Ringkasan

Strategi ini adalah sistem perdagangan kuantitatif canggih yang menggabungkan Bollinger Bands, indikator RSI, dan filter tren EMA 200-siklus. Strategi ini menggunakan kombinasi kolaboratif dari beberapa indikator teknis untuk menangkap peluang terobosan dengan probabilitas tinggi di arah tren, sambil secara efektif memfilter sinyal palsu di pasar yang bergolak.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada tiga tingkatan:

- Bollinger Bands Breakout: Menggunakan Bollinger Bands Up and Down Tracks sebagai saluran fluktuasi, harga breakout up tracks dianggap sebagai melakukan sinyal multi, breakout down tracks dianggap sebagai sinyal kosong.

- RSI mengkonfirmasi pergerakan: RSI di atas 50 mengkonfirmasi pergerakan yang lebih banyak, di bawah 50 mengkonfirmasi pergerakan yang lebih rendah, menghindari perdagangan ketika tidak ada tren.

- Filter tren EMA: Gunakan 200 siklus EMA untuk menilai tren utama, hanya membuka posisi di arah tren. Harga di atas EMA lebih banyak, di bawahnya lebih sedikit.

Konfirmasi transaksi memerlukan:

- Dua garis K berturut-turut mempertahankan status terobosan

- Transaksi lebih tinggi dari rata-rata 20 siklus

- Stop loss dinamis berdasarkan ATR

- Target keuntungan berdasarkan 1,5 kali lipat risiko / rasio keuntungan

Keunggulan Strategis

- Filtrasi sinkronisasi multi-indikator teknologi, meningkatkan kualitas sinyal secara signifikan

- Mekanisme manajemen posisi yang dinamis, menyesuaikan diri dengan fluktuasi pasar

- Mekanisme konfirmasi transaksi yang ketat, efektif mengurangi sinyal palsu

- Sistem pengendalian risiko yang lengkap, termasuk stop loss yang dinamis dan rasio keuntungan risiko yang tetap

- Ruang optimasi parameter yang fleksibel, dapat beradaptasi dengan lingkungan pasar yang berbeda

Risiko Strategis

- Optimasi parameter yang berlebihan dapat menyebabkan overfitting

- Pasar yang sangat bergejolak dapat memicu stop loss yang sering terjadi

- Pasar yang bergejolak dapat menyebabkan kerugian terus menerus

- Sinyal terlambat pada titik balik tren

- Indikator teknis mungkin memiliki sinyal yang bertentangan

Saran pengendalian risiko:

- Menegakkan Disiplin Hentikan Kerusakan

- Mengontrol risiko transaksi tunggal

- Periodic retesting validasi parameter

- Tergabung dengan Analisis Fundamental

- Hindari Perdagangan Terlalu Banyak

Arah optimasi strategi

- Memperkenalkan lebih banyak indikator teknis yang saling diverifikasi

- Mengembangkan mekanisme optimasi parameter adaptasi

- Menambahkan indikator sentimen pasar

- Optimalkan mekanisme konfirmasi transaksi

- Mengembangkan Sistem Manajemen Posisi yang Lebih Fleksibel

Ide Optimasi Utama:

- Parameter penyesuaian berdasarkan dinamika siklus pasar yang berbeda

- Menambahkan kondisi penyaringan transaksi

- Pengaturan RRR yang dioptimalkan

- Meningkatkan mekanisme penghentian kerugian

- Mengembangkan Sistem Identifikasi Sinyal yang Lebih Cerdas

Meringkaskan

Strategi ini menggunakan kombinasi organik dari indikator teknis seperti Brinks, RSI, dan EMA untuk membangun sistem perdagangan yang lengkap. Sistem ini menunjukkan nilai aplikasi yang kuat di lapangan melalui kontrol risiko yang ketat dan ruang optimasi parameter yang fleksibel, sambil menjamin kualitas perdagangan.

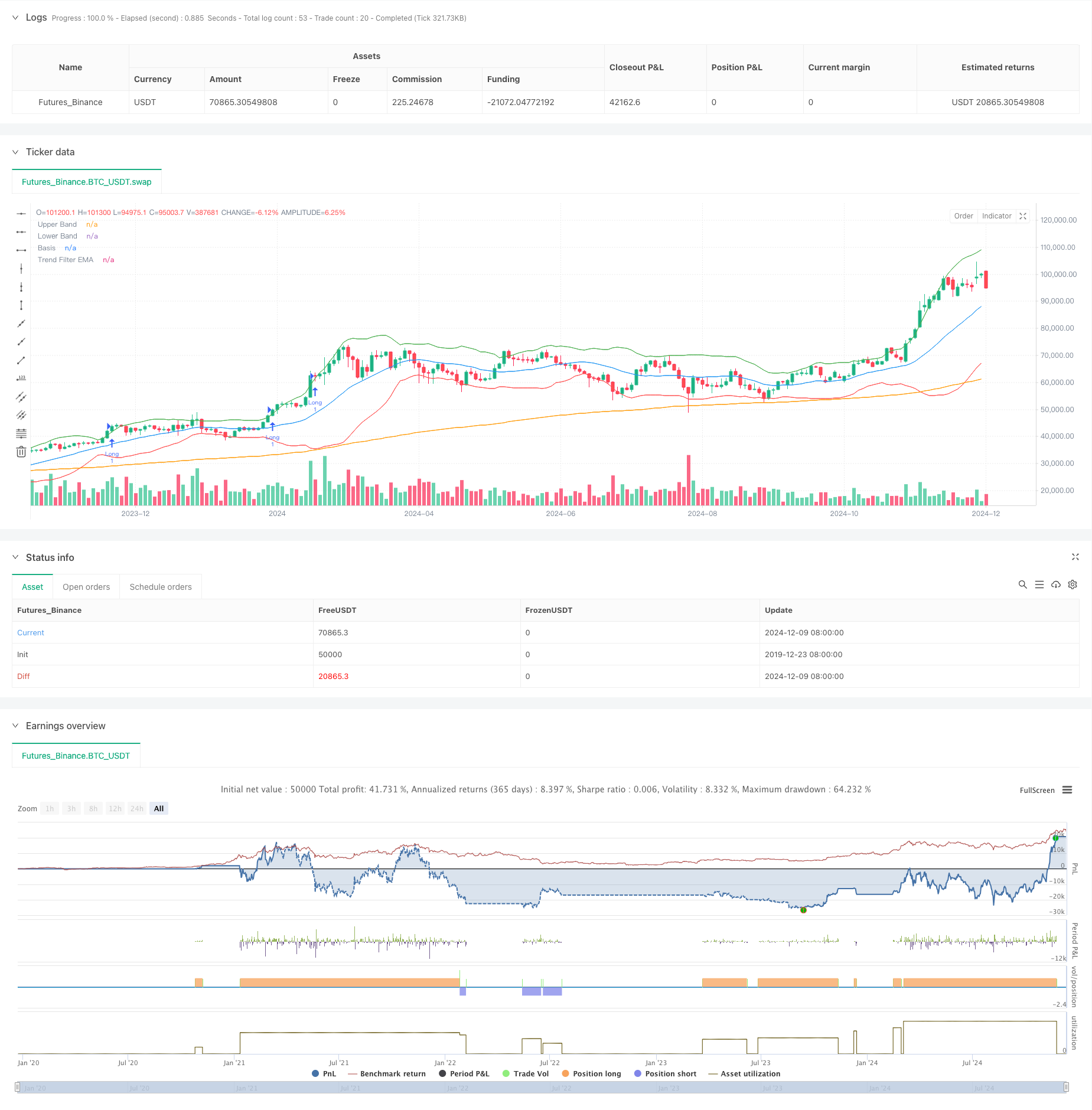

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Bollinger Breakout with Trend Filtering", overlay=true)

// === Inputs ===

length = input(20, title="Bollinger Bands Length", tooltip="The number of candles used to calculate the Bollinger Bands. Higher values smooth the bands, lower values make them more reactive.")

mult = input(2.0, title="Bollinger Bands Multiplier", tooltip="Controls the width of the Bollinger Bands. Higher values widen the bands, capturing more price movement.")

rsi_length = input(14, title="RSI Length", tooltip="The number of candles used to calculate the RSI. Shorter lengths make it more sensitive to recent price movements.")

rsi_midline = input(50, title="RSI Midline", tooltip="Defines the midline for RSI to confirm momentum. Higher values make it stricter for bullish conditions.")

risk_reward_ratio = input(1.5, title="Risk/Reward Ratio", tooltip="Determines the take-profit level relative to the stop-loss.")

atr_multiplier = input(1.5, title="ATR Multiplier for Stop-Loss", tooltip="Defines the distance of the stop-loss based on ATR. Higher values set wider stop-losses.")

volume_filter = input(true, title="Enable Volume Filter", tooltip="If enabled, trades will only execute when volume exceeds the 20-period average.")

trend_filter_length = input(200, title="Trend Filter EMA Length", tooltip="The EMA length used to filter trades based on the market trend.")

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"], tooltip="Choose whether to trade only Long, only Short, or Both directions.")

confirm_candles = input(2, title="Number of Confirming Candles", tooltip="The number of consecutive candles that must meet the conditions before entering a trade.")

// === Indicator Calculations ===

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

rsi_val = ta.rsi(close, rsi_length)

atr_val = ta.atr(14)

vol_filter = volume > ta.sma(volume, 20)

ema_trend = ta.ema(close, trend_filter_length)

// === Helper Function for Confirmation ===

confirm_condition(cond, lookback) =>

count = 0

for i = 0 to lookback - 1

count += cond[i] ? 1 : 0

count == lookback

// === Trend Filter ===

trend_is_bullish = close > ema_trend

trend_is_bearish = close < ema_trend

// === Long and Short Conditions with Confirmation ===

long_raw_condition = close > upper_band * 1.01 and rsi_val > rsi_midline and (not volume_filter or vol_filter) and trend_is_bullish

short_raw_condition = close < lower_band * 0.99 and rsi_val < rsi_midline and (not volume_filter or vol_filter) and trend_is_bearish

long_condition = confirm_condition(long_raw_condition, confirm_candles)

short_condition = confirm_condition(short_raw_condition, confirm_candles)

// === Trade Entry and Exit Logic ===

if long_condition and (trade_direction == "Long" or trade_direction == "Both")

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - (atr_multiplier * atr_val), limit=close + (atr_multiplier * risk_reward_ratio * atr_val))

if short_condition and (trade_direction == "Short" or trade_direction == "Both")

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + (atr_multiplier * atr_val), limit=close - (atr_multiplier * risk_reward_ratio * atr_val))

// === Plotting ===

plot(upper_band, color=color.green, title="Upper Band")

plot(lower_band, color=color.red, title="Lower Band")

plot(basis, color=color.blue, title="Basis")

plot(ema_trend, color=color.orange, title="Trend Filter EMA")