Strategi Perdagangan Kuantitatif Rata-rata Pergerakan Ganda

Ringkasan

Strategi ini adalah jenis strategi trend-following yang dilakukan dengan menghitung rata-rata bergerak cepat dan rata-rata bergerak lambat, dan digabungkan dengan indikator garis polarization untuk membuat keputusan jual beli. Lakukan lebih banyak ketika melewati rata-rata bergerak lambat di atas rata-rata bergerak cepat; kosong ketika melewati rata-rata bergerak lambat di bawah rata-rata bergerak cepat.

Prinsip Strategi

- Hitung rata-rata bergerak cepat dan rata-rata bergerak lambat. Parameter rata-rata bergerak dapat disesuaikan.

- Membandingkan dua rata-rata bergerak, menilai arah tren pasar. Ketika rata-rata bergerak cepat melewati rata-rata bergerak lambat, menilai pasar multihead; Ketika rata-rata bergerak cepat melewati rata-rata bergerak lambat, menilai pasar kosong.

- Hubungan antara harga close out dan moving average digunakan sebagai konfirmasi lebih lanjut. Sinyal beli hanya dihasilkan ketika harga close out melewati garis cepat dan lebih tinggi dari harga close out. Sinyal jual hanya dihasilkan ketika harga close out melewati garis lambat dan lebih rendah dari harga close out.

- Fake breakout filter dengan indikator garis parallax. Hanya ketika garis cepat melewati garis lambat, dan harga close out lebih tinggi dari garis cepat, dan harga saham lebih tinggi dari garis parallax, sinyal beli akhirnya dihasilkan; dan sebaliknya.

- Berdasarkan batas kerugian maksimum yang dapat ditanggung. Perhitungan harga stop loss spesifik dalam kombinasi dengan indikator ATR

Keunggulan Strategis

- Menggunakan Moving Average untuk menentukan arah tren pasar, menghindari perdagangan yang sering terjadi di pasar yang tidak jelas arahnya

- Kondisi penyaringan ganda efektif untuk menghindari masalah penembusan palsu yang umum

- Mengontrol kerugian tunggal secara efektif dengan strategi stop loss

Risiko Strategis

- Strategi indikator mudah menghasilkan sinyal palsu

- Tidak mempertimbangkan risiko mata uang

- Mungkin ada perbedaan di awal.

Ada beberapa cara untuk mengoptimalkan masalah di atas:

- Optimalkan parameter moving average agar lebih sesuai dengan varietas tertentu

- Dapat digabungkan dengan indikator atau model lain untuk memfilter sinyal

- Pertimbangkan risiko mata uang untuk real-time hedging atau konversi otomatis akun broker

Arah optimasi

- Optimalkan parameter moving average untuk menangkap tren yang lebih baik

- Menambah portofolio model untuk meningkatkan akurasi sinyal

- Verifikasi Periode Berkali-kali, Hindari Kecurangan

- Optimalkan strategi stop loss dan meningkatkan strategi stabilitas

Meringkaskan

Strategi ini adalah salah satu dari dua rata-rata bergerak yang khas dan strategi pelacakan tren kombinasi indikator. Dengan membandingkan arah dua rata-rata bergerak, menilai tren pasar; dan dengan kombinasi berbagai indikator penyaringan untuk menghindari sinyal palsu, menghasilkan sinyal perdagangan. Selain itu, strategi ini memiliki fungsi stop loss untuk mengendalikan kerugian tunggal. Keuntungan adalah bahwa logika strategi sederhana dan jelas, mudah dipahami, dapat diimplementasikan dan dioptimalkan sesuai kebutuhan.

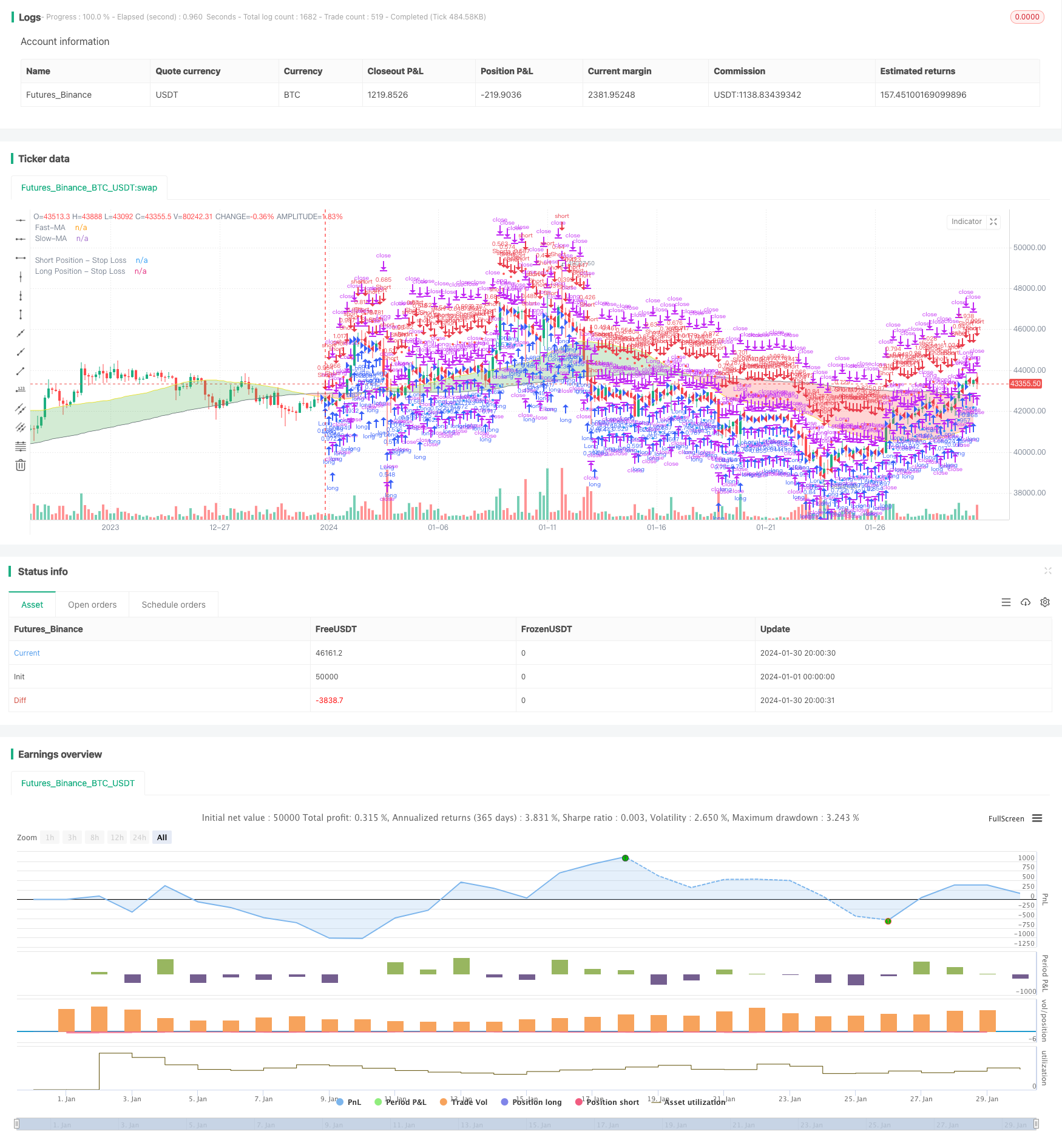

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title="2 MA | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2000"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//---------------------------------------

//SLOW MA INPUTS

averageType1 = input.string(defval="SMA", group="Slow MA Inputs", title="Slow MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=160, group="Slow MA Inputs", title="Slow MA Length", minval=50)

averageSource1 = input(close, title="Slow MA Source", group="Slow MA Inputs")

//SLOW MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

//----------------------------------

//FAST MA INPUTS

averageType2 = input.string(defval="SMA", group="Fast MA Inputs", title="Fast MA Type", options=["SMA","EMA","WMA","HMA","RMA","SWMA","ALMA","VWMA","VWAP"])

averageLength2 = input.int(defval=40, group="Fast MA Inputs", title="Fast MA Length", maxval=40)

averageSource2 = input(close, title="Fast MA Source", group="Fast MA Inputs")

//FAST MA TYPE

MovAvgType2(averageType2, averageSource2, averageLength2) =>

switch str.upper(averageType2)

"SMA" => ta.sma(averageSource2, averageLength2)

"EMA" => ta.ema(averageSource2, averageLength2)

"WMA" => ta.wma(averageSource2, averageLength2)

"HMA" => ta.hma(averageSource2, averageLength2)

"RMA" => ta.rma(averageSource2, averageLength2)

"SWMA" => ta.swma(averageSource2)

"ALMA" => ta.alma(averageSource2, averageLength2, 0.85, 6)

"VWMA" => ta.vwma(averageSource2, averageLength2)

"VWAP" => ta.vwap(averageSource2)

=> runtime.error("Moving average type '" + averageType2 +

"' not found!"), na

//---------------------------------------------------

//MA VALUES

FASTMA = MovAvgType2(averageType2, averageSource2, averageLength2)

SLOWMA = MovAvgType1(averageType1, averageSource1, averageLength1)

//BUY/SELL TRIGGERS

bullish_trend = FASTMA > SLOWMA and close > FASTMA

bearish_trend = FASTMA < SLOWMA and close < FASTMA

//MAs PLOT

plot1 = plot(SLOWMA,color=color.gray, linewidth=1, title="Slow-MA")

plot2 = plot(FASTMA,color=color.yellow, linewidth=1, title="Fast-MA")

fill(plot1, plot2, color=SLOWMA>FASTMA ? color.new(color.red, 70) : color.new(color.green, 70), title="EMA Clouds")

//-----------------------------------------------------

//PARABOLIC SAR USER INPUT

usepsarFilter = input.bool(title='Use Parabolic Sar?', defval=true, group = "Parabolic SAR Inputs")

psar_display = input.bool(title="Display Parabolic Sar?", defval=false, group="Parabolic SAR Inputs")

start = input.float(title="Start", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

increment = input.float(title="Increment", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

maximum = input.float(title="Maximum", defval=0.2, group="Parabolic SAR Inputs", step=0.001)

//SAR VALUES

psar = request.security(syminfo.tickerid, "D", ta.sar(start, increment, maximum))

//BULLISH & BEARISH PSAR CONDITIONS

bullish_psar = (usepsarFilter ? low > psar : bullish_trend )

bearsish_psar = (usepsarFilter ? high < psar : bearish_trend)

//SAR PLOT

psar_plot = if low > psar

color.rgb(198, 234, 199, 13)

else

color.rgb(219, 134, 134, 48)

plot(psar_display ? psar : na, color=psar_plot, title="Par SAR")

//-------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and bullish_trend and bullish_psar and LongPositions

true

long_exit = if inTradeWindow and bearish_trend

true

short_entry = if inTradeWindow and bearish_trend and bearsish_psar and ShortPositions

true

short_exit = if inTradeWindow and bullish_trend

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(14, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)