Ringkasan

Strategi ini adalah sistem pelacakan tren yang menggabungkan beberapa indikator teknis. Ini terutama didasarkan pada sinyal silang RSI, MACD dan SMA untuk menentukan arah perdagangan, sementara menggunakan indikator ATR untuk secara dinamis menyesuaikan level stop loss dan profit. Strategi ini juga mengintegrasikan filter volume perdagangan untuk memastikan perdagangan di bawah likuiditas pasar yang memadai, dan menggunakan sebagian mekanisme stop loss untuk mengoptimalkan manajemen dana.

Prinsip Strategi

Strategi ini menggunakan mekanisme triple verification untuk mengkonfirmasi sinyal transaksi:

- Arah tren utama berdasarkan hubungan posisi 50 dan 200

- Gunakan RSI untuk mencari peluang masuk di area overbought dan oversold

- Kombinasi dengan indikator MACD untuk mengkonfirmasi dinamika tren

- Penggunaan filter volume transaksi untuk memastikan likuiditas pasar yang cukup

- Pengaturan target stop loss dan profit yang dinamis berdasarkan ATR

Tujuan dari verifikasi ganda adalah untuk mengurangi sinyal palsu dan meningkatkan keakuratan perdagangan. Strategi ini digunakan untuk membuka posisi dengan melakukan beberapa kondisi: (trend up + RSI dengan 40 + MACD up + konfirmasi volume transaksi) dan menggunakan ATR dua kali lipat sebagai stop loss dan empat kali lipat sebagai stop loss.

Keunggulan Strategis

- Verifikasi silang berbagai indikator teknis untuk mengurangi sinyal palsu

- Mekanisme stop loss volatilitas yang dinamis, beradaptasi dengan kondisi pasar yang berbeda

- Menggunakan strategi stop-loss parsial untuk mengunci sebagian keuntungan sambil mempertahankan ruang untuk naik

- Penyaringan volume transaksi memastikan likuiditas pasar yang memadai

- Sistem manajemen risiko yang lengkap, termasuk stop loss tetap, tracking stop loss, dan profit parsial

Risiko Strategis

- Beberapa indikator dapat menyebabkan kehilangan beberapa peluang perdagangan

- Mungkin mengalami penurunan besar di pasar yang bergejolak

- Optimasi parameter yang berlebihan dapat menyebabkan overfitting

- Penyaringan volume transaksi dapat melewatkan peluang di pasar dengan likuiditas rendah

- Stop loss dinamis mungkin dipicu terlalu dini pada saat volatilitas tinggi

Arah optimasi strategi

- Pertimbangkan untuk memasukkan mekanisme adaptasi tingkat volatilitas pasar, menyesuaikan parameter secara dinamis dalam lingkungan yang berbeda

- Memperkenalkan analisis multi-siklus untuk meningkatkan akurasi penilaian tren

- Mengoptimalkan rasio stop-loss parsial, menyesuaikan strategi stop-loss dalam kondisi pasar yang berbeda

- Menambahkan filter kekuatan tren untuk menghindari perdagangan di lingkungan tren yang lemah

- Pertimbangan untuk menambahkan analisis faktor musiman untuk optimalisasi waktu transaksi

Meringkaskan

Ini adalah strategi pelacakan tren yang komprehensif, membangun sistem perdagangan yang solid melalui penggunaan kombinasi dari beberapa indikator teknis. Karakteristik utama strategi ini adalah beradaptasi dengan perubahan pasar melalui mekanisme stop loss dan profit yang dinamis, sambil memastikan keamanan. Meskipun ada beberapa tempat yang perlu dioptimalkan, kerangka kerja secara keseluruhan masuk akal dan cocok untuk perbaikan lebih lanjut dan pengujian langsung.

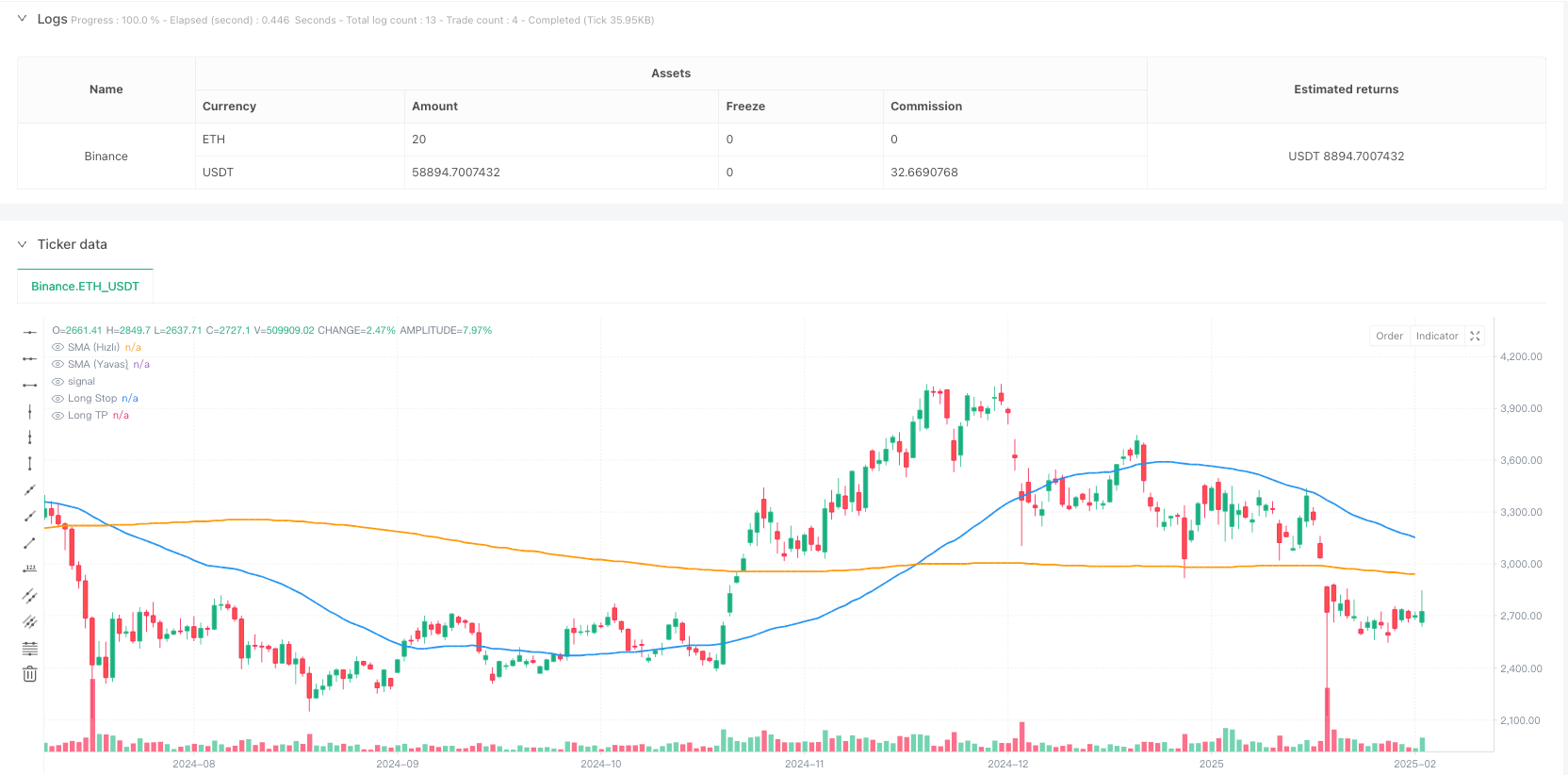

/*backtest

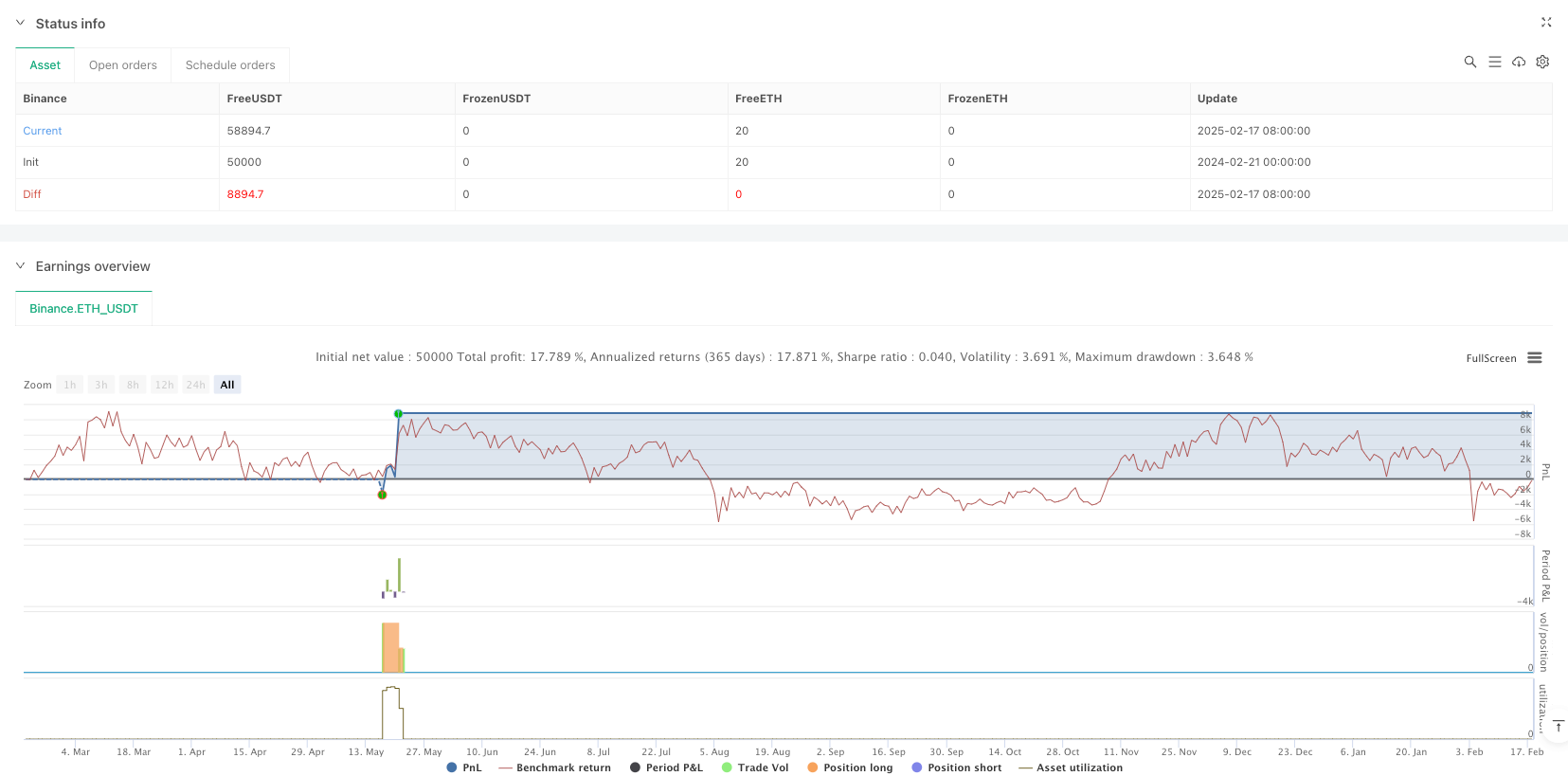

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy( title="AI Trade Strategy v2 (Extended) - Fixed", shorttitle="AI_Trade_v2", overlay=true, format=format.price, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, pyramiding=0)

//============================================================================

//=== 1) Basic Indicators (SMA, RSI, MACD) ==================================

//============================================================================

// Time Filter (optional, you can update)

inDateRange = (time >= timestamp("2018-01-01T00:00:00")) and (time <= timestamp("2069-01-01T00:00:00"))

// RSI Parameters

rsiLength = input.int(14, "RSI Period")

rsiOB = input.int(60, "RSI Overbought Level")

rsiOS = input.int(40, "RSI Oversold Level")

rsiSignal = ta.rsi(close, rsiLength)

// SMA Parameters

smaFastLen = input.int(50, "SMA Fast Period")

smaSlowLen = input.int(200, "SMA Slow Period")

smaFast = ta.sma(close, smaFastLen)

smaSlow = ta.sma(close, smaSlowLen)

// MACD Parameters

fastLength = input.int(12, "MACD Fast Period")

slowLength = input.int(26, "MACD Slow Period")

signalLength = input.int(9, "MACD Signal Period")

[macdLine, signalLine, histLine] = ta.macd(close, fastLength, slowLength, signalLength)

//============================================================================

//=== 2) Additional Filter (Volume) ========================================

//============================================================================

useVolumeFilter = input.bool(true, "Use Volume Filter?")

volumeMaPeriod = input.int(20, "Volume MA Period")

volumeMa = ta.sma(volume, volumeMaPeriod)

// If volume filter is enabled, current bar volume should be greater than x times the average volume

volMultiplier = input.float(1.0, "Volume Multiplier (Volume > x * MA)")

volumeFilter = not useVolumeFilter or (volume > volumeMa * volMultiplier)

//============================================================================

//=== 3) Trend Conditions (SMA) ============================================

//============================================================================

isBullTrend = smaFast > smaSlow

isBearTrend = smaFast < smaSlow

//============================================================================

//=== 4) Entry Conditions (RSI + MACD + Trend + Volume) ====================

//============================================================================

// RSI crossing above 30 + Bullish Trend + Positive MACD + Volume Filter

longCondition = isBullTrend and ta.crossover(rsiSignal, rsiOS) and (macdLine > signalLine) and volumeFilter

shortCondition = isBearTrend and ta.crossunder(rsiSignal, rsiOB) and (macdLine < signalLine) and volumeFilter

//============================================================================

//=== 5) ATR-based Stop + Trailing Stop ===================================

//============================================================================

atrPeriod = input.int(14, "ATR Period")

atrMultiplierSL = input.float(2.0, "Stop Loss ATR Multiplier")

atrMultiplierTP = input.float(4.0, "Take Profit ATR Multiplier")

atrValue = ta.atr(atrPeriod)

//============================================================================

//=== 6) Trade (Position) Management ======================================

//============================================================================

if inDateRange

//--- Long Entry ---

if longCondition

strategy.entry(id="Long", direction=strategy.long, comment="Long Entry")

//--- Short Entry ---

if shortCondition

strategy.entry(id="Short", direction=strategy.short, comment="Short Entry")

//--- Stop & TP for Long Position ---

if strategy.position_size > 0

// ATR-based fixed Stop & TP calculation

longStopPrice = strategy.position_avg_price - atrValue * atrMultiplierSL

longTakeProfit = strategy.position_avg_price + atrValue * atrMultiplierTP

// PARTIAL EXIT: (Example) take 50% of the position at early TP

partialTP = strategy.position_avg_price + (atrValue * 2.5)

strategy.exit( id = "Partial TP Long", stop = na, limit = partialTP, qty_percent= 50, from_entry = "Long" )

// Trailing Stop + Final ATR Stop

// WARNING: trail_offset=... is the offset in price units.

// For example, in BTCUSDT, a value like 300 means a 300 USDT trailing distance.

float trailingDist = atrValue * 1.5

strategy.exit( id = "Long Exit (Trail)", stop = longStopPrice, limit = longTakeProfit, from_entry = "Long", trail_offset= trailingDist )

//--- Stop & TP for Short Position ---

if strategy.position_size < 0

// ATR-based fixed Stop & TP calculation for Short

shortStopPrice = strategy.position_avg_price + atrValue * atrMultiplierSL

shortTakeProfit = strategy.position_avg_price - atrValue * atrMultiplierTP

// PARTIAL EXIT: (Example) take 50% of the position at early TP

partialTPShort = strategy.position_avg_price - (atrValue * 2.5)

strategy.exit( id = "Partial TP Short", stop = na, limit = partialTPShort, qty_percent= 50, from_entry = "Short" )

// Trailing Stop + Final ATR Stop for Short

float trailingDistShort = atrValue * 1.5

strategy.exit( id = "Short Exit (Trail)", stop = shortStopPrice, limit = shortTakeProfit, from_entry = "Short", trail_offset= trailingDistShort )

//============================================================================

//=== 7) Plot on Chart (SMA, etc.) =========================================

//============================================================================

plot(smaFast, color=color.blue, linewidth=2, title="SMA (Fast)")

plot(smaSlow, color=color.orange, linewidth=2, title="SMA (Slow)")

// (Optional) Plot Stop & TP levels dynamically:

longStopForPlot = strategy.position_size > 0 ? strategy.position_avg_price - atrValue * atrMultiplierSL : na

longTPForPlot = strategy.position_size > 0 ? strategy.position_avg_price + atrValue * atrMultiplierTP : na

shortStopForPlot = strategy.position_size < 0 ? strategy.position_avg_price + atrValue * atrMultiplierSL : na

shortTPForPlot = strategy.position_size < 0 ? strategy.position_avg_price - atrValue * atrMultiplierTP : na

plot(longStopForPlot, color=color.red, style=plot.style_linebr, title="Long Stop")

plot(longTPForPlot, color=color.green, style=plot.style_linebr, title="Long TP")

plot(shortStopForPlot, color=color.red, style=plot.style_linebr, title="Short Stop")

plot(shortTPForPlot, color=color.green, style=plot.style_linebr, title="Short TP")