Prediksi titik tinggi dan rendah otomatis dan strategi perdagangan

Tanggal Pembuatan:

2024-03-15 17:22:36

Akhirnya memodifikasi:

2024-03-15 17:22:36

menyalin:

6

Jumlah klik:

723

1

fokus pada

1664

Pengikut

Ringkasan

Strategi ini menggunakan indikator yang relatif kuat (RSI) untuk menilai kondisi overbought dan oversold, yang dikombinasikan dengan penembusan titik tinggi dan rendah 9:15 untuk menentukan peluang masuk.

Prinsip Strategi

- Menentukan 9:00 sampai 9:15 sebagai zona formasi titik tinggi dan rendah.

- Harga tertinggi dan terendah yang tercatat pada pukul 9:15 adalah sessionHigh dan sessionLow.

- Perhitungan harga target multihead (sessionHigh+200), target head (sessionLow-200) dan harga stop loss yang sesuai.

- Dapatkan harga penutupan saat ini dan indikator RSI.

- Kondisi pembukaan posisi: harga penutupan melampaui sesi tinggi dan RSI lebih besar dari level overbought.

- Kondisi untuk membuka posisi dengan posisi kosong: harga penutupan turun di bawah sessionLow dan RSI lebih kecil dari oversold level.

- Menggambar harga yang relevan, dan secara otomatis membuka posisi overhead atau kosong sesuai dengan kondisi pembukaan.

Analisis Keunggulan

- Sederhana dan mudah digunakan: Strategi didasarkan pada titik tinggi dan rendah 9:15 yang jelas dan indikator RSI, logikanya jelas, mudah dipahami dan diterapkan.

- Tingkat otomatisasi yang tinggi: Strategi ini memiliki perhitungan harga target dan harga stop loss serta penilaian kondisi untuk membuka posisi, yang dapat mengotomatiskan eksekusi perdagangan.

- Stop loss tepat waktu: Berdasarkan harga stop loss yang ditetapkan pada titik tinggi dan rendah 9:15, titik stop loss yang jelas dapat dikendalikan secara efektif setelah posisi dibuka.

- Pelacakan tren: menilai overbought dan oversold melalui indikator RSI, intervensi pada awal pembentukan tren, yang dapat membantu tren berjalan.

Analisis risiko

- Risiko optimasi parameter: parameter strategi seperti panjang RSI dan overbought overbought threshold perlu dioptimalkan sesuai dengan karakteristik pasar, dan parameter yang berbeda dapat menghasilkan hasil yang berbeda.

- Risiko indikator tunggal: Strategi ini bergantung pada indikator RSI, yang mungkin gagal dalam kondisi pasar tertentu.

- Risiko Volatilitas di Daftar Harga: Volatilitas harga setelah 9:15 dapat memicu stop loss dan kehilangan tren.

- Kurangnya manajemen posisi: Kurangnya kontrol posisi dan manajemen dana dalam strategi, terlalu sering membuka posisi dapat membawa risiko tambahan.

Arah optimasi

- Stop loss dinamis: melakukan penyesuaian posisi stop loss secara dinamis berdasarkan indikator seperti amplitudo fluktuasi harga atau ATR, untuk melacak perubahan harga.

- Kombinasi dengan indikator lain: pengenalan indikator lain seperti MACD, sistem rata-rata, dan lain-lain untuk menilai tren, meningkatkan akurasi posisi.

- Kondisi masuk yang optimal: RSI harus disesuaikan dengan overbought dan oversold untuk menghindari keterbatasan yang ditimbulkan oleh pegangan tetap.

- Memperkenalkan manajemen posisi: Mengontrol posisi berdasarkan kondisi pasar yang berfluktuasi, misalnya menggunakan metode seperti model risiko persentase.

Meringkaskan

Strategi ini didasarkan pada titik tinggi dan rendah 9:15, menggunakan indikator RSI untuk menilai tren, secara otomatis menghitung harga target dan harga stop loss, dan secara otomatis membuka posisi multihead atau posisi kosong sesuai dengan kondisi pembukaan posisi. Logika strategi sederhana, otomatisasi yang tinggi, dapat dengan cepat menangkap tren. Namun, strategi ini juga memiliki risiko dalam hal pengoptimalan parameter, single-indicator spread, volatilitas tengah, dan manajemen posisi.

Kode Sumber Strategi

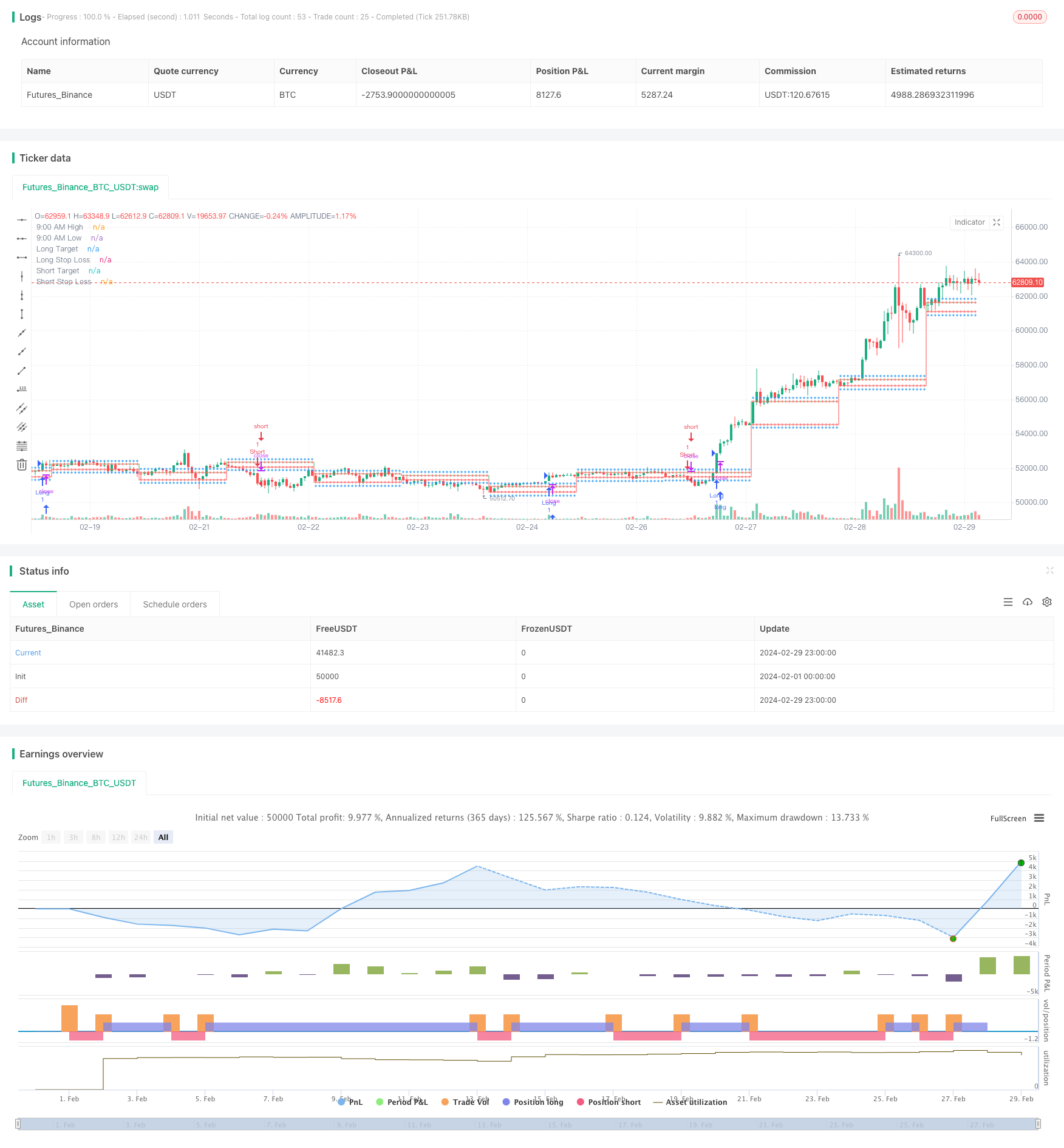

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("9:15 AM High/Low with Automatic Forecasting", overlay=true)

// Parameters

showSignals = input(true, title="Show Signals")

// Define session time

sessionStartHour = input(9, title="Session Start Hour")

sessionStartMinute = input(0, title="Session Start Minute")

sessionEndHour = input(9, title="Session End Hour")

sessionEndMinute = input(15, title="Session End Minute")

// Calculate session high and low

var float sessionHigh = na

var float sessionLow = na

if (hour == sessionStartHour and minute == sessionStartMinute)

sessionHigh := high

sessionLow := low

// Update session high and low if within session time

if (hour == sessionStartHour and minute >= sessionStartMinute and minute < sessionEndMinute)

sessionHigh := high > sessionHigh or na(sessionHigh) ? high : sessionHigh

sessionLow := low < sessionLow or na(sessionLow) ? low : sessionLow

// Plot horizontal lines for session high and low

plot(sessionHigh, color=color.green, title="9:00 AM High", style=plot.style_stepline, linewidth=1)

plot(sessionLow, color=color.red, title="9:00 AM Low", style=plot.style_stepline, linewidth=1)

// Calculate targets and stop loss

longTarget = sessionHigh + 200

longStopLoss = sessionLow

shortTarget = sessionLow - 200

shortStopLoss = sessionHigh

// Plot targets and stop loss

plot(longTarget, color=color.blue, title="Long Target", style=plot.style_cross, linewidth=1)

plot(longStopLoss, color=color.red, title="Long Stop Loss", style=plot.style_cross, linewidth=1)

plot(shortTarget, color=color.blue, title="Short Target", style=plot.style_cross, linewidth=1)

plot(shortStopLoss, color=color.red, title="Short Stop Loss", style=plot.style_cross, linewidth=1)

// RSI

rsiLength = input(14, title="RSI Length")

overboughtLevel = input(60, title="Overbought Level")

oversoldLevel = input(40, title="Oversold Level")

rsi = ta.rsi(close, rsiLength)

// Entry conditions

longCondition = close > sessionHigh and rsi > overboughtLevel

shortCondition = close < sessionLow and rsi < oversoldLevel

// Long entry

if (showSignals and longCondition)

strategy.entry("Long", strategy.long)

// Short entry

if (showSignals and shortCondition)

strategy.entry("Short", strategy.short)