Ringkasan

Strategi ini adalah sistem perdagangan komprehensif yang menggabungkan beberapa indikator teknis, terutama untuk menangkap peluang perdagangan dengan secara dinamis memantau pergerakan pasar dan perubahan tren. Strategi ini mengintegrasikan beberapa indikator seperti sistem rata-rata (EMA), indikator relatif kuat (RSI), indikator dispersi rata-rata konvergensi bergerak (MACD), dan Bollinger Bands (BB), dan memperkenalkan mekanisme stop loss dinamis berdasarkan amplitudo gelombang nyata (ATR), yang memungkinkan analisis dan pengendalian risiko multi-dimensi pasar.

Prinsip Strategi

Strategi ini menggunakan mekanisme pengesahan sinyal bertingkat-tingkat, yang meliputi:

- Pengertian tren: menggunakan persilangan 7 siklus dan 14 siklus EMA untuk menentukan arah tren pasar

- Analisis dinamika: Melalui indikator RSI untuk memantau pasar overbought dan oversold, 30⁄70 untuk setel threshold dinamika

- Pengakuan kekuatan tren: memperkenalkan indikator ADX untuk menilai kekuatan tren, mengkonfirmasi adanya tren kuat ketika ADX> 25

- Pengadilan Bandung Bergelombang: Menggunakan Brin untuk menentukan Bandung Bergelombang Harga, yang dikombinasikan dengan harga yang menyentuh Brin untuk menghasilkan sinyal perdagangan

- Verifikasi volume transaksi: menggunakan filter volume transaksi dinamis dan linear untuk memastikan transaksi terjadi di bawah aktivitas pasar yang cukup

- Pengendalian risiko: Strategi stop loss dinamis yang dirancang berdasarkan ATR, dengan jarak stop loss 1,5 kali ATR

Keunggulan Strategis

- Verifikasi sinyal multi-dimensi yang efektif untuk mengurangi sinyal palsu

- Mekanisme Stop Loss Dinamis Meningkatkan Kemampuan Adaptasi Risiko Strategi

- Menggabungkan analisis volume dan intensitas tren untuk meningkatkan keandalan perdagangan

- Parameter indikator dapat disesuaikan, memiliki kemampuan adaptasi yang baik

- Mekanisme masuk dan keluar yang lengkap, logika transaksi yang jelas

- Menggunakan indikator teknis standar yang mudah dipahami dan dipertahankan

Risiko Strategis

- Beberapa indikator dapat menyebabkan kelambatan sinyal

- Optimasi parameter mungkin memiliki risiko overfitting

- Perdagangan yang sering terjadi di pasar horizontal

- Sistem sinyal yang rumit dapat meningkatkan beban komputasi

- Jumlah sampel yang lebih besar diperlukan untuk memverifikasi efektivitas strategi.

Arah optimasi strategi

- Memperkenalkan mekanisme penyesuaian volatilitas pasar, parameter indikator penyesuaian dinamis

- Menambahkan Filter Waktu untuk Menghindari Perdagangan di Waktu yang Buruk

- Strategi penghematan yang optimal, pertimbangkan penghematan bergerak

- Termasuk biaya transaksi, optimalisasi posisi terbuka

- Memperkenalkan mekanisme manajemen posisi untuk melakukan penyesuaian posisi yang dinamis

Meringkaskan

Strategi ini bekerja sama dengan kolaborasi multi-indikator untuk membangun sistem perdagangan yang lebih lengkap. Kelebihan utamanya adalah mekanisme konfirmasi sinyal multi-dimensi dan sistem kontrol risiko yang dinamis, tetapi juga perlu memperhatikan optimasi parameter dan masalah adaptasi pasar. Dengan terus-menerus mengoptimalkan dan menyesuaikan, strategi ini diharapkan untuk mempertahankan kinerja yang stabil di berbagai lingkungan pasar.

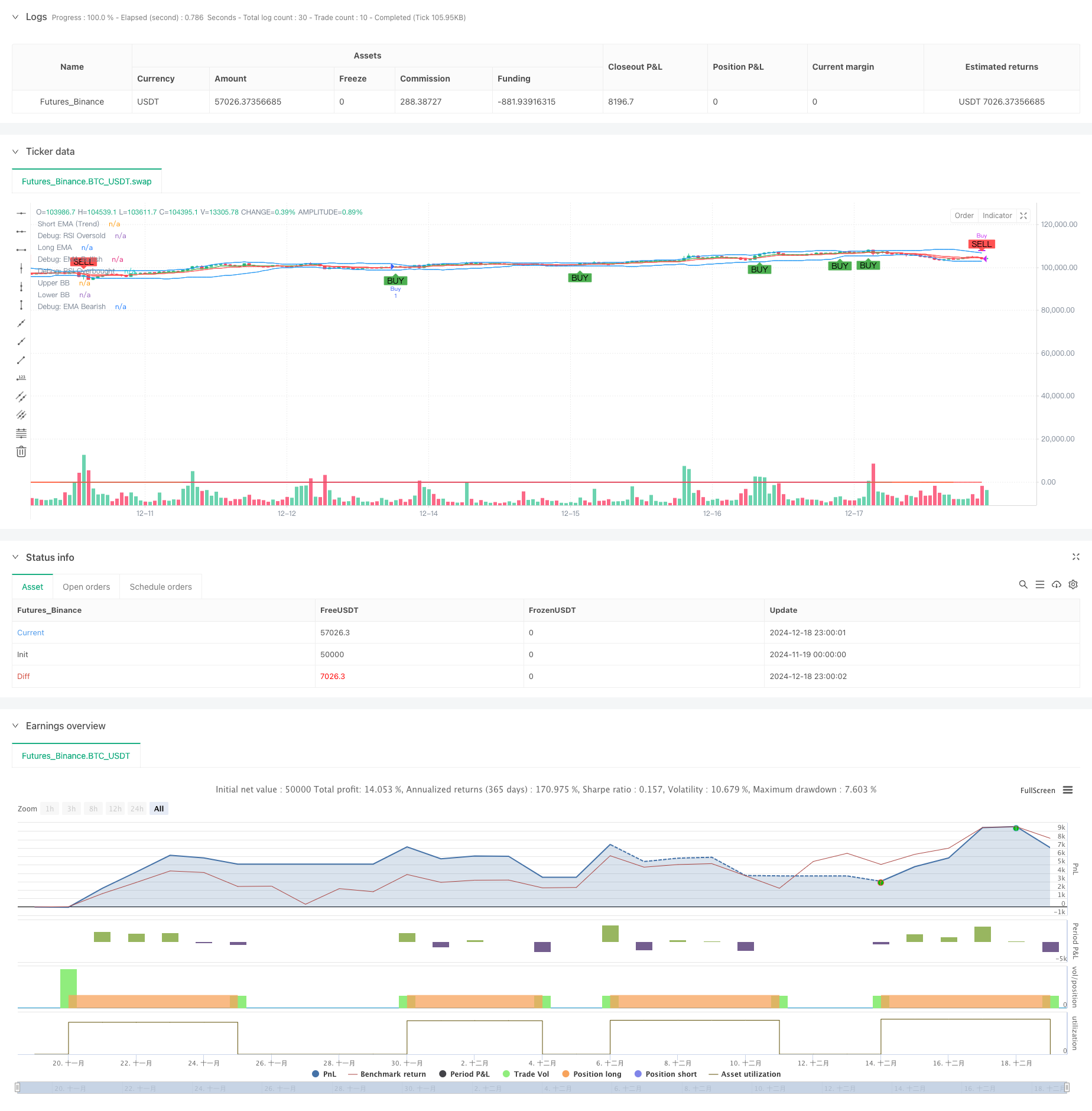

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USDT Scalping Strategy", overlay=true)

// Input Parameters

emaShortLength = input.int(7, title="Short EMA Length")

emaLongLength = input.int(14, title="Long EMA Length")

rsiLength = input.int(7, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level") // Adjusted to 70 for broader range

rsiOversold = input.int(30, title="RSI Oversold Level") // Adjusted to 30 for broader range

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalLength = input.int(9, title="MACD Signal Length")

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Standard Deviation") // Adjusted to 2.0 for better signal detection

// EMA Calculation

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

macdHistogram = macdLine - signalLine

// Bollinger Bands Calculation

basis = ta.sma(close, bbLength)

deviation = ta.stdev(close, bbLength)

bbUpper = basis + (bbStdDev * (deviation > 1e-5 ? deviation : 1e-5)) // Ensure robust Bollinger Band calculation

bbLower = basis - bbStdDev * deviation

// Volume Condition

volCondition = volume > ta.sma(volume, input.int(20, title="Volume SMA Period")) // Dynamic volume filter

// Trend Strength (ADX)

// True Range Calculation

tr = math.max(high - low, math.max(math.abs(high - close[1]), math.abs(low - close[1])))

// Directional Movement

plusDM = high - high[1] > low[1] - low ? math.max(high - high[1], 0) : 0

minusDM = low[1] - low > high - high[1] ? math.max(low[1] - low, 0) : 0

// Smooth Moving Averages

atr_custom = ta.rma(tr, 14)

plusDI = 100 * ta.rma(plusDM, 14) / atr_custom // Correct reference to atr_custom

minusDI = 100 * ta.rma(minusDM, 14) / atr_custom // Correct reference to atr_custom

// ADX Calculation

adx = plusDI + minusDI > 0 ? 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI), 14) : na // Simplified ternary logic for ADX calculation // Prevent division by zero // Prevent division by zero // Final ADX

strongTrend = adx > 25

// Conditions for Buy Signal

emaBullish = emaShort > emaLong

rsiOversoldCondition = rsi < rsiOversold

macdBullishCrossover = ta.crossover(macdLine, signalLine)

priceAtLowerBB = close <= bbLower

buySignal = emaBullish and (rsiOversoldCondition or macdBullishCrossover or priceAtLowerBB) // Relaxed conditions by removing volCondition and strongTrend

// Conditions for Sell Signal

emaBearish = emaShort < emaLong

rsiOverboughtCondition = rsi > rsiOverbought

macdBearishCrossover = ta.crossunder(macdLine, signalLine)

priceAtUpperBB = close >= bbUpper

sellSignal = emaBearish and (rsiOverboughtCondition or macdBearishCrossover or priceAtUpperBB) // Relaxed conditions by removing volCondition and strongTrend

// Plot EMA Lines

trendColor = emaShort > emaLong ? color.green : color.red

plot(emaShort, color=trendColor, title="Short EMA (Trend)") // Simplified color logic

plot(emaLong, color=color.red, title="Long EMA")

// Plot Bollinger Bands

plot(bbUpper, color=color.blue, title="Upper BB")

plot(bbLower, color=color.blue, title="Lower BB")

// Plot Buy and Sell Signals

plot(emaBullish ? 1 : na, color=color.green, linewidth=1, title="Debug: EMA Bullish")

plot(emaBearish ? 1 : na, color=color.red, linewidth=1, title="Debug: EMA Bearish")

plot(rsiOversoldCondition ? 1 : na, color=color.orange, linewidth=1, title="Debug: RSI Oversold")

plot(rsiOverboughtCondition ? 1 : na, color=color.purple, linewidth=1, title="Debug: RSI Overbought")

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small) // Dynamic size for signals

// Strategy Execution with ATR-based Stop Loss and Take Profit

// Reuse atr_custom from earlier calculation

stopLoss = low - (input.float(1.5, title="Stop Loss Multiplier") * atr_custom) // Consider dynamic adjustment based on market conditions // Adjustable stop-loss multiplier

takeProfit = close + (2 * atr_custom)

if (buySignal)

strategy.entry("Buy", strategy.long, stop=stopLoss) // Removed limit to simplify trade execution

if (sellSignal)

strategy.close("Buy")