Ringkasan

Strategi ini adalah sistem perdagangan pelacakan tren berdasarkan Gaussian Ripple dan StochRSI. Strategi ini mengidentifikasi tren pasar melalui saluran Gaussian dan menggabungkan zona overbought dan oversold dari indikator StochRSI untuk mengoptimalkan waktu masuk.

Prinsip Strategi

Inti dari strategi ini adalah saluran harga yang dibangun berdasarkan algoritma Gosnell Wave. Implementasi spesifik mencakup beberapa langkah kunci berikut:

- Fungsi f_filt9x menggunakan fungsi polinomial f_filt9x untuk mengimplementasikan gelombang Gaussian 9-kelas, dengan optimasi titik-titik untuk meningkatkan efek filter

- Jalur gelombang utama dan saluran tingkat fluktuasi berdasarkan harga HLC3

- Mode Reduced Lag diperkenalkan untuk mengurangi latensi filter, dan mode FastResponse untuk meningkatkan kecepatan respons

- Untuk menentukan sinyal perdagangan, gunakan rentang overbought/oversold (80⁄20) dari indikator Stoch RSI

- Ketika saluran Gauss naik dan harga melintasi rel, sinyal multitasking dihasilkan bersama dengan indikator StochRSI

- Ketika harga turun ke jalur yang lebih baik, keluarlah dari posisi kosong.

Keunggulan Strategis

- Gosen Wave memiliki kemampuan pengurangan kebisingan yang sangat baik, yang dapat secara efektif menyaring kebisingan pasar

- Melalui multiple matching, trend dapat dilacak dengan lancar dan mengurangi sinyal palsu.

- Mendukung optimasi latensi dan responsif mode, dapat disesuaikan dengan karakteristik pasar

- Mengoptimalkan waktu masuk dengan indikator StochRSI untuk meningkatkan tingkat keberhasilan perdagangan

- Menggunakan lebar saluran dinamis untuk beradaptasi dengan perubahan volatilitas pasar

Risiko Strategis

- Ghosn memiliki keterlambatan tertentu yang dapat menyebabkan masuk atau keluar tidak tepat waktu.

- Peningkatan biaya transaksi yang mungkin disebabkan oleh sinyal perdagangan yang sering terjadi di pasar yang bergejolak

- StochRSI dapat menghasilkan sinyal lag dalam kondisi pasar tertentu

- Proses pengoptimalan parameter yang rumit, yang memerlukan penyesuaian ulang parameter untuk berbagai kondisi pasar

- Sistem yang menuntut sumber daya komputasi yang tinggi, dengan beberapa keterlambatan dalam komputasi real-time

Arah optimasi strategi

- Memperkenalkan mekanisme optimasi parameter adaptif, menyesuaikan parameter secara dinamis sesuai dengan kondisi pasar

- Menambahkan modul identifikasi lingkungan pasar, menggunakan kombinasi parameter yang berbeda dalam kondisi pasar yang berbeda

- Optimalkan algoritma Gosselin Wave untuk mengurangi keterlambatan perhitungan

- Masukkan lebih banyak indikator teknis untuk verifikasi silang dan meningkatkan keandalan sinyal

- Mengembangkan mekanisme smart stop loss untuk meningkatkan kemampuan pengendalian risiko

Meringkaskan

Strategi ini, melalui kombinasi dari Gaussian dan StochRSI, memungkinkan pelacakan tren pasar secara efektif. Sistem ini memiliki kemampuan pengurangan kebisingan dan kemampuan untuk mengenali tren yang baik, tetapi ada juga keterbelakangan dan kesulitan dalam pengoptimalan parameter. Dengan terus-menerus mengoptimalkan dan menyempurnakan, strategi ini diharapkan untuk menghasilkan keuntungan yang stabil dalam perdagangan nyata.

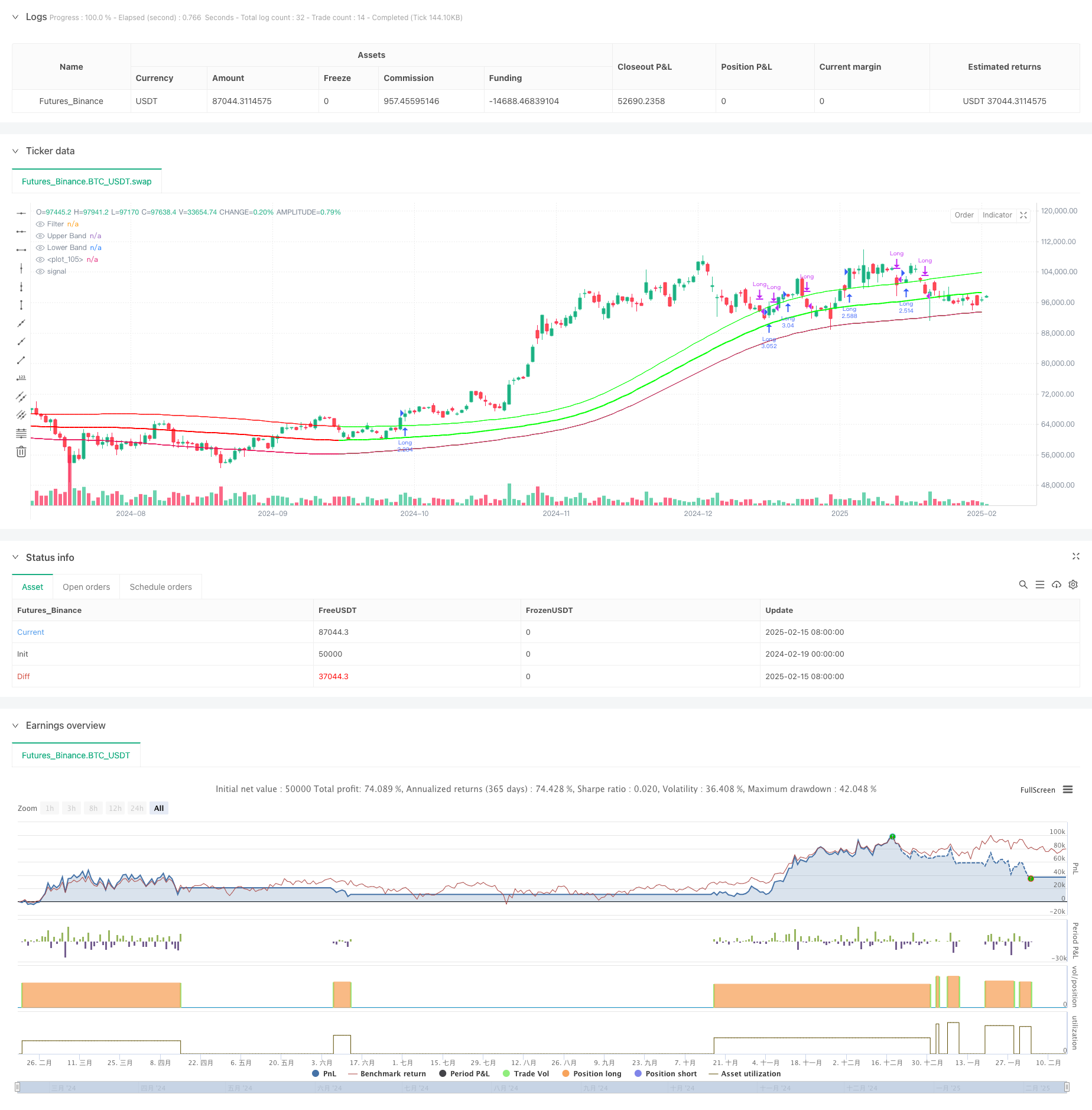

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Demo GPT - Gaussian Channel Strategy v3.0", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=0, default_qty_type=strategy.percent_of_equity, default_qty_value=250)

// ============================================

// Gaussian Functions (Must be at top)

// ============================================

f_filt9x(_a, _s, _i) =>

var int _m2 = 0, var int _m3 = 0, var int _m4 = 0, var int _m5 = 0, var int _m6 = 0,

var int _m7 = 0, var int _m8 = 0, var int _m9 = 0, var float _f = 0.0

_x = 1 - _a

_m2 := _i == 9 ? 36 : _i == 8 ? 28 : _i == 7 ? 21 : _i == 6 ? 15 : _i == 5 ? 10 : _i == 4 ? 6 : _i == 3 ? 3 : _i == 2 ? 1 : 0

_m3 := _i == 9 ? 84 : _i == 8 ? 56 : _i == 7 ? 35 : _i == 6 ? 20 : _i == 5 ? 10 : _i == 4 ? 4 : _i == 3 ? 1 : 0

_m4 := _i == 9 ? 126 : _i == 8 ? 70 : _i == 7 ? 35 : _i == 6 ? 15 : _i == 5 ? 5 : _i == 4 ? 1 : 0

_m5 := _i == 9 ? 126 : _i == 8 ? 56 : _i == 7 ? 21 : _i == 6 ? 6 : _i == 5 ? 1 : 0

_m6 := _i == 9 ? 84 : _i == 8 ? 28 : _i == 7 ? 7 : _i == 6 ? 1 : 0

_m7 := _i == 9 ? 36 : _i == 8 ? 8 : _i == 7 ? 1 : 0

_m8 := _i == 9 ? 9 : _i == 8 ? 1 : 0

_m9 := _i == 9 ? 1 : 0

_f := math.pow(_a, _i) * nz(_s) + _i * _x * nz(_f[1]) - (_i >= 2 ? _m2 * math.pow(_x, 2) * nz(_f[2]) : 0) + (_i >= 3 ? _m3 * math.pow(_x, 3) * nz(_f[3]) : 0) - (_i >= 4 ? _m4 * math.pow(_x, 4) * nz(_f[4]) : 0) + (_i >= 5 ? _m5 * math.pow(_x, 5) * nz(_f[5]) : 0) - (_i >= 6 ? _m6 * math.pow(_x, 6) * nz(_f[6]) : 0) + (_i >= 7 ? _m7 * math.pow(_x, 7) * nz(_f[7]) : 0) - (_i >= 8 ? _m8 * math.pow(_x, 8) * nz(_f[8]) : 0) + (_i == 9 ? _m9 * math.pow(_x, 9) * nz(_f[9]) : 0)

_f

f_pole(_a, _s, _i) =>

_f1 = f_filt9x(_a, _s, 1)

_f2 = _i >= 2 ? f_filt9x(_a, _s, 2) : 0.0

_f3 = _i >= 3 ? f_filt9x(_a, _s, 3) : 0.0

_f4 = _i >= 4 ? f_filt9x(_a, _s, 4) : 0.0

_f5 = _i >= 5 ? f_filt9x(_a, _s, 5) : 0.0

_f6 = _i >= 6 ? f_filt9x(_a, _s, 6) : 0.0

_f7 = _i >= 7 ? f_filt9x(_a, _s, 7) : 0.0

_f8 = _i >= 8 ? f_filt9x(_a, _s, 8) : 0.0

_f9 = _i == 9 ? f_filt9x(_a, _s, 9) : 0.0

_fn = _i == 1 ? _f1 : _i == 2 ? _f2 : _i == 3 ? _f3 : _i == 4 ? _f4 : _i == 5 ? _f5 : _i == 6 ? _f6 : _i == 7 ? _f7 : _i == 8 ? _f8 : _i == 9 ? _f9 : na

[_fn, _f1]

// ============================================

// Date Filter

// ============================================

startDate = input(timestamp("1 Jan 2018"), "Start Date", group="Time Settings")

endDate = input(timestamp("31 Dec 2069"), "End Date", group="Time Settings")

timeCondition = true

// ============================================

// Stochastic RSI (Hidden Calculations)

// ============================================

stochRsiK = input.int(3, "Stoch RSI K", group="Stochastic RSI", tooltip="Only for calculations, not visible")

stochRsiD = input.int(3, "Stoch RSI D", group="Stochastic RSI")

rsiLength = input.int(14, "RSI Length", group="Stochastic RSI")

stochLength = input.int(14, "Stochastic Length", group="Stochastic RSI")

rsiValue = ta.rsi(close, rsiLength)

k = ta.sma(ta.stoch(rsiValue, rsiValue, rsiValue, stochLength), stochRsiK)

d = ta.sma(k, stochRsiD)

// ============================================

// Gaussian Channel

// ============================================

gaussianSrc = input(hlc3, "Source", group="Gaussian")

poles = input.int(4, "Poles", minval=1, maxval=9, group="Gaussian")

samplingPeriod = input.int(144, "Sampling Period", minval=2, group="Gaussian")

multiplier = input.float(1.414, "Multiplier", step=0.1, group="Gaussian")

reducedLag = input.bool(false, "Reduced Lag Mode", group="Gaussian")

fastResponse = input.bool(false, "Fast Response Mode", group="Gaussian")

// Gaussian Calculations

beta = (1 - math.cos(4 * math.asin(1) / samplingPeriod)) / (math.pow(1.414, 2 / poles) - 1)

alpha = -beta + math.sqrt(math.pow(beta, 2) + 2 * beta)

lag = (samplingPeriod - 1) / (2 * poles)

srcData = reducedLag ? gaussianSrc + (gaussianSrc - gaussianSrc[lag]) : gaussianSrc

trData = reducedLag ? ta.tr(true) + (ta.tr(true) - ta.tr(true)[lag]) : ta.tr(true)

[mainFilter, filter1] = f_pole(alpha, srcData, poles)

[trFilter, trFilter1] = f_pole(alpha, trData, poles)

finalFilter = fastResponse ? (mainFilter + filter1) / 2 : mainFilter

finalTrFilter = fastResponse ? (trFilter + trFilter1) / 2 : trFilter

upperBand = finalFilter + finalTrFilter * multiplier

lowerBand = finalFilter - finalTrFilter * multiplier

// ============================================

// Trading Logic

// ============================================

longCondition =

finalFilter > finalFilter[1] and // Green Channel

close > upperBand and // Price above upper band

(k >= 80 or k <= 20) and // Stoch RSI condition

timeCondition

exitCondition = ta.crossunder(close, upperBand)

if longCondition

strategy.entry("Long", strategy.long)

if exitCondition

strategy.close("Long")

// ============================================

// Visuals (Gaussian Only)

// ============================================

bandColor = finalFilter > finalFilter[1] ? color.new(#00ff00, 0) : color.new(#ff0000, 0)

plot(finalFilter, "Filter", bandColor, 2)

plot(upperBand, "Upper Band", bandColor)

plot(lowerBand, "Lower Band", bandColor)

fill(plot(upperBand), plot(lowerBand), color.new(bandColor, 90))

barcolor(close > open and close > upperBand ? color.green :

close < open and close < lowerBand ? color.red : na)