Kombinasi indikator strategi pelacakan tren terobosan

Ringkasan

Strategi ini disebut strategi pelacakan tren terobosan dengan kombinasi indikator pivot. Strategi ini menggunakan berbagai indikator untuk mengidentifikasi arah tren pasar dan melakukan operasi pelacakan tren. Strategi ini terutama terdiri dari beberapa bagian berikut:

- Menggunakan indikator tren gelombang untuk menilai tren utama pasar

- Kombinasi RSI dan Indeks Aliran Uang memfilter beberapa sinyal palsu

- Indikator EMA menilai arah tindakan spesifik

- Pengunjung yang datang menggunakan metode pelacakan terobosan untuk memastikan tren berjalan.

Prinsip Strategi

Strategi ini terutama menilai arah dan kekuatan tren besar, dan mengatur perdagangan dua arah yang lebih banyak. Prinsip operasi spesifik adalah sebagai berikut:

Sinyal Masuk Berbagai Kepala:

- Harga lebih tinggi dari 200-day EMA, menunjukkan berada di pasar berlebih

- Harga kembali ke support di sekitar EMA 50 hari

- Indikator gelombang berbalik ke atas dan sinyal beli muncul

- RSI dan MFI menunjukkan overbought

- 3 Garis K Berturut-turut Menembus EMA 50 Hari, Menunjukkan Kenaikan

Sinyal masuk tanpa kepala: Kebalikan dari sinyal masuk multi-kepala

Stop Loss adalah: Ada dua pilihan: harga minimum / harga maksimum stop loss, ATR stop loss

Analisis Keunggulan Strategi

Strategi ini memiliki keuntungan sebagai berikut:

- Mengintegrasikan berbagai indikator untuk menilai tren besar, menghindari terobosan palsu

- Menggunakan EMA untuk menilai arah operasi, mudah untuk melacak tren

- Metode Tracking Stop Loss Untuk Mendapatkan Keuntungan Berkelanjutan

- Anda dapat melakukan banyak shorting sekaligus dan mengikuti arah pasar

Analisis Risiko Strategi

Strategi ini juga memiliki beberapa risiko:

- Probabilitas sinyal yang salah

- Stop loss set terlalu kecil, meningkatkan risiko stop loss

- Lebih banyak transaksi, biaya transaksi adalah kerugian tersembunyi

Untuk mengurangi risiko di atas, optimasi dapat dilakukan dalam beberapa hal berikut:

- Mengatur parameter indikator, memfilter sinyal yang salah

- Stop loss yang lebih longgar

- Optimalkan parameter indikator untuk mengurangi jumlah transaksi

Arah optimasi strategi

Dari sisi kode, strategi ini dapat dioptimalkan dengan cara berikut:

- Menyesuaikan indikator gelombang, RSI dan parameter MFI untuk memilih kombinasi parameter terbaik

- Uji kinerja dari parameter siklus EMA yang berbeda

- Menyesuaikan Stop Loss dengan Rasio Risiko Keuntungan untuk Konfigurasi Optimal

Dengan penyesuaian dan pengujian parameter, strategi dapat memaksimalkan keuntungan dan mengurangi risiko dan penarikan.

Meringkaskan

Strategi ini menggunakan berbagai indikator untuk menentukan arah tren besar, menggunakan indikator EMA sebagai sinyal operasi khusus, dan menggunakan metode tracking stop loss untuk mengunci keuntungan. Dengan pengoptimalan parameter, dapat memperoleh keuntungan yang lebih stabil. Namun, juga harus memperhatikan risiko sistemik tertentu, perlu terus memperhatikan efek indikator dan perubahan lingkungan pasar.

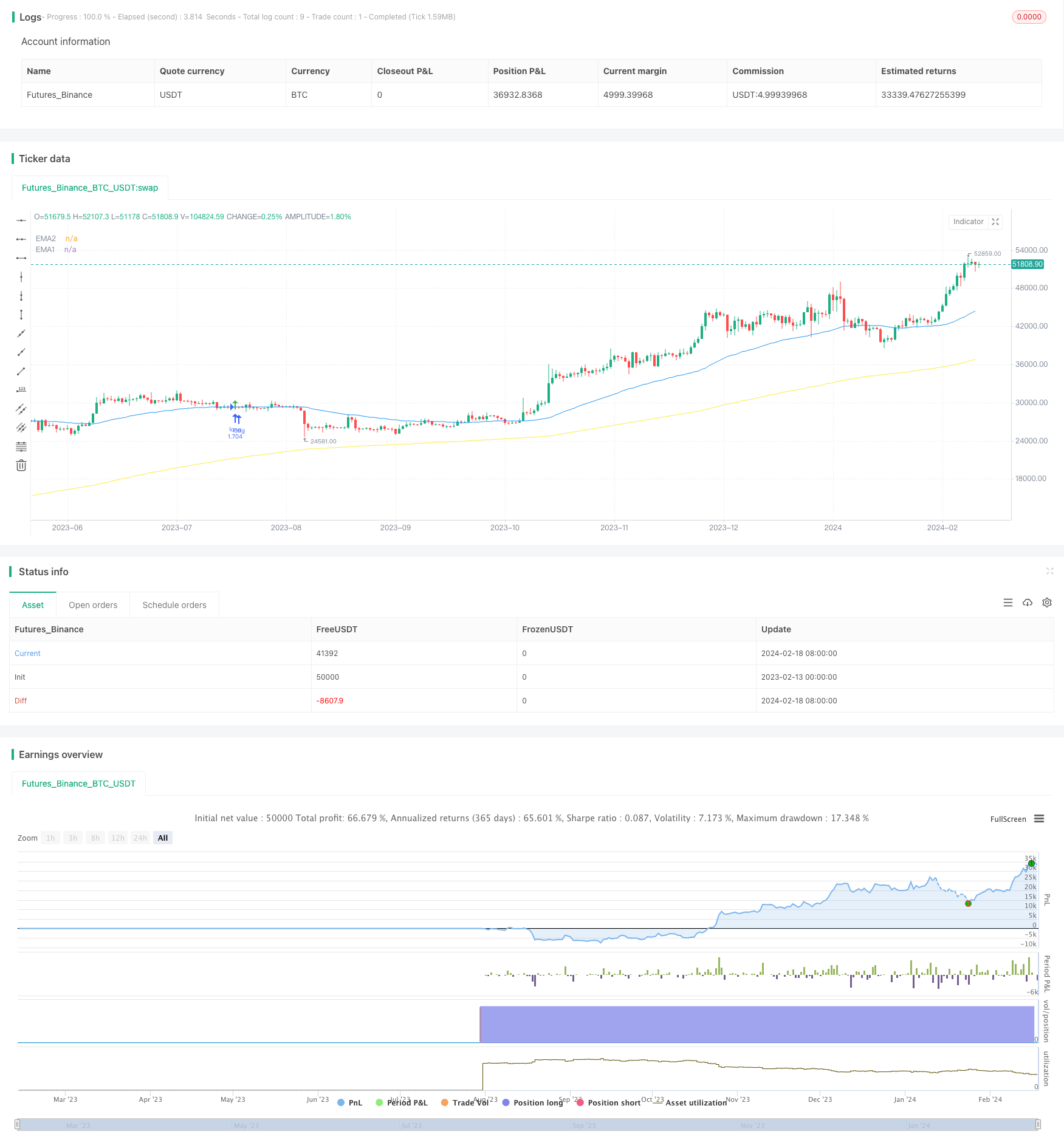

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Lowest Low/ Highest High & ATR Stop Loss/ Take Profit

//Optimized for the 30 minutes chart

strategy(title="TradePro's Trading Idea Cipher B+ Divergence EMA Pullback Strategy", shorttitle="WT MFI RSI EMA PB STRAT", overlay = true, pyramiding = 0, max_bars_back=5000, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=5000, currency=currency.USD)

// { Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2020,title="FromYear",minval=2016)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

zeroline = 0

// } Time Range

// { Wavetrend, RSI, MFI

// WaveTrend

cl = input(12, "Channel Length")

al = input(12, "Average Length")

overbought = input(53, title = 'WT Overbought Level 1', type = input.integer)

oversold = input(-53, title = 'WT Oversold Level 1', type = input.integer)

ap = hlc3

esa = ema(ap, cl)

d = ema(abs(ap - esa), cl)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, al)

wt1 = tci

wt2 = sma(wt1,4)

wtOs = wt2 <= oversold

wtOb = wt2 >= overbought

wtX = cross(wt1, wt2)

wtUp = wt2 - wt1 <= 0

wtDown = wt2 - wt1 >= 0

buySignal = wtX and wtOs and wtUp

sellSignal = wtX and wtOb and wtDown

// RSI & MFI

rsiMFIPosY = input(2, title = 'MFI Area Y Pos', type = input.float)

rsiMFIperiod = input(80,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(200, title = 'MFI Area multiplier', type = input.float)

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

// } Wavetrend, RSI, MFI

// { EMA

emasrc = close

res = input(title="EMA Timeframe", type=input.resolution, defval="30")

len1 = input(title="EMA1 Length", type=input.integer, defval=200)

col1 = color.yellow

len2 = input(title="EMA2 Length", type=input.integer, defval=50)

col2 = color.blue

// Calculate EMA

ema1 = ema(emasrc, len1)

emaSmooth1 = security(syminfo.tickerid, res, ema1, barmerge.gaps_off, barmerge.lookahead_off)

ema2 = ema(emasrc, len2)

emaSmooth2 = security(syminfo.tickerid, res, ema2, barmerge.gaps_off, barmerge.lookahead_off)

// Draw EMA

plot(emaSmooth1, title="EMA1", linewidth=1, color=col1)

plot(emaSmooth2, title="EMA2", linewidth=1, color=col2)

// } EMA

// { Long Entry

enablelong = input(true, title="Enable long?")

//Long Signal

upcondition = close > emaSmooth1

wavetrendlong = wt1 and wt2 < zeroline

mfilong = rsiMFI > 0

emapblong1 = (close > emaSmooth2) and (close[1] < emaSmooth2[1])

emapblong2 = ((close[2] > emaSmooth2[2]) and (close[3] > emaSmooth2[3]) and (close[4] > emaSmooth2[4])) or ((close[5] > emaSmooth2[5]) and (close[6] > emaSmooth2[6]) and (close[7] > emaSmooth2[7])) or ((close[8] > emaSmooth2[8]) and (close[9] > emaSmooth2[9]) and (close[10] > emaSmooth2[10]))

longcondition = upcondition and wavetrendlong and buySignal and mfilong and emapblong1 and emapblong2

//strategy buy long

if (longcondition) and (afterStartDate) and strategy.opentrades < 1 and (enablelong == true)

strategy.entry("long", strategy.long)

plotshape(longcondition, style=shape.arrowup,

location=location.abovebar, color=color.green)

// } Long Entry

// { Short Entry

enableshort = input(true, title="Enable short?")

//Short Signal

downcondition = close < emaSmooth1

wavetrendshort = wt1 and wt2 > zeroline

mfishort = rsiMFI < 0

emapbshort1 = (close < emaSmooth2) and (close[1] > emaSmooth2[1])

emapbshort2 = ((close[2] < emaSmooth2[2]) and (close[3] < emaSmooth2[3]) and (close[4] < emaSmooth2[4])) or ((close[5] < emaSmooth2[5]) and (close[6] < emaSmooth2[6]) and (close[7] < emaSmooth2[7])) or ((close[8] < emaSmooth2[8]) and (close[9] < emaSmooth2[9]) and (close[10] < emaSmooth2[10]))

shortcondition = downcondition and wavetrendshort and sellSignal and mfishort and emapbshort1 and emapbshort2

//strategy buy short

if (shortcondition) and (afterStartDate) and strategy.opentrades < 1 and (enableshort == true)

strategy.entry("short", strategy.short)

plotshape(shortcondition, style=shape.arrowdown,

location=location.belowbar, color=color.red)

// } Short Entry

// { Exit Conditions

bought = strategy.position_size[1] < strategy.position_size

sold = strategy.position_size[1] > strategy.position_size

barsbought = barssince(bought)

barssold = barssince(sold)

slbuffer = input(title="SL Buffer", type=input.float, step=0.1, defval=0)

// } Exit Conditions

// { Lowest Low/ Highes High Exit Condition

enablelowhigh = input(false, title="Enable lowest low/ highest high exit?")

//Lowest Low LONG

profitfactorlong = input(title="ProfitfactorLong", type=input.float, step=0.1, defval=2)

loLen = input(title="Lowest Low Lookback", type=input.integer,

defval=50, minval=2)

stop_level_long = lowest(low, loLen)[1]

if enablelowhigh == true and strategy.position_size>0

profit_level_long = strategy.position_avg_price + ((strategy.position_avg_price - stop_level_long[barsbought])*profitfactorlong) + slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_long[barsbought] - slbuffer, limit=profit_level_long)

//Lowest Low SHORT

profitfactorshort = input(title="ProfitfactorShort", type=input.float, step=0.1, defval=2)

highLen = input(title="highest high lookback", type=input.integer,

defval=50, minval=2)

stop_level_short = highest(high, highLen)[1]

if enablelowhigh == true and strategy.position_size<0

profit_level_short = strategy.position_avg_price - ((stop_level_short[barssold] - strategy.position_avg_price)*profitfactorshort) - slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_short[barssold] + slbuffer, limit=profit_level_short)

// } Lowest Low/ Highes High Exit Condition

// { ATR Take Profit/ Stop Loss

enableatr = input(true, title="Enable ATR exit?")

atrprofitfactorlong = input(title="ATR Profitfactor Long", type=input.float, step=0.1, defval=6)

atrstopfactorlong = input(title="ATR Stopfactor Long", type=input.float, step=0.1, defval=5)

atrprofitfactorshort = input(title="ATR Profitfactor Short", type=input.float, step=0.1, defval=3)

atrstopfactorshort = input(title="ATR Stopfactor Short", type=input.float, step=0.1, defval=5)

//ATR

lengthATR = input(title="ATR Length", defval=11, minval=1)

atr = atr(lengthATR)

//LONG EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barsbought1 = barssince(bought)

profit_level = strategy.position_avg_price + (atr*atrprofitfactorlong)

stop_level = strategy.position_avg_price - (atr*atrstopfactorlong)

strategy.exit("Take Profit/ Stop Loss", "long", stop=stop_level[barsbought1], limit=profit_level[barsbought1])

//SHORT EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barssold1 = barssince(sold)

profit_level = strategy.position_avg_price - (atr*atrprofitfactorshort)

stop_level = strategy.position_avg_price + (atr*atrstopfactorshort)

strategy.exit("Take Profit/ Stop Loss", "short", stop=stop_level[barssold1], limit=profit_level[barssold1])

// } ATR Take Profit/ Stop Loss