Sistem perdagangan manajemen risiko dinamis berdasarkan rata-rata pergerakan dan zona penawaran dan permintaan

MA SMA DEMAND ZONE SUPPLY ZONE STOP LOSS TAKE PROFIT risk management CROSSOVER

Ringkasan

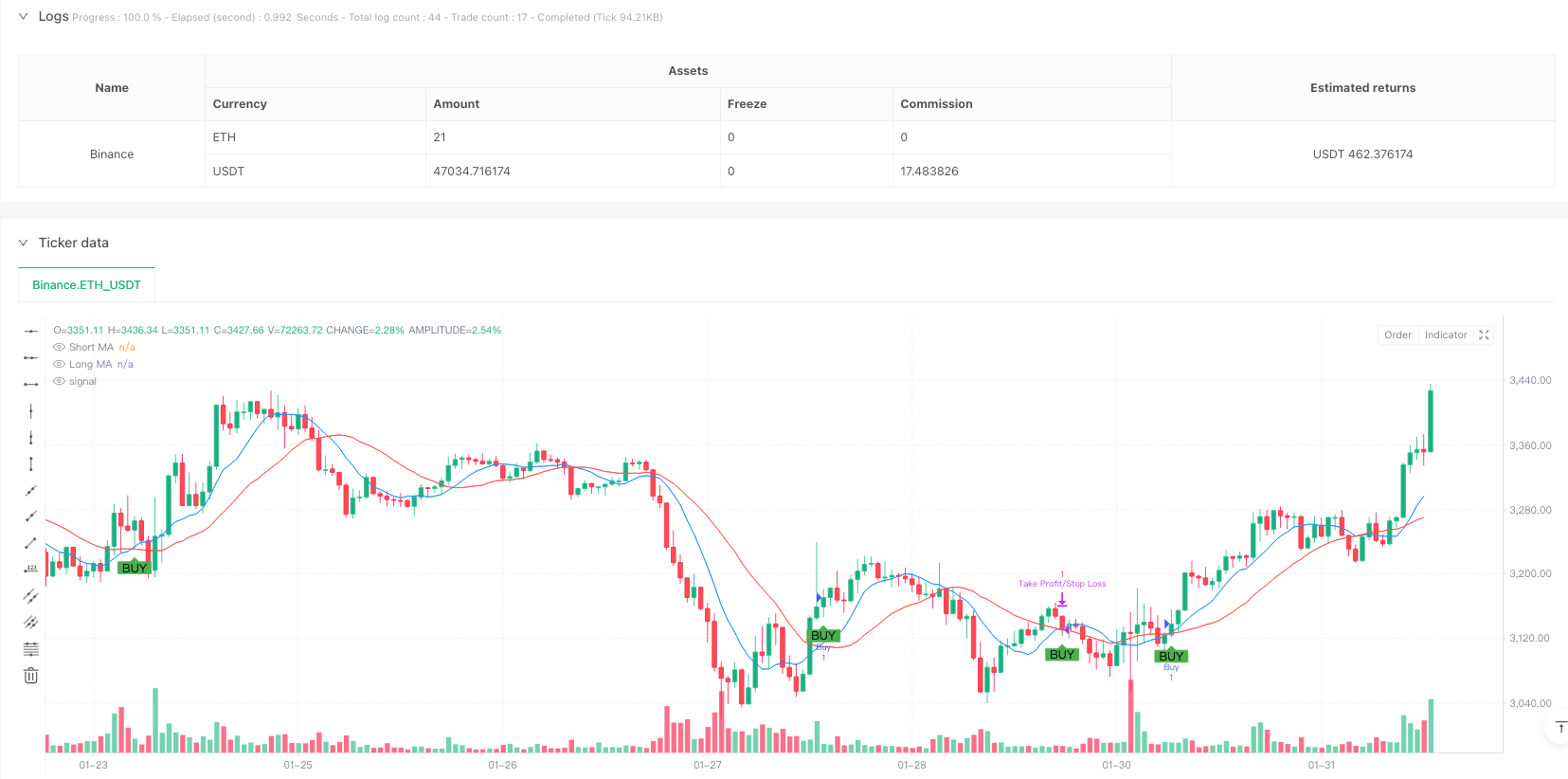

Ini adalah strategi perdagangan komprehensif yang menggabungkan persimpangan rata-rata bergerak, identifikasi area penawaran dan permintaan, dan stop loss yang dinamis. Strategi ini menentukan arah perdagangan melalui persimpangan rata-rata bergerak jangka pendek dan jangka panjang, sambil menggunakan area penawaran dan permintaan sebagai titik dukungan dan resistensi harga yang penting, dan bekerja dengan stop loss persentase untuk mengelola risiko.

Prinsip Strategi

Strategi ini menggunakan rata-rata bergerak sederhana (SMA) 9 dan 21 periode untuk menentukan arah tren. Sistem akan mengirimkan sinyal multi ketika harga berada di dalam area permintaan (support) 1% dan rata-rata jangka pendek melintasi rata-rata jangka panjang ke atas; Sistem akan mengirimkan sinyal kosong ketika harga berada di dalam area resistensi (support) 1% dan rata-rata jangka pendek melintasi rata-rata jangka panjang ke bawah.

Keunggulan Strategis

- Multiple confirmation mechanism: Menggabungkan indikator teknis (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((())))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))

- Manajemen risiko yang dinamis: Stop loss stop-loss berdasarkan persentase harga masuk yang disesuaikan dengan kondisi pasar yang berbeda

- Sinyal perdagangan visual: area permintaan dan penawaran ditandai dengan jelas pada grafik dan sinyal perdagangan untuk memudahkan analisis dan verifikasi

- Parameter yang dapat disesuaikan secara fleksibel: Periode garis rata-rata, kondisi konfirmasi wilayah permintaan dan penawaran, rasio stop loss dan stop loss dapat disesuaikan sesuai dengan karakteristik pasar yang berbeda

- Logika strategi yang jelas: kondisi masuk dan keluar yang jelas, mudah untuk dilacak dan dioptimalkan

Risiko Strategis

- Risiko pasar yang bergoyang: seringnya persilangan garis rata dapat menyebabkan terlalu banyak sinyal palsu

- Risiko slippage: perdagangan di dekat area permintaan dan penawaran mungkin menghadapi slippage yang lebih besar

- Sensitivitas parameter: parameter optimal dapat bervariasi dalam berbagai kondisi pasar

- Stop loss margin risk: Stop loss persentase tetap mungkin tidak cocok untuk semua kondisi pasar

- Manajemen risiko dana: Strategi tidak menyertakan fungsionalitas manajemen skala posisi

Arah optimasi strategi

- Pengenalan konfirmasi konversi: penambahan indikator konversi dalam analisa area persimpangan rata-rata dan penawaran permintaan untuk meningkatkan keandalan sinyal

- Optimasi parameter dinamis: otomatis menyesuaikan stop loss stop loss rasio dan area penawaran dan permintaan berdasarkan fluktuasi pasar

- Menambahkan filter tren: Menambahkan penilaian tren untuk periode yang lebih lama, menghindari perdagangan ke arah yang berlawanan dengan tren besar

- Pengelolaan dana yang lebih baik: penambahan skala posisi berdasarkan volatilitas

- Peningkatan identifikasi area penawaran dan permintaan: memperkenalkan lebih banyak indikator teknis untuk mengkonfirmasi efektivitas area penawaran dan permintaan

Meringkaskan

Ini adalah sistem strategi yang menggabungkan metode analisis teknis klasik dengan konsep manajemen risiko modern. Strategi ini memberikan kerangka perdagangan yang relatif andal dengan melakukan perdagangan di dekat area harga penting dan digabungkan dengan sinyal crossover rata-rata bergerak.

/*backtest

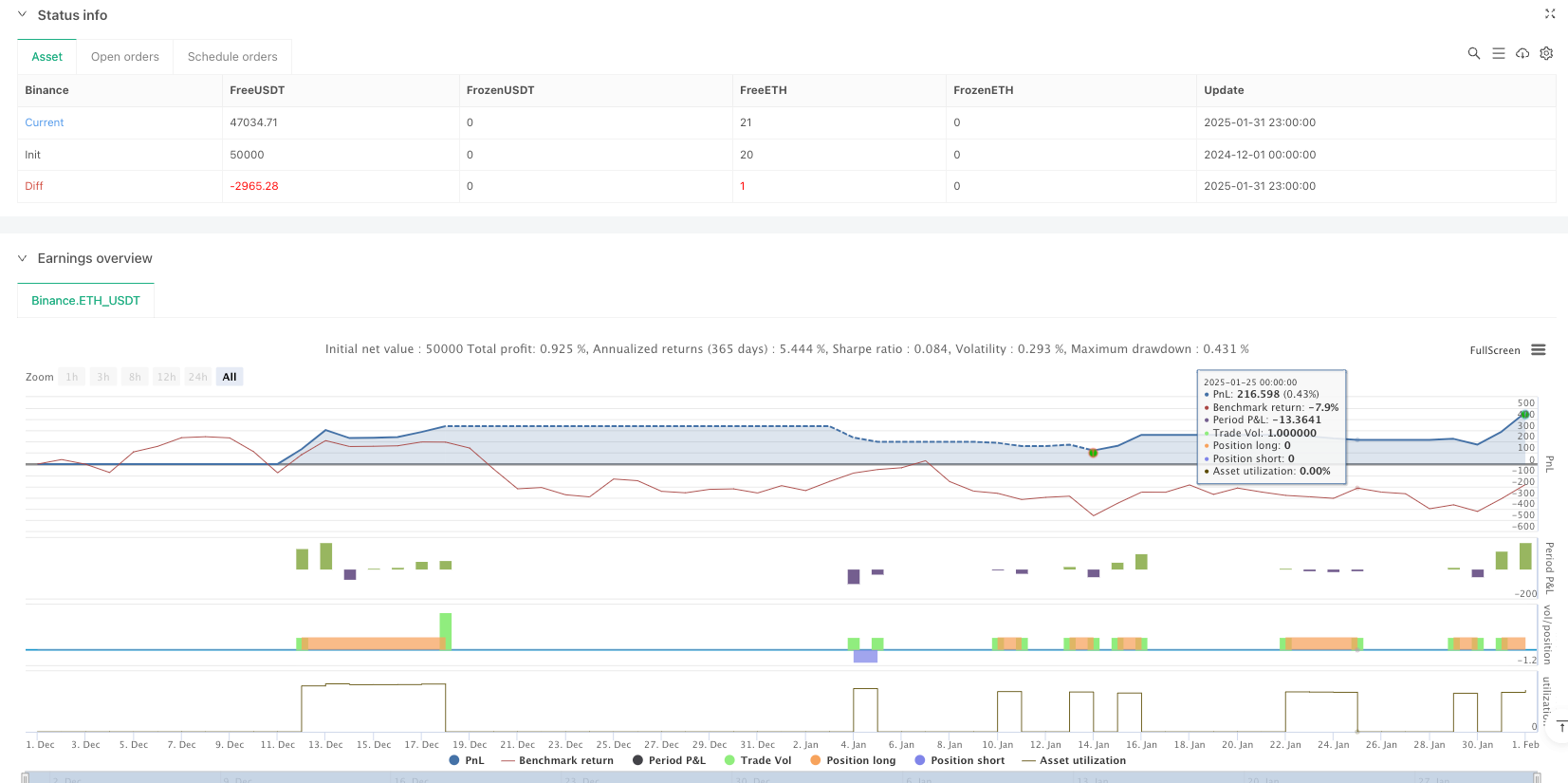

start: 2024-12-01 00:00:00

end: 2025-02-01 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("MA Crossover with Demand/Supply Zones + Stop Loss/Take Profit", overlay=true)

// Input parameters for Moving Averages

shortLength = input.int(9, title="Short MA Length", minval=1)

longLength = input.int(21, title="Long MA Length", minval=1)

// Input parameters for Demand/Supply Zones

zoneLookback = input.int(50, title="Zone Lookback Period", minval=10)

zoneStrength = input.int(2, title="Zone Strength (Candles)", minval=1)

// Input parameters for Stop Loss and Take Profit

stopLossPerc = input.float(1.0, title="Stop Loss (%)", minval=0.1) / 100

takeProfitPerc = input.float(2.0, title="Take Profit (%)", minval=0.1) / 100

// Calculate moving averages

shortMA = ta.sma(close, shortLength)

longMA = ta.sma(close, longLength)

// Plot moving averages

plot(shortMA, color=color.blue, title="Short MA")

plot(longMA, color=color.red, title="Long MA")

// Identify Demand and Supply Zones

var float demandZone = na

var float supplyZone = na

// Detect Demand Zones (Price makes a significant low and bounces up)

if (ta.lowest(low, zoneLookback) == low[zoneStrength] and close[zoneStrength] > open[zoneStrength])

demandZone := low[zoneStrength]

// Detect Supply Zones (Price makes a significant high and drops down)

if (ta.highest(high, zoneLookback) == high[zoneStrength] and close[zoneStrength] < open[zoneStrength])

supplyZone := high[zoneStrength]

// Draw Demand and Supply Zones using lines

var line demandLine = na

var line supplyLine = na

// Trade Logic: Only open trades near Demand/Supply Zones

isNearDemand = demandZone > 0 and close <= demandZone * 1.01 // Within 1% of demand zone

isNearSupply = supplyZone > 0 and close >= supplyZone * 0.99 // Within 1% of supply zone

// Calculate Stop Loss and Take Profit levels

stopLossLevel = strategy.position_avg_price * (1 - stopLossPerc) // Stop loss for long positions

takeProfitLevel = strategy.position_avg_price * (1 + takeProfitPerc) // Take profit for long positions

stopLossLevelShort = strategy.position_avg_price * (1 + stopLossPerc) // Stop loss for short positions

takeProfitLevelShort = strategy.position_avg_price * (1 - takeProfitPerc) // Take profit for short positions

// Generate buy/sell signals based on MA crossover and zones

if (ta.crossover(shortMA, longMA) and isNearDemand)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", stop=stopLossLevel, limit=takeProfitLevel)

if (ta.crossunder(shortMA, longMA) and isNearSupply)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", stop=stopLossLevelShort, limit=takeProfitLevelShort)

// Optional: Plot buy/sell signals on the chart

plotshape(series=ta.crossover(shortMA, longMA) and isNearDemand, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=ta.crossunder(shortMA, longMA) and isNearSupply, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")