Tinjauan Strategi

Strategi ini adalah sistem perdagangan cerdas yang didasarkan pada indikator tren gelombang (Wave Trend) dan investasi terdesentralisasi (Dollar Cost Averaging). Strategi ini menganalisis tren turun naik di pasar, secara bertahap membangun posisi ketika pasar berada di zona oversold, dan secara bertahap mengambil keuntungan ketika bull market dikonfirmasi. Strategi ini menggabungkan keunggulan analisis teknis dan manajemen risiko, mampu secara konsisten mengakumulasi posisi dan mengambil keuntungan selama siklus pasar.

Prinsip Strategi

Logika inti dari strategi ini mencakup elemen-elemen kunci berikut:

- Menggunakan HLC3 harga rata-rata dan indeks Moving Average (EMA) untuk menghitung indikator tren gelombang, mengidentifikasi pasar overbought dan oversold

- Mengukur tren siklus besar melalui Awesome Oscillator untuk menentukan status pasar bull dan bear

- Pada periode bear market, ketika harga berada di zona oversold, jumlah gudang dibangun secara batch, dan jumlah gudang dibangun secara dinamis sesuai dengan tingkat oversold.

- Ketika pasar naik, sistem akan mengirimkan sinyal “beli emas” yang meningkatkan posisi.

- Selama bull market, ketika harga memasuki zona overbought, sistem akan mengurangi keuntungan saham secara bertahap sesuai dengan tingkat overbought

- Ketika ada sinyal bearish atau puncak pasar, sistem akan mengosongkan semua kepemilikan untuk mengunci keuntungan

Keunggulan Strategis

- Menurunkan Biaya Pembangunan Gudang dengan Diversifikasi Investasi dan Menghindari Risiko Penarikan

- Beberapa indikator teknis saling melakukan validasi silang untuk meningkatkan keandalan sinyal perdagangan

- Manajemen posisi yang fleksibel, menyesuaikan jumlah pembelian dan penjualan sesuai dengan kondisi pasar yang dinamis

- Memiliki sifat defensif yang kuat, dan dapat menghentikan kerugian pada saat sinyal bearish muncul

- Strategi logis yang jelas, parameter yang dapat disesuaikan, dan beradaptasi dengan lingkungan pasar yang berbeda

Risiko Strategis

- Di pasar yang bergejolak, transaksi bisa terjadi lebih sering dan meningkatkan biaya transaksi.

- Strategi spread trading mungkin melewatkan titik beli terbaik dalam situasi kenaikan harga yang cepat dan sepihak

- Indikator teknis yang tertunda dan mungkin tidak bereaksi dalam situasi pasar yang bergejolak

- Setting parameter yang tidak tepat dapat menyebabkan waktu yang tidak tepat untuk membangun atau mengurangi gudang

Arah optimasi strategi

- Memperkenalkan indikator volatilitas, mengoptimalkan jumlah perhitungan untuk penempatan dan pengurangan

- Menambahkan lebih banyak indikator sentimen pasar untuk meningkatkan akurasi penilaian tren

- Mengembangkan sistem parameter adaptif untuk menyesuaikan parameter sesuai dengan dinamika siklus pasar yang berbeda

- Menambahkan Modul Manajemen Uang untuk Kontrol Posisi yang Lebih Rinci

Meringkaskan

Ini adalah strategi perdagangan cerdas yang secara organik menggabungkan analisis teknis dengan manajemen risiko. Dengan indikator tren gelombang dan metode investasi terdesentralisasi, untuk mencapai pertumbuhan pendapatan yang stabil sambil melindungi keamanan dana. Keunggulan inti dari strategi ini adalah adaptasi dalam berbagai lingkungan pasar, serta logika perdagangan yang jelas dan mekanisme kontrol risiko.

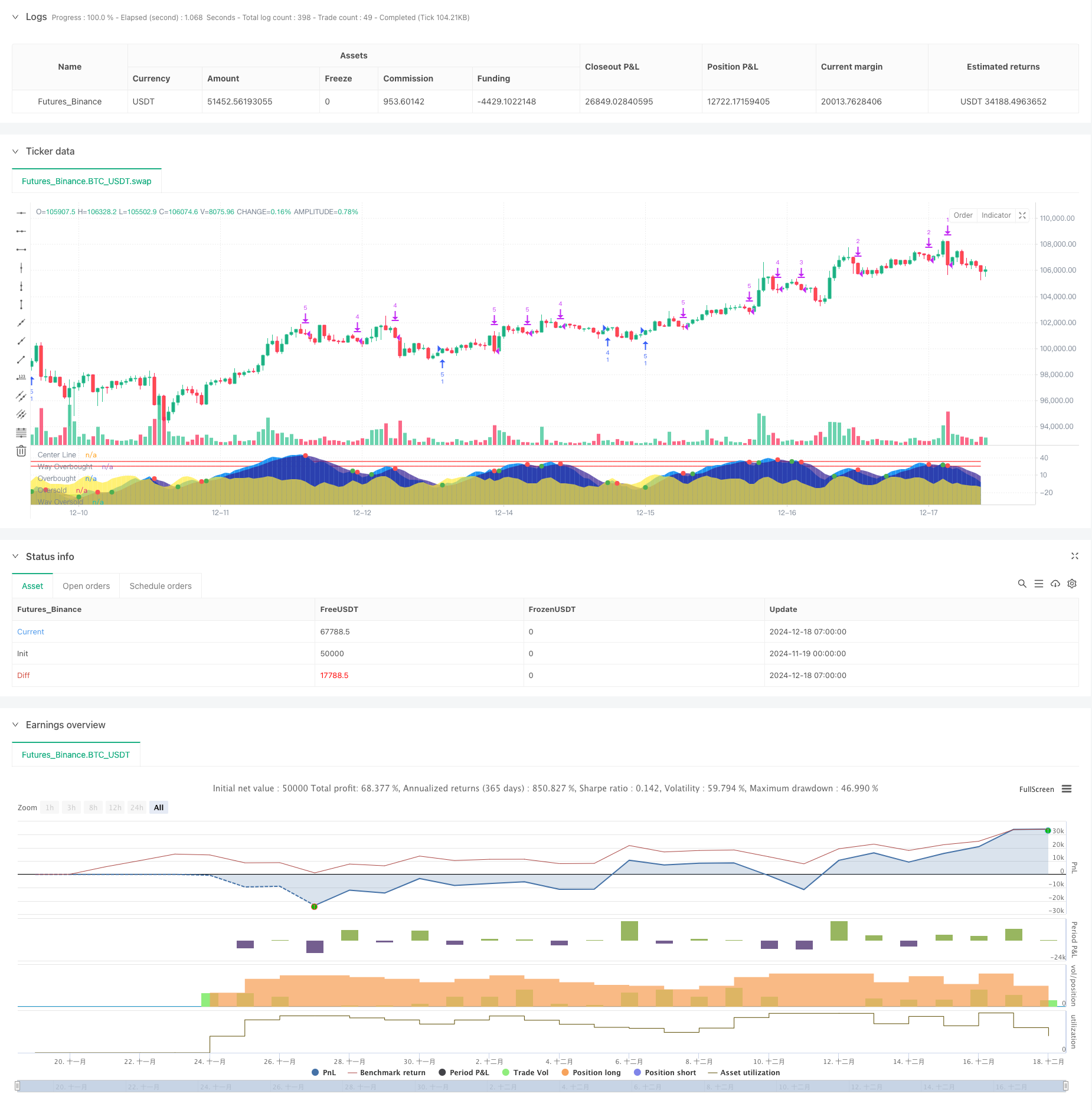

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Copyright (c) 2024 Seth Ethington.

// All rights reserved.

//

// If this script provides you Bread then share the Dough!

// BTC (God's Money) Address: bc1qrpxvea8ze4ayj2vtr0slp774rulm898gyhe3ss

//

// Redistribution and use in source and binary forms,

// whether you tweak it or not, is totally fine,

// but only if you swear on your life that BTC is God's Money!

//

// If you're redistributing the source code,

// you must keep the above copyright notice and,

// more importantly, the sacred BTC address!

//

strategy(title="Cipher DCA Strategy", shorttitle="Cipher DCA", overlay=false, initial_capital=100, pyramiding=30, currency=currency.USD, slippage=1, commission_type=strategy.commission.percent, commission_value=0.1, default_qty_type=strategy.percent_of_equity, process_orders_on_close=true)

// Input parameters for the starting date

startDate = input(timestamp("2019-01-01 00:00:00"), title="Start Date (YYYY-MM-DD HH:MM:SS)")

// Input parameters for the indicator

fastLength = input.int(4, title="Fast Wave Length", group="Wave Calculator") // Length for EMA smoothing of the price channel

slowLength = input.int(33, title="Slow Wave Length", group="Wave Calculator") // Length for EMA smoothing of the trend channel

wayOverBoughtLevel = input.float(33, title="Way OverBought Level", group="Wave Calculator")

overBoughtLevel = input.float(25, title="Over Bought Level", group="Wave Calculator")

wayOverSoldLevel = input.float(-33, title="Way Over Sold Level", group="Wave Calculator")

overSoldLevel = input.float(-25, title="Over Sold Level", group="Wave Calculator")

accumulatingLevel = input.float(0, title="Accumulating Level", group="Wave Calculator")

// Calculate the average price (HLC3 = (High + Low + Close) / 3)

averagePrice = hlc3

// Compute the smoothed average price (ESA: Exponential Smoothing Average)

exponentialSmoothingAverage = ta.ema(averagePrice, fastLength)

// Compute the deviation (D) between the price and the smoothed average

priceDeviation = ta.ema(math.abs(averagePrice - exponentialSmoothingAverage), fastLength)

// Compute the commodity index (CI) which is normalized price movement

commodityIndex = (averagePrice - exponentialSmoothingAverage) / (0.015 * priceDeviation)

// Smooth the commodity index to create Wave Trend 1 (WT1)

fastWaveTrend = ta.ema(commodityIndex, slowLength)

// //log.info("fastWaveTrend= " + str.tostring(fastWaveTrend))

// Further smooth WT1 using a simple moving average to create Wave Trend 2 (WT2)

slowWaveTrend = ta.sma(fastWaveTrend, 5)

// //log.info("slowWaveTrend= " + str.tostring(slowWaveTrend))

// Plot the center line (0) for reference

plot(0, color=color.white, title="Center Line")

// Plot overbought and oversold levels

plot(wayOverBoughtLevel, color=color.red, title="Way Overbought")

plot(overBoughtLevel, color=color.red, title="Overbought")

plot(overSoldLevel, color=color.green, title="Oversold")

plot(wayOverSoldLevel, color=color.green, title="Way Oversold")

// Plot WT1 and WT2 as filled areas for better visibility

plot(fastWaveTrend, style=plot.style_area, color=color.new(color.blue, 0), title="Fast Wave")

plot(slowWaveTrend, style=plot.style_area, color=color.new(color.navy, 30), title="Slow Wave")

// Highlight the difference between fastWave vs slowWave

waveTrendDifference = fastWaveTrend - slowWaveTrend

// //log.info("waveTrendDifference=" + str.tostring(waveTrendDifference))

plot(waveTrendDifference, color=color.new(color.yellow, 30),style=plot.style_area, title="WT1 - WT2 Difference") //No transparency

// Plot buy and sell signals at crossovers

isCrossover = ta.cross(fastWaveTrend, slowWaveTrend)

// //log.info("isCrossover=" + str.tostring(isCrossover))

plot(isCrossover ? slowWaveTrend : na, color=(slowWaveTrend - fastWaveTrend > 0 ? color.red : color.green), style=plot.style_circles, linewidth=4, title="Crossover Signals")

float waveTrend = na

if (slowWaveTrend > 0 and fastWaveTrend > 0)

waveTrend := math.max(slowWaveTrend, fastWaveTrend)

// //log.info("Both trends are positive. waveTrend set to max value: " + str.tostring(waveTrend))

else if (slowWaveTrend < 0 and fastWaveTrend < 0)

waveTrend := math.min(slowWaveTrend, fastWaveTrend)

// //log.info("Both trends are negative. waveTrend set to min value: " + str.tostring(waveTrend))

else

waveTrend := 0

// //log.info("Trends are mixed. waveTrend set to 0.")

// Time to Sell

isCrossingDown = waveTrendDifference < 0

// Time to Buy

isCrossingUp = waveTrendDifference > 0

//-----------------------------------------------------------

// Detect Bull Market and Bear Market using the Awesome Oscillator

// User input for AO thresholds

ao_threshold = input.float(-10, "AO Bull Market Threshold", minval=-50, maxval=50, step=1, group = "Bear and Bull Thresholds")

ao_cycletop_threshold = input.float(5, "AO Bear Market Threshold", minval=0, maxval=200, step=1, group = "Bear and Bull Thresholds")

// Define the Awesome Oscillator

ao = ta.sma(hl2, fastLength) - ta.sma(hl2, slowLength)

// Convert current bar time to the first day of the month for monthly calculations

currentMonthStart = timestamp(year, month, 1, 0, 0)

prevMonthStart = time - (time - currentMonthStart)

// Calculate AO for the start of the month and previous month

aoCurrentMonth = request.security(syminfo.tickerid, 'M', ao[0])

aoPrevMonth1 = request.security(syminfo.tickerid, 'M', ao[1])

aoPrevMonth2 = request.security(syminfo.tickerid, 'M', ao[2])

// Detect bull market based on monthly AO

isBullMarket = aoCurrentMonth > aoPrevMonth1 and aoPrevMonth1 > aoPrevMonth2 and aoCurrentMonth > ao_threshold

// Detect cycle top based on monthly AO

isBearMarket = aoCurrentMonth > ao_cycletop_threshold and aoPrevMonth1 > aoCurrentMonth

// Detect when a bull market is starting

var bool isBullMarketStarting = na

if (not isBullMarket[1] and isBullMarket)

isBullMarketStarting := true

else

isBullMarketStarting := false

// Logging

//log.info("isBullMarket is " + str.tostring(isBullMarket))

//log.info("isCycleTop is " + str.tostring(isBearMarket))

// Plot transparent overlays for Bull Market and Cycle Top

overlayColor = isBullMarket ? color.new(color.green, 80) : isBearMarket ? color.new(color.red, 60) : na

bgcolor(overlayColor, title="Market Condition Overlay")

//----------------------------------------------------------

// Calculate Potential Liquidations and Golden Buy Zones

volLength = input.int(20, "Volume Length", minval=1, group="Golden Buy Indicator")

volStdDevThreshold = input.float(2.0, "Volume Standard Diviation Threshold", step=0.1, group="Golden Buy Indicator")

aoWeeklyThreshold = input.int(0, "Awesome Oscillator Oversold Threshold", step=1, group="Golden Buy Indicator")

// Start Accumulating when the price is oversold or price action is flat

isStartAccumulating = waveTrend <= accumulatingLevel and not isBearMarket

// Start Selling when we are now in a Bull Market

isStartSelling = waveTrend > accumulatingLevel

// Calculate Overbought and Oversold Levels

isOverSold = waveTrend < overSoldLevel

isWayOverSold = waveTrend < wayOverSoldLevel

isOverBought = waveTrend > overBoughtLevel

isWayOverBought = waveTrend > wayOverBoughtLevel

//log.info("isOverSold= " + str.tostring(isOverSold) + " isWayOverSold= " + str.tostring(isWayOverSold) + " isOverBought= " + str.tostring(isOverBought) + " isWayOverBought= " + str.tostring(isWayOverBought))

//Weekly Awesome Oscillator to detect oversold levels

aoWeekly = request.security(syminfo.tickerid, "W", ao)

// Get standard deviation of volume over last 20 bars

volumeStDev = ta.stdev(volume, volLength)

// Detect volume spikes

volumeSpike = volume > (ta.sma(volume, volLength) + volStdDevThreshold * volumeStDev)

isGoldenBuyZone = volumeSpike and aoWeekly < aoWeeklyThreshold and not isBearMarket

plotshape(series=isGoldenBuyZone ? -60 : na, style=shape.triangleup, location=location.absolute, color=color.yellow, size=size.tiny, offset=0, title="Golden Buy Zone")

isMarketTop = volumeSpike and aoWeekly > -aoWeeklyThreshold and isBullMarket

plotshape(series=isMarketTop ? 60 : na, style=shape.triangledown, location=location.absolute, color=color.purple, size=size.tiny, offset=0, title="Market Top")

//---------------------------------------------------------

// Buying and Selling Input parameters for the indicator

isBullMarketStartingPercent = input.float(1.0, title="Starting a Bull Market Percent", step=0.01, group="Buy and Sell")

goldenBuyPercent = input.float(0.00006, title="Golden Buy Percent", step=0.01, group="Buy and Sell")

wayOverSoldPercent = input.float(0.00004, title="Way Over Sold Percent", step=0.01, group="Buy and Sell")

overSoldPercent = input.float(0.00002, title="Over Sold Percent", step=0.01, group="Buy and Sell")

crossOverPercent = input.float(0.00002, title="Cross Over Percent", step=0.01, group="Buy and Sell")

overBoughtPercent = input.float(0.00005, title="Over Bought Percent", step=0.01, group="Buy and Sell")

wayOverBoughtPercent = input.float(0.00006, title="Way Over Bought Percent", step=0.01, group="Buy and Sell")

//Execute Buy and Sell Strategy

// Execute only if the bar's time is after the start date

if (true)

if ((isCrossover and isCrossingUp and isStartAccumulating) or isGoldenBuyZone or isBullMarketStarting)

if (isGoldenBuyZone)

strategy.entry("Golden Buy", strategy.long, qty = goldenBuyPercent * strategy.initial_capital)

//log.info("Golden Buy " + str.tostring(goldenBuyPercent))

else if (isBullMarketStarting)

strategy.entry("Bull Buy", strategy.long, qty = isBullMarketStartingPercent * strategy.initial_capital)

//log.info("Way Over Sold Buy " + str.tostring(wayOverSoldPercent))

else if (isWayOverSold)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = wayOverSoldPercent * strategy.initial_capital)

//log.info("Way Over Sold Buy " + str.tostring(wayOverSoldPercent))

else if (isOverSold)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = overSoldPercent * strategy.initial_capital)

//log.info("Over Sold Buy " + str.tostring(overSoldPercent))

else if (isCrossover)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = crossOverPercent * strategy.initial_capital)

//log.info("Crossover Buy " + str.tostring(crossOverPercent))

else if (isCrossover and isCrossingDown and isStartSelling) or isBearMarket or isMarketTop

if (isBearMarket)

strategy.close_all("Close all")

//log.info("Closing All Open Positions")

else if (isWayOverBought or isMarketTop)

int openTrades = strategy.opentrades // Get the number of open trades

int tradesToClose = math.floor(openTrades * wayOverBoughtPercent)

//log.info("# of tradesToClose= " + str.tostring(tradesToClose))

// Loop through and close 100% of the open trades determined

for i = 0 to tradesToClose

// Close the trade by referencing the correct index

strategy.close(str.tostring(openTrades - 1 - i), qty_percent = 100)

//log.info("Sell 100%: Closed trade # " + str.tostring(openTrades - 1 - i))

else if (isOverBought)

int openTrades = strategy.opentrades // Get the number of open trades

int tradesToClose = math.floor(openTrades * overBoughtPercent)

//log.info("# of tradesToClose= " + str.tostring(tradesToClose))

// Loop through and close 100% of the open trades determined

for i = 0 to tradesToClose

// Close the trade by referencing the correct index

strategy.close(str.tostring(openTrades - 1 - i), qty_percent = 100)

//log.info("Sell 100%: Closed trade # " + str.tostring(openTrades - 1 - i))

else if (isStartSelling)

strategy.close(str.tostring(strategy.opentrades - 1), qty_percent =50)

//log.info("Sell 100% of Last Trade: Closed trade # " + str.tostring(strategy.opentrades - 1))