Strategi Kombinasi Pembalikan Rata-rata Pergerakan Ganda dan Titik Pivot

Ringkasan

Strategi ini adalah kombinasi dari strategi 123 dan strategi pivot point dengan tujuan untuk mendapatkan tingkat kemenangan yang lebih tinggi. Strategi 123 dan strategi pivot point menentukan titik balik tren, dan strategi pivot point menentukan titik dukungan dan resistensi penting.

Prinsip Strategi

123 strategi pembalikan bentuk

Strategi ini didasarkan pada indikator acak untuk menentukan titik balik tren. Prinsipnya adalah: Ketika harga penutupan 2 hari berturut-turut lebih rendah dari harga penutupan sebelumnya, dan pada hari ke-9 indikator STO lambat lebih rendah dari 50, lakukan over; ketika harga penutupan 2 hari berturut-turut lebih tinggi dari harga penutupan sebelumnya, dan pada hari ke-9 indikator STO cepat lebih tinggi dari 50, lakukan over.

Strategi Pivot Point

Strategi ini menghitung 3 garis dukungan dan 3 garis resistensi berdasarkan harga tertinggi, terendah, dan harga penutupan hari sebelumnya. Metode perhitungan spesifik adalah:

Titik pusat = (maksimum + minimum + akhir) / 3

Support 1 = 2*Titik pusat - tertinggi

Resistensi 1 = 2Titik pusat - terendah

Dukungan 2 = titik pusat - resistensi 1 - Dukungan 1

Resistensi 2 = titik pusat + resistensi 1 - dukungan 1)

Dukungan 3 = Minimal -2.(Tinggi - titik tengah)

Resistensi 3 = maksimum + 2*(Titik tengah - terendah)

Dan masuk dan keluar berdasarkan posisi dukungan dan resistensi.

Keunggulan Strategis

- Kombinasi dari dua jenis strategi yang berbeda memberikan keuntungan yang lebih tinggi, baik untuk menentukan pembalikan tren dan juga untuk mengunci titik harga tertentu.

- 123 strategi bentuk dapat secara efektif menilai titik balik tren dalam jangka pendek

- Strategi pivot point dapat menggunakan filter resistance bit pendukung utama untuk melakukan false breakout

Risiko dan perlindungan

- Indikator acak ganda memiliki keterlambatan tertentu, mungkin melewatkan pembalikan garis pendek

- Hubspot tidak 100% efektif, mungkin ada terobosan untuk terus beroperasi

- Parameter dapat disesuaikan sesuai, atau digunakan dalam kombinasi dengan indikator lain untuk melindungi risiko

Arah optimasi strategi

- Menguji dampak dari berbagai parameter terhadap efektivitas strategi

- Anda dapat mencoba kombinasi dengan indikator atau bentuk lain untuk meningkatkan efektivitas strategi.

- Parameter optimasi dinamis yang dapat digabungkan dengan algoritma pembelajaran mesin

Meringkaskan

Strategi ini dengan cerdik menggabungkan penilaian tren dengan titik harga kunci, dapat menentukan titik pembalikan tren, dan dapat memanfaatkan sinyal penyaringan resistensi dukungan. Dengan mengoptimalkan kombinasi parameter dan strategi, efeknya dapat ditingkatkan lebih lanjut. Strategi ini layak untuk dipelajari dan diterapkan lebih lanjut oleh pedagang kuantitatif.

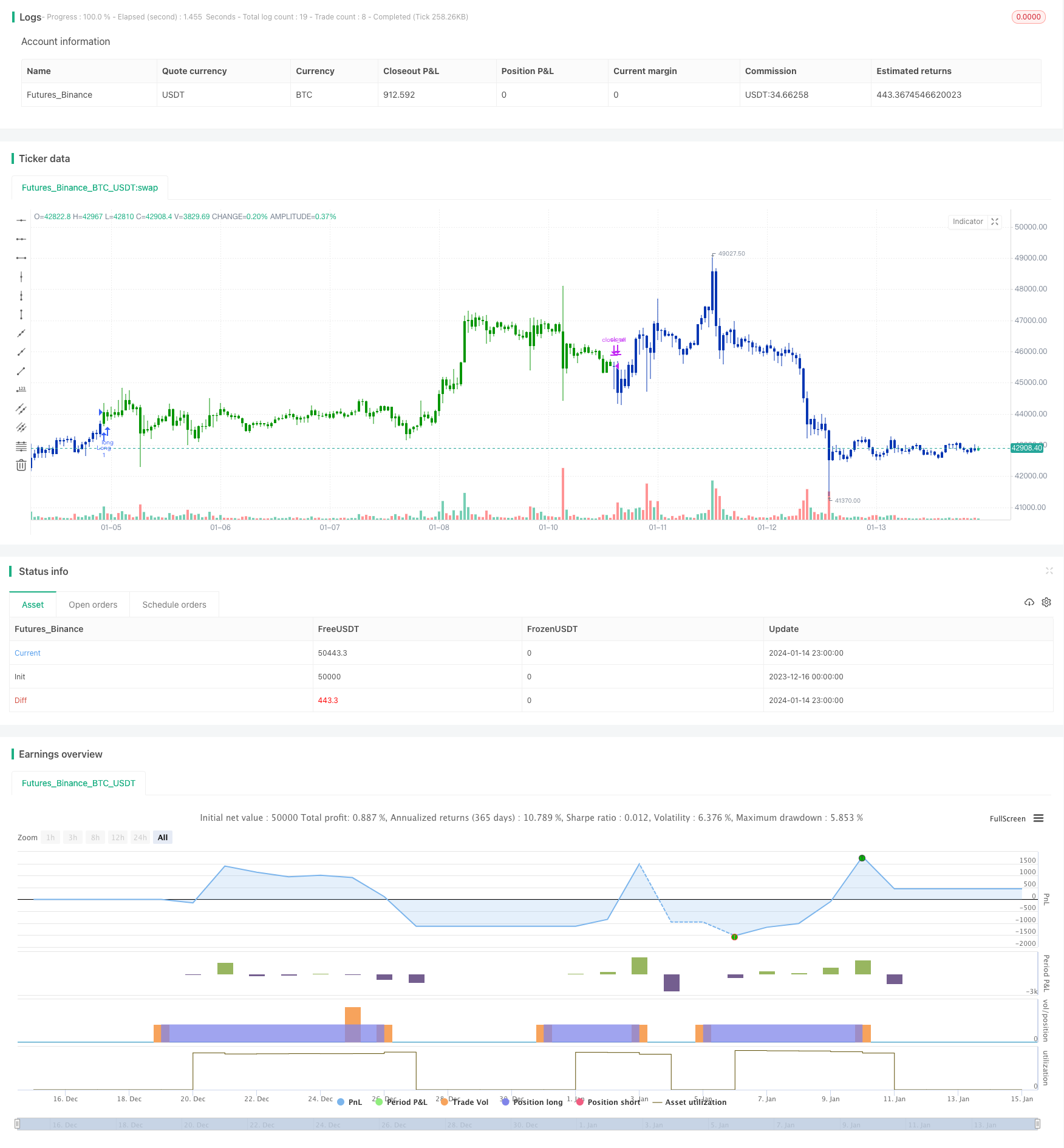

/*backtest

start: 2023-12-16 00:00:00

end: 2024-01-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/04/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Pivot points simply took the high, low, and closing price from the previous period and

// divided by 3 to find the pivot. From this pivot, traders would then base their

// calculations for three support, and three resistance levels. The calculation for the most

// basic flavor of pivot points, known as ‘floor-trader pivots’, along with their support and

// resistance levels.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

PP2(res,SellFrom,BuyFrom) =>

pos = 0.0

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

vPP = (xHigh+xLow+xClose) / 3

vS1 = 2*vPP - xHigh

vR1 = 2*vPP-xLow

vS2 = vPP - (vR1 - vS1)

vR2 = vPP + (vR1 - vS1)

vS3 = xLow - 2 * (xHigh - vPP)

vR3 = xHigh + 2 * (vPP - xLow)

S = iff(BuyFrom == "S1", vS1,

iff(BuyFrom == "S2", vS2,

iff(BuyFrom == "S3", vS3,0)))

B = iff(SellFrom == "R1", vR1,

iff(SellFrom == "R2", vR2,

iff(SellFrom == "R3", vR3,0)))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Pivot Point V2)", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Pivot Point V2 ----")

res = input(title="Resolution", type=input.resolution, defval="D")

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3"])

BuyFrom = input(title="Buy from ", defval="S1", options=["S1", "S2", "S3"])

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posPP2 = PP2(res,SellFrom,BuyFrom)

pos = iff(posReversal123 == 1 and posPP2 == 1 , 1,

iff(posReversal123 == -1 and posPP2 == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )