy" ,style=shape.labeldown ,size=size.small,color=white )