Strategi Kombinasi Bollinger Bands dan K-line

Ringkasan

Ini adalah strategi pelacakan tren yang menggunakan Bollinger Bands dan K-Line sebagai sinyal entri. Ini dirancang untuk menangkap tren dalam jangka waktu yang lebih lama dan berlaku untuk perdagangan forex.

Prinsip Strategi

Strategi ini dibangun dengan memperhitungkan kisaran standar deviasi harga untuk membentuk Bollinger Bands. Bandwidth mewakili volatilitas pasar. Ketika harga mendekati tren naik atau tren turun, ini dianggap sebagai sinyal overbought dan oversold.

Secara khusus, melakukan sinyal ganda adalah: titik rendah ke atas menerobos rel bawah, dan munculnya beberapa penetrasi atau garis K yang panjang ke bawah. sinyal kosong adalah: titik tinggi ke bawah menerobos rel atas, dan munculnya penetrasi kepala kosong atau garis K yang panjang.

Stop loss adalah harga yang telah ditetapkan sebelumnya. Stop loss adalah harga yang sebagian berhenti saat melewati garis tengah Brin.

Analisis Keunggulan

Strategi ini menggabungkan tren dan peluang re-entry. Bollinger Bands dapat mengidentifikasi tren dan overbought oversold opportunities. K-Line menilai waktu re-entry dan menghindari false breakout.

Pengaturan Stop Loss jelas, risiko dapat dikendalikan. Cocok untuk operasi garis panjang, mengurangi frekuensi perdagangan.

Analisis risiko

Risiko terbesar dari strategi ini adalah kegagalan untuk menangkap tren atau terjadinya guncangan besar.

Selain itu, penalti berangkat dari lapangan tergantung pada lini tengah, dan mungkin terjadi penalti terlalu dini atau terlalu terlambat.

Hal ini dapat dioptimalkan dengan mengadaptasi kombinasi parameter, mengidentifikasi bentuk K-line yang lebih dapat diandalkan, atau memodifikasi standar hambatan berdasarkan tingkat fluktuasi.

Arah optimasi

Dapat dikombinasikan dengan indikator lain untuk menentukan tren siklus besar, menghindari operasi berlawanan. Atau menambahkan algoritma pembelajaran mesin untuk menentukan kombinasi parameter terbaik.

Stop-loss juga dapat diubah menjadi stop-loss yang bergerak atau stop-loss yang berfluktuasi untuk memaksimalkan keuntungan.

Meringkaskan

Ini adalah strategi tren jangka panjang berdasarkan Bollinger Bands dan K-Line Technical Indicators. Ini cocok untuk digunakan sebagai strategi dasar, memiliki beberapa keandalan dan ruang untuk keuntungan, tetapi masih perlu terus diuji dan dioptimalkan untuk meningkatkan stabilitas.

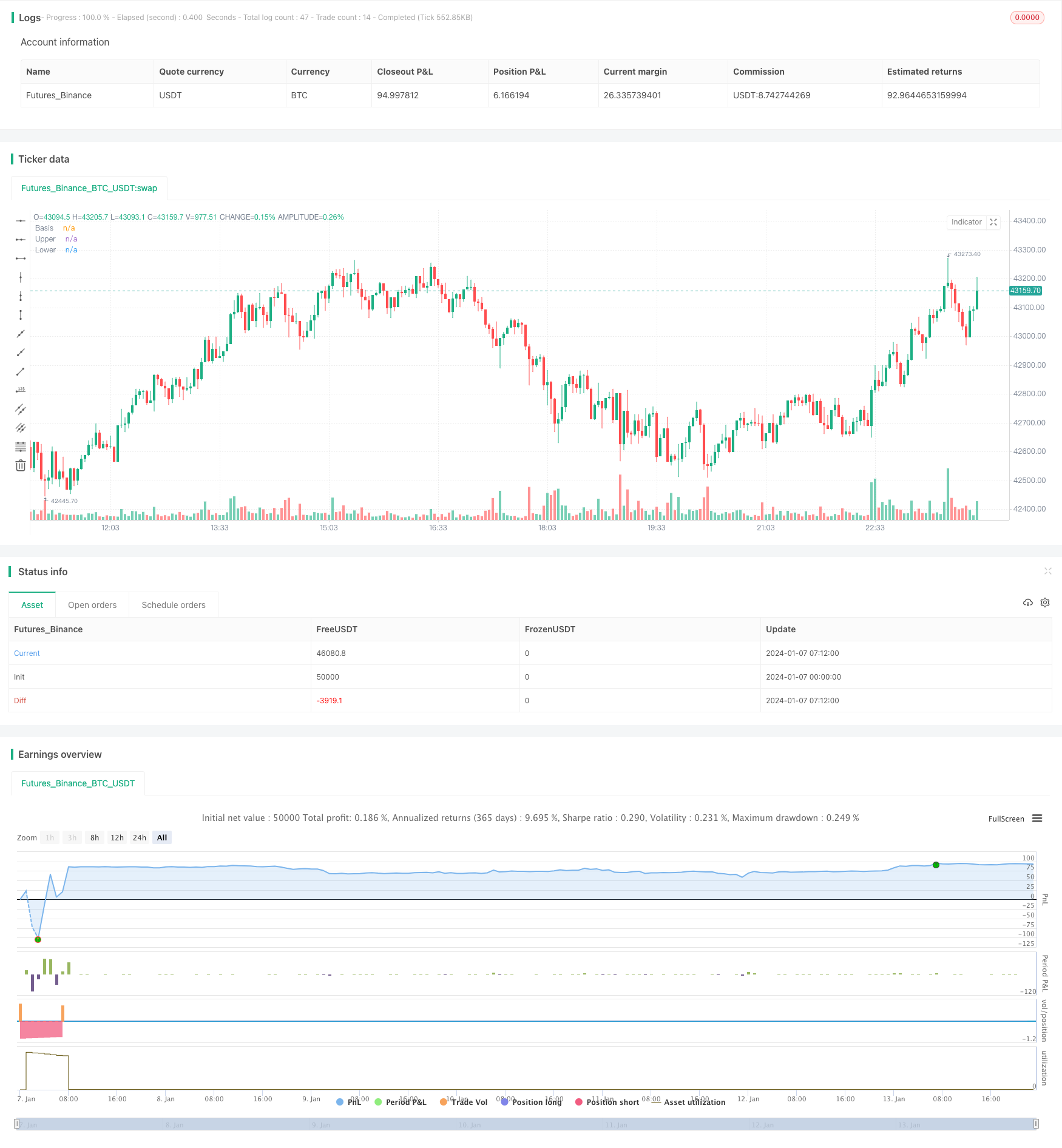

/*backtest

start: 2024-01-07 00:00:00

end: 2024-01-14 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BB策略", overlay=true)

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upper, "Upper", color=color.teal, offset = offset)

p2 = plot(lower, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

diff=upper-lower

//plot(upper*0.9985, "Upper", color=color.white, offset = offset)

//plot(lower*1.0015, "Lower", color=color.white, offset = offset)

//Engulfing Candles

openBarPrevious = open[1]

closeBarPrevious = close[1]

openBarCurrent = open

closeBarCurrent = close

//If current bar open is less than equal to the previous bar close AND current bar open is less than previous bar open AND current bar close is greater than previous bar open THEN True

bullishEngulfing = openBarCurrent <= closeBarPrevious and openBarCurrent < openBarPrevious and

closeBarCurrent > openBarPrevious

//If current bar open is greater than equal to previous bar close AND current bar open is greater than previous bar open AND current bar close is less than previous bar open THEN True

bearishEngulfing = openBarCurrent >= closeBarPrevious and openBarCurrent > openBarPrevious and

closeBarCurrent < openBarPrevious

//bullishEngulfing/bearishEngulfing return a value of 1 or 0; if 1 then plot on chart, if 0 then don't plot

//plotshape(bullishEngulfing, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

//plotshape(bearishEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//alertcondition(bullishEngulfing, title="Bullish Engulfing", message="[CurrencyPair] [TimeFrame], Bullish candle engulfing previous candle")

//alertcondition(bearishEngulfing, title="Bearish Engulfing", message="[CurrencyPair] [TimeFrame], Bearish candle engulfing previous candle")

//Long Upper Shadow - Bearish

C_Len = 14 // ema depth for bodyAvg

C_ShadowPercent = 5.0 // size of shadows

C_ShadowEqualsPercent = 100.0

C_DojiBodyPercent = 5.0

C_Factor = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi = max(close, open)

C_BodyLo = min(close, open)

C_Body = C_BodyHi - C_BodyLo

C_BodyAvg = ema(C_Body, C_Len)

C_SmallBody = C_Body < C_BodyAvg

C_LongBody = C_Body > C_BodyAvg

C_UpShadow = high - C_BodyHi

C_DnShadow = C_BodyLo - low

C_HasUpShadow = C_UpShadow > C_ShadowPercent / 100 * C_Body

C_HasDnShadow = C_DnShadow > C_ShadowPercent / 100 * C_Body

C_WhiteBody = open < close

C_BlackBody = open > close

C_Range = high-low

C_IsInsideBar = C_BodyHi[1] > C_BodyHi and C_BodyLo[1] < C_BodyLo

C_BodyMiddle = C_Body / 2 + C_BodyLo

C_ShadowEquals = C_UpShadow == C_DnShadow or (abs(C_UpShadow - C_DnShadow) / C_DnShadow * 100) < C_ShadowEqualsPercent and (abs(C_DnShadow - C_UpShadow) / C_UpShadow * 100) < C_ShadowEqualsPercent

C_IsDojiBody = C_Range > 0 and C_Body <= C_Range * C_DojiBodyPercent / 100

C_Doji = C_IsDojiBody and C_ShadowEquals

patternLabelPosLow = low - (atr(30) * 0.6)

patternLabelPosHigh = high + (atr(30) * 0.6)

C_LongUpperShadowBearishNumberOfCandles = 1

C_LongShadowPercent = 75.0

C_LongUpperShadowBearish = C_UpShadow > C_Range/100*C_LongShadowPercent

//alertcondition(C_LongUpperShadowBearish, title = "Long Upper Shadow", message = "New Long Upper Shadow - Bearish pattern detected.")

//if C_LongUpperShadowBearish

// var ttBearishLongUpperShadow = "Long Upper Shadow\nTo indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices."

// label.new(bar_index, patternLabelPosHigh, text="LUS", style=label.style_label_down, color = color.red, textcolor=color.white, tooltip = ttBearishLongUpperShadow)

//gcolor(highest(C_LongUpperShadowBearish?1:0, C_LongUpperShadowBearishNumberOfCandles)!=0 ? color.red : na, offset=-(C_LongUpperShadowBearishNumberOfCandles-1))

C_Len1 = 14 // ema depth for bodyAvg

C_ShadowPercent1 = 5.0 // size of shadows

C_ShadowEqualsPercent1 = 100.0

C_DojiBodyPercent1 = 5.0

C_Factor1 = 2.0 // shows the number of times the shadow dominates the candlestick body

C_BodyHi1 = max(close, open)

C_BodyLo1 = min(close, open)

C_Body1 = C_BodyHi1 - C_BodyLo1

C_BodyAvg1 = ema(C_Body1, C_Len1)

C_SmallBody1 = C_Body1 < C_BodyAvg1

C_LongBody1 = C_Body1 > C_BodyAvg1

C_UpShadow1 = high - C_BodyHi1

C_DnShadow1 = C_BodyLo1 - low

C_HasUpShadow1 = C_UpShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_HasDnShadow1 = C_DnShadow1 > C_ShadowPercent1 / 100 * C_Body1

C_WhiteBody1 = open < close

C_BlackBody1 = open > close

C_Range1 = high-low

C_IsInsideBar1 = C_BodyHi1[1] > C_BodyHi1 and C_BodyLo1[1] < C_BodyLo1

C_BodyMiddle1 = C_Body1 / 2 + C_BodyLo1

C_ShadowEquals1 = C_UpShadow1 == C_DnShadow1 or (abs(C_UpShadow1 - C_DnShadow1) / C_DnShadow1 * 100) < C_ShadowEqualsPercent1 and (abs(C_DnShadow1 - C_UpShadow1) / C_UpShadow1 * 100) < C_ShadowEqualsPercent1

C_IsDojiBody1 = C_Range1 > 0 and C_Body1 <= C_Range1 * C_DojiBodyPercent1 / 100

C_Doji1 = C_IsDojiBody1 and C_ShadowEquals1

patternLabelPosLow1 = low - (atr(30) * 0.6)

patternLabelPosHigh1 = high + (atr(30) * 0.6)

C_LongLowerShadowBullishNumberOfCandles1 = 1

C_LongLowerShadowPercent1 = 75.0

C_LongLowerShadowBullish1 = C_DnShadow1 > C_Range1/100*C_LongLowerShadowPercent1

//alertcondition1(C_LongLowerShadowBullish1, title = "Long Lower Shadow", message = "New Long Lower Shadow - Bullish pattern detected.")

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=1, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=11, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2030, minval=1800, maxval=2100)

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

//多單

if ((bullishEngulfing or C_LongLowerShadowBullish1) and inDateRange and cross(low,lower))

strategy.entry("L", strategy.long, qty=1,stop=(low[1]))

//strategy.close("L",comment = "L exit",when=cross(basis,close),qty_percent=50)

if crossunder(close,upper*0.9985)

strategy.close("L",comment = "L exit",qty_percent=1)

//空單

if (((bullishEngulfing == 0) or C_LongUpperShadowBearish) and inDateRange and cross(close,upper))

strategy.entry("S", strategy.short,qty= 1,stop=(high[1]))

//strategy.close("S",comment = "S exit",when=cross(basis,close),qty_percent=50)

if crossunder(lower*1.0015,close)

strategy.close("S",comment = "S exit",qty_percent=1)