Posisi dinamis SPARK dan strategi perdagangan indikator ganda

supertrend RSI ATR

Ringkasan

Strategi SPARK adalah strategi perdagangan kuantitatif yang menggabungkan penyesuaian posisi dinamis dan konfirmasi indikator ganda. Strategi ini menggunakan indikator SuperTrend dan indeks relatif kuat (RSI) untuk mengidentifikasi titik masuk dan keluar potensial, sambil menggunakan mekanisme penyesuaian posisi dinamis untuk mengoptimalkan alokasi dana. Strategi ini juga menyediakan pengaturan stop-loss yang fleksibel, serta parameter kustom seperti kontrol frekuensi perdagangan minimum dan pilihan preferensi arah.

Prinsip Strategi

Inti dari strategi SPARK adalah aplikasi gabungan dari indikator SuperTrend dan indikator RSI. Indikator SuperTrend menilai arah tren dengan membandingkan hubungan antara harga penutupan dengan posisi resistensi dukungan dinamis, sedangkan indikator RSI digunakan untuk mengidentifikasi status pasar overbought dan oversold.

Strategi ini menggunakan mekanisme penyesuaian posisi dinamis untuk mengoptimalkan alokasi dana untuk setiap transaksi. Dengan mengatur persentase portofolio dan tingkat leverage, strategi dapat secara otomatis menghitung ukuran posisi optimal berdasarkan kondisi pasar saat ini dan saldo akun. Selain itu, strategi ini juga menyediakan pengaturan stop loss yang fleksibel, yang dapat dipilih dengan persentase tetap atau cara perhitungan dinamis.

Keunggulan Strategis

- Konfirmasi indikator ganda: Dengan menggabungkan dua indikator SuperTrend dan RSI, strategi SPARK dapat lebih akurat mengidentifikasi titik masuk dan keluar potensial, mengurangi kemungkinan kesalahan penilaian.

- Penyesuaian posisi dinamis: Strategi ini menggunakan mekanisme penyesuaian posisi dinamis, yang dapat secara otomatis mengoptimalkan alokasi dana untuk setiap transaksi berdasarkan persentase portofolio dan tingkat leverage, meningkatkan efisiensi penggunaan dana.

- Manajemen risiko yang fleksibel: Strategi memberikan pengaturan stop-loss yang fleksibel, yang dapat dipilih berdasarkan preferensi risiko pribadi dengan persentase tetap atau perhitungan dinamis, untuk mengendalikan risiko yang tepat.

- Kustomisasi parameter: Strategi memungkinkan pengguna untuk menyesuaikan beberapa parameter input seperti panjang ATR, perkalian, RSI threshold, dan lain-lain untuk menyesuaikan dengan kondisi pasar yang berbeda dan preferensi perdagangan.

Risiko Strategis

- Risiko pasar: Meskipun strategi SPARK menggunakan mekanisme konfirmasi indikator ganda dan pengaturan posisi dinamis, risiko kerugian masih mungkin terjadi dalam kondisi pasar yang ekstrim.

- Risiko optimasi parameter: kinerja strategi sangat bergantung pada pilihan parameter input. Pengaturan parameter yang tidak tepat dapat menyebabkan kinerja strategi yang buruk.

- Risiko over-fit: Jika parameter strategi dioptimalkan secara berlebihan, strategi tersebut mungkin akan berkinerja buruk dalam kondisi pasar di masa depan.

Arah optimasi strategi

- Memperkenalkan lebih banyak indikator: Pertimbangkan untuk memperkenalkan indikator teknis lainnya, seperti MACD, Brinband, dan lain-lain, untuk meningkatkan akurasi pengakuan sinyal lebih lanjut.

- Mengoptimalkan Stop Loss: Menjelajahi strategi stop loss yang lebih canggih, seperti stop loss bergerak, stop loss dinamis, dan lain-lain, untuk lebih melindungi keuntungan dan membatasi kerugian.

- Adaptasi parameter: Mengembangkan mekanisme adaptasi, menyesuaikan parameter strategi sesuai dengan situasi pasar yang dinamis, untuk menyesuaikan diri dengan lingkungan pasar yang terus berubah.

Meringkaskan

Strategi SPARK menyediakan pedagang dengan solusi perdagangan kuantitatif yang komprehensif dengan menggabungkan indikator SuperTrend dan RSI, dan menggunakan mekanisme penyesuaian posisi dinamis dan alat manajemen risiko yang fleksibel. Meskipun strategi mungkin menghadapi beberapa risiko, dengan terus-menerus mengoptimalkan dan memperbaiki, strategi SPARK diharapkan untuk mencapai kinerja yang stabil dalam berbagai kondisi pasar.

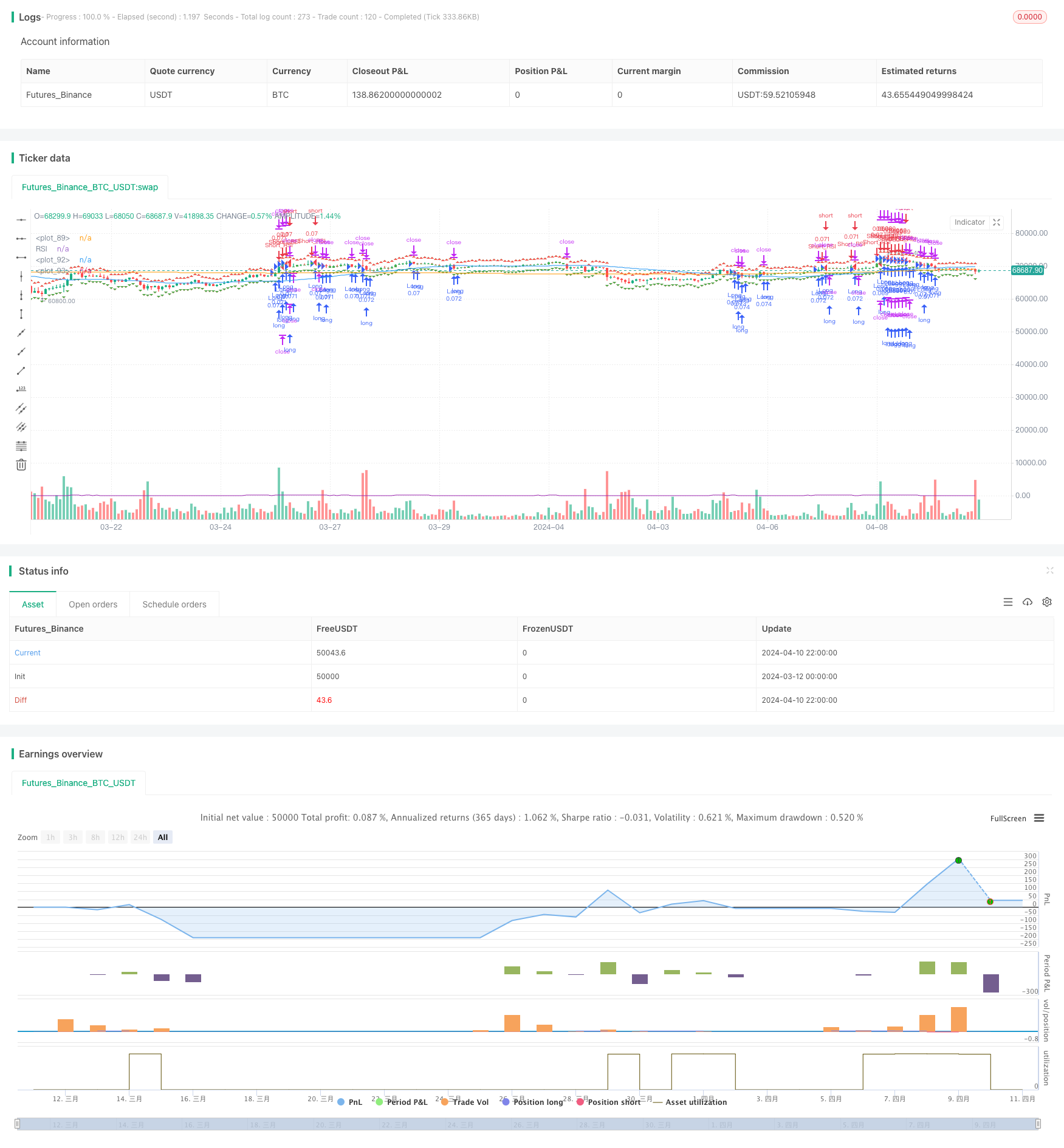

/*backtest

start: 2024-03-12 00:00:00

end: 2024-04-11 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SPARK", shorttitle="SPARK", overlay=true)

// Choose whether to activate the minimal bars in trade feature

minBarsEnabled = input(true, title="Activate Minimal Bars in Trade")

portfolioPercentage = input(10, title="Portfolio Percentage", minval=1, maxval=100)

// Leverage Input

leverage = input(1, title="Leverage", minval=1)

// Calculate position size according to portfolio percentage and leverage

positionSizePercent = portfolioPercentage / 100 * leverage

positionSize = (strategy.initial_capital / close) * positionSizePercent

// Take Profit and Stop Loss settings

useFixedTPSL = input(1, title="Use Fixed TP/SL", options=[1, 0])

tp_sl_step = 0.1

fixedTP = input(2.0, title="Fixed Take Profit (%)", step=tp_sl_step)

fixedSL = input(1.0, title="Fixed Stop Loss (%)", step=tp_sl_step)

// Calculate Take Profit and Stop Loss Levels

takeProfitLong = close * (1 + fixedTP / 100)

takeProfitShort = close * (1 - fixedTP / 100)

stopLossLong = close * (1 - fixedSL / 100)

stopLossShort = close * (1 + fixedSL / 100)

// Plot TP and SL levels on the chart

plotshape(series=takeProfitLong, title="Take Profit Long", color=color.green, style=shape.triangleup, location=location.abovebar)

plotshape(series=takeProfitShort, title="Take Profit Short", color=color.red, style=shape.triangledown, location=location.belowbar)

plotshape(series=stopLossLong, title="Stop Loss Long", color=color.red, style=shape.triangleup, location=location.abovebar)

plotshape(series=stopLossShort, title="Stop Loss Short", color=color.green, style=shape.triangledown, location=location.belowbar)

// Minimum Bars Between Trades Input

minBarsBetweenTrades = input(5, title="Minimum Bars Between Trades")

// Inputs for selecting trading direction

tradingDirection = input("Both", "Choose Trading Direction", options=["Long", "Short", "Both"])

// SuperTrend Function

trendFlow(src, atrLength, multiplier) =>

atr = atr(atrLength)

up = hl2 - (multiplier * atr)

dn = hl2 + (multiplier * atr)

trend = 1

trend := nz(trend[1], 1)

up := src > nz(up[1], 0) and src[1] > nz(up[1], 0) ? max(up, nz(up[1], 0)) : up

dn := src < nz(dn[1], 0) and src[1] < nz(dn[1], 0) ? min(dn, nz(dn[1], 0)) : dn

trend := src > nz(dn[1], 0) ? 1 : src < nz(up[1], 0)? -1 : nz(trend[1], 1)

[up, dn, trend]

// Inputs for SuperTrend settings

atrLength1 = input(7, title="ATR Length for Trend 1")

multiplier1 = input(4.0, title="Multiplier for Trend 1")

atrLength2 = input(14, title="ATR Length for Trend 2")

multiplier2 = input(3.618, title="Multiplier for Trend 2")

atrLength3 = input(21, title="ATR Length for Trend 3")

multiplier3 = input(3.5, title="Multiplier for Trend 3")

atrLength4 = input(28, title="ATR Length for Trend 4")

multiplier4 = input(3.382, title="Multiplier for Trend 4")

// Calculate SuperTrend

[up1, dn1, trend1] = trendFlow(close, atrLength1, multiplier1)

[up2, dn2, trend2] = trendFlow(close, atrLength2, multiplier2)

[up3, dn3, trend3] = trendFlow(close, atrLength3, multiplier3)

[up4, dn4, trend4] = trendFlow(close, atrLength4, multiplier4)

// Entry Conditions based on SuperTrend and Elliott Wave-like patterns

longCondition = trend1 == 1 and trend2 == 1 and trend3 == 1 and trend4 == 1

shortCondition = trend1 == -1 and trend2 == -1 and trend3 == -1 and trend4 == -1

// Calculate bars since last trade

barsSinceLastTrade = barssince(tradingDirection == "Long" ? longCondition : shortCondition)

// Strategy Entry logic based on selected trading direction and minimum bars between trades

if tradingDirection == "Long" or tradingDirection == "Both"

if longCondition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("TP/SL Long", from_entry="Long", stop=stopLossLong, limit=takeProfitLong)

if tradingDirection == "Short" or tradingDirection == "Both"

if shortCondition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("TP/SL Short", from_entry="Short", stop=stopLossShort, limit=takeProfitShort)

// Color bars based on position

var color barColor = na

barColor := strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : na

// Plot colored bars

plotcandle(open, high, low, close, color=barColor)

// Plot moving averages

plot(sma(close, 50), color=color.blue)

plot(sma(close, 200), color=color.orange)

// More customizable trading bot - adding a new indicator

// This indicator is the RSI (Relative Strength Index)

// RSI Inputs

rsi_length = input(14, title="RSI Length")

rsi_oversold = input(30, title="RSI Oversold")

rsi_overbought = input(70, title="RSI Overbought")

// Calculate RSI

rsi = rsi(close, rsi_length)

// Plot RSI

plot(rsi, color=color.purple, title="RSI")

// Entry Conditions based on RSI

rsi_long_condition = rsi < rsi_oversold

rsi_short_condition = rsi > rsi_overbought

// Strategy Entry logic based on RSI

if tradingDirection == "Long" or tradingDirection == "Both"

if rsi_long_condition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Long_RSI", strategy.long, qty=positionSize)

strategy.exit("TP/SL Long_RSI", from_entry="Long_RSI", stop=stopLossLong, limit=takeProfitLong)

if tradingDirection == "Short" or tradingDirection == "Both"

if rsi_short_condition and (not minBarsEnabled or barsSinceLastTrade >= minBarsBetweenTrades)

strategy.entry("Short_RSI", strategy.short, qty=positionSize)

strategy.exit("TP/SL Short_RSI", from_entry="Short_RSI", stop=stopLossShort, limit=takeProfitShort)