1

fokus pada

1664

Pengikut

Ringkasan

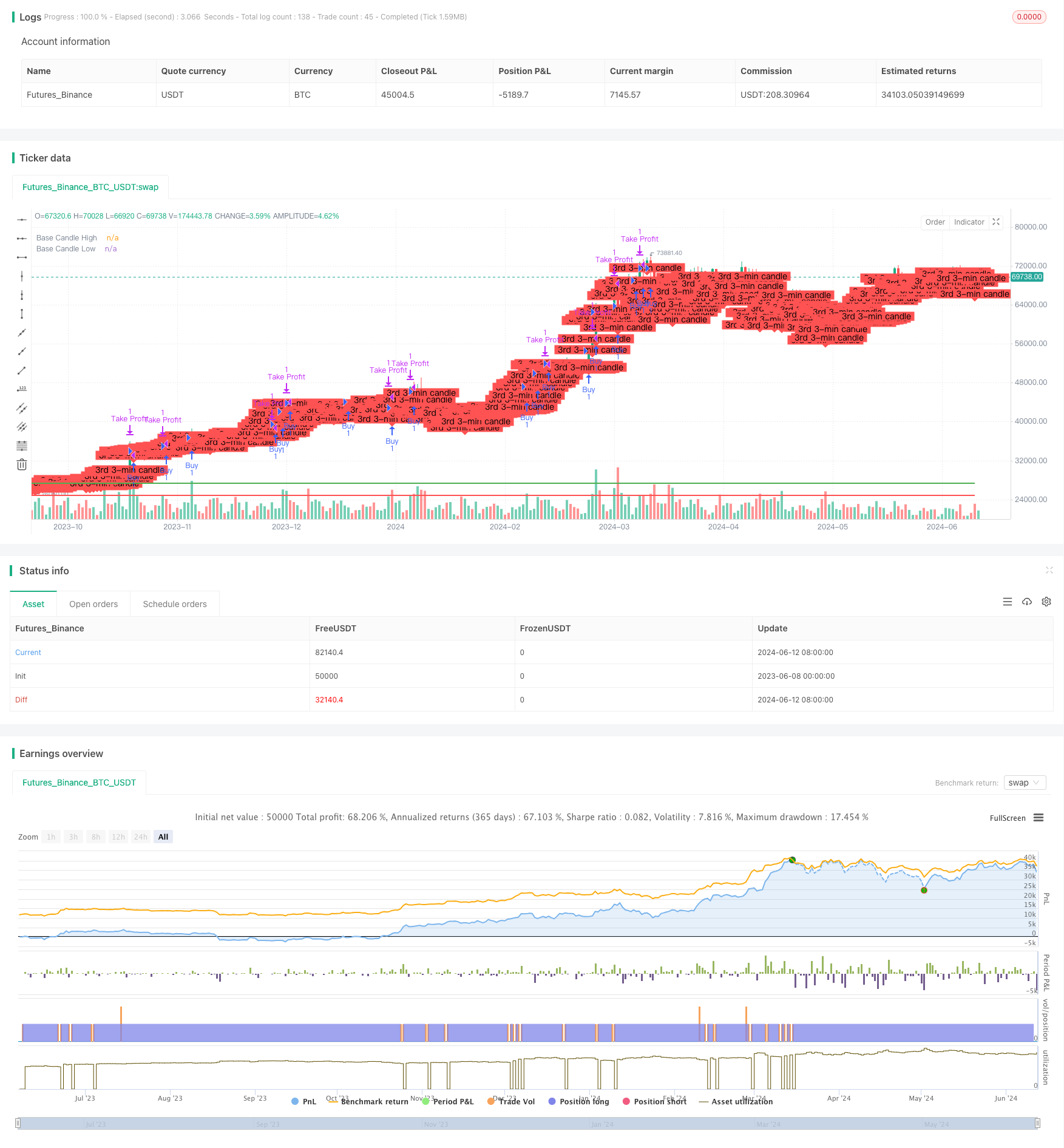

Strategi utama adalah menggunakan tiga menit K garis tinggi rendah sebagai titik pecah, ketika harga menembus tiga menit K garis tinggi, dan ketika harga menembus titik rendah kosong. Strategi ini cocok untuk perdagangan dalam hari, menutup posisi pada hari yang sama, dan melanjutkan perdagangan pada hari berikutnya.

Prinsip Strategi

- Dapatkan data K-line tiga menit pertama setelah bukaan setiap hari, dan catat harga tertinggi dan terendah dari K-line ketiga.

- Ketika harga menembus harga tertinggi dari garis K ketiga, buka lebih banyak, dan harga target ditambah 100 poin pada harga buka posisi, sampai ditutup atau mencapai harga target di posisi rata.

- Ketika harga menembus harga terendah dari garis K ketiga, buka posisi kosong, harga target dikurangi 100 poin dari harga buka posisi, sampai ditutup atau mencapai harga target di posisi rata.

- Setiap hari, posisi ditutup dan perdagangan dilanjutkan keesokan harinya.

Keunggulan Strategis

- Ini adalah salah satu cara yang paling sederhana untuk memahami dan mengimplementasikan.

- Ini berlaku untuk transaksi intraday dan memiliki tingkat pemanfaatan yang tinggi.

- “Risk relatif rendah, posisi stop loss jelas.

- Untuk pasar yang lebih cenderung.

Risiko Strategis

- Jika pasar berfluktuasi besar, maka kemungkinan akan terjadi penurunan besar.

- Harga saham di bursa naik turun, dan risiko lebih tinggi.

- Ini adalah salah satu dari beberapa hal yang dapat Anda lakukan untuk menghindari masalah ini.

Arah optimasi strategi

- Anda dapat mempertimbangkan untuk menambahkan indikator seperti moving averages untuk memfilter sinyal kebisingan di pasar yang bergoyang.

- Anda dapat mempertimbangkan untuk mengoptimalkan waktu untuk membuka posisi, menghindari periode terbuka.

- Anda dapat mempertimbangkan untuk mengoptimalkan titik stop loss untuk meningkatkan stabilitas strategi.

- Manajemen posisi dapat dipertimbangkan untuk mengendalikan risiko penarikan balik.

Meringkaskan

Strategi ini didasarkan pada tiga menit K garis tinggi-rendah, untuk perdagangan dalam sehari. Keuntungan adalah sederhana mudah dipahami, mudah dilakukan, risiko relatif rendah. Namun, ada juga beberapa risiko, seperti ketika pasar berfluktuasi besar, mungkin akan terjadi penarikan besar.

Kode Sumber Strategi

/*backtest

start: 2023-06-08 00:00:00

end: 2024-06-13 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Banknifty Strategy", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Parameters

start_date = input(timestamp("2024-01-01 00:00"), title="Start Date")

end_date = input(timestamp("2024-06-07 23:59"), title="End Date")

// Time settings

var startTime = timestamp("2024-06-09 09:15")

var endTime = timestamp("2024-06-09 09:24")

// Variables to store the 3rd 3-minute candle

var bool isCandleFound = false

var float thirdCandleHigh = na

var float thirdCandleLow = na

var float baseCandleHigh = na

var float baseCandleLow = na

var float entryPrice = na

var float targetPrice = na

// Check if the current time is within the specified date range

inDateRange = true

// Capture the 3rd 3-minute candle

if (inDateRange and not isCandleFound)

var int candleCount = 0

if (true)

candleCount := candleCount + 1

if (candleCount == 3)

thirdCandleHigh := high

thirdCandleLow := low

isCandleFound := true

// Wait for a candle to close above the high of the 3rd 3-minute candle

if (isCandleFound and na(baseCandleHigh) and close > thirdCandleHigh)

baseCandleHigh := close

baseCandleLow := low

// Strategy logic for buying and selling

if (not na(baseCandleHigh))

// Buy condition

if (high > baseCandleHigh and strategy.opentrades == 0)

entryPrice := high

targetPrice := entryPrice + 100

strategy.entry("Buy", strategy.long, limit=entryPrice)

// Sell condition

if (low < baseCandleLow and strategy.opentrades == 0)

entryPrice := low

targetPrice := entryPrice - 100

strategy.entry("Sell", strategy.short, limit=entryPrice)

// Exit conditions

if (strategy.opentrades > 0)

// Exit BUY trade when profit is 100 points or carry forward to next day

if (strategy.position_size > 0 and high >= targetPrice)

strategy.exit("Take Profit", from_entry="Buy", limit=targetPrice)

// Exit SELL trade when profit is 100 points or carry forward to next day

if (strategy.position_size < 0 and low <= targetPrice)

strategy.exit("Take Profit", from_entry="Sell", limit=targetPrice)

// Close trades at the end of the day

if (time == timestamp("2024-06-09 15:30"))

strategy.close("Buy", comment="Market Close")

strategy.close("Sell", comment="Market Close")

// Plotting for visualization

plotshape(series=isCandleFound, location=location.belowbar, color=color.red, style=shape.labeldown, text="3rd 3-min candle")

plot(baseCandleHigh, title="Base Candle High", color=color.green, linewidth=2, style=plot.style_line)

plot(baseCandleLow, title="Base Candle Low", color=color.red, linewidth=2, style=plot.style_line)