Ringkasan

Strategi ini adalah sistem perdagangan lengkap yang menggabungkan serangkaian indikator teknis, yang membuat keputusan perdagangan berdasarkan indikator first-look. Sistem ini menentukan waktu masuk melalui antene dan garis dasar untuk menentukan waktu masuk, sambil menggabungkan indeks yang relatif kuat dan rata-rata bergerak sebagai kondisi penyaringan tambahan. Strategi ini menggunakan komponen awan sebagai stop loss dinamis, membentuk sistem kontrol risiko yang lengkap.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada elemen-elemen kunci berikut:

- Sinyal masuk dihasilkan dari persilangan antena dengan baseline, yang membentuk sinyal multi-sinyal di atas, dan sinyal vakum di bawah

- Hubungan posisi harga terhadap awan ((Kumo) sebagai konfirmasi tren, harga di atas awan lebih banyak, harga di bawah awan lebih sedikit

- Hubungan posisi antara rata-rata bergerak 50 hari dan 200 hari sebagai kondisi penyaringan tren

- Indikator RSI Lingkar sebagai konfirmasi kuat dan lemah pasar, memfilter sinyal palsu

- Menggunakan batas atas dan bawah awan sebagai posisi stop loss dinamis untuk manajemen risiko dinamis

Keunggulan Strategis

- Kombinasi dari beberapa indikator teknis memberikan sinyal perdagangan yang lebih andal dan secara signifikan mengurangi dampak dari sinyal palsu

- Menggunakan grafik awan sebagai stop loss dinamis, dapat secara otomatis menyesuaikan posisi stop loss sesuai dengan fluktuasi pasar, baik melindungi keuntungan dan memberikan harga ruang yang cukup untuk berfluktuasi

- Filter RSI perorangan untuk menghindari perdagangan yang tidak menguntungkan di zona overbought dan oversold

- Moving average crossover memberikan konfirmasi tren tambahan dan meningkatkan tingkat keberhasilan perdagangan

- Sistem pengendalian risiko yang komprehensif, termasuk setiap bagian dari masuk, memegang, dan keluar

Risiko Strategis

- Filtrasi multi-indikator dapat menyebabkan terlewatkan beberapa peluang potensial

- Sinyal breakout palsu yang sering terjadi dapat terjadi di pasar yang bergejolak

- Indikator Cloud Graph sendiri memiliki keterlambatan, yang dapat mempengaruhi waktu masuk

- Stop loss yang dinamis mungkin terlalu longgar di pasar yang cepat berfluktuasi

- Terlalu banyak kondisi penyaringan dapat mengurangi peluang perdagangan dan mempengaruhi keuntungan keseluruhan dari strategi

Arah optimasi strategi

- Memperkenalkan indikator volatilitas, menyesuaikan parameter strategi berdasarkan fluktuasi pasar

- Optimalkan pengaturan parameter diagram awan agar lebih sesuai dengan lingkungan pasar yang berbeda

- Meningkatkan analisis volume transaksi dan meningkatkan keandalan sinyal

- Memperkenalkan mekanisme penyaringan waktu untuk menghindari periode waktu yang bergejolak

- Mengembangkan sistem optimasi parameter yang dapat beradaptasi, dan mengimplementasikan penyesuaian strategi secara dinamis

Meringkaskan

Strategi ini membangun sistem perdagangan yang lengkap dengan menggabungkan beberapa indikator teknis. Strategi ini tidak hanya berfokus pada produksi sinyal, tetapi juga mencakup mekanisme kontrol risiko yang sempurna. Dengan pengaturan beberapa kondisi penyaringan, tingkat keberhasilan perdagangan secara efektif ditingkatkan.

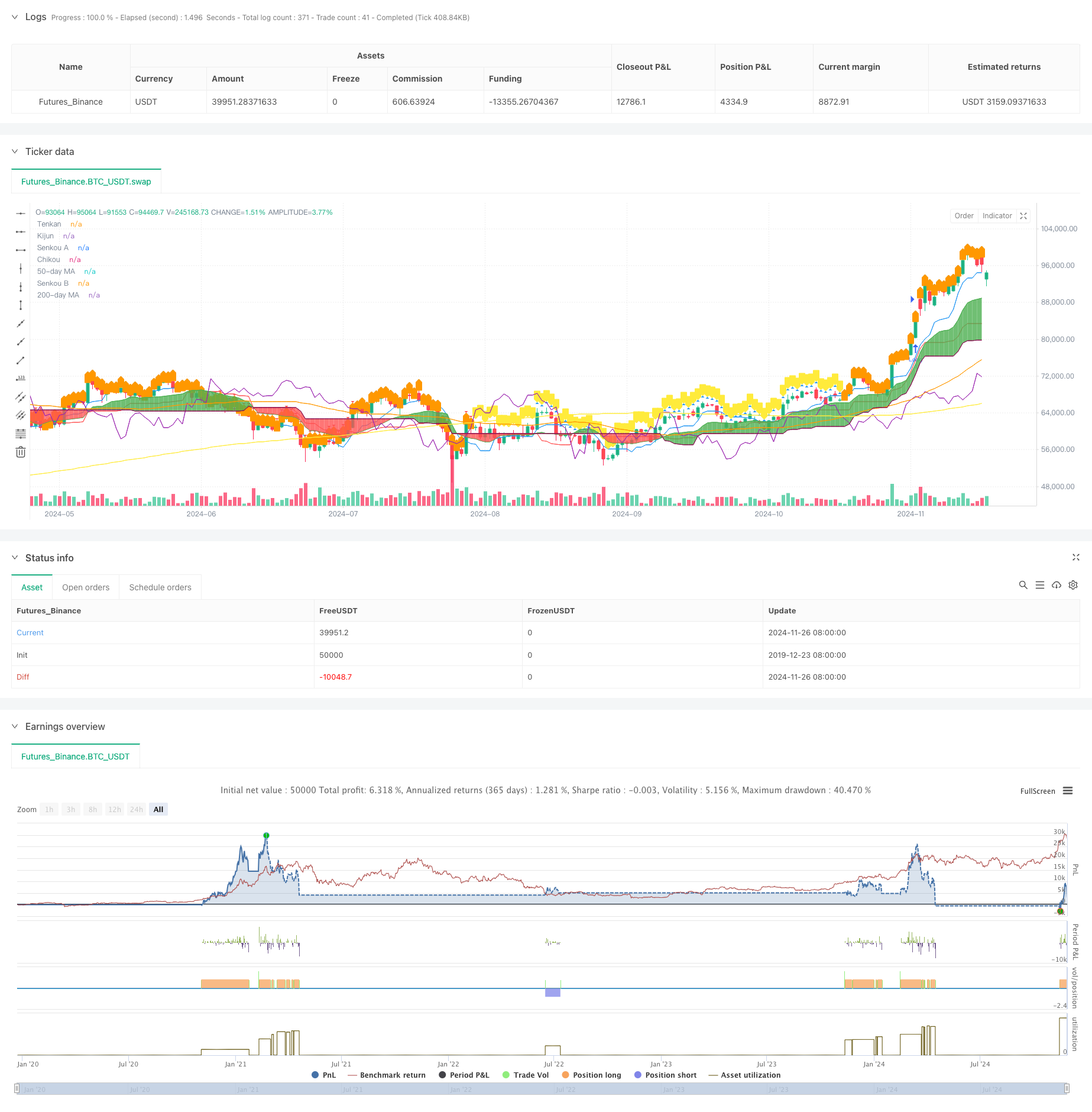

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Strategy with Optional RSI, MA Filters and Alerts", overlay=true)

// Input for date and time filter

startDate = input(timestamp("2020-01-01 00:00"), title="Start Date")

endDate = input(timestamp("2023-01-01 00:00"), title="End Date")

// Inputs for Ichimoku settings

tenkanPeriod = input.int(9, title="Tenkan Period")

kijunPeriod = input.int(26, title="Kijun Period")

senkouBPeriod = input.int(52, title="Senkou B Period")

// Inputs for Moving Average settings

useMAFilter = input.bool(true, title="Enable Moving Average Filter?")

ma50Period = input.int(50, title="50-day MA Period")

ma200Period = input.int(200, title="200-day MA Period")

// Inputs for RSI settings

useRSIFilter = input.bool(true, title="Enable RSI Filter?")

rsiPeriod = input.int(14, title="RSI Period")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

// Ichimoku Cloud components

tenkan = (ta.highest(high, tenkanPeriod) + ta.lowest(low, tenkanPeriod)) / 2

kijun = (ta.highest(high, kijunPeriod) + ta.lowest(low, kijunPeriod)) / 2

senkouA = ta.sma(tenkan + kijun, 2) / 2

senkouB = (ta.highest(high, senkouBPeriod) + ta.lowest(low, senkouBPeriod)) / 2

chikou = close[26]

// Moving Averages

ma50 = ta.sma(close, ma50Period)

ma200 = ta.sma(close, ma200Period)

// Weekly RSI

rsiSource = request.security(syminfo.tickerid, "W", ta.rsi(close, rsiPeriod))

// Plotting the Ichimoku Cloud components

pTenkan = plot(tenkan, color=color.blue, title="Tenkan")

pKijun = plot(kijun, color=color.red, title="Kijun")

pSenkouA = plot(senkouA, color=color.green, title="Senkou A")

pSenkouB = plot(senkouB, color=color.maroon, title="Senkou B")

plot(chikou, color=color.purple, title="Chikou")

plot(ma50, color=color.orange, title="50-day MA")

plot(ma200, color=color.yellow, title="200-day MA")

// Corrected fill function

fill(pSenkouA, pSenkouB, color=senkouA > senkouB ? color.green : color.red, transp=90)

// Debugging: Output values on the chart to see if conditions are ever met

plotshape(series=(tenkan > kijun), color=color.blue, style=shape.triangleup, title="Tenkan > Kijun")

plotshape(series=(tenkan < kijun), color=color.red, style=shape.triangledown, title="Tenkan < Kijun")

plotshape(series=(ma50 > ma200), color=color.orange, style=shape.labelup, title="MA 50 > MA 200")

plotshape(series=(ma50 < ma200), color=color.yellow, style=shape.labeldown, title="MA 50 < MA 200")

// Define the trailing stop loss using Kumo

var float trailingStopLoss = na

// Check for MA conditions (apply only if enabled)

maConditionLong = not useMAFilter or (useMAFilter and ma50 > ma200)

maConditionShort = not useMAFilter or (useMAFilter and ma50 < ma200)

// Check for Ichimoku Cloud conditions

ichimokuLongCondition = close > math.max(senkouA, senkouB)

ichimokuShortCondition = close < math.min(senkouA, senkouB)

// Check for RSI conditions (apply only if enabled)

rsiConditionLong = not useRSIFilter or (useRSIFilter and rsiSource > rsiOverbought)

rsiConditionShort = not useRSIFilter or (useRSIFilter and rsiSource < rsiOversold)

// Combine conditions for entry

longCondition = maConditionLong and tenkan > kijun and ichimokuLongCondition and rsiConditionLong

shortCondition = maConditionShort and tenkan < kijun and ichimokuShortCondition and rsiConditionShort

// Date and time filter

withinDateRange = true

// Check for Long Condition

if (longCondition and withinDateRange)

strategy.entry("Long", strategy.long)

trailingStopLoss := math.min(senkouA, senkouB)

alert("Buy Signal: Entering Long Position", alert.freq_once_per_bar_close)

// Check for Short Condition

if (shortCondition and withinDateRange)

strategy.entry("Short", strategy.short)

trailingStopLoss := math.max(senkouA, senkouB)

alert("Sell Signal: Entering Short Position", alert.freq_once_per_bar_close)

// Exit conditions

exitLongCondition = close < kijun or tenkan < kijun

exitShortCondition = close > kijun or tenkan > kijun

if (exitLongCondition and strategy.position_size > 0)

strategy.close("Long")

alert("Exit Signal: Closing Long Position", alert.freq_once_per_bar_close)

if (exitShortCondition and strategy.position_size < 0)

strategy.close("Short")

alert("Exit Signal: Closing Short Position", alert.freq_once_per_bar_close)

// Apply trailing stop loss

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Long", stop=trailingStopLoss)

else if (strategy.position_size < 0)

strategy.exit("Trailing Stop Short", stop=trailingStopLoss)