Ringkasan

Strategi ini adalah sistem perdagangan komprehensif yang menggabungkan beberapa indikator teknis klasik, termasuk rata-rata pergerakan (MA), indeks kekuatan relatif (RSI), divergensi konvergensi rata-rata pergerakan (MACD) dan Bollinger Bands (BB). Sistem ini menggunakan kerja sama terkoordinasi dari indikator-indikator ini untuk menemukan sinyal beli dan jual yang lebih akurat di pasar, sehingga meningkatkan tingkat keberhasilan transaksi.

Prinsip Strategi

Strategi ini mengadopsi mekanisme verifikasi sinyal berlapis-lapis, yang terutama mencakup aspek-aspek berikut:

- Tentukan arah tren yang mendasarinya dengan menggunakan persilangan rata-rata pergerakan jangka pendek (9 hari) dan jangka panjang (21 hari)

- Gunakan RSI (14 hari) untuk mengidentifikasi area overbought dan oversold, menetapkan 70 dan 30 sebagai level utama

- Gunakan MACD (12, 26, 9) untuk mengkonfirmasi kekuatan tren dan kemungkinan titik balik

- Gunakan Bollinger Bands (20 hari, 2 deviasi standar) untuk menentukan kisaran fluktuasi harga dan titik pembalikan potensial

Sistem menghasilkan sinyal perdagangan dalam kondisi berikut:

- Sinyal beli utama: MA jangka pendek melintasi MA jangka panjang

- Sinyal jual utama: MA jangka pendek melintasi bawah MA jangka panjang

- Sinyal beli tambahan: RSI di bawah 30 dan histogram MACD positif dan harga menyentuh Bollinger Band bagian bawah

- Sinyal jual tambahan: RSI berada di atas 70 dan histogram MACD negatif dan harga menyentuh Bollinger Band atas

Keunggulan Strategis

- Analisis multidimensi: Dengan mengintegrasikan beberapa indikator teknis, perspektif analisis pasar yang lebih komprehensif disediakan

- Mekanisme konfirmasi sinyal: kombinasi sinyal utama dan tambahan dapat mengurangi dampak sinyal palsu

- Kontrol risiko yang sempurna: Gunakan kombinasi Bollinger Bands dan RSI untuk mengendalikan risiko titik masuk

- Kemampuan pelacakan tren: Melalui kerjasama MA dan MACD, kita tidak hanya dapat memahami tren utama, tetapi juga mengidentifikasi titik balik tren

- Efek visualisasi yang kuat: Sistem menyediakan antarmuka grafis yang jelas, termasuk petunjuk warna latar belakang dan penanda bentuk

Risiko Strategis

- Histerisis sinyal: Rata-rata pergerakan itu sendiri memiliki histerisis, yang dapat menyebabkan titik masuk yang kurang optimal

- Risiko pasar yang fluktuatif: Sinyal palsu sering terjadi di pasar yang sideways dan fluktuatif

- Indikator yang saling bertentangan: Beberapa indikator mungkin menghasilkan sinyal yang saling bertentangan pada waktu tertentu

- Sensitivitas parameter: Efek strategi sensitif terhadap pengaturan parameter dan memerlukan optimasi parameter yang memadai.

Arah optimasi strategi

- Penyesuaian parameter dinamis: Parameter setiap indikator dapat disesuaikan secara otomatis sesuai dengan volatilitas pasar

- Klasifikasi lingkungan pasar: Tambahkan mekanisme pengenalan untuk lingkungan pasar yang berbeda dan gunakan kombinasi sinyal yang berbeda dalam kondisi pasar yang berbeda

- Mekanisme stop loss yang ditingkatkan: Tambahkan skema stop loss yang lebih fleksibel, seperti trailing stop loss atau stop loss berbasis ATR

- Optimalisasi manajemen posisi: menyesuaikan ukuran posisi secara dinamis berdasarkan kekuatan sinyal dan volatilitas pasar

- Koordinasi kerangka waktu: Pertimbangkan untuk menambahkan beberapa analisis kerangka waktu untuk meningkatkan keandalan sinyal

Meringkaskan

Ini adalah sistem strategi perdagangan multidimensi yang dirancang dengan baik yang menyediakan sinyal perdagangan melalui sinergi beberapa indikator teknis. Keuntungan utama dari strategi ini terletak pada kerangka analitis yang komprehensif dan mekanisme konfirmasi sinyal yang ketat, tetapi perlu juga memperhatikan masalah-masalah seperti optimalisasi parameter dan kemampuan beradaptasi terhadap lingkungan pasar. Melalui arahan pengoptimalan yang direkomendasikan, strategi ini masih memiliki banyak ruang untuk perbaikan.

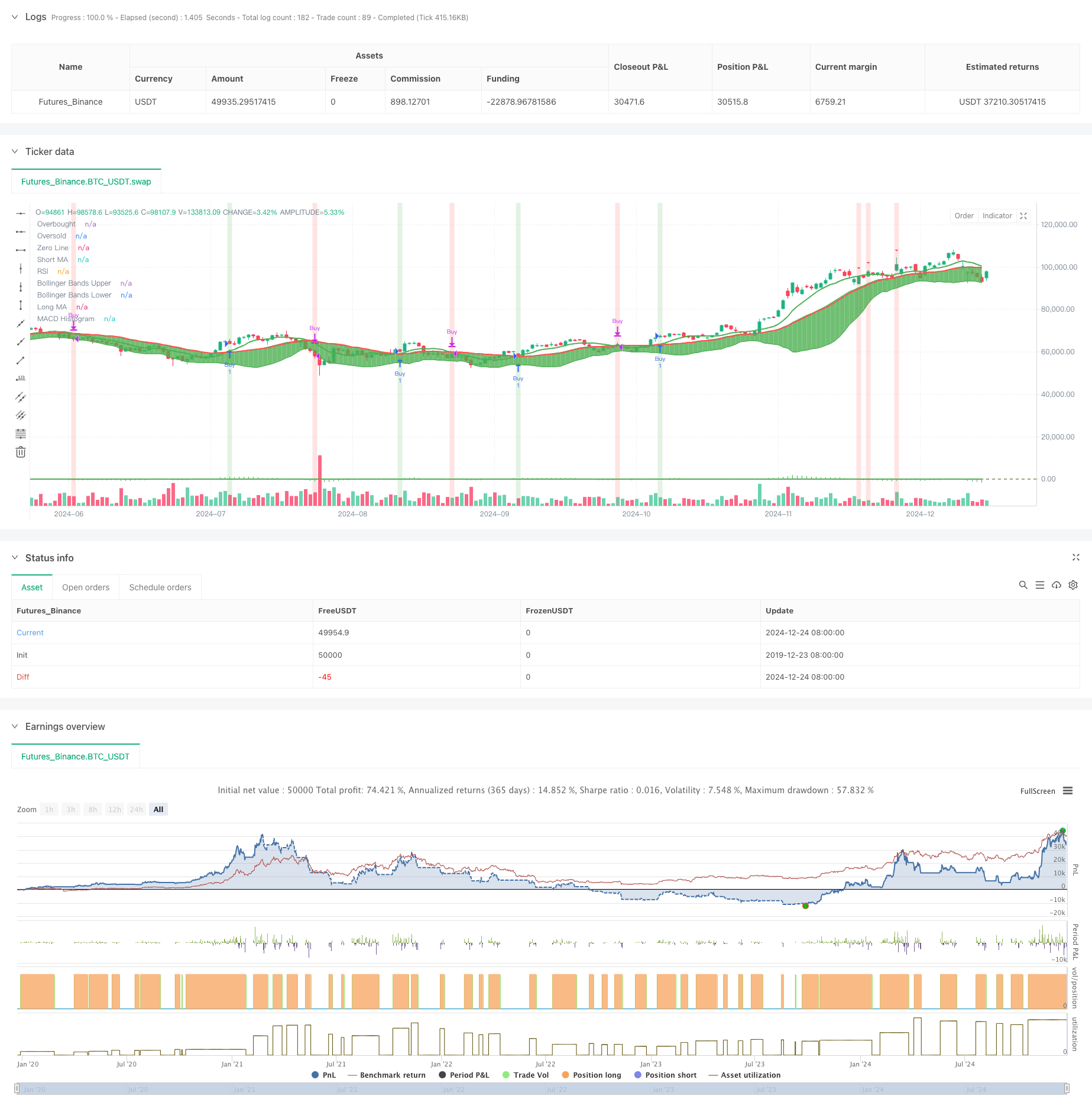

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultimate Buy/Sell Indicator", overlay=true)

// Inputs for Moving Averages

shortMaLength = input.int(9, title="Short MA Length", minval=1)

longMaLength = input.int(21, title="Long MA Length", minval=1)

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=100)

// Inputs for MACD

macdShortLength = input.int(12, title="MACD Short EMA Length", minval=1)

macdLongLength = input.int(26, title="MACD Long EMA Length", minval=1)

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing", minval=1)

// Inputs for Bollinger Bands

bbLength = input.int(20, title="Bollinger Bands Length", minval=1)

bbMultiplier = input.float(2.0, title="Bollinger Bands Multiplier", minval=0.1)

// Calculate Moving Averages

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Calculate Bollinger Bands

[bbUpper, bbBasis, bbLower] = ta.bb(close, bbLength, bbMultiplier)

// Define colors

colorPrimary = color.new(color.green, 0)

colorSecondary = color.new(color.red, 0)

colorBackgroundBuy = color.new(color.green, 80)

colorBackgroundSell = color.new(color.red, 80)

colorTextBuy = color.new(color.green, 0)

colorTextSell = color.new(color.red, 0)

// Plot Moving Averages

plot(shortMa, color=colorPrimary, linewidth=2, title="Short MA")

plot(longMa, color=colorSecondary, linewidth=2, title="Long MA")

// Plot Bollinger Bands

bbUpperLine = plot(bbUpper, color=colorPrimary, linewidth=1, title="Bollinger Bands Upper")

bbLowerLine = plot(bbLower, color=colorPrimary, linewidth=1, title="Bollinger Bands Lower")

fill(bbUpperLine, bbLowerLine, color=color.new(colorPrimary, 90))

// Buy/Sell Conditions based on MA cross

buySignal = ta.crossover(shortMa, longMa)

sellSignal = ta.crossunder(shortMa, longMa)

// Execute Buy/Sell Orders

if buySignal

strategy.entry("Buy", strategy.long, 1)

strategy.close("Sell", qty_percent=1) // Close all positions when selling

if sellSignal

strategy.close("Sell", qty_percent=1) // Close all positions when selling

strategy.close("Buy") // Close any remaining buy positions

// Plot Buy/Sell Signals for MA crossovers

plotshape(series=buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Sell Signal")

// Background Color based on Buy/Sell Signal for MA crossovers

bgcolor(buySignal ? colorBackgroundBuy : na, title="Buy Signal Background")

bgcolor(sellSignal ? colorBackgroundSell : na, title="Sell Signal Background")

// Plot RSI with Overbought/Oversold Levels

hline(rsiOverbought, "Overbought", color=colorSecondary, linestyle=hline.style_dashed, linewidth=1)

hline(rsiOversold, "Oversold", color=colorPrimary, linestyle=hline.style_dashed, linewidth=1)

plot(rsi, color=colorPrimary, linewidth=2, title="RSI")

// Plot MACD Histogram

plot(macdHist, color=colorPrimary, style=plot.style_histogram, title="MACD Histogram", linewidth=2)

hline(0, "Zero Line", color=color.new(color.gray, 80))

// Additional Buy/Sell Conditions based on RSI, MACD, and Bollinger Bands

additionalBuySignal = rsi < rsiOversold and macdHist > 0 and close < bbLower

additionalSellSignal = rsi > rsiOverbought and macdHist < 0 and close > bbUpper

// Plot Additional Buy/Sell Signals

plotshape(series=additionalBuySignal and not buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Additional Buy Signal")

plotshape(series=additionalSellSignal and not sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Additional Sell Signal")

// Background Color based on Additional Buy/Sell Signal

bgcolor(additionalBuySignal and not buySignal ? colorBackgroundBuy : na, title="Additional Buy Signal Background")

bgcolor(additionalSellSignal and not sellSignal ? colorBackgroundSell : na, title="Additional Sell Signal Background")