Strategi Perdagangan Jangka Pendek Momentum Breakout

Ringkasan

Strategi ini memantau data perdagangan SPY, menggabungkan sinyal dari berbagai indikator teknis seperti moving average, MACD, RSI, dan lain-lain, untuk menilai tren jangka pendek dan membuat keputusan beli dan jual untuk menghasilkan keuntungan dari perdagangan garis pendek.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada indikator teknis berikut untuk menilai tren jangka pendek dan waktu masuk:

- Fork emas dan Fork mati dari indeks moving average (EMA) pada tanggal 5 dan 13 digunakan untuk menilai pergeseran tren bullish.

- Indikator MACD menilai apakah ada pergerakan ke atas.

- Indeks ADX menilai apakah ada tren.

- RSI adalah indikator untuk menilai kekuatan tren.

Dengan mengoptimalkan parameter indikator di atas, menentukan titik balik polygon yang penting. Tampilkan sinyal putih untuk menunjuk L atau S saat memenuhi 5⁄6 kondisi, dan ketika enam kondisi terpenuhi, tunjukkan sinyal berbentuk △ emas pada saat penutupan grafik tersebut.

Kondisi yang membentuk sinyal beli:

EMA 5 hari lebih besar dari EMA 13 hari dan garis MACD lebih rendah dari 0,5 dan ADX lebih tinggi dari 20 dan kemiringan MACD lebih besar dari 0 dan garis sinyal lebih tinggi dari -0,1 dan RSI lebih tinggi dari 40

Kondisi yang membentuk sinyal penjualan:

EMA 5 hari kurang dari EMA 13 hari dan garis MACD lebih tinggi dari -0.5 dan ADX lebih tinggi dari 20 dan garis sinyal lebih rendah dari 0 dan kemiringan MACD kurang dari 0 dan RSI lebih rendah dari 60

Analisis Keunggulan

Strategi ini memiliki keuntungan sebagai berikut:

- Dengan kombinasi berbagai sinyal indikator, penilaian lebih akurat.

- Dengan optimasi parameter, sensitivitas dan keakuratan penilaian dapat diseimbangkan.

- Sinyal penilaian ringkas dan jelas, ambang batas operasi rendah.

- Ini berlaku untuk perdagangan jangka pendek dan sesuai dengan preferensi risiko sebagian besar investor.

- Pertimbangkan kebutuhan operasi hard disk, dan hindari fluktuasi tinggi pada waktu akhir.

Analisis risiko

Strategi ini juga memiliki risiko sebagai berikut:

- Pengaturan parameter yang tidak tepat dapat menyebabkan risiko kesalahan penilaian. Perlu terus diuji dan dioptimalkan.

- Satu varietas, tidak dapat mendistribusikan risiko industri dan alokasi aset

- Biaya transaksi dan risiko slippage yang ditimbulkan oleh seringnya transaksi.

- Tidak ada kesempatan untuk membangun gudang di akhir pekan, mungkin akan kehilangan beberapa kesempatan.

Arah optimasi

Strategi ini dapat terus dioptimalkan dari dimensi-dimensi berikut:

- Tes mengubah pengaturan parameter untuk meningkatkan akurasi penilaian.

- Meningkatkan Stop Loss Indicator untuk mengendalikan kerugian tunggal.

- Optimalkan waktu pembukaan posisi, filter saat volatilitas tinggi di tail.

- Menambahkan varietas lain sebagai sasaran strategi.

- Menggabungkan algoritma pembelajaran mesin untuk meningkatkan kemampuan beradaptasi parameter.

Meringkaskan

Strategi ini dengan melacak data SPY, menggabungkan berbagai indikator teknis seperti moving average, MACD, RSI untuk menilai tren jangka pendek, frekuensi operasi tinggi, penarikan rendah, sangat cocok untuk perdagangan garis pendek. Dapat terus dioptimalkan dari beberapa dimensi, dengan ruang perbaikan yang besar.

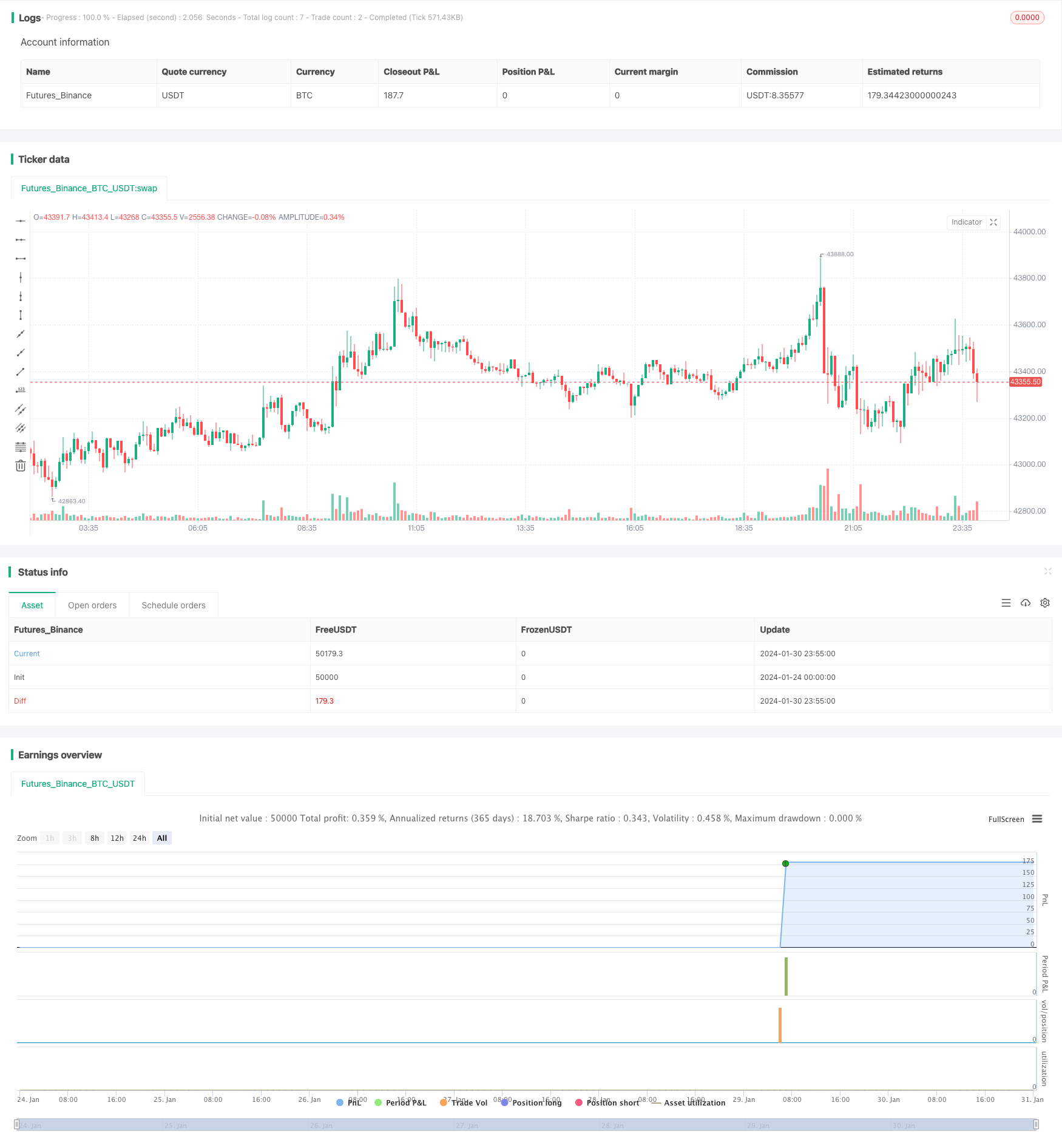

/*backtest

start: 2024-01-24 00:00:00

end: 2024-01-31 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="SPY 1 Minute Day Trader", overlay=true)

//This script has been created to take into account how the following variables impact trend for SPY 1 Minute

//The SPY stop losses/take profit have been set at 30 cents which equates to 15 cents on SPY 1 DTE ATM contracts

//5 ema vs 13 ema : A cross establishes start of trend

//MACD (Line, Signal & Slope) : If you have momentum

//ADX : if you are trending

//RSI : If the trend has strength

//The above has been optimized to determine pivot points in the trend using key values for these 6 indicators

//bounce up = ema5 > ema13 and macdLine < .5 and adx > 20 and macdSlope > 0 and signalLine > -.1 and rsiSignal > 40

//bounce down = ema5 < ema13 and macdLine > -.5 and adx > 20 and signalLine < 0 and macdSlope < 0 and rsiSignal < 60

//White L's indicate that 5 of 6 conditions are met due to impending uptrend w/ missing one in green below it

//Yellow L's indicate that 6 of 6 conditions still are met

//White S's indicate that 5 of 6 conditions are met due to impending downtrend w/ missing condition in red above it

//Yellow S's indicate that 6 of 6 conditions still are met

//After a downtrend or uptrend is established, once it closes it can't repeat for 10 minutes

//Won't open any trades on last two minutes of any hours to avoid volatility

//Will close any open trades going into last minute of hour

// Initialize variables

var float long_entry_price = na

var float short_entry_price = na

var float stop_loss = na

var float take_profit = na

var float short_stop_loss = na

var float short_take_profit = na

var float option_SL = 0.3 //approx 15 cents on SPY 1 DTE

var float option_TP = 0.3 //approx 15 cents on SPY 1 DTE

var long_entry_time = 0

var short_entry_time = 0

var allow_long_entry = true

var allow_short_entry = true

var allow_trades = true

var hourlyclose = 0

var notify = 0

var shortnotify = 0

// Calculate the EMAs & SMAs

ema5 = ta.ema(close, 5)

ema13 = ta.ema(close, 13)

sma20 = ta.sma(close, 20)

// Input parameters

fastLength = input.int(12, minval=1, title="Fast Length")

slowLength = input.int(26, minval=1, title="Slow Length")

signalLength = input.int(9, minval=1, title="Signal Smoothing")

// Inputs

length = input.int(14, "Length")

smoothK = input.int(3, "SmoothK")

src = input(close, "Source")

overbought = input.float(80, "Overbought")

oversold = input.float(20, "Oversold")

//Stochastic Calculation

highestHigh = ta.highest(src, length)

lowestLow = ta.lowest(src, length)

k = 100 * ((src - lowestLow) / (highestHigh - lowestLow))

d = ta.sma(k, smoothK)

// Calculate MACD

[macdLines, signalLines, _] = ta.macd(close, fastLength, slowLength, signalLength)

// Calculate slope of MACD line

macdSlope = (macdLines - macdLines[1]) / (bar_index - bar_index[1])

// Calculate the RSI

rsiValue = ta.rsi(close, 5)

// Calculate the signal line as the SMA of the RSI for 5 minute over 9 periods

rsiSignal = ta.sma(rsiValue, 9)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Length of the ATR

atr_length = input.int(14, title="ATR Length", minval=1)

// Calculate the True Range

tr = ta.tr(true)

// Calculate the ATR

atr = ta.atr(atr_length)

// Length of the ADX

len = input.int(14, minval=1)

// Set minimum number of bars between trades

min_bars_between_trades = 10

// Calculate the Directional Movement

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

// Calculate the Smoothed Directional Movement

plusDI = 100 * ta.ema(plusDM, len) / ta.ema(tr, len)

minusDI = 100 * ta.ema(minusDM, len) / ta.ema(tr, len)

// Calculate the Directional Index (DX)

DX = 100 * math.abs(plusDI - minusDI) / (plusDI + minusDI)

// Calculate the ADX

adx = ta.ema(DX, len)

// Get high, low, and close prices

highPrice = high

lowPrice = low

closePrice = close

// Determine buy and sell signals - Tried to optimize as much as possible - changing these do impact results

buy_signal = ema5 > ema13 and macdLine < .5 and adx > 20 and macdSlope > 0 and signalLine > -.1 and rsiSignal > 40

short_buy_signal = ema5 < ema13 and macdLine > -.5 and adx > 20 and signalLine < 0 and macdSlope < 0 and rsiSignal < 60

// Define long entry conditions

C1 = ema5 > ema13 ? 1 : 0 //E below bar when only one missing

C2 = d < 70 ? 1 : 0 //no longer part of signal - but was Smoothed Stoicastic

C3 = macdLine < .5 ? 1 : 0 //M below bar when only one missing

C4 = adx > 20 ? 1 : 0 //A below bar when only one missing

C5 = macdSlope > 0 ? 1 : 0 //% below bar when only one missing

C6 = signalLine > -.01 ? 1 : 0 //S (MACD Signal) below bar when only one missing

C7 = rsiSignal > 50 ? 1 : 0 //R below bar when only one missing

// Define short entry conditions

C8 = ema5 < ema13 ? 1 : 0 //E above bar when only one missing

C9 = d > 40 ? 1 : 0 //no longer part of signal - but was Smoothed Stoicastic

C10 = macdLine > -0.5 ? 1 : 0 //M above bar when only one missing

C11 = adx > 20 ? 1 : 0 //A above bar when only one missing

C12 = macdSlope < 0 ? 1 : 0 //% above bar when only one missing

C13 = signalLine < 0 ? 1 : 0 //S (MACD Signal) above bar when only one missing

C14 = rsiSignal < 50 ? 1 : 0 //R above bar when only one missing

// Long or Short Incoming denoted by white color and gold means all conditions met

plotchar((C1 + C3 + C4 + C5 + C6 + C7) == 5 ? 1 : na, title="Pivot Up White", char="L", location=location.belowbar, color=color.white, size = size.tiny)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) == 5 ? 1 : na, title="Pivot Down White", char="S", location=location.abovebar, color=color.white, size = size.tiny)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) > 5 ? 1 : na, title="Pivot Up Gold", char="L", location=location.belowbar, color=color.yellow, size = size.tiny)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) > 5 ? 1 : na, title="Pivot Down Gold", char="S", location=location.abovebar, color=color.yellow, size = size.tiny)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C1) != 1 ? 1 : na, title="Missing", char = "", text="E", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C3) != 1 ? 1 : na, title="Missing", char = "", text="M", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C4) != 1 ? 1 : na, title="Missing", char = "", text="A", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C5) != 1 ? 1 : na, title="Missing", char = "", text="%", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C6) != 1 ? 1 : na, title="Missing", char = "", text="S", location=location.belowbar, color=color.green, size = size.small)

plotchar((C1 + C3 + C4 + C5 + C6 + C7) >= 5 and (C7) != 1 ? 1 : na, title="Missing", char = "", text="R", location=location.belowbar, color=color.green, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C8) != 1 ? 1 : na, title="Missing", char = "", text="E", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C10) != 1 ? 1 : na, title="Missing", char = "", text="M", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C11) != 1 ? 1 : na, title="Missing", char = "", text="A", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C12) != 1 ? 1 : na, title="Missing", char = "", text="%", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C13) != 1 ? 1 : na, title="Missing", char = "", text="S", location=location.abovebar, color=color.red, size = size.small)

plotchar((C8 + C10 + C11 + C12 + C13 + C14) >= 5 and (C14) != 1 ? 1 : na, title="Missing", char = "", text="R", location=location.abovebar, color=color.red, size = size.small)

// Execute buy and sell orders

if buy_signal and allow_trades and allow_long_entry //Don't buy on last 2 minutes of hour

long_entry_price := open

strategy.entry("Pivot Up", strategy.long)

stop_loss := long_entry_price - option_SL

take_profit := long_entry_price + option_TP

long_entry_time := time

allow_long_entry := false

allow_trades := false

notify := 1

plotshape(notify == 1 ? 1 : na, "Pivot Up", style=shape.triangleup, offset = 1, location=location.belowbar, size=size.normal, textcolor = color.orange, color=color.orange)

if notify == 1

notify := notify - 1

if short_buy_signal and allow_trades and allow_short_entry //Don't buy on last 2 minutes of hour

short_entry_price := open

strategy.entry("Pivot Down", strategy.short)

short_stop_loss := short_entry_price + option_SL

short_take_profit := short_entry_price - option_TP

short_entry_time := time

allow_short_entry := false

allow_trades := false

shortnotify := 1

plotshape(shortnotify == 1 ? 1 : na, "Pivot Down", style=shape.triangledown, offset = 1, location=location.abovebar, size=size.normal, textcolor = color.orange, color=color.orange)

if shortnotify == 1

shortnotify := shortnotify - 1

// Take scalp when in a position and 5 or more parameters are met!

if strategy.position_size != 0 and (C1 + C3 + C4 + C5 + C6 + C7) >5

strategy.exit("Exit Longs", "Pivot Up", stop=stop_loss, limit = take_profit)

else if strategy.position_size != 0 and (C8 + C10 + C11 + C12 + C13 + C14) >5

strategy.exit("Exit Shorts", "Pivot Down", stop=short_stop_loss, limit = short_take_profit)

// Reset allow_trades after cool-down period of min_bars_between_trades bars set above

if time > long_entry_time + (time - time[1]) * min_bars_between_trades

allow_long_entry := true

allow_trades := true

if time > short_entry_time + (time - time[1]) * min_bars_between_trades

allow_short_entry := true

allow_trades := true

// Close all positions at the end of the trading day and when volatile hours approach!

if strategy.position_size != 0

strategy.close("Pivot Up")

strategy.close("Pivot Down")

hourlyclose := 1

plotshape(hourlyclose == 1 ? 1 : na, "Suggested Volatile Hour Close", text="Suggested Volatile Hour Close", offset = 1, style=shape.triangledown, location=location.abovebar, size=size.tiny, textcolor = color.orange, color=color.orange)

if hourlyclose == 1

hourlyclose := hourlyclose - 1