Ringkasan

Strategi ini adalah strategi pelacakan tren berdasarkan indeks moving averages (EMA) dan indikator momentum. Strategi ini melakukan perdagangan ketika tren pasar jelas dengan menggabungkan sinyal pergerakan dan filter tren EMA. Strategi ini mencakup modul manajemen risiko yang lengkap, filter waktu perdagangan yang fleksibel, dan fitur analisis statistik terperinci untuk meningkatkan stabilitas dan keandalan strategi.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada elemen-elemen kunci berikut:

- Identifikasi sinyal momentum: Dengan menghitung nilai momentum dalam periode waktu yang disesuaikan oleh pengguna, sinyal multitasking dihasilkan saat momentum melewati batas atas dan sinyal kosong dihasilkan saat batas bawah.

- Filter tren EMA: menggunakan 200 siklus EMA sebagai dasar penilaian tren, harga di atas EMA diizinkan untuk melakukan lebih banyak, harga di bawah EMA diizinkan untuk melakukan lebih sedikit.

- Filter waktu: Anda dapat mengatur waktu perdagangan tertentu dan mendukung penyesuaian zona waktu GMT, sehingga strategi lebih sesuai dengan waktu perdagangan di pasar yang berbeda.

- Pengendalian risiko: mendukung pengaturan stop loss dan stop loss berdasarkan ATR atau persentase tetap, dan membatasi jumlah maksimum transaksi per hari.

Keunggulan Strategis

- Trending Tracking: Menggunakan EMA dan Dynamic Dual Confirmation untuk menangkap tren utama.

- Pengelolaan risiko yang baik: menawarkan berbagai jenis stop loss, baik dengan stop loss dinamis ATR atau stop loss persentase tetap.

- Analisis statistik menyeluruh: pelacakan real-time dari beberapa indikator kinerja, termasuk tingkat kemenangan dalam penerbangan, rasio risiko-keuntungan, dll.

- Fleksibilitas parameter: parameter utama dapat disesuaikan secara optimal sesuai dengan karakteristik pasar yang berbeda.

Risiko Strategis

Risiko pasar yang bergoyang: Pasar yang bergoyang di lateral dapat menghasilkan sinyal penembusan palsu yang sering. Solusi yang disarankan: Tambahkan filter indikator getaran atau tingkatkan ambang batas.

Risiko tergelincir: kemungkinan tergelincir lebih besar selama periode volatilitas yang tinggi. Solusi yang disarankan: Tetapkan batas stop loss yang wajar dan hindari perdagangan pada saat volatilitas tinggi.

Risiko over-trading: sinyal yang terlalu sering dapat menyebabkan over-trading. Solusi yang disarankan: Tetapkan batas maksimum transaksi per hari yang masuk akal.

Arah optimasi strategi

- Optimasi parameter dinamis: Anda dapat secara otomatis menyesuaikan penurunan momentum dan siklus EMA sesuai dengan fluktuasi pasar.

- Analisis siklus waktu ganda: Menambahkan periode waktu ganda untuk mengkonfirmasi tren, meningkatkan keandalan sinyal.

- Identifikasi lingkungan pasar: menambahkan modul analisis volatilitas, dengan pengaturan parameter yang berbeda dalam lingkungan pasar yang berbeda.

- Kekuatan sinyal berskala: Kekuatan sinyal terobosan berskala, skala kepemilikan disesuaikan dengan dinamika kekuatan sinyal.

Meringkaskan

Ini adalah strategi pelacakan tren yang dirancang dengan baik untuk menangkap peluang pasar dengan cara menggabungkan momentum breakout dan tren EMA. Sistem manajemen risiko strategi ini utuh, kemampuan analisis statistik yang kuat, dengan kepraktisan yang baik dan kemampuan untuk diperluas. Dengan terus-menerus mengoptimalkan dan menyempurnakan, strategi ini diharapkan dapat mempertahankan kinerja yang stabil di berbagai lingkungan pasar.

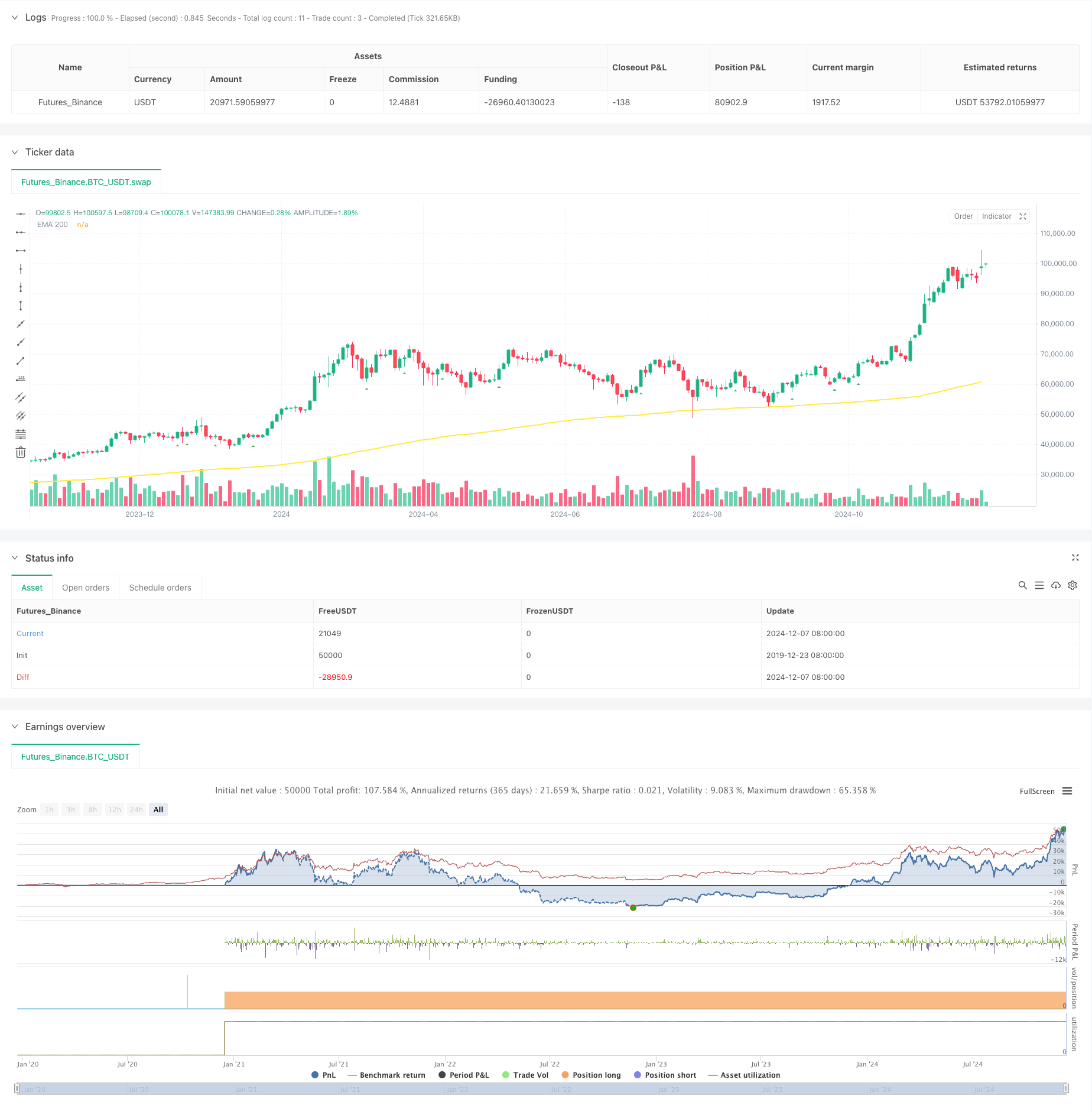

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("[Mustang Algo] EMA Momentum Strategy",

shorttitle="[Mustang Algo] Mom Strategy",

overlay=true,

initial_capital=10000,

default_qty_type=strategy.fixed,

default_qty_value=1,

pyramiding=0,

calc_on_every_tick=false,

max_bars_back=5000)

// Momentum Parameters

len = input.int(10, minval=1, title="Length")

src = input(close, title="Source")

momTimeframe = input.timeframe("", title="Momentum Timeframe")

timeframe_gaps = input.bool(true, title="Autoriser les gaps de timeframe")

momFilterLong = input.float(5, title="Filtre Momentum Long", minval=0)

momFilterShort = input.float(-5, title="Filtre Momentum Short", maxval=0)

// EMA Filter

useEmaFilter = input.bool(true, title="Utiliser Filtre EMA")

emaLength = input.int(200, title="EMA Length", minval=1)

// Position Size

contractSize = input.float(1.0, title="Taille de position", minval=0.01, step=0.01)

// Time filter settings

use_time_filter = input.bool(false, title="Utiliser le Filtre de Temps")

start_hour = input.int(9, title="Heure de Début", minval=0, maxval=23)

start_minute = input.int(30, title="Minute de Début", minval=0, maxval=59)

end_hour = input.int(16, title="Heure de Fin", minval=0, maxval=23)

end_minute = input.int(30, title="Minute de Fin", minval=0, maxval=59)

gmt_offset = input.int(0, title="Décalage GMT", minval=-12, maxval=14)

// Risk Management

useAtrSl = input.bool(false, title="Utiliser ATR pour SL/TP")

atrPeriod = input.int(14, title="Période ATR", minval=1)

atrMultiplier = input.float(1.5, title="Multiplicateur ATR pour SL", minval=0.1, step=0.1)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", minval=0.01, step=0.01)

tpRatio = input.float(2.0, title="Take Profit Ratio", minval=0.1, step=0.1)

// Daily trade limit

maxDailyTrades = input.int(2, title="Limite de trades par jour", minval=1)

// Variables for tracking daily trades

var int dailyTradeCount = 0

// Reset daily trade count

if dayofweek != dayofweek[1]

dailyTradeCount := 0

// Time filter function

is_within_session() =>

current_time = time(timeframe.period, "0000-0000:1234567", gmt_offset)

start_time = timestamp(year, month, dayofmonth, start_hour, start_minute, 0)

end_time = timestamp(year, month, dayofmonth, end_hour, end_minute, 0)

in_session = current_time >= start_time and current_time <= end_time

not use_time_filter or in_session

// EMA Calculation

ema200 = ta.ema(close, emaLength)

// Momentum Calculation

gapFillMode = timeframe_gaps ? barmerge.gaps_on : barmerge.gaps_off

mom = request.security(syminfo.tickerid, momTimeframe, src - src[len], gapFillMode)

// ATR Calculation

atr = ta.atr(atrPeriod)

// Signal Detection with Filters

crossoverUp = ta.crossover(mom, momFilterLong)

crossoverDown = ta.crossunder(mom, momFilterShort)

emaUpTrend = close > ema200

emaDownTrend = close < ema200

// Trading Conditions

longCondition = crossoverUp and (not useEmaFilter or emaUpTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

shortCondition = crossoverDown and (not useEmaFilter or emaDownTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

// Calcul des niveaux de Stop Loss et Take Profit

float stopLoss = useAtrSl ? (atr * atrMultiplier) : (close * stopLossPerc / 100)

float takeProfit = stopLoss * tpRatio

// Modification des variables pour éviter les erreurs de repainting

var float entryPrice = na

var float currentStopLoss = na

var float currentTakeProfit = na

// Exécution des ordres avec gestion des positions

if strategy.position_size == 0

if longCondition

entryPrice := close

currentStopLoss := entryPrice - stopLoss

currentTakeProfit := entryPrice + takeProfit

strategy.entry("Long", strategy.long, qty=contractSize)

strategy.exit("Exit Long", "Long", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

if shortCondition

entryPrice := close

currentStopLoss := entryPrice + stopLoss

currentTakeProfit := entryPrice - takeProfit

strategy.entry("Short", strategy.short, qty=contractSize)

strategy.exit("Exit Short", "Short", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

// Plot EMA

plot(ema200, color=color.yellow, linewidth=2, title="EMA 200")

// Plot Signals

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// // Performance Statistics

// var int longWins = 0

// var int longLosses = 0

// var int shortWins = 0

// var int shortLosses = 0

// if strategy.closedtrades > 0

// trade = strategy.closedtrades - 1

// isLong = strategy.closedtrades.entry_price(trade) < strategy.closedtrades.exit_price(trade)

// isWin = strategy.closedtrades.profit(trade) > 0

// if isLong and isWin

// longWins += 1

// else if isLong and not isWin

// longLosses += 1

// else if not isLong and isWin

// shortWins += 1

// else if not isLong and not isWin

// shortLosses += 1

// longTrades = longWins + longLosses

// shortTrades = shortWins + shortLosses

// longWinRate = longTrades > 0 ? (longWins / longTrades) * 100 : 0

// shortWinRate = shortTrades > 0 ? (shortWins / shortTrades) * 100 : 0

// overallWinRate = strategy.closedtrades > 0 ? (strategy.wintrades / strategy.closedtrades) * 100 : 0

// avgRR = strategy.grossloss != 0 ? math.abs(strategy.grossprofit / strategy.grossloss) : 0

// // Display Statistics

// var table statsTable = table.new(position.top_right, 4, 7, border_width=1)

// if barstate.islastconfirmedhistory

// table.cell(statsTable, 0, 0, "Type", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 0, "Win", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 0, "Lose", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 0, "Daily Trades", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 1, "Long", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 1, str.tostring(longWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 1, str.tostring(longLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 1, str.tostring(dailyTradeCount) + "/" + str.tostring(maxDailyTrades), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 2, "Short", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 2, str.tostring(shortWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 2, str.tostring(shortLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 3, "Win Rate", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 3, "Long: " + str.tostring(longWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 3, "Short: " + str.tostring(shortWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 4, "Overall", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 4, "Win Rate: " + str.tostring(overallWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 4, "Total: " + str.tostring(strategy.closedtrades) + " | RR: " + str.tostring(avgRR, "#.##"), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 5, "Trading Hours", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 5, "Start: " + str.format("{0,time,HH:mm}", start_hour * 60 * 60 * 1000 + start_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 5, "End: " + str.format("{0,time,HH:mm}", end_hour * 60 * 60 * 1000 + end_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 5, "GMT: " + (gmt_offset >= 0 ? "+" : "") + str.tostring(gmt_offset), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 6, "SL/TP Method", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 6, useAtrSl ? "ATR-based" : "Percentage-based", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 6, useAtrSl ? "ATR: " + str.tostring(atrPeriod) : "SL%: " + str.tostring(stopLossPerc), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 6, "TP Ratio: " + str.tostring(tpRatio), bgcolor=color.new(color.blue, 90))