Ringkasan

Strategi ini adalah strategi perdagangan volatilitas berbasis indikator teknis yang menggabungkan beberapa sinyal seperti persimpangan rata-rata, RSI overbought dan oversold, dan ATR stop loss. Inti dari strategi ini adalah untuk menangkap tren pasar melalui persimpangan EMA jangka pendek dan SMA jangka panjang, sementara menggunakan indikator RSI untuk konfirmasi sinyal, dan mengatur posisi stop loss dan stop loss melalui ATR.

Prinsip Strategi

Strategi ini membangun sistem perdagangan dengan menggunakan kombinasi indikator teknis berlapis:

- Penghakiman tren: menggunakan persilangan 20 siklus EMA dan 50 siklus SMA untuk menilai arah tren, di mana SMA di atas dianggap sebagai sinyal multipel, sedangkan di bawah dianggap sebagai sinyal kosong.

- Layer Konfirmasi Dinamika: Menggunakan indikator RSI untuk menilai overbought dan oversold, RSI di bawah 70 memungkinkan overbought dan di atas 30 memungkinkan overbought.

- Lapisan perhitungan volatilitas: menggunakan 14 siklus ATR untuk menghitung posisi stop loss stop loss, dengan stop loss yang disetel ke 1,5 kali ATR, dan stop loss yang disetel ke 3 kali ATR.

- Manajemen Posisi: Menghitung jumlah posisi yang dibuka secara dinamis berdasarkan modal awal dan rasio risiko per transaksi (default 1%)

Keunggulan Strategis

- Pengesahan sinyal ganda: Mengurangi gangguan sinyal palsu secara efektif dengan crossover rata-rata, RSI dan ATR.

- Stop loss yang dinamis: Berdasarkan ATR yang dinamis, posisi stop loss dapat disesuaikan dengan perubahan volatilitas pasar.

- Fleksibel dalam arah transaksi: Anda dapat mengaktifkan perdagangan multihead atau headless secara terpisah sesuai dengan kondisi pasar.

- Kontrol risiko yang ketat: Mengontrol secara efektif risiko setiap transaksi dengan kontrol persentase risiko dan manajemen posisi dinamis.

- Dukungan visualisasi: Strategi menyediakan dukungan visualisasi grafik lengkap, termasuk penandaan sinyal dan tampilan indikator.

Risiko Strategis

- Risiko pasar bergoyang: Dalam pasar bergoyang horizontal, persilangan rata-rata dapat menghasilkan terlalu banyak sinyal palsu.

- Risiko slippage: Pada periode fluktuasi yang kuat, harga transaksi aktual mungkin memiliki deviasi besar dari harga sinyal.

- Manajemen risiko dana: Jika Anda menetapkan rasio risiko yang terlalu tinggi, Anda dapat menyebabkan kerugian tunggal yang terlalu besar.

- Sensitivitas parameter: Efek kebijakan sangat sensitif terhadap pengaturan parameter, yang memerlukan penyesuaian yang hati-hati.

Arah optimasi strategi

- Menambahkan filter kekuatan tren: Anda dapat menambahkan indikator ADX untuk memfilter sinyal perdagangan di lingkungan tren yang lemah.

- Optimalkan siklus rata-rata: Anda dapat secara dinamis menyesuaikan parameter rata-rata sesuai dengan karakteristik siklus pasar yang berbeda.

- Perbaikan mekanisme stop loss: dapat menambah fitur stop loss tracking dan lebih baik melindungi keuntungan.

- Meningkatkan konfirmasi volume transaksi: Menambahkan indikator volume transaksi sebagai konfirmasi tambahan, meningkatkan keandalan sinyal.

- Klasifikasi lingkungan pasar: menambahkan modul identifikasi lingkungan pasar, menggunakan kombinasi parameter yang berbeda dalam lingkungan pasar yang berbeda.

Meringkaskan

Strategi ini menggunakan kombinasi dari beberapa indikator teknis untuk membangun sistem perdagangan yang relatif lengkap. Keunggulan strategi ini adalah keandalan pengakuan sinyal dan integritas manajemen risiko, tetapi juga perlu memperhatikan dampak lingkungan pasar pada kinerja strategi. Dengan arah optimasi yang disarankan, strategi ini memiliki ruang untuk perbaikan yang lebih besar.

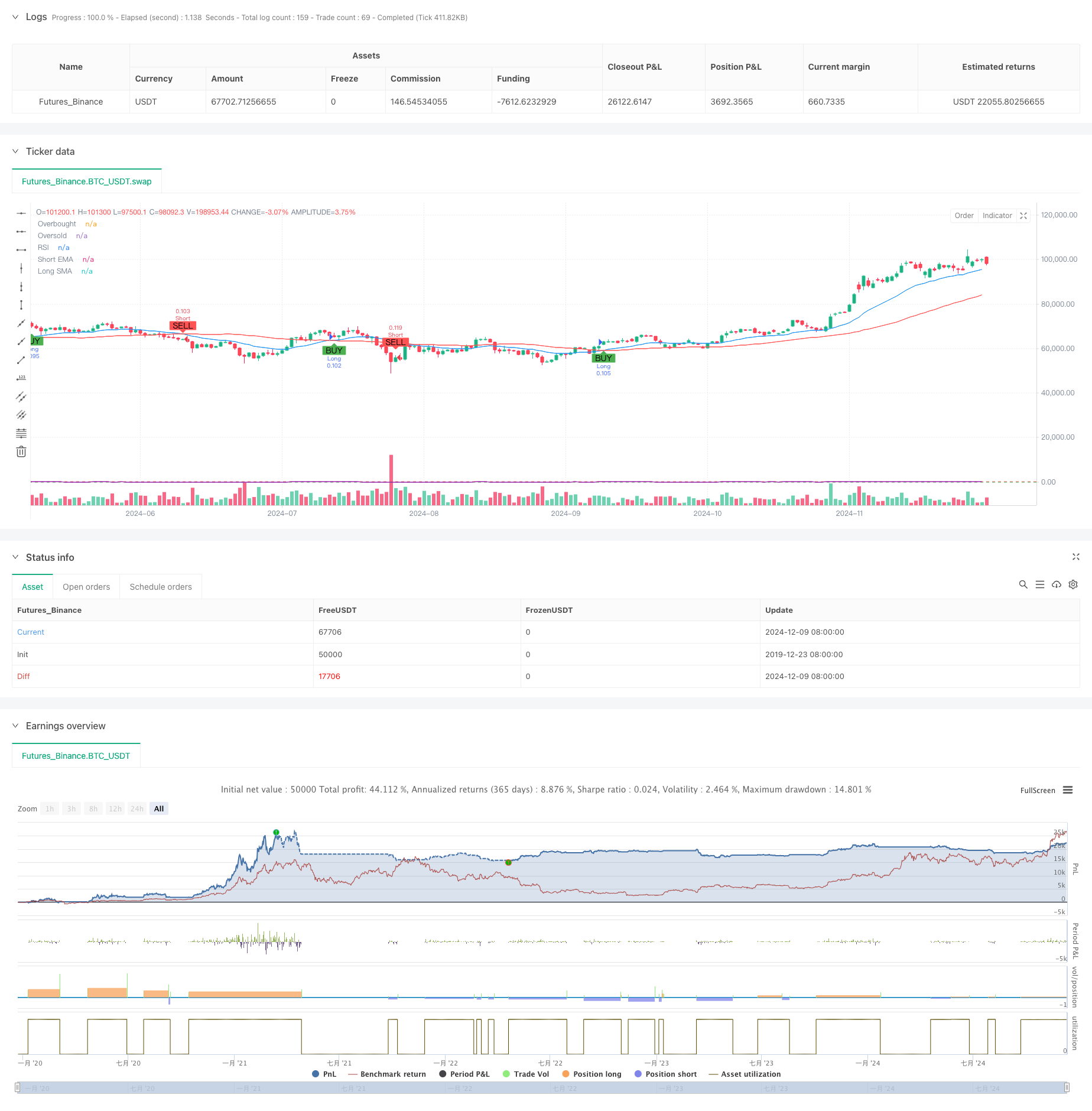

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © CryptoRonin84

//@version=5

strategy("Swing Trading Strategy with On/Off Long and Short", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input for turning Long and Short trades ON/OFF

enable_long = input.bool(true, title="Enable Long Trades")

enable_short = input.bool(true, title="Enable Short Trades")

// Input parameters for strategy

sma_short_length = input.int(20, title="Short EMA Length", minval=1)

sma_long_length = input.int(50, title="Long SMA Length", minval=1)

sl_percentage = input.float(1.5, title="Stop Loss (%)", step=0.1, minval=0.1)

tp_percentage = input.float(3, title="Take Profit (%)", step=0.1, minval=0.1)

risk_per_trade = input.float(1, title="Risk Per Trade (%)", step=0.1, minval=0.1)

capital = input.float(10000, title="Initial Capital", step=100)

// Input for date range for backtesting

start_date = input(timestamp("2020-01-01 00:00"), title="Backtest Start Date")

end_date = input(timestamp("2024-12-31 23:59"), title="Backtest End Date")

inDateRange = true

// Moving averages

sma_short = ta.ema(close, sma_short_length)

sma_long = ta.sma(close, sma_long_length)

// RSI setup

rsi = ta.rsi(close, 14)

rsi_overbought = 70

rsi_oversold = 30

// ATR for volatility-based stop-loss calculation

atr = ta.atr(14)

stop_loss_level_long = strategy.position_avg_price - (1.5 * atr)

stop_loss_level_short = strategy.position_avg_price + (1.5 * atr)

take_profit_level_long = strategy.position_avg_price + (3 * atr)

take_profit_level_short = strategy.position_avg_price - (3 * atr)

// Position sizing based on risk per trade

risk_amount = capital * (risk_per_trade / 100)

position_size = risk_amount / (close * sl_percentage / 100)

// Long and Short conditions

long_condition = ta.crossover(sma_short, sma_long) and rsi < rsi_overbought

short_condition = ta.crossunder(sma_short, sma_long) and rsi > rsi_oversold

// Execute long trades

if (long_condition and inDateRange and enable_long)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Long", stop=stop_loss_level_long, limit=take_profit_level_long)

// Execute short trades

if (short_condition and inDateRange and enable_short)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Short", stop=stop_loss_level_short, limit=take_profit_level_short)

// Plot moving averages

plot(sma_short, title="Short EMA", color=color.blue)

plot(sma_long, title="Long SMA", color=color.red)

// Plot RSI on separate chart

hline(rsi_overbought, "Overbought", color=color.red)

hline(rsi_oversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

// Plot signals on chart

plotshape(series=long_condition and enable_long, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=short_condition and enable_short, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Background color for backtest range

bgcolor(inDateRange ? na : color.red, transp=90)