Strategi perdagangan kuantitatif berdasarkan saluran SSL dan tren gelombang

Ringkasan

Strategi ini didasarkan pada indikator SSL Channel dan Trend Wave, yang dikombinasikan dengan indikator tambahan lainnya, untuk mencapai strategi perdagangan kuantitatif yang lebih lengkap. Nama strategi ini mencakup indikator inti SSL Channel dan Trend Wave, serta kata kunci untuk perdagangan kuantitatif, sesuai dengan persyaratan.

Prinsip Strategi

Strategi ini didasarkan pada enam syarat masuk, dua di antaranya adalah syarat inti, yaitu:

- Bentuk dasar dari indikator campuran SSL adalah biru (meningkat) atau merah (menurun)

- Indikator SSL channel bercabang atas (menuju ke atas) atau bawah (menuju ke bawah)

- Indikator tren gelombang bercabang atas (menuju) atau bawah (menuju ke bawah)

- Ketinggian garis K masuk tidak melebihi nilai ambang

- Garis masuk K terletak di dalam Jalan Bryn.

- Titik akhir tidak menyentuh garis rata

Ketika 6 kondisi ini terpenuhi secara bersamaan, strategi akan masuk untuk melakukan over atau under. Jarak stop loss dihitung berdasarkan nilai indikator ATR, dan jarak stop loss adalah dua kali Rasio Risiko Reward dari stop loss.

Strategi ini juga memiliki mekanisme manajemen risiko yang lengkap, termasuk pengaturan stop loss, kontrol ukuran posisi, dan kontrol penarikan maksimum. Selain itu, strategi ini memetakan garis tambahan di grafik, yang dapat melihat secara intuitif setiap stop loss dan stop loss, serta kerugian spesifik. Ini sangat membantu untuk analisis dan strategi optimasi.

Analisis Keunggulan

Keuntungan terbesar dari strategi ini adalah akurasi yang sangat tinggi dalam menentukan arah tren menggunakan indikator saluran SSL, kemudian bekerja sama dengan indikator seperti tren gelombang untuk konfirmasi, dapat mengurangi sinyal palsu secara signifikan. Pada saat yang sama, persyaratan masuk yang ketat juga dapat menghindari transaksi yang tidak perlu, sehingga mengurangi jumlah transaksi dan mengurangi biaya transaksi.

Selain itu, mekanisme pengelolaan risiko dan dana yang baik dari strategi ini juga merupakan keuntungan besar. Strategi stop-loss dan stop-loss yang baik yang telah ditetapkan sebelumnya dapat secara efektif mengontrol kerugian maksimum dalam satu transaksi.

Analisis risiko

Risiko terbesar dari strategi ini adalah bahwa persyaratan masuk yang ketat akan melewatkan beberapa peluang perdagangan, yang menyebabkan beberapa dampak pada profitabilitas. Strategi ini juga mengurangi profitabilitas ketika pasar berada dalam keadaan goyah.

Selain itu, indikator seperti tren gelombang menilai efek dari tren pasar, juga dapat dipengaruhi oleh abnormalitas pasar seperti false breakout. Pada saat ini perlu untuk menyesuaikan parameter, atau menambahkan indikator lain untuk konfirmasi.

Secara keseluruhan, risiko dari strategi ini dapat dikontrol. Dengan penyesuaian dan pengoptimalan parameter, strategi dapat disesuaikan dengan kondisi pasar yang berbeda.

Arah optimasi

Strategi ini juga dapat dioptimalkan dengan beberapa cara:

Parameter yang dioptimalkan untuk tren gelombang, sehingga dapat lebih akurat menilai titik-titik perubahan tren

Menambahkan indikator lain untuk konfirmasi, seperti KDJ, MACD, dan lain-lain, untuk menghindari dampak false breach

Optimalisasi parameter dapat disesuaikan dengan varietas dan siklus yang berbeda untuk meningkatkan stabilitas strategi

Menambahkan algoritma pembelajaran mesin, memanfaatkan pelatihan data historis, dan parameter strategi optimasi real-time

Strategi untuk meningkatkan frekuensi perdagangan dan profitabilitas dengan menggunakan algoritma seperti High Frequency Factor

Implementasi langkah-langkah optimasi ini diharapkan dapat meningkatkan profitabilitas dan stabilitas strategi.

Meringkaskan

Secara keseluruhan, strategi ini mengintegrasikan berbagai indikator dan mekanisme masuk yang ketat, serta memberikan efek pengendalian risiko yang baik sambil memastikan tingkat kemenangan yang tinggi. Dengan arah optimasi di masa depan, strategi ini memiliki potensi besar untuk dikembangkan sebagai strategi perdagangan kuantitatif yang disarankan.

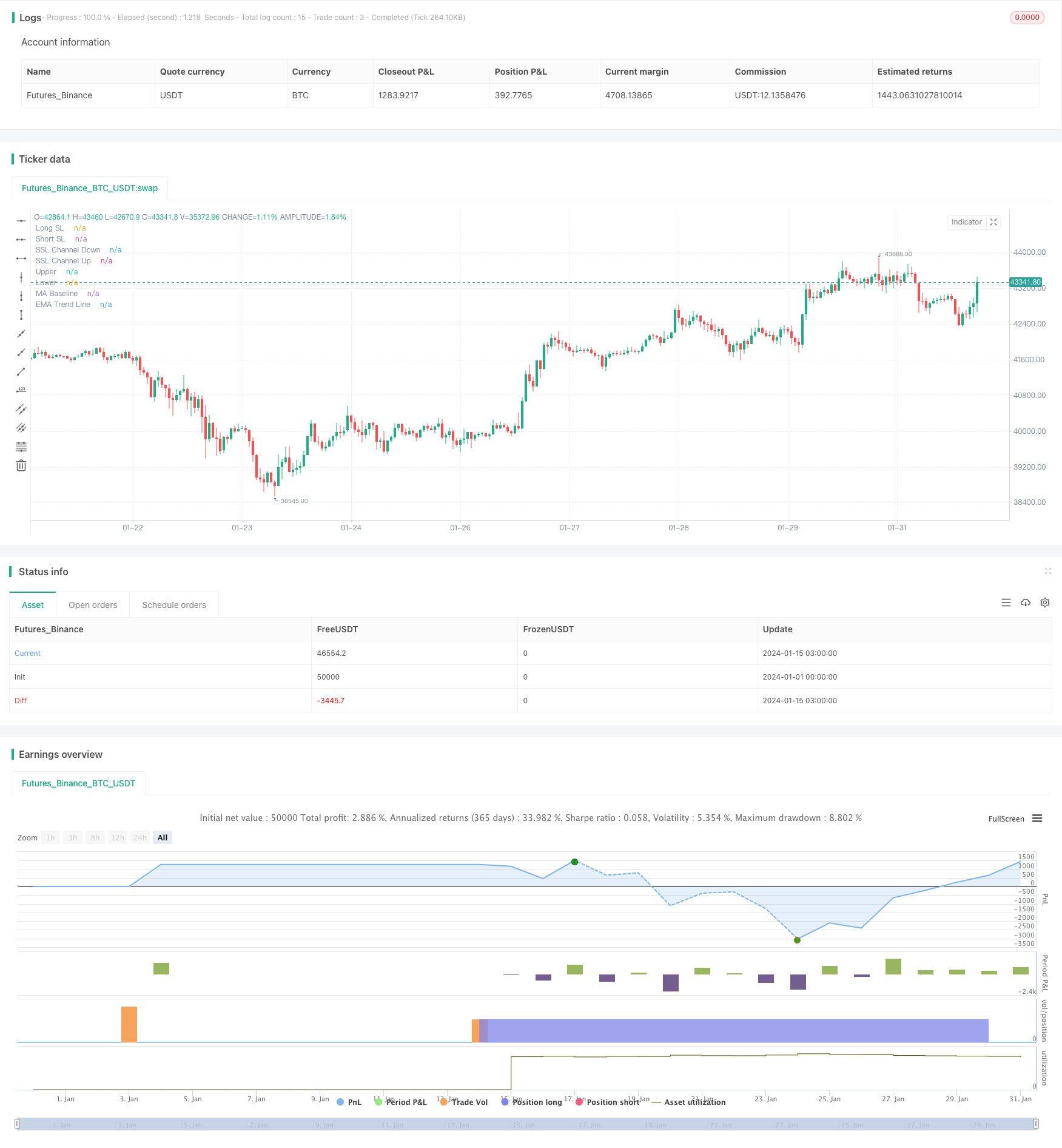

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @credits

// - Wave Trend: Indicator: WaveTrend Oscillator [WT] by @LazyBear

// - SSL Channel: SSL channel by @ErwinBeckers

// - SSL Hybrid: SSL Hybrid by @Mihkel00

// - Keltner Channels: Keltner Channels Bands by @ceyhun

// - Candle Height: Candle Height in Percentage - Columns by @FreeReveller

// - NNFX ATR: NNFX ATR by @sueun123

//

// Strategy: Based on the YouTube video "This Unique Strategy Made 47% Profit in 2.5 Months [SSL + Wave Trend Strategy Tested 100 Times]" by TradeSmart.

// @description

//

// Strategy incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Based on strategy conditions below

//

// - Trade exit: Based on strategy conditions below

//

// - Backtesting: Configurable backtesting range by date

//

// - Chart drawings: Each entry condition indicator can be turned on and off

// TP/SL boxes drawn for all trades. Can be turned on and off

// Trade exit information labels. Can be turned on and off

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Alerting: Alerts on LONG and SHORT trade entries

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: SSL Hybrid baseline is BLUE

// C2: SSL Channel crosses up (green on top)

// C3: Wave Trend crosses up (represented by pink candle body)

// C4: Entry candle height is not greater than configured threshold

// C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

// C6: Take Profit target does not touch EMA (represents resistance)

//

// SHORT: C1: SSL Hybrid baseline is RED

// C2: SSL Channel crosses down (red on top)

// C3: Wave Trend crosses down (represented by orange candle body)

// C4: Entry candle height is not greater than configured threshold

// C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

// C6: Take Profit target does not touch EMA (represents support)

//

// - Trade exit: Stop Loss: Size configurable with NNFX ATR multiplier

// Take Profit: Calculated from Stop Loss using R:R ratio

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("SSL + Wave Trend Strategy", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ----------------------

// Trade Entry Conditions

// ----------------------

useSslHybrid = input.bool (true, "Use SSL Hybrid Condition", group = "Strategy: Entry Conditions", inline = "SC1")

useKeltnerCh = input.bool (true, "Use Keltner Channel Condition ", group = "Strategy: Entry Conditions", inline = "SC2")

keltnerChWicks = input.bool (true, "Keltner Channel Include Wicks", group = "Strategy: Entry Conditions", inline = "SC2")

useEma = input.bool (true, "Target not touch EMA Condition", group = "Strategy: Entry Conditions", inline = "SC3")

useCandleHeight = input.bool (true, "Use Candle Height Condition", group = "Strategy: Entry Conditions", inline = "SC4")

candleHeight = input.float (1.0, "Candle Height Threshold ", group = "Strategy: Entry Conditions", inline = "SC5", minval = 0, step = 0.1, tooltip = "Percentage difference between high and low of a candle. Expressed as a decimal. Lowering this value will filter out trades on volatile candles.")

// ---------------------

// Trade Exit Conditions

// ---------------------

slAtrMultiplier = input.float (1.7, "Stop Loss ATR Multiplier ", group = "Strategy: Exit Conditions", inline = "EC1", minval = 0, step = 0.1, tooltip = "Size of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// ---------------

// Risk Management

// ---------------

riskReward = input.float (2.5, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Used to determine Take Profit level. Take Profit will be Stop Loss multiplied by this value.")

accountRiskPercent = input.float (1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM2", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// ----------

// Date Range

// ----------

startYear = input.int (2022, "Start Date ", group = "Strategy: Date Range", inline = "DR1", minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = "Strategy: Date Range", inline = "DR2", minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Display Settings

// ----------------

showTpSlBoxes = input.bool (true, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool (false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// ------------------

// Indicator Settings

// ------------------

// Indicator display options

showSslHybrid = input.bool (true, "Show SSL Hybrid", group = "Indicators: Drawings", inline = "ID1")

showSslChannel = input.bool (true, "Show SSL Channel", group = "Indicators: Drawings", inline = "ID2")

showEma = input.bool (true, "Show EMA", group = "Indicators: Drawings", inline = "ID3")

showKeltner = input.bool (true, "Show Keltner Channel", group = "Indicators: Drawings", inline = "ID4")

showWaveTrend = input.bool (true, "Show Wave Trend Flip Candles", group = "Indicators: Drawings", inline = "ID5")

showAtrSl = input.bool (true, "Show ATR Stop Loss Bands", group = "Indicators: Drawings", inline = "ID6")

// Wave Trend Settings

n1 = input.int (10, "Channel Length ", group = "Indicators: Wave Trend", inline = "WT1")

n2 = input.int (21, "Average Length ", group = "Indicators: Wave Trend", inline = "WT2")

obLevel1 = input.int (60, "Over Bought Level 1 ", group = "Indicators: Wave Trend", inline = "WT3")

obLevel2 = input.int (53, "Over Bought Level 2 ", group = "Indicators: Wave Trend", inline = "WT4")

osLevel1 = input.int (-60, "Over Sold Level 1 ", group = "Indicators: Wave Trend", inline = "WT5")

osLevel2 = input.int (-53, "Over Sold Level 2 ", group = "Indicators: Wave Trend", inline = "WT6")

// SSL Channel Settings

sslChLen = input.int (10, "Period ", group = "Indicators: SSL Channel", inline = "SC1")

// SSL Hybrid Settings

// Show/hide Inputs

show_color_bar = input.bool (false, "Show Color Bars", group = "Indicators: SSL Hybrid", inline = "SH2")

// Baseline Inputs

maType = input.string ("HMA", "Baseline Type ", group = "Indicators: SSL Hybrid", inline = "SH3", options=["SMA", "EMA", "DEMA", "TEMA", "LSMA", "WMA", "MF", "VAMA", "TMA", "HMA", "JMA", "Kijun v2", "EDSMA", "McGinley"])

len = input.int (60, "Baseline Length ", group = "Indicators: SSL Hybrid", inline = "SH4")

src = input.source (close, "Source ", group = "Indicators: SSL Hybrid", inline = "SH5")

kidiv = input.int (1, "Kijun MOD Divider ", group = "Indicators: SSL Hybrid", inline = "SH6", maxval=4)

jurik_phase = input.int (3, "* Jurik (JMA) Only - Phase ", group = "Indicators: SSL Hybrid", inline = "SH7")

jurik_power = input.int (1, "* Jurik (JMA) Only - Power ", group = "Indicators: SSL Hybrid", inline = "SH8")

volatility_lookback = input.int (10, "* Volatility Adjusted (VAMA) Only - Volatility lookback length", group = "Indicators: SSL Hybrid", inline = "SH9")

//Modular Filter Inputs

beta = input.float (0.8, "Modular Filter, General Filter Only - Beta ", group = "Indicators: SSL Hybrid", inline = "SH10", minval=0, maxval=1, step=0.1)

feedback = input.bool (false, "Modular Filter Only - Feedback", group = "Indicators: SSL Hybrid", inline = "SH11")

z = input.float (0.5, "Modular Filter Only - Feedback Weighting ", group = "Indicators: SSL Hybrid", inline = "SH12", step=0.1, minval=0, maxval=1)

//EDSMA Inputs

ssfLength = input.int (20, "EDSMA - Super Smoother Filter Length ", group = "Indicators: SSL Hybrid", inline = "SH13", minval=1)

ssfPoles = input.int (2, "EDSMA - Super Smoother Filter Poles ", group = "Indicators: SSL Hybrid", inline = "SH14", options=[2, 3])

///Keltner Baseline Channel Inputs

useTrueRange = input.bool (true, "Use True Range?", group = "Indicators: SSL Hybrid", inline = "SH15")

multy = input.float (0.2, "Base Channel Multiplier ", group = "Indicators: SSL Hybrid", inline = "SH16", step=0.05)

// EMA Settings

emaLength = input.int (200, "EMA Length ", group = "Indicators: EMA", inline = "E1", minval = 1)

// Keltner Channel Settings

kcLength = input.int (20, "Length ", group = "Indicators: Keltner Channel", inline = "KC1", minval=1)

kcMult = input.float (1.5, "Multiplier ", group = "Indicators: Keltner Channel", inline = "KC2")

kcSrc = input.source (close, "Source ", group = "Indicators: Keltner Channel", inline = "KC3")

alen = input.int (10, "ATR Length ", group = "Indicators: Keltner Channel", inline = "KC4", minval=1)

// Candle Height in Percentage Settings

chPeriod = input.int (20, "Period ", group = "Indicators: Candle Height", inline = "CH1")

// NNFX ATR Settings

nnfxAtrLength = input.int (14, "Length ", group = "Indicators: NNFX ATR (Stop Loss Settings)", inline = "ATR1", minval = 1)

nnfxSmoothing = input.string ("RMA", "Smoothing ", group = "Indicators: NNFX ATR (Stop Loss Settings)", inline = "ATR3", options = ["RMA", "SMA", "EMA", "WMA"])

// =============================================================================

// INDICATORS

// =============================================================================

// ----------

// Wave Trend

// ----------

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Show Wave Trend crosses on chart as colour changes (pink bullish, orange bearish)

wtBreakUp = ta.crossover (wt1, wt2)

wtBreakDown = ta.crossunder (wt1, wt2)

barColour = showWaveTrend ? wtBreakUp ? color.fuchsia : wtBreakDown ? color.orange : na : na

barcolor(color = barColour)

// -----------

// SSL Channel

// -----------

smaHigh = ta.sma(high, sslChLen)

smaLow = ta.sma(low, sslChLen)

var int sslChHlv = na

sslChHlv := close > smaHigh ? 1 : close < smaLow ? -1 : sslChHlv[1]

sslChDown = sslChHlv < 0 ? smaHigh : smaLow

sslChUp = sslChHlv < 0 ? smaLow : smaHigh

plot(showSslChannel ? sslChDown : na, "SSL Channel Down", linewidth=1, color=color.new(color.red, 30))

plot(showSslChannel ? sslChUp : na, "SSL Channel Up", linewidth=1, color=color.new(color.lime, 30))

// ----------

// SSL Hybrid

// ----------

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf:= c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == "TMA"

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == "MF"

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == "LSMA"

result := ta.linreg(src, len, 0)

result

if type == "SMA" // Simple

result := ta.sma(src, len)

result

if type == "EMA" // Exponential

result := ta.ema(src, len)

result

if type == "DEMA" // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == "TEMA" // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == "WMA" // Weighted

result := ta.wma(src, len)

result

if type == "VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down= ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == "HMA" // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == "JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == "Kijun v2"

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == "McGinley"

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == "EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter= stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//COLORS

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

//PLOTS

p1 = plot(showSslHybrid ? BBMC : na, color=color.new(color_bar, 0), linewidth=4, title="MA Baseline")

barcolor(show_color_bar ? color_bar : na)

// ---

// EMA

// ---

ema = ta.ema(close, emaLength)

plot(showEma ? ema : na, "EMA Trend Line", color.white)

// ----------------

// Keltner Channels

// ----------------

kcMa = ta.ema(kcSrc, kcLength)

KTop2 = kcMa + kcMult * ta.atr(alen)

KBot2 = kcMa - kcMult * ta.atr(alen)

upperPlot = plot(showKeltner ? KTop2 : na, color=color.new(color.blue, 0), title="Upper", style = plot.style_stepline)

lowerPlot = plot(showKeltner ? KBot2 : na, color=color.new(color.blue, 0), title="Lower", style = plot.style_stepline)

// ---------------------------

// Candle Height in Percentage

// ---------------------------

percentHL = (high - low) / low * 100

percentRed = open > close ? (open - close) / close * 100 : 0

percentGreen= open < close ? (close - open) / open * 100 : 0

// --------

// NNFX ATR

// --------

function(source, length) =>

if nnfxSmoothing == "RMA"

ta.rma(source, nnfxAtrLength)

else

if nnfxSmoothing == "SMA"

ta.sma(source, nnfxAtrLength)

else

if nnfxSmoothing == "EMA"

ta.ema(source, nnfxAtrLength)

else

ta.wma(source, nnfxAtrLength)

formula(number, decimals) =>

factor = math.pow(10, decimals)

int(number * factor) / factor

nnfxAtr = formula(function(ta.tr(true), nnfxAtrLength), 5) * slAtrMultiplier

//Sell

longSlAtr = nnfxAtrLength ? close - nnfxAtr : close + nnfxAtr

shortSlAtr = nnfxAtrLength ? close + nnfxAtr : close - nnfxAtr

plot(showAtrSl ? longSlAtr : na, "Long SL", color = color.new(color.red, 35), linewidth = 1, trackprice = true, editable = true, style = plot.style_stepline)

plot(showAtrSl ? shortSlAtr : na, "Short SL", color = color.new(color.red, 35), linewidth = 1, trackprice = true, editable = true, style = plot.style_stepline)

// =============================================================================

// FUNCTIONS

// =============================================================================

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// See strategy description at top for details on trade entry/exit logis

// ----------

// CONDITIONS

// ----------

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// Exit calculations

slAmount = nnfxAtr

slPercent = math.abs((1 - (close - slAmount) / close) * 100)

tpPercent = slPercent * riskReward

tpPoints = percentAsPoints(tpPercent)

tpTarget = calcProfitTrgtPrice(tpPoints, wtBreakUp)

inDateRange = true

// Condition 1: SSL Hybrid blue for long or red for short

bullSslHybrid = useSslHybrid ? close > upperk : true

bearSslHybrid = useSslHybrid ? close < lowerk : true

// Condition 2: SSL Channel crosses up for long or down for short

bullSslChannel = ta.crossover(sslChUp, sslChDown)

bearSslChannel = ta.crossover(sslChDown, sslChUp)

// Condition 3: Wave Trend crosses up for long or down for short

bullWaveTrend = wtBreakUp

bearWaveTrend = wtBreakDown

// Condition 4: Entry candle heignt <= 0.6 on Candle Height in Percentage

candleHeightValid = useCandleHeight ? percentGreen <= candleHeight and percentRed <= candleHeight : true

// Condition 5: Entry candle is inside Keltner Channel

withinCh = keltnerChWicks ? high < KTop2 and low > KBot2 : open < KTop2 and close < KTop2 and open > KBot2 and close > KBot2

insideKeltnerCh = useKeltnerCh ? withinCh : true

// Condition 6: TP target does not touch 200 EMA

bullTpValid = useEma ? not (close < ema and tpTarget > ema) : true

bearTpValid = useEma ? not (close > ema and tpTarget < ema) : true

// Combine all entry conditions

goLong = inDateRange and bullSslHybrid and bullSslChannel and bullWaveTrend and candleHeightValid and insideKeltnerCh and bullTpValid

goShort = inDateRange and bearSslHybrid and bearSslChannel and bearWaveTrend and candleHeightValid and insideKeltnerCh and bearTpValid

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

alert(message="BUY Trade Entry Alert", freq=alert.freq_once_per_bar_close)

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

alert(message="SELL Trade Entry Alert", freq=alert.freq_once_per_bar_close)

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

// printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

// printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

// Print TP/SL box for current open trade

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// =============================================================================

// DEBUGGING

// =============================================================================

// Data window plots

plotchar(goLong, "Enter Long", "")

plotchar(goShort, "Enter Short", "")