Ringkasan

Strategi ini adalah sistem perdagangan komprehensif yang menggabungkan beberapa indikator kunci dalam analisis teknis, termasuk sistem dua rata-rata (SMA), dispersi konvergensi rata-rata bergerak (MACD), indeks kekuatan relatif (RSI), dan analisis titik resistensi. Gagasan inti dari strategi ini adalah untuk mengkonfirmasi sinyal perdagangan melalui indikator teknis multi-dimensi, sekaligus mengkombinasikan indikator sentimen pasar untuk mengoptimalkan manajemen posisi, yang pada akhirnya mencapai tujuan peningkatan rasio keuntungan dan risiko.

Prinsip Strategi

Strategi ini menggunakan dua rata-rata bergerak sederhana jangka pendek (10 hari) dan jangka panjang (30 hari) sebagai sistem sinyal utama. Sistem akan mengeluarkan sinyal multi ketika rata-rata jangka pendek melintasi rata-rata jangka panjang ke atas, sementara MACD menunjukkan tren multi arah (MACD di atas garis sinyal).

Keunggulan Strategis

- Multiple Confirmation Mechanism: Meningkatkan keandalan sinyal trading dengan crossover rata-rata, MACD trend dan multiple verifikasi resistance

- Manajemen Posisi Cerdas: Menggunakan indikator RSI untuk memantau sentimen, untuk mengelola risiko lebih baik

- Adaptif: parameter strategi dapat disesuaikan dengan kondisi pasar yang berbeda

- Pengendalian risiko yang lebih baik: pengaturan berbagai mekanisme stop loss, termasuk stop loss teknis dan stop loss emosional

- Tingkat sistematisasi yang tinggi: keputusan perdagangan sepenuhnya sistematis, mengurangi gangguan dari penilaian subjektif

Risiko Strategis

- Sistem linier dapat menghasilkan sinyal palsu di pasar yang bergejolak

- Terlalu mengandalkan indikator teknis dapat mengabaikan faktor-faktor mendasar

- Optimasi parameter dapat menyebabkan overfitting

- Identifikasi titik resistansi mungkin terlambat dalam perjalanan cepat

- Indeks RSI mungkin gagal dalam kondisi pasar tertentu

Arah optimasi strategi

- Pengenalan indikator volume transaksi: dapat meningkatkan penilaian terhadap kekuatan tren pasar

- Parameter penyesuaian dinamis: Periode rata-rata dan RSI threshold secara otomatis disesuaikan dengan fluktuasi pasar

- Menambahkan filter tren: memperkenalkan garis rata-rata jangka panjang sebagai filter tren

- Mengoptimalkan perhitungan bit resistansi: pertimbangkan untuk menggunakan algoritma identifikasi bit resistansi dinamis

- Tambahkan indikator volatilitas: untuk menyesuaikan ukuran posisi dan posisi stop loss

Meringkaskan

Strategi ini membangun sistem perdagangan yang lengkap dengan menggabungkan beberapa indikator teknis klasik. Keunggulan strategi adalah mekanisme pengakuan sinyal ganda dan sistem kontrol risiko yang baik, tetapi tetap memperhatikan dampak lingkungan pasar pada kinerja strategi. Dengan arah optimasi yang disarankan, stabilitas dan adaptasi strategi diharapkan ditingkatkan lebih lanjut. Dalam aplikasi langsung, investor disarankan untuk menyesuaikan parameter sesuai dengan preferensi risiko mereka sendiri dan lingkungan pasar, dan selalu tetap memperhatikan dasar-dasar pasar.

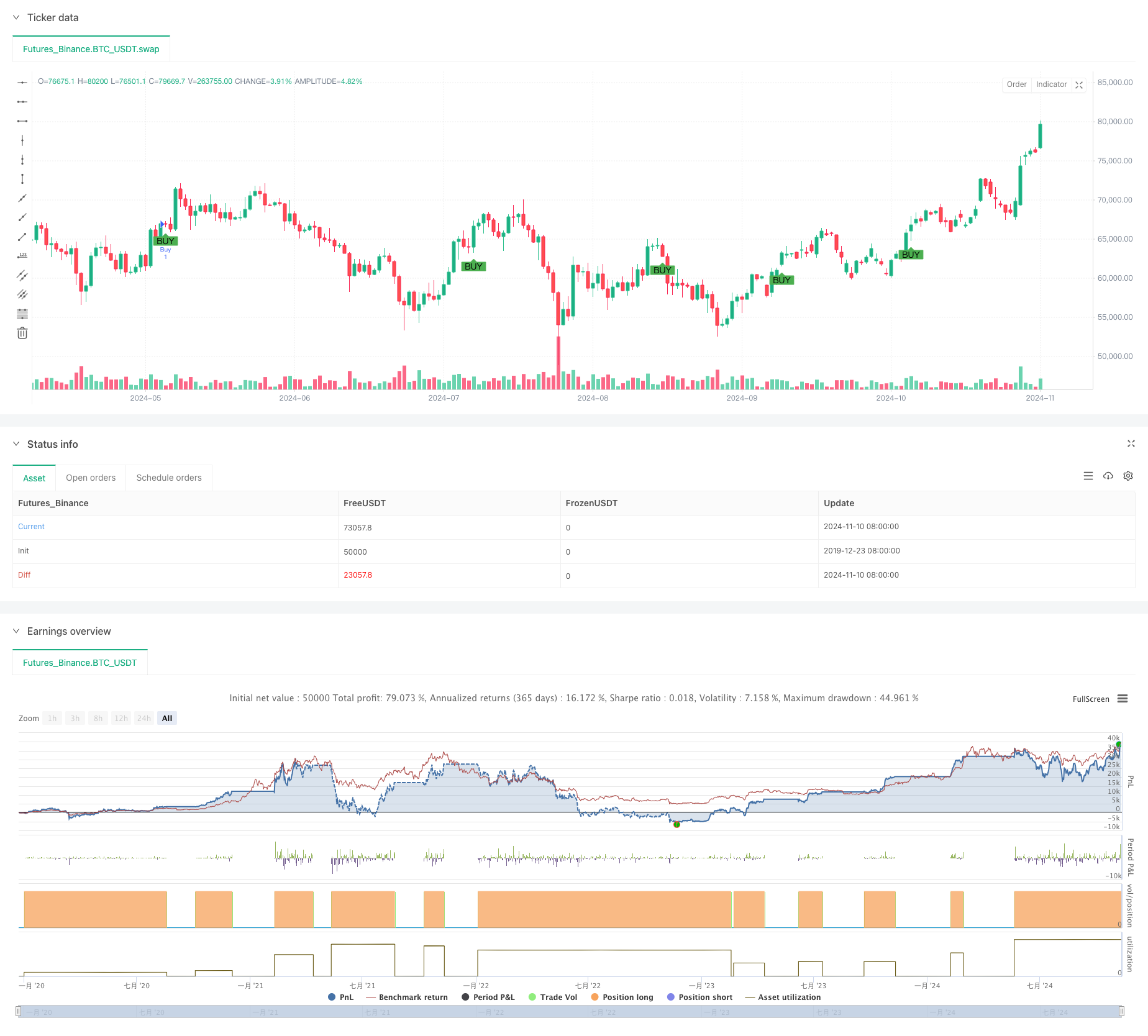

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment (Enhanced RR)", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Define buy condition based on SMA and MACD

buyCondition = ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance

sellCondition = close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance)

if (sellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Add alert for buy condition

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

// Add alert for sell condition to notify when price hits major resistance

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

// Add alert for early close condition (for losing trades)

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

// Add alert for holding winning condition (optional)

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")