Ringkasan

Ini adalah strategi yang menggabungkan beberapa indikator teknis untuk melacak tren dan peluang terobosan. Strategi ini menangkap tren pasar dan peluang terobosan dengan mengintegrasikan sistem garis rata-rata (EMA), indikator intensitas tren (ADX), indikator volatilitas pasar (ATR), analisis kuantitatif harga (OBV) dan beberapa indikator tambahan seperti grafik awan Ichimoku dan indikator acak (Stochastic). Strategi ini menyiapkan filter waktu yang ketat, yang hanya beroperasi dalam periode perdagangan tertentu, untuk meningkatkan efisiensi perdagangan.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada penilaian komprehensif dari berbagai indikator teknis:

- Membangun sistem pelacakan tren menggunakan 50 siklus dan 200 siklus EMA

- Kekuatan tren dikonfirmasi oleh indikator ADX

- Menggunakan peta awan Ichimoku untuk memberikan konfirmasi tren tambahan

- Kombinasi Indikator Stochastic untuk mengidentifikasi area overbought dan oversold

- Menggunakan ATR untuk mengatur stop loss dan profit target secara dinamis

- Verifikasi dukungan volume transaksi melalui OBV

Strategi ini akan mengirimkan sinyal beli jika kondisi berikut ini terpenuhi:

- Dalam periode waktu yang diizinkan untuk bertransaksi

- Harga berada di atas EMA jangka pendek

- EMA jangka pendek di atas EMA jangka panjang

- ADX lebih tinggi dari set threshold

- Harga berada di atas grafik awan

- Stochastic berada di zona oversold

Keunggulan Strategis

- Verifikasi silang indikator teknologi multi-lapisan untuk meningkatkan keandalan sinyal

- Menggabungkan trend tracking dan volatility breakout untuk meningkatkan kemampuan adaptasi strategi

- Hindari waktu transaksi yang tidak efisien melalui filter waktu

- Pengaturan target stop loss dan profit yang dinamis untuk beradaptasi dengan pergerakan pasar

- Analisis harga dan kuantitas memberikan perspektif pasar yang lebih komprehensif

- Aturan masuk dan keluar yang sistematis, mengurangi penilaian subjektif

Risiko Strategis

- Sistem multi-indikator dapat menyebabkan lag sinyal

- Terlalu banyak sinyal palsu di pasar Forex

- Parameter yang lebih sulit untuk dioptimalkan, risiko over-optimalisasi tinggi

- Pembatasan waktu transaksi mungkin melewatkan hal penting

- Stop loss yang terlalu besar dapat menyebabkan kerugian tunggal yang tinggi

Saran pengendalian risiko:

- Periksa dan optimalkan pengaturan parameter secara teratur

- Pertimbangkan untuk menambahkan filter tingkat fluktuasi

- Menerapkan aturan manajemen dana yang lebih ketat

- Meningkatkan indikator tambahan untuk konfirmasi tren

Arah optimasi strategi

- Memperkenalkan sistem parameter adaptif, menyesuaikan parameter indikator secara dinamis sesuai dengan kondisi pasar

- Menambahkan mekanisme klasifikasi keadaan pasar, menggunakan aturan generasi sinyal yang berbeda dalam lingkungan pasar yang berbeda

- Pengaturan filter waktu yang dioptimalkan, analisis waktu perdagangan terbaik berdasarkan data historis

- Memperbaiki strategi stop loss, pertimbangkan untuk menggunakan tracking stop loss

- Menambahkan indikator sentimen pasar untuk meningkatkan kualitas sinyal

Meringkaskan

Strategi ini membangun sistem perdagangan yang lengkap dengan menggunakan beberapa indikator teknis secara komprehensif. Keunggulan strategi ini adalah verifikasi silang multi-indikator dan kontrol risiko yang ketat, tetapi juga menghadapi tantangan seperti pengoptimalan parameter dan keterlambatan sinyal. Dengan terus-menerus mengoptimalkan dan memperbaiki, strategi ini diharapkan untuk mempertahankan kinerja yang stabil di berbagai lingkungan pasar.

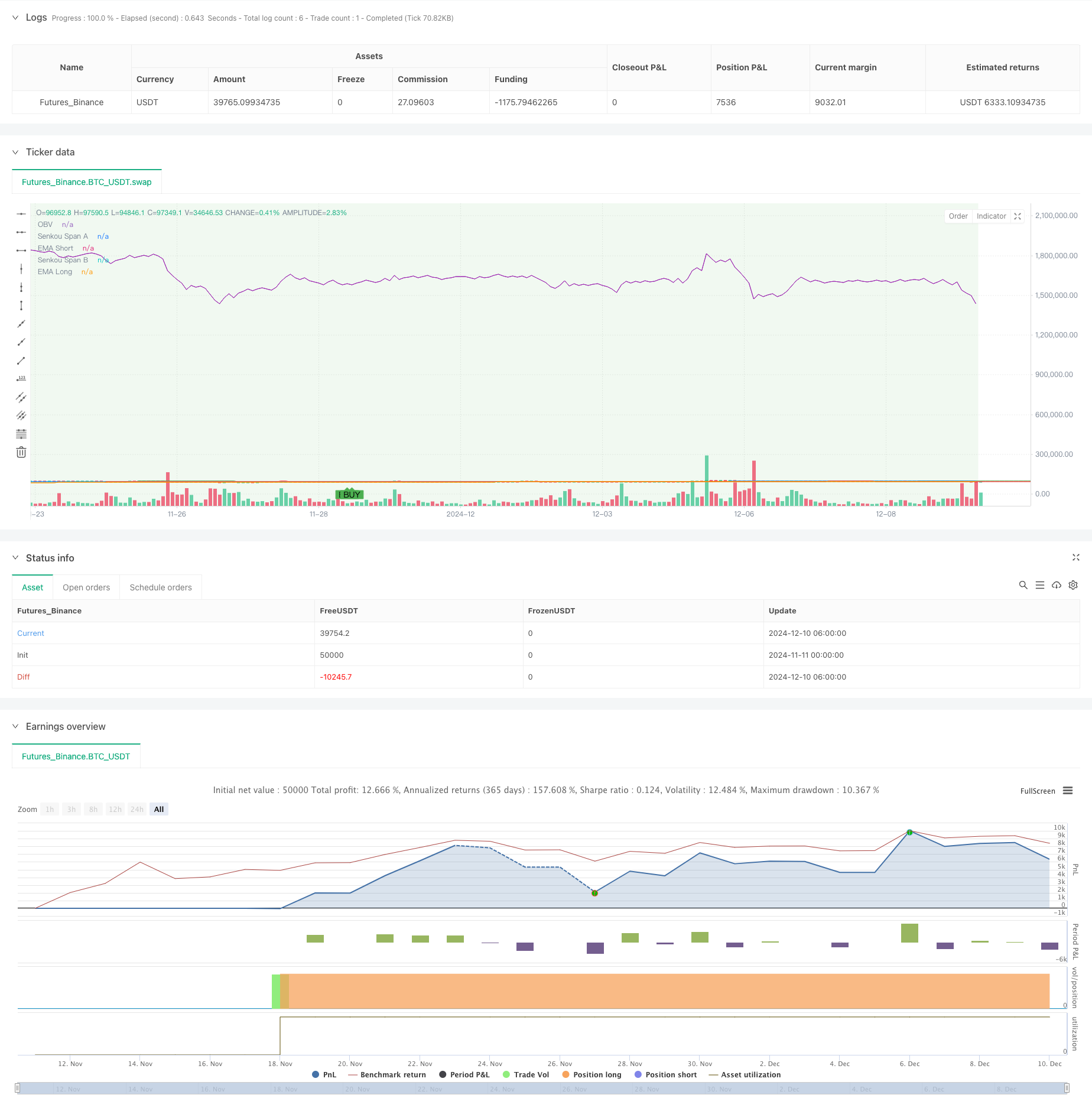

/*backtest

start: 2024-11-11 00:00:00

end: 2024-12-10 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Khaleq Strategy Pro - Fixed Version", overlay=true)

// === Input Settings ===

ema_short = input.int(50, "EMA Short", minval=1)

ema_long = input.int(200, "EMA Long", minval=1)

adx_threshold = input.int(25, "ADX Threshold", minval=1)

atr_multiplier = input.float(2.0, "ATR Multiplier", minval=0.1)

time_filter_start = input(timestamp("0000-01-01 09:00:00"), "Trading Start Time", group="Time Filter")

time_filter_end = input(timestamp("0000-01-01 17:00:00"), "Trading End Time", group="Time Filter")

// === Ichimoku Settings ===

tenkan_len = 9

kijun_len = 26

senkou_span_b_len = 52

displacement = 26

// === Calculations ===

// Ichimoku Components

tenkan_sen = (ta.highest(high, tenkan_len) + ta.lowest(low, tenkan_len)) / 2

kijun_sen = (ta.highest(high, kijun_len) + ta.lowest(low, kijun_len)) / 2

senkou_span_a = (tenkan_sen + kijun_sen) / 2

senkou_span_b = (ta.highest(high, senkou_span_b_len) + ta.lowest(low, senkou_span_b_len)) / 2

// EMA Calculations

ema_short_val = ta.ema(close, ema_short)

ema_long_val = ta.ema(close, ema_long)

// Manual ADX Calculation

length = 14

dm_plus = math.max(ta.change(high), 0)

dm_minus = math.max(-ta.change(low), 0)

tr = math.max(high - low, math.max(math.abs(high - close[1]), math.abs(low - close[1])))

tr14 = ta.sma(tr, length)

dm_plus14 = ta.sma(dm_plus, length)

dm_minus14 = ta.sma(dm_minus, length)

di_plus = (dm_plus14 / tr14) * 100

di_minus = (dm_minus14 / tr14) * 100

dx = math.abs(di_plus - di_minus) / (di_plus + di_minus) * 100

adx_val = ta.sma(dx, length)

// ATR Calculation

atr_val = ta.atr(14)

// Stochastic RSI Calculation

k = ta.stoch(close, high, low, 14)

d = ta.sma(k, 3)

// Time Filter

is_within_time = true

// Support and Resistance (High and Low Levels)

resistance_level = ta.highest(high, 20)

support_level = ta.lowest(low, 20)

// Volume Analysis (On-Balance Volume)

vol_change = ta.change(close)

obv = ta.cum(vol_change > 0 ? volume : vol_change < 0 ? -volume : 0)

// === Signal Conditions ===

buy_signal = is_within_time and

(close > ema_short_val) and

(ema_short_val > ema_long_val) and

(adx_val > adx_threshold) and

(close > senkou_span_a) and

(k < 20) // Stochastic oversold

sell_signal = is_within_time and

(close < ema_short_val) and

(ema_short_val < ema_long_val) and

(adx_val > adx_threshold) and

(close < senkou_span_b) and

(k > 80) // Stochastic overbought

// === Plotting ===

// Plot Buy and Sell Signals

plotshape(buy_signal, color=color.green, style=shape.labelup, title="Buy Signal", location=location.belowbar, text="BUY")

plotshape(sell_signal, color=color.red, style=shape.labeldown, title="Sell Signal", location=location.abovebar, text="SELL")

// Plot EMAs

plot(ema_short_val, color=color.blue, title="EMA Short")

plot(ema_long_val, color=color.orange, title="EMA Long")

// Plot Ichimoku Components

plot(senkou_span_a, color=color.green, title="Senkou Span A", offset=displacement)

plot(senkou_span_b, color=color.red, title="Senkou Span B", offset=displacement)

// // Plot Support and Resistance using lines

// var line resistance_line = na

// var line support_line = na

// if bar_index > 1

// line.delete(resistance_line)

// line.delete(support_line)

// resistance_line := line.new(x1=bar_index - 1, y1=resistance_level, x2=bar_index, y2=resistance_level, color=color.red, width=1, style=line.style_dotted)

// support_line := line.new(x1=bar_index - 1, y1=support_level, x2=bar_index, y2=support_level, color=color.green, width=1, style=line.style_dotted)

// Plot OBV

plot(obv, color=color.purple, title="OBV")

// Plot Background for Trend (Bullish/Bearish)

bgcolor(close > ema_long_val ? color.new(color.green, 90) : color.new(color.red, 90), title="Trend Background")

// === Alerts ===

alertcondition(buy_signal, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sell_signal, title="Sell Alert", message="Sell Signal Triggered")

// === Strategy Execution ===

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.close("Buy")

strategy.exit("Sell", "Buy", stop=close - atr_multiplier * atr_val, limit=close + atr_multiplier * atr_val)