Ringkasan

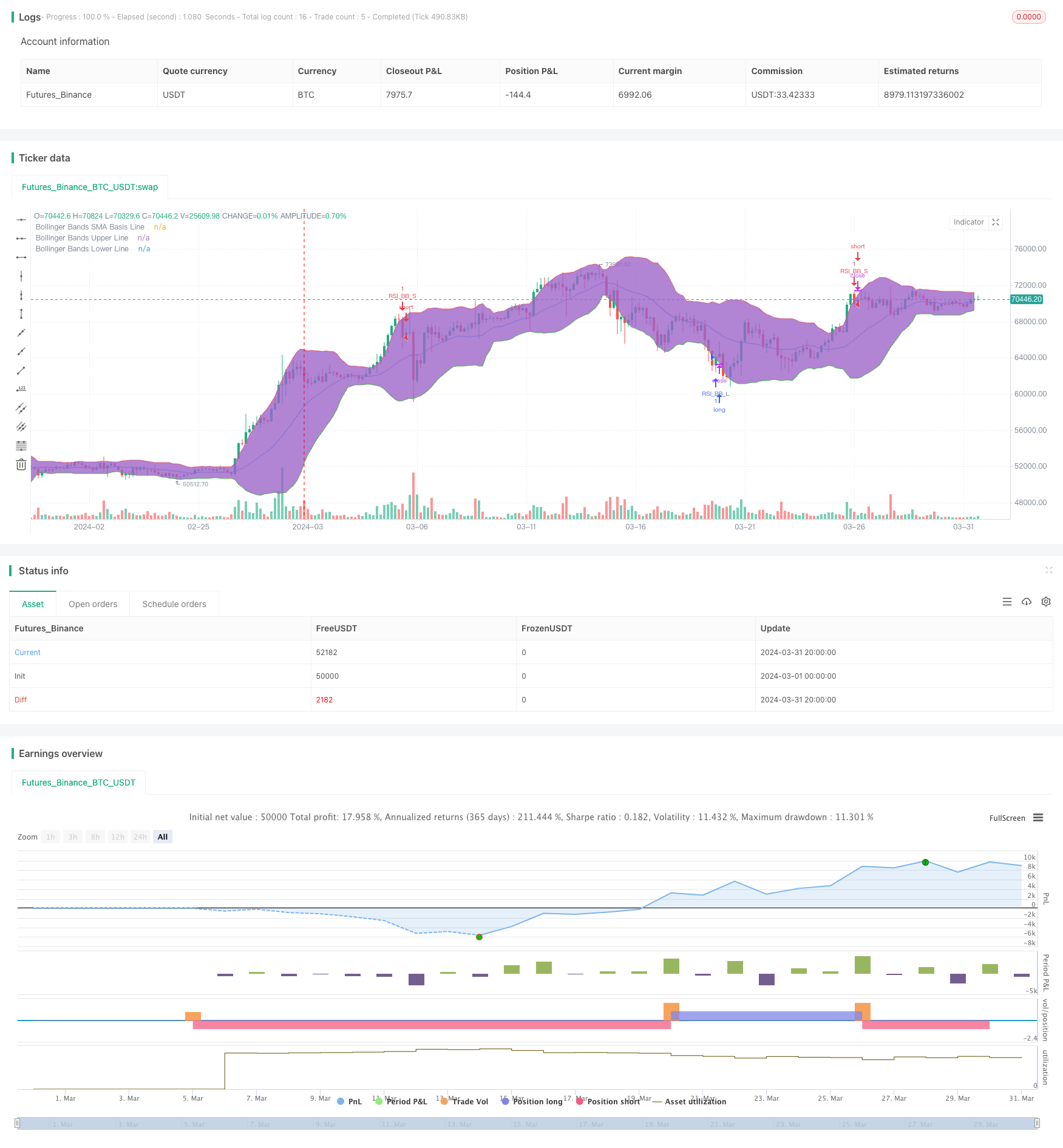

Strategi ini menggabungkan dua indikator teknis yang relatif kuat (RSI) dan Bollinger Bands (Bollinger Bands), menghasilkan sinyal beli ketika harga berada di bawah Bollinger Bands dan menghasilkan sinyal jual ketika harga berada di atas Bollinger Bands. Strategi ini hanya akan memicu sinyal perdagangan jika indikator RSI dan indikator Bollinger Bands berada di posisi oversold atau oversold pada saat yang sama.

Prinsip Strategi

- Perhitungan nilai RSI berdasarkan parameter RSI yang ditetapkan.

- Perhitungan rel tengah, rel atas dan rel bawah menggunakan rumus Brin Belt.

- Perhitungan apakah harga penutupan saat ini telah menembus Bollinger Bands atau tidak.

- Untuk menentukan apakah RSI saat ini lebih tinggi dari overbought atau lebih rendah dari oversold.

- Ketika kedua indikator Brin dan RSI memenuhi kondisi beli atau jual, maka akan dihasilkan sinyal perdagangan yang sesuai.

Keunggulan Strategis

- Dengan menggabungkan dua indikator teknis, yaitu tren dan momentum, Anda dapat menilai kondisi pasar secara lebih komprehensif.

- Menggunakan dua indikator sebagai kondisi penyaringan secara bersamaan secara efektif mengurangi probabilitas munculnya sinyal palsu.

- Kode logis yang jelas, parameter pengaturan yang fleksibel, cocok untuk lingkungan pasar yang berbeda dan gaya perdagangan.

Risiko Strategis

- Dalam pasar yang bergolak, strategi ini mungkin menghasilkan lebih banyak transaksi yang merugikan.

- Setting parameter yang tidak tepat dapat menyebabkan kinerja strategi yang buruk dan perlu dioptimalkan sesuai dengan situasi yang sebenarnya.

- Strategi ini tidak menetapkan stop loss, dan mungkin menghadapi risiko penarikan yang lebih besar.

Arah optimasi strategi

- Parameter RSI dan BRI dapat dioptimalkan berdasarkan karakteristik pasar dan preferensi pribadi.

- Menggunakan indikator teknis lainnya seperti MACD, rata-rata, dan lain-lain untuk meningkatkan keandalan sinyal.

- Tetapkan stop loss dan stop loss yang wajar untuk mengendalikan risiko transaksi tunggal.

- Untuk pasar yang bergejolak, pertimbangan dapat diberikan untuk meningkatkan kondisi penilaian atau mengurangi posisi, mengurangi biaya yang ditimbulkan oleh perdagangan yang sering terjadi.

Meringkaskan

Strategi ganda RSI dan Brin Belt dapat menilai keadaan pasar secara komprehensif dengan menggabungkan indikator tren dan momentum, dan memberikan sinyal perdagangan yang sesuai. Namun, strategi ini mungkin berkinerja buruk di pasar yang bergoyang, dan tidak memiliki kontrol risiko, sehingga perlu berhati-hati saat digunakan di pasar nyata. Dengan cara mengoptimalkan parameter, memperkenalkan indikator lain, dan mengatur stop loss yang masuk akal, stabilitas dan profitabilitas strategi ini dapat ditingkatkan lebih lanjut.

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger + RSI, Double Strategy (by ChartArt) v1.1", shorttitle="CA_-_RSI_Bol_Strat_1.1", overlay=true)

// ChartArt's RSI + Bollinger Bands, Double Strategy - Update

//

// Version 1.1

// Idea by ChartArt on January 18, 2015.

//

// This strategy uses the RSI indicator

// together with the Bollinger Bands

// to sell when the price is above the

// upper Bollinger Band (and to buy when

// this value is below the lower band).

//

// This simple strategy only triggers when

// both the RSI and the Bollinger Bands

// indicators are at the same time in

// a overbought or oversold condition.

//

// In this version 1.1 the strategy was

// both simplified for the user and

// made more successful in backtesting.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

///////////// RSI

RSIlength = input(14,title="RSI Period Length")

RSIoverSold = 30

RSIoverBought = 70

price = close

vrsi = rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(20, minval=1,title="Bollinger Period Length")

BBmult = input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(price, BBlength)

BBdev = BBmult * stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = crossover(source, BBlower)

sellEntry = crossunder(source, BBupper)

plot(BBbasis, color=color.blue,title="Bollinger Bands SMA Basis Line")

p1 = plot(BBupper, color=color.red,title="Bollinger Bands Upper Line")

p2 = plot(BBlower, color=color.green,title="Bollinger Bands Lower Line")

fill(p1, p2)

// Entry conditions

crossover_rsi = crossover(vrsi, RSIoverSold) and crossover(source, BBlower)

crossunder_rsi = crossunder(vrsi, RSIoverBought) and crossunder(source, BBupper)

///////////// RSI + Bollinger Bands Strategy

if (not na(vrsi))

if (crossover_rsi)

strategy.entry("RSI_BB_L", strategy.long, comment="RSI_BB_L")

else

strategy.cancel(id="RSI_BB_L")

if (crossunder_rsi)

strategy.entry("RSI_BB_S", strategy.short, comment="RSI_BB_S")

else

strategy.cancel(id="RSI_BB_S")