Ringkasan

Strategi ini adalah sistem pelacakan tren yang menggabungkan dua rata-rata bergerak dan indikator MACD. Ini menggunakan rata-rata bergerak periode 50 dan 200 untuk menentukan arah tren, sementara menggunakan indikator MACD untuk menangkap momen masuk tertentu. Strategi ini menggunakan mekanisme stop-loss yang dinamis dan meningkatkan kualitas perdagangan dengan beberapa kondisi penyaringan.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada beberapa elemen utama:

- Penghakiman tren: Menggunakan hubungan posisi 50 dan 200 untuk menilai tren keseluruhan. Ketika garis rata-rata cepat berada di atas garis rata-rata lambat, itu adalah tren naik, sebaliknya adalah tren turun.

- Sinyal masuk: Setelah mengkonfirmasi arah tren, gunakan persilangan indikator MACD untuk memicu sinyal masuk tertentu. Dalam tren naik, MACD masuk lebih banyak saat melewati jalur sinyal; dalam tren turun, MACD masuk kosong saat melewati jalur sinyal.

- Penyaringan perdagangan: Memperkenalkan beberapa mekanisme penyaringan seperti interval perdagangan minimum, kekuatan tren, dan MACD threshold untuk menghindari perdagangan berlebihan dalam lingkungan pasar yang bergejolak.

- Pengendalian risiko: Menggunakan stop loss dengan jumlah poin tetap dan mekanisme stop yang dapat disesuaikan, sekaligus menggabungkan garis rata-rata bergerak dan sinyal reversal dari MACD sebagai kondisi keluaran dinamis.

Keunggulan Strategis

- Mengikuti tren dengan mengkombinasikan momentum: Menggabungkan garis rata-rata bergerak dan indikator MACD, Anda dapat memahami tren besar dan menentukan waktu masuk dengan tepat.

- Manajemen risiko yang baik: Ada banyak mekanisme stop loss, termasuk stop loss tetap dan stop loss dinamis yang dipicu oleh indikator teknis.

- Fleksibilitas pengaturan parameter: parameter kunci seperti stop loss, stop loss point, dan periode rata-rata dapat disesuaikan secara fleksibel sesuai dengan kondisi pasar.

- Mekanisme penyaringan cerdas: mengurangi sinyal palsu dan meningkatkan kualitas transaksi melalui beberapa kondisi penyaringan.

- Performance Statistics yang komprehensif: fitur statistik transaksi yang terperinci, termasuk perhitungan real-time dari indikator-indikator penting seperti tingkat kemenangan, rata-rata keuntungan dan kerugian.

Risiko Strategis

- Risiko pasar bergoyang: Dalam pasar bergoyang horizontal, sinyal palsu dapat sering terjadi, disarankan untuk menambahkan indikator konfirmasi tren.

- Risiko slippage: Periode kecil perdagangan rentan terhadap slippage, disarankan untuk membiarkan pengaturan stop loss sesuai.

- Sensitivitas parameter: kinerja kebijakan sangat sensitif terhadap pengaturan parameter, yang memerlukan optimasi parameter yang memadai.

- Ketergantungan pada kondisi pasar: Strategi dapat bekerja dengan baik di pasar tren yang kuat, tetapi efeknya mungkin tidak stabil di lingkungan pasar lainnya.

Arah optimasi strategi

- Optimasi Stop Loss Dinamis: Anda dapat menyesuaikan stop loss secara dinamis sesuai dengan indikator ATR, sehingga lebih sesuai dengan fluktuasi pasar.

- Optimasi waktu masuk: Anda dapat menambahkan indikator tambahan seperti RSI untuk mengkonfirmasi waktu masuk dan meningkatkan akurasi perdagangan.

- Optimasi manajemen posisi: memperkenalkan sistem manajemen posisi dinamis berdasarkan volatilitas untuk mengendalikan risiko dengan lebih baik.

- Identifikasi lingkungan pasar: menambahkan modul identifikasi lingkungan pasar, menggunakan kombinasi parameter yang berbeda dalam kondisi pasar yang berbeda.

Meringkaskan

Ini adalah sistem perdagangan pelacakan tren yang dirancang secara rasional dan logis. Dengan menggabungkan indikator teknis klasik dan metode manajemen risiko modern, strategi ini berfokus pada pengendalian risiko sambil menangkap tren. Meskipun ada beberapa tempat yang perlu dioptimalkan, secara keseluruhan ini adalah strategi perdagangan yang bernilai praktis.

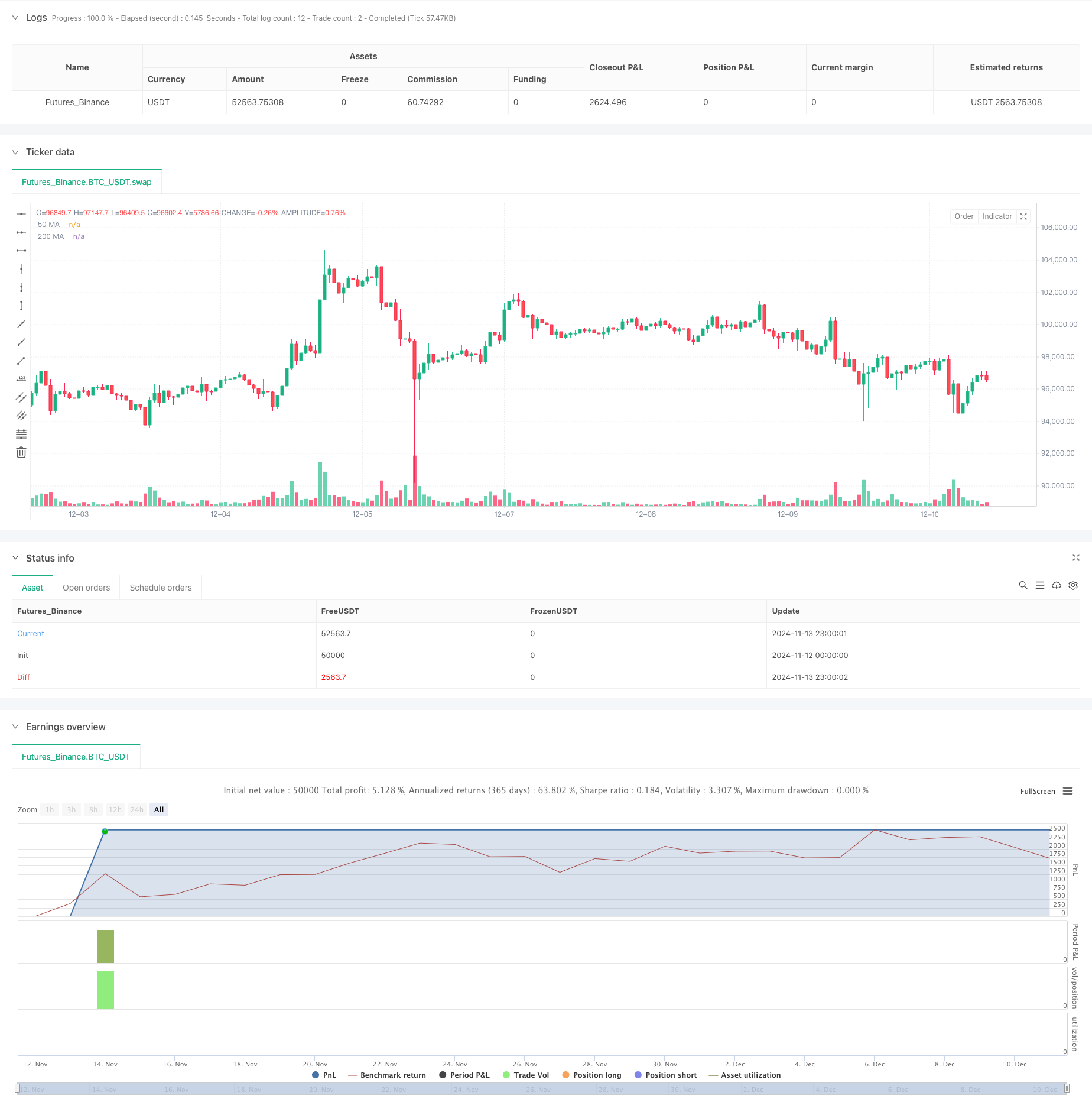

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © WolfofAlgo

//@version=5

strategy("Trend Following Scalping Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Input Parameters

stopLossPips = input.float(5.0, "Stop Loss in Pips", minval=1.0)

takeProfitPips = input.float(10.0, "Take Profit in Pips", minval=1.0)

useFixedTakeProfit = input.bool(true, "Use Fixed Take Profit")

// Moving Average Parameters

fastMA = input.int(50, "Fast MA Period")

slowMA = input.int(200, "Slow MA Period")

// MACD Parameters

macdFastLength = input.int(12, "MACD Fast Length")

macdSlowLength = input.int(26, "MACD Slow Length")

macdSignalLength = input.int(9, "MACD Signal Length")

// Trade Filter Parameters (Adjusted to be less strict)

minBarsBetweenTrades = input.int(5, "Minimum Bars Between Trades", minval=1)

trendStrengthPeriod = input.int(10, "Trend Strength Period")

minTrendStrength = input.float(0.4, "Minimum Trend Strength", minval=0.1, maxval=1.0)

macdThreshold = input.float(0.00005, "MACD Threshold", minval=0.0)

// Variables for trade management

var int barsLastTrade = 0

barsLastTrade := nz(barsLastTrade[1]) + 1

// Calculate Moving Averages

ma50 = ta.sma(close, fastMA)

ma200 = ta.sma(close, slowMA)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

// Calculate trend strength (simplified)

trendDirection = ta.ema(close, trendStrengthPeriod) > ta.ema(close, trendStrengthPeriod * 2)

isUptrend = close > ma50 and ma50 > ma200

isDowntrend = close < ma50 and ma50 < ma200

// Calculate pip value

pointsPerPip = syminfo.mintick * 10

// Entry Conditions with Less Strict Filters

macdCrossUp = ta.crossover(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

macdCrossDown = ta.crossunder(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

// Long and Short Conditions

longCondition = close > ma50 and macdCrossUp and barsLastTrade >= minBarsBetweenTrades and isUptrend

shortCondition = close < ma50 and macdCrossDown and barsLastTrade >= minBarsBetweenTrades and isDowntrend

// Exit Conditions (made more lenient)

exitLongCondition = macdCrossDown or close < ma50

exitShortCondition = macdCrossUp or close > ma50

// Reset bars counter on new trade

if (longCondition or shortCondition)

barsLastTrade := 0

// Calculate stop loss and take profit levels

longStopPrice = strategy.position_avg_price - (stopLossPips * pointsPerPip)

longTakeProfitPrice = strategy.position_avg_price + (takeProfitPips * pointsPerPip)

shortStopPrice = strategy.position_avg_price + (stopLossPips * pointsPerPip)

shortTakeProfitPrice = strategy.position_avg_price - (takeProfitPips * pointsPerPip)

// Plot Moving Averages

plot(ma50, "50 MA", color=color.blue)

plot(ma200, "200 MA", color=color.red)

// Plot Entry Signals

plotshape(longCondition, "Long Signal", shape.triangleup, location.belowbar, color.green, size=size.small)

plotshape(shortCondition, "Short Signal", shape.triangledown, location.abovebar, color.red, size=size.small)

// Strategy Entry Rules

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short", strategy.short)

// Strategy Exit Rules

if (strategy.position_size > 0 and exitLongCondition)

strategy.close("Long")

if (strategy.position_size < 0 and exitShortCondition)

strategy.close("Short")

// Stop Loss and Take Profit Management

if (strategy.position_size > 0)

strategy.exit("Long TP/SL", "Long", stop=longStopPrice, limit=useFixedTakeProfit ? longTakeProfitPrice : na)

if (strategy.position_size < 0)

strategy.exit("Short TP/SL", "Short", stop=shortStopPrice, limit=useFixedTakeProfit ? shortTakeProfitPrice : na)

// Performance Metrics

var float totalTrades = 0

var float winningTrades = 0

var float totalProfitPips = 0

var float totalLossPips = 0

if (strategy.closedtrades > 0)

totalTrades := strategy.closedtrades

winningTrades := strategy.wintrades

totalProfitPips := strategy.grossprofit / pointsPerPip

totalLossPips := math.abs(strategy.grossloss) / pointsPerPip

// Display Stats

var label statsLabel = na

label.delete(statsLabel[1])

// Create performance stats text

var string stats = ""

if (strategy.closedtrades > 0)

winRate = (winningTrades / math.max(totalTrades, 1)) * 100

avgWin = totalProfitPips / math.max(winningTrades, 1)

avgLoss = totalLossPips / math.max(totalTrades - winningTrades, 1)

plRatio = avgWin / math.max(avgLoss, 1)

stats := "Win Rate: " + str.tostring(winRate, "#.##") + "%\n" +

"Avg Win: " + str.tostring(avgWin, "#.##") + " pips\n" +

"Avg Loss: " + str.tostring(avgLoss, "#.##") + " pips\n" +

"P/L Ratio: " + str.tostring(plRatio, "#.##") + "\n" +

"Total Trades: " + str.tostring(totalTrades, "#")

statsLabel := label.new(x=bar_index, y=high, text=stats, style=label.style_label_down, color=color.new(color.blue, 80))