Ringkasan

Strategi ini adalah sistem perdagangan analisis teknis komprehensif yang menggabungkan pengenalan pola grafik klasik dengan analisis tren. Sistem ini terutama mengandalkan pengenalan pola grafik klasik, termasuk lebih dari sepuluh pola grafik yang berbeda, sambil menggabungkan rata-rata bergerak jangka pendek dan jangka panjang untuk mengkonfirmasi tren pasar, sehingga menghasilkan sinyal jual beli.

Prinsip Strategi

Strategi ini menggunakan mekanisme pengesahan sinyal bertingkat:

- Menggunakan 6-periode indeks moving average (EMA) sebagai indikator tren jangka pendek

- Tren jangka panjang berdasarkan rata-rata bergerak sederhana (SMA) 50 dan 200 periode

- Mengidentifikasi berbagai bentuk gambar:

- Keluarga bintang salib (umumnya bintang salib, salib makam, salib runcing)

- Bentuk jarum: jarum, jarum gantung, jarum terbalik, dan bintang

- Menelan Bentuk

- Bentuk garis rahim

- Bentuk bintang terbit/setengah

- Bentuk Trisat/Trisat

- Kombinasi tren dan bentuk menghasilkan sinyal perdagangan

Keunggulan Strategis

- Konfirmasi multi-dimensi sinyal: meningkatkan keandalan sinyal perdagangan dengan pengkonfirmasi ganda rata-rata bergerak dan bentuk graph

- Adaptif: dapat beradaptasi dengan berbagai kondisi pasar, menangkap tren dan peluang untuk membalikkannya

- Pengendalian risiko yang sempurna: mengurangi sinyal palsu dengan kondisi yang ketat dari pengenalan bentuk

- Logika operasi yang jelas: setiap sinyal perdagangan memiliki persyaratan masuk yang jelas

- Skalabilitas yang kuat: kerangka kebijakan mudah menambahkan modul pengenalan bentuk baru sesuai kebutuhan

Risiko Strategis

- Keterlambatan pengakuan bentuk: Pengakuan bentuk gambar yang membutuhkan lebih banyak garis K untuk diselesaikan, mungkin kehilangan waktu masuk yang optimal

- Sinyal tumpang tindih: munculnya beberapa bentuk pada saat yang sama dapat menyebabkan sinyal bertentangan

- Kebisingan Pasar: Mungkin Terlalu Banyak Sinyal Palsu di Kota yang Bergolak

- Sensitivitas parameter: Periode rata-rata bergerak yang dipilih memiliki pengaruh besar terhadap kinerja strategi

- Kompleksitas komputasi: Perhitungan real-time dalam berbagai bentuk dapat mempengaruhi efisiensi eksekusi

Arah optimasi strategi

- Sistem bobot sinyal:

- Setelan berat yang dapat disesuaikan untuk berbagai bentuk

- Penetapan berat berdasarkan kondisi pasar yang dinamis

- Identifikasi lingkungan pasar:

- Menambahkan indikator volatilitas untuk mengidentifikasi kondisi pasar

- Menyesuaikan parameter strategi dengan kondisi pasar yang berbeda

- Optimalisasi Stop Loss:

- Desain stop loss dinamis berdasarkan karakteristik morfologi

- Menambahkan mekanisme tracking stop loss

- Filter sinyal:

- Tambahkan mekanisme konfirmasi volume transaksi

- Tambahkan Filter Kekuatan Tren

- Mengoptimalkan efisiensi komputasi:

- Algoritma pengenalan bentuk sederhana

- Optimalkan struktur data

Meringkaskan

Strategi ini membangun sistem perdagangan yang lengkap dengan mengintegrasikan berbagai alat analisis teknis. Keunggulan inti dari strategi ini adalah mekanisme pengesahan sinyal berdimensi, tetapi juga menghadapi risiko keterlambatan sinyal dan overfitting. Dengan menambahkan identifikasi lingkungan pasar dan mekanisme penyesuaian parameter dinamis, strategi ini diharapkan untuk mendapatkan kinerja yang lebih baik.

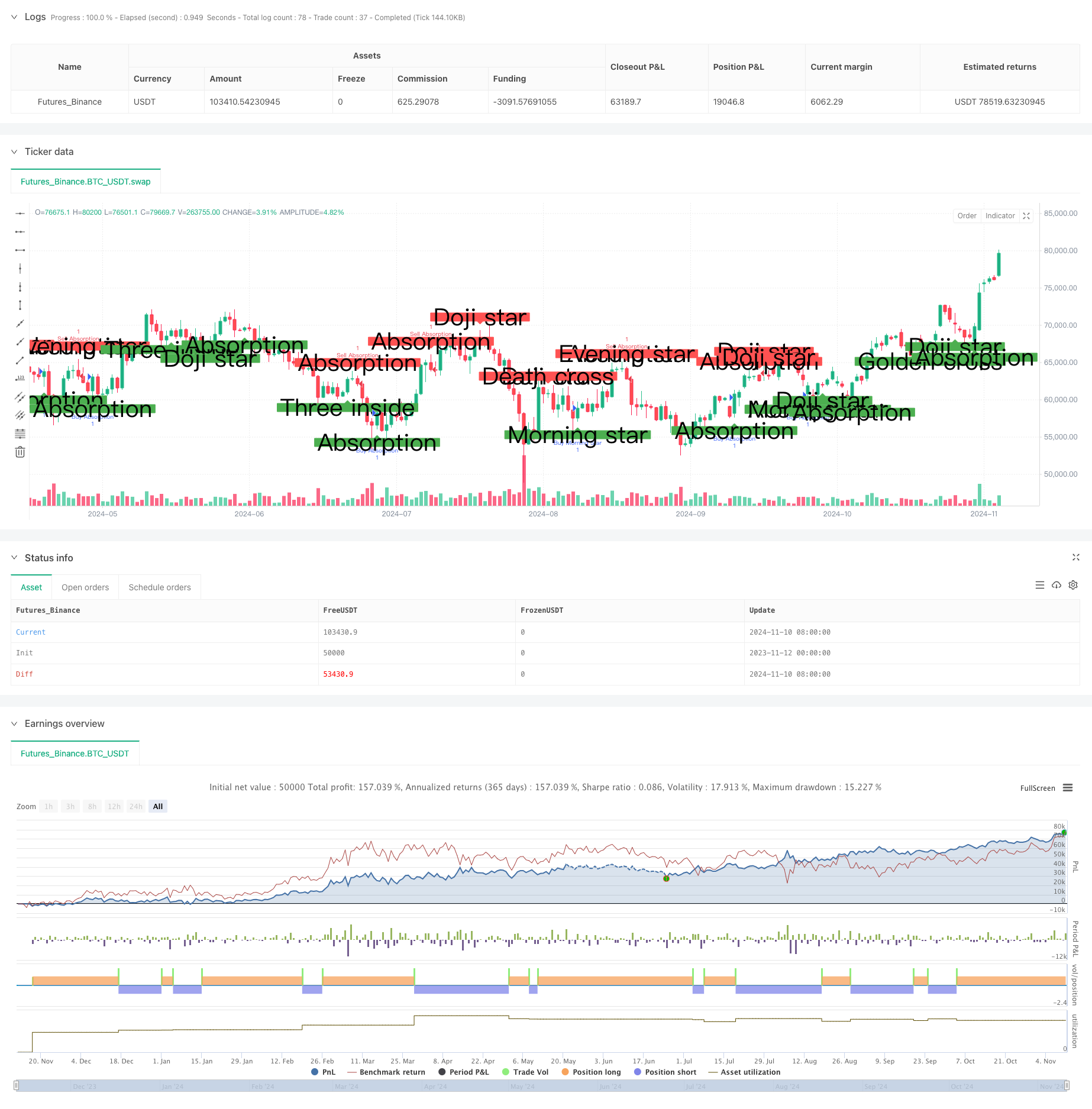

/*backtest

start: 2023-11-12 00:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("hazed candles", shorttitle="hazed candles", overlay=true)

// Inputs

ema_input = input.int(6, title="EMA value to detect trend")

show_doji = input.bool(true, title="Doji star")

show_doji_grave = input.bool(true, title="Doji grave")

show_doji_dragonfly = input.bool(true, title="Doji dragonfly")

show_hammer = input.bool(true, title="Hammer")

show_hanginman = input.bool(true, title="Hanging man")

show_rhammer = input.bool(true, title="Reversed hammer")

show_falling_star = input.bool(true, title="Falling star")

show_absorption = input.bool(true, title="Absorptions")

show_tweezers = input.bool(true, title="Tweezers")

show_triple_inside = input.bool(true, title="Triple inside")

show_three_soldiers = input.bool(true, title="Three soldiers")

show_three_crows = input.bool(true, title="Three crows")

show_morning_evening_stars = input.bool(true, title="Morning / evening stars")

show_golden_death_cross = input.bool(true, title="Golden / Death cross")

// EMA calculation

prev_p_1 = ta.ema(close, ema_input)

// Variables

lowhigh_long_prop = 10

body_prop_size = 9

bar_size_h = high - close

bar_size_l = math.max(open, close) - math.min(close, open)

body_size_h = high - low

low_body_prop = close - low

high_body_prop = high - close

low_half_eq = (low_body_prop > body_size_h / 2.5 and low_body_prop < body_size_h / 1.65)

high_half_eq = (high_body_prop > body_size_h / 2.5 and high_body_prop < body_size_h / 1.65)

open_close_eq = (bar_size_l < body_size_h / body_prop_size)

///////////////// Doji star ///////////////

doji_star_up = show_doji and close <= prev_p_1 and open_close_eq and high_body_prop and low_half_eq

doji_star_down = show_doji and close > prev_p_1 and open_close_eq and high_body_prop and low_half_eq

plotshape(doji_star_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji star")

plotshape(doji_star_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji star")

// Strategy entries for Doji star

if (doji_star_up)

strategy.entry("Buy Doji Star", strategy.long)

if (doji_star_down)

strategy.entry("Sell Doji Star", strategy.short)

///////////////// Doji grave ///////////////

long_high_body = (high_body_prop > bar_size_l * lowhigh_long_prop)

open_low_eq = ((close - low) < body_size_h / body_prop_size)

doji_grave = show_doji_grave and close > prev_p_1 and open_close_eq and open_low_eq and long_high_body

plotshape(doji_grave, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji grave")

// Strategy entries for Doji grave

if (doji_grave)

strategy.entry("Sell Doji Grave", strategy.short)

///////////////// Doji dragonfly ///////////////

long_low_body = (low_body_prop > bar_size_l * lowhigh_long_prop)

open_high_eq = ((high - close) < body_size_h / body_prop_size)

doji_dragonfly = show_doji_dragonfly and close <= prev_p_1 and open_close_eq and open_high_eq and long_low_body

plotshape(doji_dragonfly, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji dragonfly")

// Strategy entries for Doji dragonfly

if (doji_dragonfly)

strategy.entry("Buy Doji Dragonfly", strategy.long)

///////////////// Hammer ///////////////

bottom_low = close - bar_size_h * 15

bottom_high = close - bar_size_h * 1.5

top_low = open + bar_size_l * 1.5

top_high = open + bar_size_l * 15

h_down = show_hammer and prev_p_1 > close and open == high and low > bottom_low and low < bottom_high

plotshape(h_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Hammer")

// Strategy entries for Hammer

if (h_down)

strategy.entry("Buy Hammer", strategy.long)

///////////////// Hanging man ///////////////

hm_down = show_hanginman and prev_p_1 < close and open == high and low > bottom_low and low < bottom_high

plotshape(hm_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Hanging man")

// Strategy entries for Hanging man

if (hm_down)

strategy.entry("Sell Hanging Man", strategy.short)

///////////////// Reversed hammer ///////////////

rh_down = show_rhammer and prev_p_1 > open and low == close and high > top_low and high < top_high

plotshape(rh_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Reversed hammer")

// Strategy entries for Reversed hammer

if (rh_down)

strategy.entry("Buy Reversed Hammer", strategy.long)

///////////////// Fallling star ///////////////

fs_down = show_falling_star and prev_p_1 < close and low == close and high > top_low and high < top_high

plotshape(fs_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Falling star")

// Strategy entries for Falling star

if (fs_down)

strategy.entry("Sell Falling Star", strategy.short)

///////////////// Absorption ///////////////

open_1 = open[1]

close_1 = close[1]

high_1 = high[1]

low_1 = low[1]

open_2 = open[2]

close_2 = close[2]

high_2 = high[2]

low_2 = low[2]

open_3 = open[3]

close_3 = close[3]

high_3 = high[3]

low_3 = low[3]

bar_1 = math.max(open_1, close_1) - math.min(open_1, close_1)

bar_2 = math.max(open_2, close_2) - math.min(open_2, close_2)

bar_3 = math.max(open_3, close_3) - math.min(open_3, close_3)

bar_h = math.max(open, close) - math.min(open, close)

bar_size_min = bar_1 * 1.2

bar_size_f = (bar_h > bar_size_min)

absorption_up = show_absorption and bar_size_f and open_1 > close_1 and open_1 != open and open_3 > open_2 and open_2 > open_1 and open_1 > open and close > open

absorption_down = show_absorption and bar_size_f and open_1 < close_1 and open_1 != open and open_3 < open_2 and open_2 < open_1 and open_1 < open and close < open

plotshape(absorption_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Absorption")

plotshape(absorption_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Absorption")

// Strategy entries for Absorption

if (absorption_up)

strategy.entry("Buy Absorption", strategy.long)

if (absorption_down)

strategy.entry("Sell Absorption", strategy.short)

///////////////// Tweezer ///////////////

match_lows = (low_1 == low or (low_2 == low and open_2 == open_1))

sprici_up = show_tweezers and prev_p_1 > open and match_lows and open_3 > open_2 and open_2 > open_1 and open_1 > open and low != open and close_1 != low_1

plotshape(sprici_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Tweezer")

match_highs = (high_1 == high or (high_2 == high and open_2 == open_1))

sprici_down = show_tweezers and prev_p_1 <= open and match_highs and open_3 < open_2 and open_2 < open_1 and open_1 < open and high != open and close_1 != high_1

plotshape(sprici_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Tweezer")

// Strategy entries for Tweezer

if (sprici_up)

strategy.entry("Buy Tweezer", strategy.long)

if (sprici_down)

strategy.entry("Sell Tweezer", strategy.short)

///////////////// Triple inside up/down ///////////////

open_close_min = math.min(close, open)

open_close_max = math.max(close, open)

bar = open_close_max - open_close_min

open_close_min_1 = math.min(close[1], open[1])

open_close_max_1 = math.max(close[1], open[1])

open_close_min_2 = math.min(close[2], open[2])

open_close_max_2 = math.max(close[2], open[2])

body_top_1 = math.max(close[1], open[1])

body_low_1 = math.min(close[1], open[1])

triple_inside_up = show_triple_inside and open_close_min_2 == open_close_min_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close > open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three inside")

triple_inside_down = show_triple_inside and open_close_max_2 == open_close_max_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close < open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three inside")

// Strategy entries for Triple inside

if (triple_inside_up)

strategy.entry("Buy Triple Inside", strategy.long)

if (triple_inside_down)

strategy.entry("Sell Triple Inside", strategy.short)

///////////////// Triple soldiers / crows ///////////////

triple_solders = show_three_soldiers and prev_p_1 > open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close > close_1 and close_1 > close_2 and open_2 < close_2 and open_1 < close_1

plotshape(triple_solders, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three soldiers")

triple_crows = show_three_crows and prev_p_1 < open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close < close_1 and close_1 < close_2 and open_2 > close_2 and open_1 > close_1

plotshape(triple_crows, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three crows")

// Strategy entries for Three soldiers and Three crows

if (triple_solders)

strategy.entry("Buy Three Soldiers", strategy.long)

if (triple_crows)

strategy.entry("Sell Three Crows", strategy.short)

///////////////// Golden death cross ///////////////

ma_50 = ta.sma(close, 50)

ma_200 = ta.sma(close, 200)

ma_50_200_cross = ta.crossover(ma_50, ma_200) or ta.crossunder(ma_50, ma_200)

golden_cross_up = show_golden_death_cross and ma_50_200_cross and ma_50 > ma_200

plotshape(golden_cross_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Golden cross")

death_cross_down = show_golden_death_cross and ma_50_200_cross and ma_50 < ma_200

plotshape(death_cross_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Death cross")

// Strategy entries for Golden cross and Death cross

if (golden_cross_up)

strategy.entry("Buy Golden Cross", strategy.long)

if (death_cross_down)

strategy.entry("Sell Death Cross", strategy.short)

///////////////// Morning evening stars ///////////////

morning_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_min_2 > open_close_min_1 and open_close_min > open_close_min_1 and prev_p_1 > close_2 and prev_p_1 > close_1 and close > close_1 and close_3 > close_2 and close_2 > close_1 and close > body_top_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(morning_star, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Morning star")

evening_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_max_2 < open_close_max_1 and open_close_max < open_close_max_1 and prev_p_1 < close_2 and prev_p_1 < close_1 and close < close_1 and close_3 < close_2 and close_2 < close_1 and close < body_low_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(evening_star, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Evening star")

// Strategy entries for Morning star and Evening star

if (morning_star)

strategy.entry("Buy Morning Star", strategy.long)

if (evening_star)

strategy.entry("Sell Evening Star", strategy.short)