Ringkasan

Strategi ini menggabungkan beberapa indikator teknis seperti indeks relative strengths (RSI), moving averages convergence spread (MACD), Bollinger Bands (Bollinger Bands) dan volume transaksi untuk menentukan waktu perdagangan yang optimal. Strategi ini mengidentifikasi tren dan fluktuasi dengan menganalisis data harga dan volume transaksi, dan menggunakan indikator momentum dan indikator fluktuasi untuk menghasilkan sinyal perdagangan. Selain itu, strategi ini juga memperkenalkan konsep zona likuiditas untuk mengoptimalkan sinyal perdagangan lebih lanjut.

Prinsip Strategi

- Perhitungan RSI, MACD, BRI dan volume transaksi.

- Menggunakan jangka pendek dan jangka panjang moving average untuk mengidentifikasi arah tren.

- Menentukan titik tertinggi dan terendah dari zona likuiditas.

- Menciptakan sinyal beli:

- Beli ketika RSI berada di bawah 30, dan harga close-out berada di bawah Bollinger Bands dan di atas zona likuiditas.

- Ketika MACD lebih besar dari 0, tren naik ditetapkan, dan harga penutupan berada di atas titik tertinggi dari 10 garis K terdepan, dan berada di atas titik rendah di zona likuiditas, beli.

- Ketika volume transaksi melonjak, harga penutupan lebih tinggi dari Bollinger Bands dan berada di atas titik rendah di zona likuiditas, beli.

- Sinyal yang dihasilkan dan dijual:

- Ketika RSI berada di atas 70, harga close out berada di atas Bollinger Bands dan berada di bawah titik tertinggi di zona likuiditas, maka jual.

- Ketika MACD kurang dari 0, tren turun ditetapkan, harga penutupan berada di bawah titik terendah dari 10 garis K terdepan, dan berada di bawah titik tertinggi di zona likuiditas, dijual.

- Penjualan dilakukan ketika volume transaksi melonjak, harga penutupan berada di bawah Bollinger Bands dan berada di bawah titik tertinggi di zona likuiditas.

- Melakukan transaksi berdasarkan sinyal beli dan jual, menghindari pengulangan transaksi.

Keunggulan Strategis

- Komposisi multi-indikator: Komposisi strategi ini mempertimbangkan berbagai aspek seperti harga, volume transaksi, tren, dan fluktuasi untuk memberikan sinyal perdagangan yang lebih andal.

- Pengakuan tren: Dengan membandingkan rata-rata bergerak jangka pendek dan jangka panjang, strategi dapat secara efektif mengidentifikasi arah tren saat ini.

- Pertimbangan Volatilitas: Menggunakan indikator Brin’s Band dan volume transaksi, strategi dapat menangkap perubahan harga dan sentimen pasar.

- Zona likuiditas: Dengan mengidentifikasi zona likuiditas, strategi dapat melakukan perdagangan di dekat titik-titik dukungan dan resistensi penting, meningkatkan tingkat keberhasilan.

- Mencegah over-trading: Strategi ini memiliki mekanisme untuk mencegah transaksi berulang dan menghindari biaya transaksi yang tidak perlu.

Risiko Strategis

- Risiko Optimasi Parameter: Kinerja strategi bergantung pada pilihan beberapa parameter, dan pengaturan parameter yang tidak tepat dapat menyebabkan kegagalan strategi.

- Risiko pasar: Strategi dioptimalkan berdasarkan data historis dan mungkin tidak akan berkinerja baik dalam menghadapi perubahan pasar di masa depan.

- Black Swan Incident: Strategi yang tidak mampu menghadapi fluktuasi yang tidak biasa dalam kondisi pasar yang ekstrim.

- Slippage dan biaya transaksi: Slippage dan biaya transaksi dalam transaksi aktual dapat mempengaruhi kinerja keseluruhan strategi.

Arah optimasi strategi

- Optimasi parameter dinamis: menyesuaikan parameter strategi secara dinamis sesuai dengan kondisi pasar untuk menyesuaikan dengan fase pasar yang berbeda.

- Pengelolaan risiko: Memperkenalkan mekanisme stop loss dan stop loss untuk mengontrol risiko dari transaksi tunggal.

- Pengujian multi-pasar: menerapkan strategi di berbagai pasar keuangan untuk menilai kelayakan dan stabilitasnya.

- Optimasi Pembelajaran Mesin: Menggunakan algoritma pembelajaran mesin untuk mengoptimalkan strategi dan beradaptasi dengan perubahan pasar.

Meringkaskan

Strategi ini menggabungkan beberapa indikator teknis, seperti RSI, MACD, Bollinger Bands, dan volume transaksi, untuk membentuk satu set lengkap dari sistem perdagangan. Strategi ini mempertimbangkan berbagai aspek seperti harga, tren, fluktuasi, dan sentimen pasar, dan memperkenalkan konsep zona likuiditas untuk mengoptimalkan sinyal perdagangan.

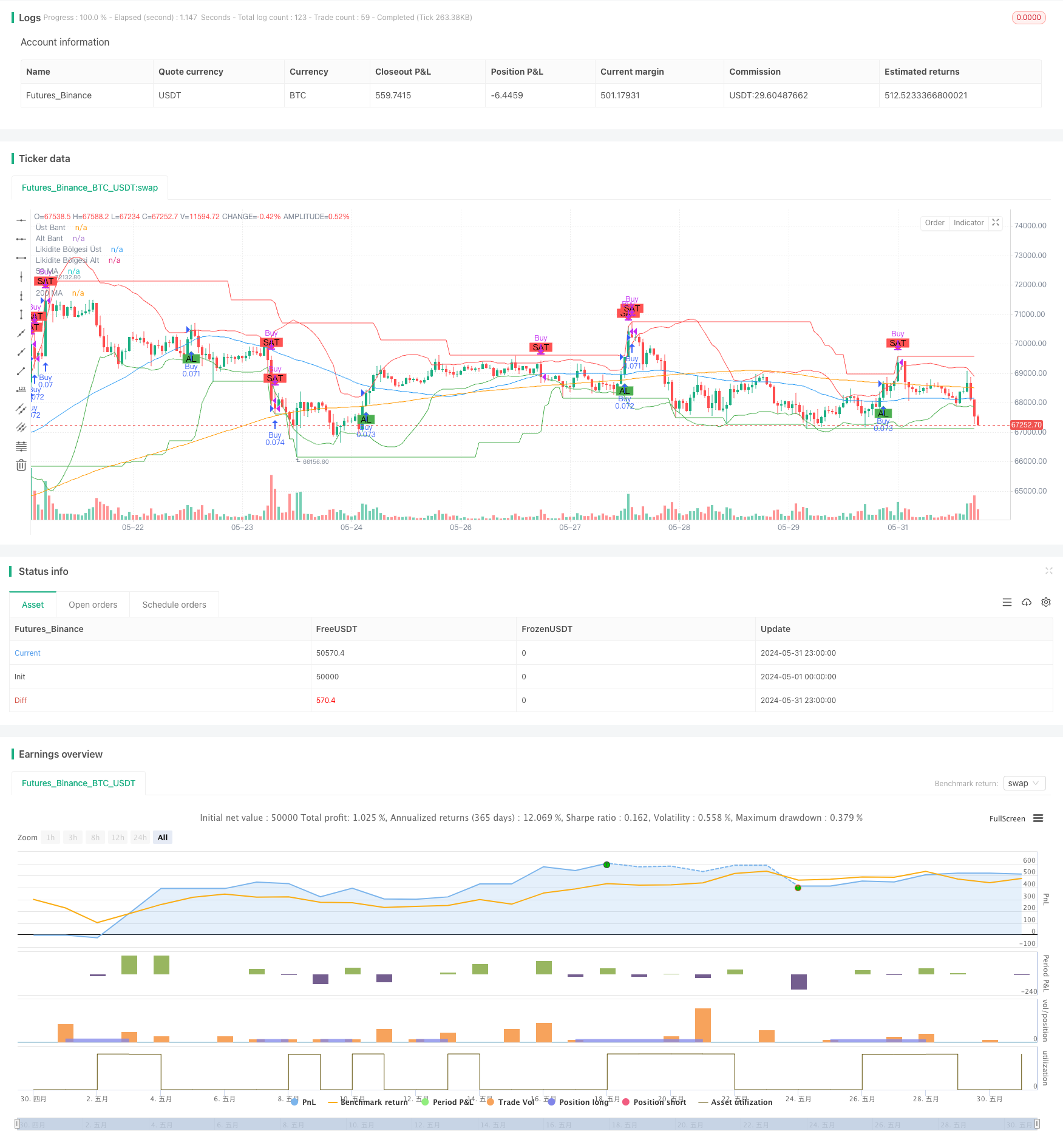

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimize Edilmiş Kapsamlı Ticaret Stratejisi - Likidite Bölgeleri ile 30 Dakika", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Optimize edilebilir parametreler

rsiPeriod = input.int(14, minval=5, maxval=30, title="RSI Periyodu")

macdShortPeriod = input.int(12, minval=5, maxval=30, title="MACD Kısa Periyodu")

macdLongPeriod = input.int(26, minval=20, maxval=50, title="MACD Uzun Periyodu")

macdSignalPeriod = input.int(9, minval=5, maxval=20, title="MACD Sinyal Periyodu")

smaPeriod = input.int(20, minval=10, maxval=50, title="SMA Periyodu")

bollingerMultiplier = input.float(2.0, minval=1.0, maxval=3.0, title="Bollinger Bantları Çarpanı")

volumeSpikeMultiplier = input.float(1.5, minval=1.0, maxval=3.0, title="Hacim Artış Çarpanı")

shortTermMAPeriod = input.int(50, minval=20, maxval=100, title="Kısa Dönem MA Periyodu")

longTermMAPeriod = input.int(200, minval=100, maxval=300, title="Uzun Dönem MA Periyodu")

liquidityZonePeriod = input.int(50, minval=10, maxval=100, title="Likidite Bölgesi Periyodu")

// İndikatörleri Tanımla

rsi = ta.rsi(close, rsiPeriod)

[macdLine, signalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

macdHist = macdLine - signalLine

basis = ta.sma(close, smaPeriod)

dev = bollingerMultiplier * ta.stdev(close, smaPeriod)

upperBand = basis + dev

lowerBand = basis - dev

volumeSpike = volume > ta.sma(volume, 20) * volumeSpikeMultiplier

// Hareketli Ortalamaları Kullanarak Trend Takibi

shortTermMA = ta.sma(close, shortTermMAPeriod)

longTermMA = ta.sma(close, longTermMAPeriod)

trendUp = shortTermMA > longTermMA

trendDown = shortTermMA < longTermMA

// Likidite Bölgelerini Belirleme

liquidityZoneHigh = ta.highest(high, liquidityZonePeriod)

liquidityZoneLow = ta.lowest(low, liquidityZonePeriod)

// Likidite Bölgelerini Çiz

plot(liquidityZoneHigh, color=color.red, title="Likidite Bölgesi Üst")

plot(liquidityZoneLow, color=color.green, title="Likidite Bölgesi Alt")

// Sinyal Durumlarını Saklamak İçin Değişkenler

var bool inPosition = false

var bool isBuy = false

// Al ve Sat Sinyali Bayrakları

var bool buyFlag = false

var bool sellFlag = false

// Bayrakları Sıfırla

buyFlag := false

sellFlag := false

// Al ve Sat Sinyallerini Tanımla

var bool buySignal = false

var bool sellSignal = false

if (barstate.isconfirmed)

buySignal := ((rsi < 30 and close < lowerBand and close > liquidityZoneLow) or

(macdHist > 0 and trendUp and close > ta.highest(high, 10)[1] and close > liquidityZoneLow) or

(volumeSpike and close > upperBand and close > liquidityZoneLow))

sellSignal := ((rsi > 70 and close > upperBand and close < liquidityZoneHigh) or

(macdHist < 0 and trendDown and close < ta.lowest(low, 10)[1] and close < liquidityZoneHigh) or

(volumeSpike and close < lowerBand and close < liquidityZoneHigh))

// Aynı Sinyali Tekrarlamamak İçin Kontroller

if (buySignal and (not inPosition or not isBuy))

inPosition := true

isBuy := true

buyFlag := true

sellFlag := false

strategy.entry("Buy", strategy.long)

if (sellSignal and inPosition and isBuy)

inPosition := false

isBuy := false

sellFlag := true

buyFlag := false

strategy.close("Buy")

// Sinyalleri Grafiğe Çiz

plotshape(series=buyFlag, location=location.belowbar, color=color.green, style=shape.labelup, text="AL")

plotshape(series=sellFlag, location=location.abovebar, color=color.red, style=shape.labeldown, text="SAT")

// Hareketli Ortalamaları ve Bollinger Bantlarını Çiz

plot(shortTermMA, color=color.blue, title="50 MA")

plot(longTermMA, color=color.orange, title="200 MA")

plot(upperBand, color=color.red, title="Üst Bant")

plot(lowerBand, color=color.green, title="Alt Bant")