Strategi perdagangan multi-kerangka waktu berdasarkan indikator kompresi

Ringkasan

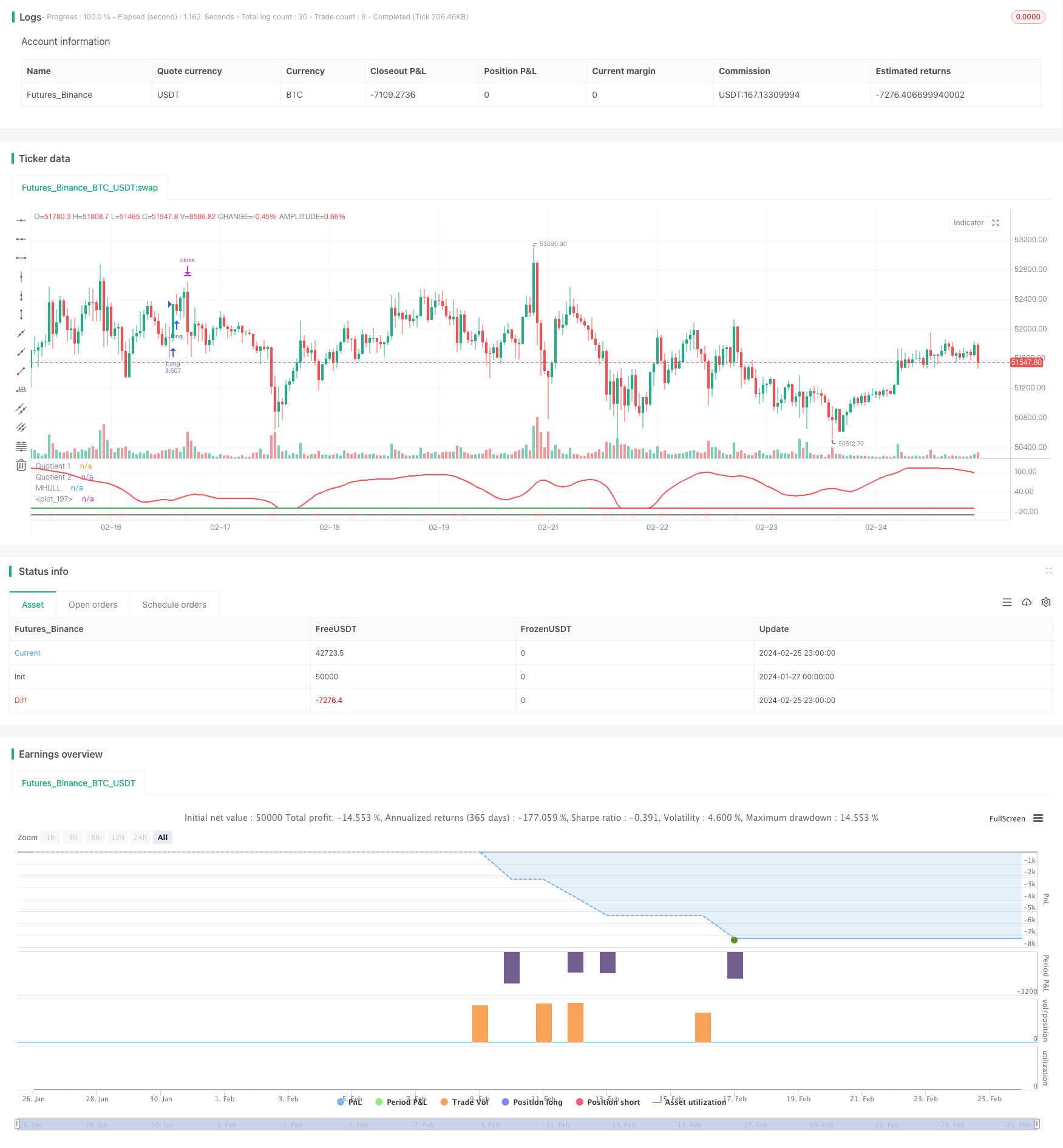

Strategi ini menggabungkan tiga indikator, yaitu Boom Hunter, Hull Suite, dan Volatility Oscillator, untuk mewujudkan strategi kuantitatif untuk melacak tren dan melakukan transaksi terobosan dalam beberapa kerangka waktu. Strategi ini berlaku untuk aset digital seperti Bitcoin yang memiliki situasi harga yang sangat fluktuatif dan mendadak.

Prinsip

Logika inti dari strategi ini didasarkan pada tiga indikator:

Boom Hunter (pengembara kain)Sebuah oscillator yang menggunakan teknik kompresi indikator untuk menilai sinyal beli dan jual melalui persilangan dua indikator (Quotient1 dan Quotient2).

Hull Suite (dalam bahasa Inggris): satu set indikator rata-rata bergerak halus, untuk menilai arah tren melalui hubungan antara rel tengah dan rel atas dan bawah.

Oscillator VolatilitasSebuah indikator oscillator yang mengukur informasi tentang pergerakan harga.

Logika masuk dari strategi ini adalah bahwa ketika dua indikator Quotient dari pemburu kain terjadi ke atas atau ke bawah, harga akan menembus rel tengah Hull dan berselisih dengan rel atas atau bawah, sementara indikator volatilitas berada di zona overbought dan oversold. Ini dapat memfilter beberapa sinyal penembusan palsu dan meningkatkan akurasi masuk.

Stop loss ditetapkan dengan mencari titik terendah atau tertinggi dalam periode tertentu (default 20 K-line), dan keuntungan diperoleh dengan stop loss persentase kali stop loss rasio yang dikonfigurasi (default 3x). Posisi dihitung berdasarkan persentase dari total aset akun (default 3%) dan stop loss untuk standar tertentu.

Keunggulan

- Menggunakan teknik kompresi indikator untuk mengekstrak sinyal perdagangan utama dalam harga untuk meningkatkan probabilitas keuntungan

- Verifikasi kombinasi multi-indikator, menghindari false breakout, dan menilai arah tren secara akurat

- Pengaturan Stop Loss Dinamis, Pelacakan Tren untuk Mengontrol Risiko

- Menggunakan indikator volatilitas untuk memastikan transaksi di lingkungan yang sangat fluktuatif

- Analisis Multi-Framework untuk Meningkatkan Stabilitas Strategi

Risiko

- Indikator pemburu kain mungkin memiliki distorsi kompresi yang menyebabkan sinyal yang salah

- Hal ini dikarenakan adanya keterlambatan dalam pelacakan paket Hull, sehingga tidak dapat melacak perubahan harga secara tepat waktu.

- Jika volatilitas turun, peluang perdagangan akan terlewatkan atau kerugian akan terjadi.

Solusi:

- Menyesuaikan parameter indikator kompresi, menyeimbangkan sensitivitas indikator

- Cobalah menggunakan moving averages seperti EHMA sebagai pengganti indikator mid-trail.

- Menambahkan indikator penilaian lain untuk menghindari ketidakpastian volatilitas

Pengoptimalan

Strategi ini dapat dioptimalkan dalam beberapa hal:

Optimasi parameterUntuk mendapatkan kombinasi parameter yang optimal dengan mengubah parameter indikator seperti panjang siklus, faktor kompresi, dan lain-lain

Pengoptimalan kerangka waktuUji siklus waktu yang berbeda (misalnya 1 menit, 5 menit, 30 menit, dan lain-lain) untuk menemukan siklus perdagangan yang paling sesuai

Optimalisasi Posisi: Mengubah ukuran dan proporsi posisi untuk setiap transaksi, untuk menemukan penggunaan dana yang optimal

Optimalisasi Stop Loss: Mengatur posisi stop loss sesuai dengan perdagangan yang berbeda, untuk mencapai rasio risiko-reward yang optimal

Kondisi Optimasi: Meningkatkan atau mengurangi kondisi penyaringan indikator untuk mendapatkan waktu masuk yang lebih akurat

Meringkaskan

Strategi ini memungkinkan perdagangan pelacakan tren dalam kerangka waktu yang beragam melalui kombinasi tiga indikator, yaitu Crop Hunter, Hull Suite, dan Volatility Oscillator. Strategi ini dapat secara efektif mengidentifikasi pergerakan harga yang tiba-tiba, dan berlaku untuk aset digital yang memiliki volatilitas tinggi. Strategi ini dapat dikontrol risiko, dioptimalkan dalam berbagai aspek melalui parameter, kondisi gelombang, dan stop loss, dan memiliki kemampuan operasional dan skalabilitas yang kuat.

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - Boom Hunter Pro

// - Hull Suite

// - Volatility Oscillator

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - Boom Hunter Pro: veryfid (https://www.tradingview.com/u/veryfid/)

// - Hull Suite: InSilico (https://www.tradingview.com/u/InSilico/)

// - Volatility Oscillator: veryfid (https://www.tradingview.com/u/veryfid/)

//@version=5

strategy("Boom Hunter + Hull Suite + Volatility Oscillator Strategy", overlay=false, initial_capital=1000, currency=currency.NONE, max_labels_count=500, default_qty_type=strategy.cash, commission_type=strategy.commission.percent, commission_value=0.01)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(20, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(3, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

profitFactor = input.float(3, "Profit Factor (R:R Ratio)", step = 0.1, group='Strategy: Risk Management')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// ---------------

// Boom Hunter Pro

// ---------------

square = input.bool(true, title='Square Line?', group='Main Settings')

//Quotient

LPPeriod = input.int(6, title='Quotient | LPPeriod', inline='quotient', group='EOT 1 (Main Oscillator)')

K1 = input.int(0, title='K1', inline='quotient', group='EOT 1 (Main Oscillator)')

esize = 60 //, title = "Size", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

ey = 50 //, title = "Y axis", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

trigno = input.int(1, 'Trigger Length', group='EOT 1 (Main Oscillator)', inline='quotient2')

trigcol = input.color(color.white, title='Trigger Color:', group='EOT 1 (Main Oscillator)', inline='q2')

// EOT 2

//Inputs

LPPeriod2 = input.int(28, title='LPPeriod2', group='EOT 2 (Red Wave)', inline='q2')

K22 = input.float(0.3, title='K2', group='EOT 2 (Red Wave)', inline='q2')

//EOT 1

//Vars

alpha1 = 0.00

HP = 0.00

a1 = 0.00

b1 = 0.00

c1 = 0.00

c2 = 0.00

c3 = 0.00

Filt = 0.00

Peak = 0.00

X = 0.00

Quotient1 = 0.00

pi = 2 * math.asin(1)

//Highpass filter cyclic components

//whose periods are shorter than 100 bars

alpha1 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP := (1 - alpha1 / 2) * (1 - alpha1 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1) * nz(HP[1]) - (1 - alpha1) * (1 - alpha1) * nz(HP[2])

//SuperSmoother Filter

a1 := math.exp(-1.414 * pi / LPPeriod)

b1 := 2 * a1 * math.cos(1.414 * pi / LPPeriod)

c2 := b1

c3 := -a1 * a1

c1 := 1 - c2 - c3

Filt := c1 * (HP + nz(HP[1])) / 2 + c2 * nz(Filt[1]) + c3 * nz(Filt[2])

//Fast Attack - Slow Decay Algorithm

Peak := .991 * nz(Peak[1])

if math.abs(Filt) > Peak

Peak := math.abs(Filt)

Peak

//Normalized Roofing Filter

if Peak != 0

X := Filt / Peak

X

Quotient1 := (X + K1) / (K1 * X + 1)

// EOT 2

//Vars

alpha1222 = 0.00

HP2 = 0.00

a12 = 0.00

b12 = 0.00

c12 = 0.00

c22 = 0.00

c32 = 0.00

Filt2 = 0.00

Peak2 = 0.00

X2 = 0.00

Quotient4 = 0.00

alpha1222 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP2 := (1 - alpha1222 / 2) * (1 - alpha1222 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1222) * nz(HP2[1]) - (1 - alpha1222) * (1 - alpha1222) * nz(HP2[2])

//SuperSmoother Filter

a12 := math.exp(-1.414 * pi / LPPeriod2)

b12 := 2 * a12 * math.cos(1.414 * pi / LPPeriod2)

c22 := b12

c32 := -a12 * a12

c12 := 1 - c22 - c32

Filt2 := c12 * (HP2 + nz(HP2[1])) / 2 + c22 * nz(Filt2[1]) + c32 * nz(Filt2[2])

//Fast Attack - Slow Decay Algorithm

Peak2 := .991 * nz(Peak2[1])

if math.abs(Filt2) > Peak2

Peak2 := math.abs(Filt2)

Peak2

//Normalized Roofing Filter

if Peak2 != 0

X2 := Filt2 / Peak2

X2

Quotient4 := (X2 + K22) / (K22 * X2 + 1)

q4 = Quotient4 * esize + ey

//Plot EOT

q1 = Quotient1 * esize + ey

trigger = ta.sma(q1, trigno)

Plot3 = plot(trigger, color=trigcol, linewidth=2, title='Quotient 1')

Plot44 = plot(q4, color=color.new(color.red, 0), linewidth=2, title='Quotient 2')

// ----------

// HULL SUITE

// ----------

//INPUT

src = input(close, title='Source')

modeSwitch = input.string('Hma', title='Hull Variation', options=['Hma', 'Thma', 'Ehma'])

length = input(200, title='Length(180-200 for floating S/R , 55 for swing entry)')

lengthMult = input(2.4, title='Length multiplier (Used to view higher timeframes with straight band)')

useHtf = input(false, title='Show Hull MA from X timeframe? (good for scalping)')

htf = input.timeframe('240', title='Higher timeframe')

//FUNCTIONS

//HMA

HMA(_src, _length) =>

ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

//EHMA

EHMA(_src, _length) =>

ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

//THMA

THMA(_src, _length) =>

ta.wma(ta.wma(_src, _length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

//SWITCH

Mode(modeSwitch, src, len) =>

modeSwitch == 'Hma' ? HMA(src, len) : modeSwitch == 'Ehma' ? EHMA(src, len) : modeSwitch == 'Thma' ? THMA(src, len / 2) : na

//OUT

_hull = Mode(modeSwitch, src, int(length * lengthMult))

HULL = useHtf ? request.security(syminfo.ticker, htf, _hull) : _hull

MHULL = HULL[0]

SHULL = HULL[2]

//COLOR

hullColor = MHULL > SHULL ? color.green : color.red

//PLOT

///< Frame

Fi1 = plot(-10, title='MHULL', color=hullColor, linewidth=2)

// -----------------

// VOLUME OSCILLATOR

// -----------------

volLength = input(80)

spike = close - open

x = ta.stdev(spike, volLength)

y = ta.stdev(spike, volLength) * -1

volOscCol = spike > x ? color.green : spike < y ? color.red : color.gray

plot(-30, color=color.new(volOscCol, transp=0), linewidth=2)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// Boom Hunter Pro entry conditions

boomLong = ta.crossover(trigger, q4)

boomShort = ta.crossunder(trigger, q4)

// Hull Suite entry conditions

hullLong = MHULL > SHULL and close > MHULL

hullShort = MHULL < SHULL and close < SHULL

// Volatility Oscillator entry conditions

volLong = spike > x

volShort = spike < y

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = boomLong and hullLong and volLong and in_date_range

shortCondition = boomShort and hullShort and volShort and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

atr = ta.atr(14)

longSl = math.min(close - atr, swingLow)

shortSl = math.max(close + atr, swingHigh)

longStopPercent = math.abs((1 - (longSl / close)) * 100)

shortStopPercent = math.abs((1 - (shortSl / close)) * 100)

longTpPercent = longStopPercent * profitFactor

shortTpPercent = shortStopPercent * profitFactor

longTp = close + (close * (longTpPercent / 100))

shortTp = close - (close * (shortTpPercent / 100))

// Position sizing (default risk 3% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=longSl, limit=longTp, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=-40)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent) + " TP Percent: " + str.tostring(longTpPercent))

if (shortCondition and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=shortSl, limit=shortTp, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=-40)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent) + " TP Percent: " + str.tostring(shortTpPercent))