Ringkasan

Strategi ini adalah sistem perdagangan inovatif yang menggabungkan urutan Fibonacci dan Bollinger Bands. Ini membentuk sistem penilaian rentang fluktuasi harga yang unik dengan mengganti kelipatan deviasi standar Bollinger Bands tradisional dengan rasio Fibonacci (1,618, 2,618, 4,236). Strategi ini mencakup fungsi manajemen transaksi lengkap, termasuk pengaturan stop-profit dan stop-loss serta penyaringan jendela waktu transaksi, menjadikannya sangat praktis dan fleksibel.

Prinsip Strategi

Logika inti strategi ini didasarkan pada interaksi antara harga dan Fibonacci Bollinger Bands. Pertama, hitung rata-rata pergerakan sederhana (SMA) harga sebagai jalur tengah, lalu gunakan ATR dikalikan dengan berbagai rasio Fibonacci untuk membentuk jalur atas dan bawah. Ketika harga menembus pita Fibonacci yang dipilih pengguna, sistem akan menghasilkan sinyal perdagangan. Secara spesifik, sinyal long dipicu ketika harga terendah lebih rendah dari target band beli dan harga tertinggi lebih tinggi dari band tersebut; sinyal short dipicu ketika harga terendah lebih rendah dari target band jual dan harga tertinggi lebih tinggi dari band tersebut. dari pada band.

Keunggulan Strategis

- Kemampuan beradaptasi yang kuat: Sesuaikan bandwidth secara dinamis melalui ATR untuk membuat strategi lebih baik beradaptasi dengan lingkungan pasar yang berbeda

- Fleksibilitas tinggi: Pengguna dapat memilih pita Fibonacci yang berbeda sebagai sinyal perdagangan sesuai dengan gaya perdagangan mereka

- Manajemen risiko yang sempurna: fungsi stop-profit, stop-loss, dan penyaringan waktu bawaan untuk mengendalikan risiko secara efektif

- Intuisi Visual: Berbagai pita transparansi ditampilkan untuk membantu pedagang memahami struktur pasar

- Logika perhitungan yang jelas: Menggunakan kombinasi indikator teknis klasik, mudah dipahami dan dipelihara

Risiko Strategis

- Risiko breakout palsu: Harga mungkin turun kembali segera setelah breakout, menghasilkan sinyal palsu

- Sensitivitas parameter: Pilihan rasio Fibonacci yang berbeda dapat memengaruhi kinerja strategi secara signifikan

- Ketergantungan waktu: Jika Anda mengaktifkan jendela waktu perdagangan, Anda mungkin kehilangan peluang perdagangan penting

- Ketergantungan lingkungan pasar: dapat menghasilkan terlalu banyak sinyal perdagangan di pasar yang bergejolak

Arah optimasi strategi

- Mekanisme konfirmasi sinyal: Disarankan untuk menambahkan indikator volume atau momentum sebagai konfirmasi terobosan

- Optimasi parameter dinamis: Rasio Fibonacci dapat disesuaikan secara otomatis berdasarkan volatilitas pasar

- Penyaringan lingkungan pasar: Tambahkan fungsi penilaian tren dan gunakan parameter yang berbeda di lingkungan pasar yang berbeda

- Sistem pembobotan sinyal: Tetapkan analisis beberapa kerangka waktu untuk meningkatkan keandalan sinyal

- Optimalisasi manajemen posisi: menyesuaikan ukuran posisi secara dinamis berdasarkan volatilitas pasar dan kekuatan sinyal

Meringkaskan

Ini adalah strategi yang secara inovatif menggabungkan alat analisis teknis klasik dan mengoptimalkan strategi Bollinger Band tradisional melalui urutan Fibonacci. Keunggulan utamanya terletak pada kemampuan beradaptasi dan fleksibilitasnya, tetapi saat menggunakannya, perhatian harus diberikan pada kesesuaian antara pemilihan parameter dan lingkungan pasar. Masih banyak ruang untuk perbaikan dalam strategi ini dengan menambahkan indikator konfirmasi tambahan dan mengoptimalkan mekanisme pembangkitan sinyal.

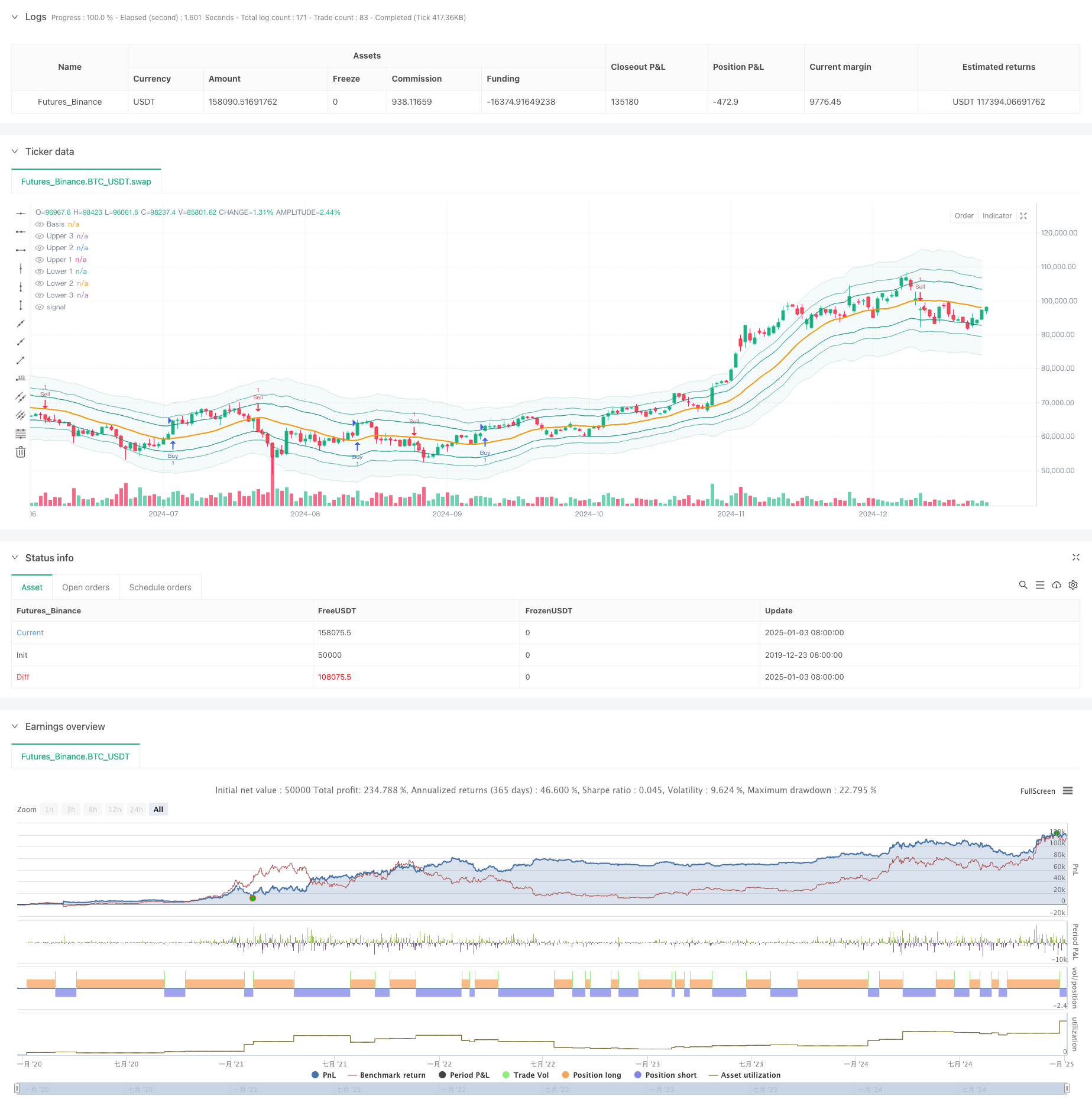

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// © sapphire_edge

// # ========================================================================= #

// #

// # _____ __ _ ______ __

// # / ___/____ _____ ____ / /_ (_)_______ / ____/___/ /___ ____

// # \__ \/ __ `/ __ \/ __ \/ __ \/ / ___/ _ \ / __/ / __ / __ `/ _ \

// # ___/ / /_/ / /_/ / /_/ / / / / / / / __/ / /___/ /_/ / /_/ / __/

// # /____/\__,_/ .___/ .___/_/ /_/_/_/ \___/ /_____/\__,_/\__, /\___/

// # /_/ /_/ /____/

// #

// # ========================================================================= #

strategy(shorttitle="⟡Sapphire⟡ FiboBands Strategy", title="[Sapphire] Fibonacci Bollinger Bands Strategy", initial_capital= 50000, currency= currency.USD,default_qty_value = 1,commission_type= strategy.commission.cash_per_contract,overlay= true )

// # ========================================================================= #

// # // Settings Menu //

// # ========================================================================= #

// -------------------- Main Settings -------------------- //

groupFiboBands = "FiboBands"

length = input.int(20, minval = 1, title = 'Length', group=groupFiboBands)

src = input(close, title = 'Source', group=groupFiboBands)

offset = input.int(0, 'Offset', minval = -500, maxval = 500, group=groupFiboBands)

fibo1 = input(defval = 1.618, title = 'Fibonacci Ratio 1', group=groupFiboBands)

fibo2 = input(defval = 2.618, title = 'Fibonacci Ratio 2', group=groupFiboBands)

fibo3 = input(defval = 4.236, title = 'Fibonacci Ratio 3', group=groupFiboBands)

fiboBuy = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Buy', group=groupFiboBands)

fiboSell = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Sell', group=groupFiboBands)

showSignals = input.bool(true, title="Show Signals", group=groupFiboBands)

signalOffset = input.int(5, title="Signal Vertical Offset", group=groupFiboBands)

// -------------------- Trade Management Inputs -------------------- //

groupTradeManagement = "Trade Management"

useProfitPerc = input.bool(false, title="Enable Profit Target", group=groupTradeManagement)

takeProfitPerc = input.float(1.0, title="Take Profit (%)", step=0.1, group=groupTradeManagement)

useStopLossPerc = input.bool(false, title="Enable Stop Loss", group=groupTradeManagement)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", step=0.1, group=groupTradeManagement)

// -------------------- Time Filter Inputs -------------------- //

groupTimeOfDayFilter = "Time of Day Filter"

useTimeFilter1 = input.bool(false, title="Enable Time Filter 1", group=groupTimeOfDayFilter)

startHour1 = input.int(0, title="Start Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

startMinute1 = input.int(0, title="Start Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

endHour1 = input.int(23, title="End Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

endMinute1 = input.int(45, title="End Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

closeAtEndTimeWindow = input.bool(false, title="Close Trades at End of Time Window", group=groupTimeOfDayFilter)

// -------------------- Trading Window -------------------- //

isWithinTradingWindow(startHour, startMinute, endHour, endMinute) =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

startInMinutes = startHour * 60 + startMinute

endInMinutes = endHour * 60 + endMinute

timeInMinutes >= startInMinutes and timeInMinutes <= endInMinutes

timeCondition = (useTimeFilter1 ? isWithinTradingWindow(startHour1, startMinute1, endHour1, endMinute1) : true)

// Check if the current bar is the last one within the specified time window

isEndOfTimeWindow() =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

endInMinutes = endHour1 * 60 + endMinute1

timeInMinutes == endInMinutes

// Logic to close trades if the time window ends

if timeCondition and closeAtEndTimeWindow and isEndOfTimeWindow()

strategy.close_all(comment="Closing trades at end of time window")

// # ========================================================================= #

// # // Calculations //

// # ========================================================================= #

sma = ta.sma(src, length)

atr = ta.atr(length)

ratio1 = atr * fibo1

ratio2 = atr * fibo2

ratio3 = atr * fibo3

upper3 = sma + ratio3

upper2 = sma + ratio2

upper1 = sma + ratio1

lower1 = sma - ratio1

lower2 = sma - ratio2

lower3 = sma - ratio3

// # ========================================================================= #

// # // Signal Logic //

// # ========================================================================= #

// -------------------- Entry Logic -------------------- //

targetBuy = fiboBuy == 'Fibo 1' ? upper1 : fiboBuy == 'Fibo 2' ? upper2 : upper3

buy = low < targetBuy and high > targetBuy

// -------------------- User-Defined Exit Logic -------------------- //

targetSell = fiboSell == 'Fibo 1' ? lower1 : fiboSell == 'Fibo 2' ? lower2 : lower3

sell = low < targetSell and high > targetSell

// # ========================================================================= #

// # // Strategy Management //

// # ========================================================================= #

// -------------------- Trade Execution Flags -------------------- //

var bool buyExecuted = false

var bool sellExecuted = false

float labelOffset = ta.atr(14) * signalOffset

// -------------------- Buy Logic -------------------- //

if buy and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Buy", strategy.long, stop=(useStopLossPerc ? close * (1 - stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 + takeProfitPerc / 100) : na))

else

strategy.entry("Buy", strategy.long)

if showSignals and not buyExecuted

buyExecuted := true

sellExecuted := false

label.new(bar_index, high - labelOffset, "◭", style=label.style_label_up, color = color.rgb(119, 0, 255, 20), textcolor=color.white)

// -------------------- Sell Logic -------------------- //

if sell and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Sell", strategy.short, stop=(useStopLossPerc ? close * (1 + stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 - takeProfitPerc / 100) : na))

else

strategy.entry("Sell", strategy.short)

if showSignals and not sellExecuted

sellExecuted := true

buyExecuted := false

label.new(bar_index, low + labelOffset, "⧩", style=label.style_label_down, color = color.rgb(255, 85, 0, 20), textcolor=color.white)

// # ========================================================================= #

// # // Plots and Charts //

// # ========================================================================= #

plot(sma, style = plot.style_line, title = 'Basis', color = color.new(color.orange, 0), linewidth = 2, offset = offset)

upp3 = plot(upper3, title = 'Upper 3', color = color.new(color.teal, 90), offset = offset)

upp2 = plot(upper2, title = 'Upper 2', color = color.new(color.teal, 60), offset = offset)

upp1 = plot(upper1, title = 'Upper 1', color = color.new(color.teal, 30), offset = offset)

low1 = plot(lower1, title = 'Lower 1', color = color.new(color.teal, 30), offset = offset)

low2 = plot(lower2, title = 'Lower 2', color = color.new(color.teal, 60), offset = offset)

low3 = plot(lower3, title = 'Lower 3', color = color.new(color.teal, 90), offset = offset)

fill(upp3, low3, title = 'Background', color = color.new(color.teal, 95))