Ringkasan

Strategi ini merupakan sistem perdagangan komprehensif yang menggabungkan beberapa indikator teknis dan sentimen pasar. Inti strategi ini menggunakan sinyal silang dari rata-rata bergerak jangka pendek dan jangka panjang (SMA), dan digabungkan dengan indikator MACD untuk mengkonfirmasi arah tren. Selain itu, strategi ini juga mengintegrasikan indikator sentimen pasar RSI, serta sistem pengenalan bentuk grafik, termasuk pengenalan bentuk dua puncak / dua dasar dan puncak bahu.

Prinsip Strategi

Strategi ini didasarkan pada beberapa komponen utama:

- Sistem Moving Average Multi-Periode: Menggunakan SMA 10 periode dan 30 periode untuk menilai tren

- Indikator MACD: Menggunakan parameter standar ((12,26,9) pengaturan untuk konfirmasi tren

- Pemantauan Sentimen Pasar: Menggunakan Indikator RSI untuk Perhitungan Overbought dan Oversold

- Grafik pengakuan bentuk: sistem pengakuan otomatis yang terdiri dari dua puncak / dua dasar dan kepala bahu puncak bentuk

- Filter waktu: fokus pada peluang perdagangan pada waktu tertentu

- Identifikasi titik resistensi: menggunakan 20 siklus mundur untuk menentukan titik resistensi utama

Kondisi pembelian harus dipenuhi: berada pada waktu perdagangan target, memakai SMA jangka pendek pada SMA jangka panjang, dan indikator MACD menunjukkan sinyal multihead. Kondisi jual harus dipenuhi: harga mencapai resistance utama, dan indikator MACD menunjukkan sinyal kosong.

Keunggulan Strategis

- Konfirmasi sinyal multi-dimensi: menggabungkan indikator teknis dan bentuk grafik untuk meningkatkan keandalan sinyal perdagangan

- Manajemen risiko yang lebih baik: termasuk mekanisme RSI untuk keluar lebih awal

- Integrasi sentimen pasar: menilai sentimen pasar melalui RSI, menghindari terlalu banyak mengejar penurunan

- Identifikasi bentuk otomatis: mengurangi bias dalam penilaian subjektif

- Filter waktu: Fokus pada saat-saat ketika pasar aktif, meningkatkan efisiensi perdagangan

Risiko Strategis

- Sensitivitas parameter: pengaturan parameter untuk beberapa indikator teknis dapat mempengaruhi kinerja kebijakan

- Risiko keterlambatan: Moving Average dan MACD memiliki keterlambatan

- Akurasi pengenalan bentuk: sistem pengenalan otomatis dapat melakukan kesalahan

- Ketergantungan pada kondisi pasar: kemungkinan munculnya sinyal palsu yang sering terjadi di pasar yang bergejolak

- Keterbatasan waktu: hanya berdagang pada waktu tertentu yang mungkin melewatkan kesempatan pada waktu lain

Arah optimasi strategi

- Adaptasi parameter: Memperkenalkan mekanisme penyesuaian parameter adaptasi yang secara otomatis menyesuaikan parameter indikator sesuai dengan fluktuasi pasar

- Sistem Berat Sinyal: Menciptakan sistem berat dari setiap sinyal indikator untuk meningkatkan akurasi pengambilan keputusan

- Optimasi Stop Loss: Meningkatkan mekanisme Stop Loss yang dinamis dan meningkatkan kemampuan pengendalian risiko

- Penguatan pengenalan bentuk: pengenalan algoritma pembelajaran mesin untuk meningkatkan akurasi pengenalan bentuk grafik

- Ekstensi siklus pengembalian: melakukan pengembalian pada siklus pasar yang berbeda untuk memverifikasi stabilitas strategi

Meringkaskan

Ini adalah strategi perdagangan yang komprehensif dan kuat, dengan kombinasi dari beberapa indikator teknis dan sentimen pasar, untuk membangun sistem perdagangan yang relatif utuh. Keunggulan strategi ini adalah pengakuan sinyal multi-dimensi dan mekanisme manajemen risiko yang baik, tetapi ada juga masalah seperti sensitivitas parameter dan akurasi pengenalan bentuk. Dengan terus-menerus mengoptimalkan dan memperbaiki, terutama dalam penyesuaian parameter dan aplikasi pembelajaran mesin, strategi ini diharapkan untuk mendapatkan kinerja yang lebih baik.

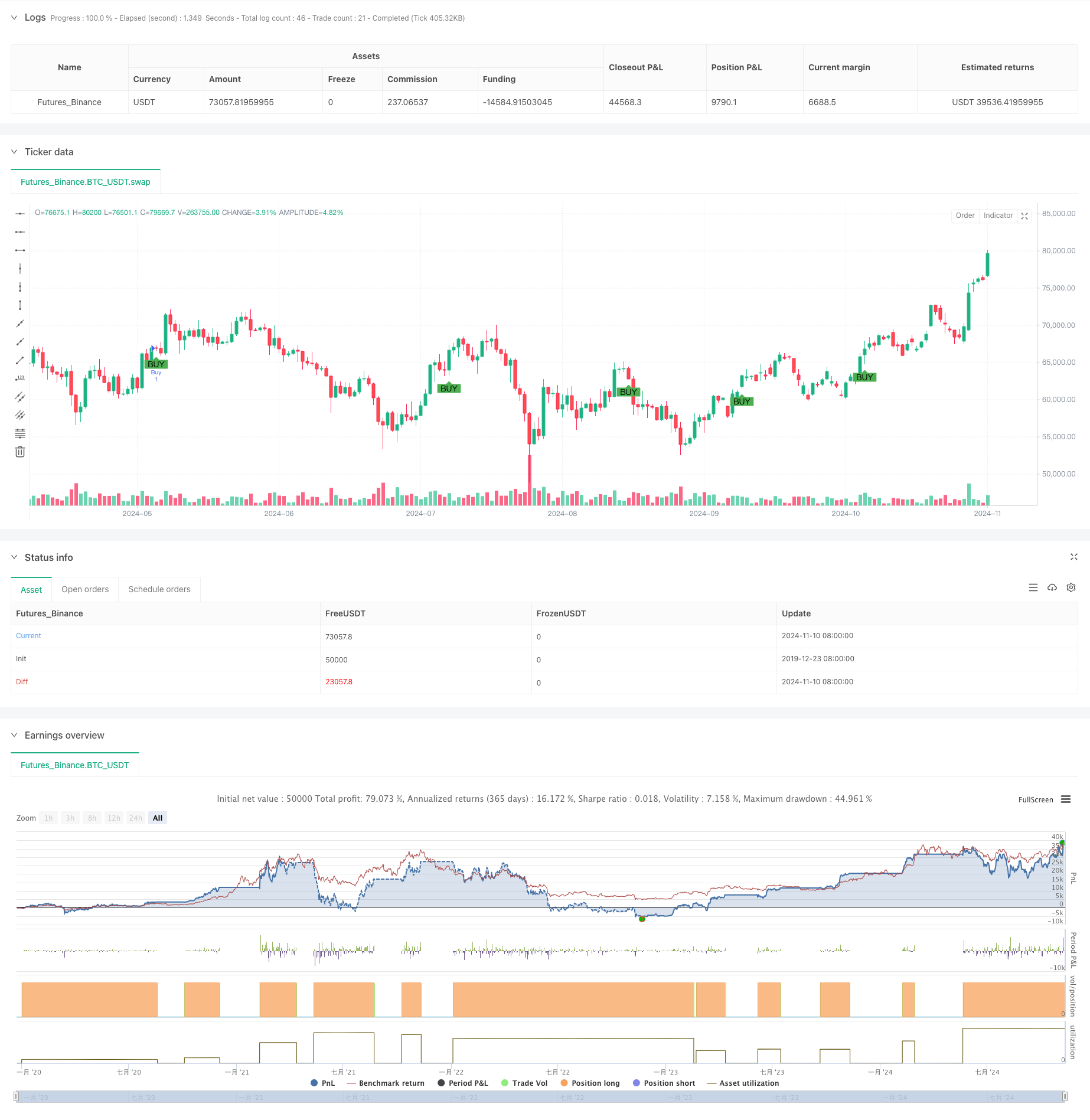

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment + Chart Patterns", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Time filtering: only trade during New York session (12:00 PM - 9:00 PM UTC)

isNewYorkSession = true

// Define buy condition based on SMA, MACD, and New York session

buyCondition = isNewYorkSession and ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance during New York session

sellCondition = isNewYorkSession and close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// ------ Chart Patterns ------ //

// Double Top/Bottom Pattern Detection

doubleTop = ta.highest(close, 50) == close[25] and ta.highest(close, 50) == close[0] // Approximate double top: two peaks

doubleBottom = ta.lowest(close, 50) == close[25] and ta.lowest(close, 50) == close[0] // Approximate double bottom: two troughs

// Head and Shoulders Pattern Detection

shoulder1 = ta.highest(close, 20)[40]

head = ta.highest(close, 20)[20]

shoulder2 = ta.highest(close, 20)[0]

isHeadAndShoulders = shoulder1 < head and shoulder2 < head and shoulder1 == shoulder2

// Pattern-based signals

patternBuyCondition = isNewYorkSession and doubleBottom and rsi < rsiOversold // Buy at double bottom in oversold conditions

patternSellCondition = isNewYorkSession and (doubleTop or isHeadAndShoulders) and rsi > rsiOverbought // Sell at double top or head & shoulders in overbought conditions

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition or patternBuyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance or pattern sell)

if (sellCondition or patternSellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition or patternBuyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition or patternSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// ------ Alerts for Patterns ------ //

// Add alert for pattern-based buy condition

alertcondition(patternBuyCondition, title="Pattern Buy Signal Activated", message="Double Bottom or Pattern Buy signal activated: Conditions met.")

// Add alert for pattern-based sell condition

alertcondition(patternSellCondition, title="Pattern Sell Signal Activated", message="Double Top or Head & Shoulders detected. Sell signal triggered.")

// Existing alerts for SMA/MACD-based conditions

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")