1

fokus pada

1664

Pengikut

Ringkasan

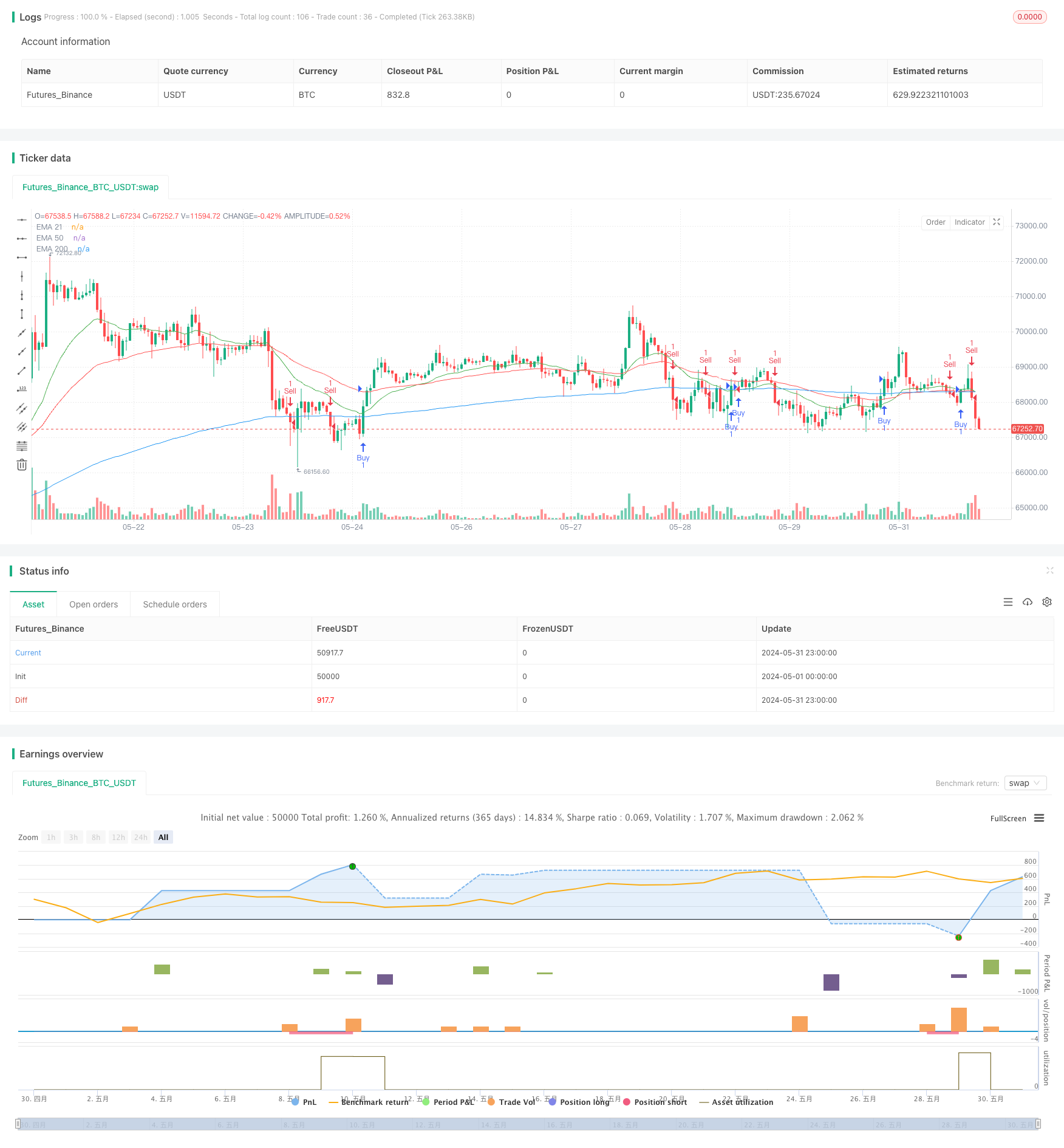

Strategi ini menggunakan tiga periode berbeda dari indeks moving average (EMA) dan indeks relative strength (RSI) untuk menilai tren pasar dan sinyal perdagangan. Strategi ini menghasilkan sinyal beli ketika harga menerobos 200 hari EMA dan RSI lebih besar dari 50, sebaliknya menghasilkan sinyal jual ketika harga turun 200 hari EMA dan RSI lebih kecil dari 50.

Prinsip Strategi

- EMA 200-, 50- dan 21-hari dihitung dengan garis biru, merah, dan hijau.

- Hitung RSI 14 periode.

- Sebuah sinyal beli dihasilkan ketika harga menutup dengan EMA 200 hari dan RSI lebih besar dari 50.

- Sinyal jual dihasilkan ketika harga close out melewati 200-day EMA dan RSI kurang dari 50.

- Ukuran posisi adalah 1% dari nilai bersih akun.

- Stop loss untuk pembelian adalah 50 poin di bawah EMA 200 hari dan stop loss adalah 100 poin di atas harga pembelian.

- Stop loss trading adalah 50 poin di atas EMA 200 hari dan stop loss trading adalah 100 poin di bawah harga jual.

Keunggulan Strategis

- Kombinasi indikator harga dan momentum membantu untuk menangkap waktu tren terbentuk dan berbalik.

- Tiga siklus EMA yang berbeda dapat secara komprehensif mencerminkan tren jangka pendek, menengah dan panjang, mengurangi frekuensi sinyal dan sinyal palsu.

- RSI dapat memfilter sinyal perdagangan di pasar yang bergoyang, mengurangi kerugian perdagangan.

- Posisi persentase tetap, yang membantu mengendalikan risiko.

- Setting Stop Loss Barrier, mencegah risiko transaksi tunggal.

Risiko Strategis

- Keterlambatan sinyal pada titik balik tren dapat menyebabkan sebagian kerugian keuntungan.

- Sinyal RSI dapat menghasilkan sinyal reversal terlalu dini dalam tren yang kuat.

- Posisi persentase tetap lebih berisiko dalam situasi fluktuasi besar.

- Stop loss yang terlalu dekat dengan garis 200 hari dapat menyebabkan stop loss yang sering terjadi.

Arah optimasi strategi

- Masukkan lebih banyak kombinasi rata-rata jangka panjang untuk mengoptimalkan sinyal.

- Pertimbangan RSI deviasi dan overbought oversold untuk menyesuaikan sinyal.

- Dimensi posisi disesuaikan secara dinamis berdasarkan indikator volatilitas seperti ATR.

- Optimalkan posisi stop loss, seperti berdasarkan resistance level, persentase atau ATR.

- Memperkenalkan kondisi penyaringan tren, seperti indikator ADX, untuk menghindari perdagangan di pasar yang bergolak.

- Optimasi parameter dan pengujian ulang untuk berbagai standar dan periode.

Meringkaskan

Strategi ini dapat menangkap situasi tren jangka menengah dan panjang yang relatif jelas melalui sinyal perdagangan di antara EMA multi-headed dan RSI yang kuat. Namun, umumnya berkinerja pada awal perubahan tren dan di pasar yang bergolak, secara keseluruhan cocok untuk pasar yang sedang tren.

Kode Sumber Strategi

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Lexi Supreme", overlay=true)

// Calculate EMA 200

ema200 = ta.ema(close, 200)

// Calculate EMA 50

ema50 = ta.ema(close, 50)

// Calculate EMA 21

ema21 = ta.ema(close, 21)

// Calculate RSI

rsiValue = ta.rsi(close, 14)

// Buy condition: RSI above 50 and price crosses above EMA 200

buyCondition = ta.crossover(close, ema200) and rsiValue > 50

// Sell condition: RSI below 50 and price crosses below EMA 200

sellCondition = ta.crossunder(close, ema200) and rsiValue < 50

// Position Size (1% of account balance)

positionSize = 1

// Stop Loss and Take Profit values for buy trades

stopLossBuy = ema200 - 0.00050

takeProfitBuy = 0.00100

// Stop Loss and Take Profit values for sell trades

stopLossSell = ema200 + 0.00050

takeProfitSell = 0.00100

// Plot EMA 200 line in blue

plot(ema200, color=color.blue, title="EMA 200")

// Plot EMA 50 line in red

plot(ema50, color=color.red, title="EMA 50")

// Plot EMA 21 line in green

plot(ema21, color=color.green, title="EMA 21")

// Plot buy entry points in yellow

plotshape(series=buyCondition, title="Buy Signal", color=color.yellow, style=shape.triangleup, location=location.belowbar, size=size.small)

// Plot sell entry points in white

plotshape(series=sellCondition, title="Sell Signal", color=color.white, style=shape.triangledown, location=location.abovebar, size=size.small)

// Strategy entry and exit conditions with position size, stop loss, and take profit for buy trades

if (buyCondition)

strategy.entry("Buy", strategy.long, qty=positionSize)

strategy.exit("Take Profit/Stop Loss Buy", from_entry="Buy", stop=stopLossBuy, limit=close + takeProfitBuy)

// Strategy entry and exit conditions with position size, stop loss, and take profit for sell trades

if (sellCondition)

strategy.entry("Sell", strategy.short, qty=positionSize)

strategy.exit("Take Profit/Stop Loss Sell", from_entry="Sell", stop=stopLossSell, limit=close - takeProfitSell)