Ringkasan

Strategi ini adalah sistem perdagangan canggih yang menggabungkan stop loss, risk reward ratio, dan RSI extreme exit tracking yang dinamis. Strategi ini melakukan perdagangan dengan mengidentifikasi bentuk tertentu di pasar (paralel K-line dan K-line acute) sambil menggunakan ATR dan titik terendah terbaru untuk mengatur stop loss dinamis dan menentukan target profit berdasarkan predeterminasi risk return ratio. Sistem ini juga mengintegrasikan mekanisme penilaian overheat / overcooling pasar berdasarkan indikator RSI, yang dapat diposisikan secara tepat waktu ketika pasar mencapai titik ekstrim.

Prinsip Strategi

Logika inti dari strategi ini mencakup bagian-bagian utama berikut:

- Sinyal masuk didasarkan pada dua bentuk: bentuk paralel K-line (yang besar diikuti oleh yang kecil) dan bentuk K-line ganda.

- Tracking Stop Dinamis menggunakan ATR perkalian untuk menyesuaikan harga terendah dari garis N-root K terbaru, untuk memastikan stop loss dapat secara dinamis beradaptasi dengan pergerakan pasar.

- Target keuntungan didasarkan pada pengaturan rasio risiko-pengembalian yang tetap, yang ditentukan dengan menghitung nilai risiko ® untuk setiap transaksi.

- Ukuran posisi dihitung berdasarkan jumlah risiko tetap dan nilai risiko setiap transaksi secara dinamis.

- RSI Extreme Exit Mechanism (RSI Exit Mechanism) adalah mekanisme yang memicu sinyal imbang ketika pasar terlalu panas atau terlalu dingin.

Keunggulan Strategis

- Manajemen risiko dinamis: Dengan kombinasi ATR dan titik rendah terbaru, stop loss dapat disesuaikan dengan dinamika pasar yang bergejolak.

- Kontrol posisi yang tepat: Metode perhitungan posisi yang didasarkan pada jumlah risiko tetap memastikan bahwa risiko untuk setiap transaksi adalah sama.

- Multi-dimensional exit mechanism: kombinasi dari tracking stop loss, target profit tetap, dan RSI extreme triple exit mechanism.

- Fleksibel dalam memilih arah perdagangan: Anda dapat memilih untuk melakukan perdagangan hanya dengan mata uang plus, hanya dengan mata uang minus, atau perdagangan dua arah.

- Pengaturan risiko-pengembalian yang jelas: Mengharapkan keuntungan yang jelas dari setiap perdagangan dengan menetapkan risiko-pengembalian yang lebih tinggi daripada yang Anda harapkan.

Risiko Strategis

- Risiko keakuratan pengenalan bentuk: Identifikasi garis K paralel dan garis K acuan mungkin ada kesalahan pengertian.

- Risiko slippage dari pengaturan stop loss: kemungkinan slippage yang lebih besar di pasar yang bergejolak.

- RSI Extreme Exit May Be Premature: RSI Extreme Exit May Be Premature: RSI Extreme Exit May Be Premature: RSI Exit May Be Premature: RSI Extreme Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI Exit May Be Premature: RSI May Be Premature: RSI May Be Pr

- Keterbatasan RR yang tetap: RR yang optimal dalam berbagai kondisi pasar mungkin berbeda.

- Risiko over-optimisasi parameter: Kombinasi beberapa parameter dapat menyebabkan over-optimisasi.

Arah optimasi strategi

- Optimasi sinyal masuk: Anda dapat menambahkan lebih banyak indikator konfirmasi bentuk, seperti volume transaksi, indikator tren, dll.

- Rasio risiko-pengembalian dinamis: Rasio risiko-pengembalian disesuaikan dengan dinamika volatilitas pasar.

- Parameter cerdas beradaptasi sendiri: algoritma pembelajaran mesin diperkenalkan untuk mengoptimalkan parameter secara dinamis.

- Pengesahan multi-siklus waktu: mekanisme pengesahan sinyal yang menambahkan lebih banyak periode waktu.

- Klasifikasi lingkungan pasar: Menggunakan kombinasi parameter yang berbeda sesuai dengan lingkungan pasar yang berbeda.

Meringkaskan

Ini adalah strategi perdagangan yang dirancang dengan baik, dengan menggabungkan beberapa konsep analisis teknis yang matang, untuk membangun sistem perdagangan yang lengkap. Keunggulan strategi adalah sistem manajemen risiko yang komprehensif dan aturan perdagangan yang fleksibel, tetapi juga perlu memperhatikan optimasi parameter dan masalah adaptasi pasar.

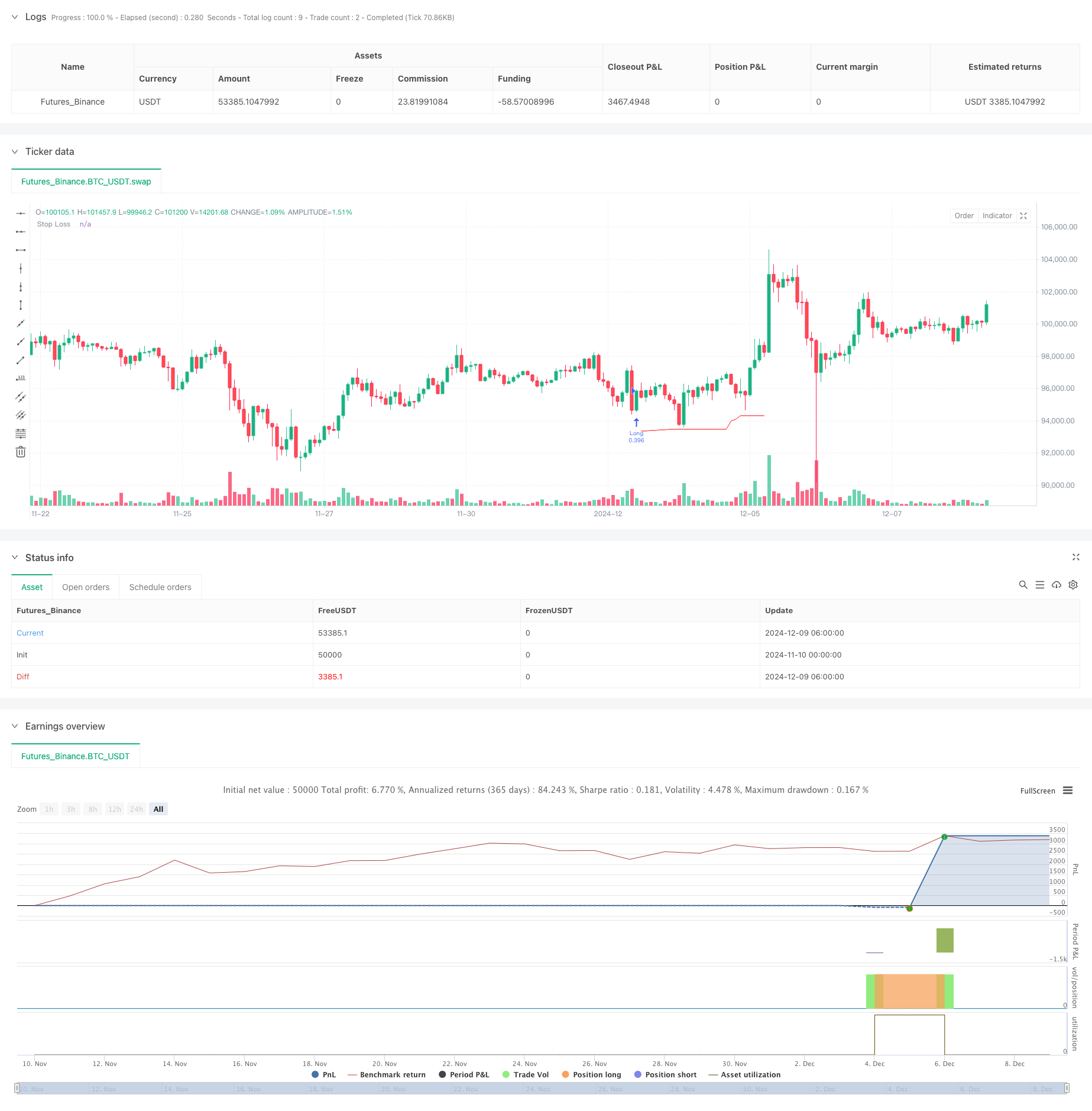

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading | www.TheArtOfTrading.com

// @version=5

strategy("Trailing stop 1", overlay=true)

// Get user input

int BAR_LOOKBACK = input.int(10, "Bar Lookback")

int ATR_LENGTH = input.int(14, "ATR Length")

float ATR_MULTIPLIER = input.float(1.0, "ATR Multiplier")

rr = input.float(title="Risk:Reward", defval=3)

// Basic definition

var float shares=na

risk = 1000

var float R=na

E = strategy.position_avg_price

// Input option to choose long, short, or both

side = input.string("Long", title="Side", options=["Long", "Short", "Both"])

// RSI exit option

RSIexit = input.string("Yes", title="Exit at RSI extreme?", options=["Yes", "No"])

RSIup = input(75)

RSIdown = input(25)

// Get indicator values

float atrValue = ta.atr(ATR_LENGTH)

// Calculate stop loss values

var float trailingStopLoss = na

float longStop = ta.lowest(low, BAR_LOOKBACK) - (atrValue * ATR_MULTIPLIER)

float shortStop = ta.highest(high, BAR_LOOKBACK) + (atrValue * ATR_MULTIPLIER)

// Check if we can take trades

bool canTakeTrades = not na(atrValue)

bgcolor(canTakeTrades ? na : color.red)

//Long pattern

//Two pin bar

onepinbar = (math.min(close,open)-low)/(high-low)>0.6 and math.min(close,open)-low>ta.sma(high-low,14)

twopinbar = onepinbar and onepinbar[1]

notatbottom = low>ta.lowest(low[1],10)

// Parallel

bigred = (open-close)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

biggreen = (close-open)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

parallel = bigred[1] and biggreen

atbottom = low==ta.lowest(low,10)

// Enter long trades (replace this entry condition)

longCondition = parallel

if (longCondition and canTakeTrades and strategy.position_size == 0 and (side == "Long" or side == "Both"))

R:= close-longStop

shares:= risk/R

strategy.entry("Long", strategy.long,qty=shares)

// Enter short trades (replace this entry condition)

shortCondition = parallel

if (shortCondition and canTakeTrades and strategy.position_size == 0 and (side == "Short" or side == "Both"))

R:= shortStop - close

shares:= risk/R

strategy.entry("Short", strategy.short,qty=shares)

// Update trailing stop

if (strategy.position_size > 0)

if (na(trailingStopLoss) or longStop > trailingStopLoss)

trailingStopLoss := longStop

else if (strategy.position_size < 0)

if (na(trailingStopLoss) or shortStop < trailingStopLoss)

trailingStopLoss := shortStop

else

trailingStopLoss := na

// Exit trades with trailing stop

strategy.exit("Long Exit", "Long", stop=trailingStopLoss, limit = E + rr*R )

strategy.exit("Short Exit", "Short", stop=trailingStopLoss, limit = E - rr*R)

//Close trades at RSI extreme

if ta.rsi(high,14)>RSIup and RSIexit == "Yes"

strategy.close("Long")

if ta.rsi(low,14)<RSIdown and RSIexit == "Yes"

strategy.close("Short")

// Draw stop loss

plot(trailingStopLoss, "Stop Loss", color.red, 1, plot.style_linebr)