Ringkasan

Strategi ini adalah sistem perdagangan komprehensif yang menggabungkan filter Gaussian Channel dan indikator RSI acak. Strategi ini menggunakan model matematika yang rumit untuk membangun saluran yang dapat secara efektif menyaring kebisingan pasar dan menangkap perubahan harga yang signifikan.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada komponen-komponen kunci berikut:

- Calculation of Gaussian channel: Menggunakan filter Gaussian multipolar untuk memproses data harga HLC3 untuk menciptakan saluran adaptif. Mengoptimalkan efek filter dengan parameter beta dan alpha, dan dapat dipilih untuk mengurangi lag.

- Penyesuaian lebar saluran: penyesuaian lebar saluran secara dinamis berdasarkan amplitudo riil ((TR), menggunakan 1.414 sebagai perkalian default.

- Sinyal RSI acak: Kombinasi 14 siklus RSI dan indikator acak, menghasilkan sinyal di atas 80 atau di bawah 20.

- Syarat masuk: harus memenuhi tiga syarat sekaligus: Gaussian channel up, harga breakthrough on track, dan sinyal trigger RSI acak.

- Logika Keluar: Pecat posisi saat harga turun di atas Gaussian channel.

Keunggulan Strategis

- Keandalan sinyal: mekanisme konfirmasi multi-indikator secara signifikan meningkatkan keandalan sinyal perdagangan.

- Adaptif: Gauss Channel dapat menyesuaikan lebar saluran secara otomatis sesuai dengan fluktuasi pasar.

- Filter kebisingan: Filter Gaussian efektif mengurangi dampak kebisingan pasar.

- Fleksibilitas tinggi: menyediakan beberapa parameter yang dapat disesuaikan, termasuk siklus jalur, jumlah titik kutub, dan parameter RSI.

- Intuisi visual: Mengindikasikan arah tren dan sinyal perdagangan melalui perubahan warna.

Risiko Strategis

- Sensitivitas parameter: Jumlah titik dan pengaturan siklus sampel saluran Gaussian berpengaruh besar pada kinerja strategi.

- Risiko keterbelakangan: Meskipun ada opsi untuk mengurangi keterbelakangan, indikator itu sendiri masih memiliki keterbelakangan.

- Risiko terobosan palsu: Sering terjadi sinyal terobosan palsu di pasar horizontal.

- Kurangnya manajemen dana: versi saat ini tidak memiliki mekanisme manajemen posisi yang terperinci.

Arah optimasi strategi

- Identifikasi kondisi pasar: Menambahkan indikator kekuatan tren, menyesuaikan parameter strategi dalam kondisi pasar yang berbeda.

- Pengoptimalan parameter dinamis: pengaturan parameter saluran Gaussian secara otomatis disesuaikan dengan volatilitas pasar.

- Pengelolaan posisi yang lebih baik: Sistem manajemen posisi dinamis yang didasarkan pada volatilitas.

- Peningkatan mekanisme exit: Peningkatan Stop Loss Mobile dan sebagian keuntungan dari mekanisme close-out.

- Optimasi kerangka waktu: Memverifikasi sinyal pada beberapa kerangka waktu, meningkatkan stabilitas transaksi.

Meringkaskan

Strategi ini membangun sistem perdagangan dengan adaptivitas yang lebih kuat dengan menggabungkan filter Gaussian Channel dan indikator RSI acak. Dasar matematika Gaussian Channel menjamin kehalusan dan keandalan sinyal, sementara kombinasi RSI acak meningkatkan akurasi waktu masuk lebih jauh. Keunggulan utama strategi ini adalah penyaringan yang efektif dari kebisingan pasar dan pengendalian yang akurat terhadap tren, tetapi juga perlu memperhatikan masalah optimasi numerik dan manajemen risiko.

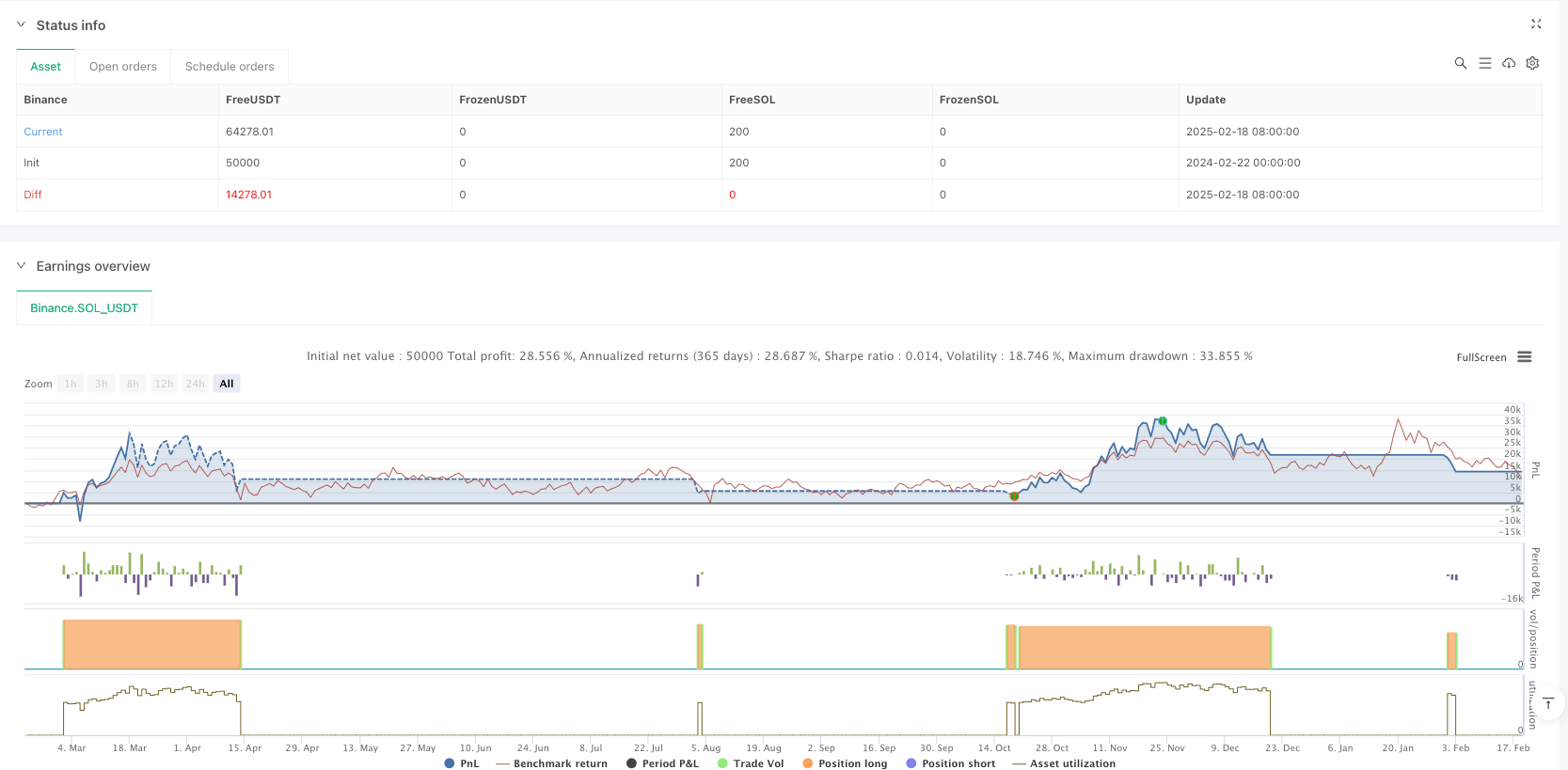

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy(title="Gaussian Channel Strategy v3.0", overlay=true, calc_on_every_tick=false, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1, slippage=0, fill_orders_on_standard_ohlc=true)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Gaussian Filter Functions (Must be declared first)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

f_filt9x(_a, _s, _i) =>

var int _m2 = 0, var int _m3 = 0, var int _m4 = 0, var int _m5 = 0, var int _m6 = 0,

var int _m7 = 0, var int _m8 = 0, var int _m9 = 0, var float _f = .0

_x = 1 - _a

_m2 := _i == 9 ? 36 : _i == 8 ? 28 : _i == 7 ? 21 : _i == 6 ? 15 : _i == 5 ? 10 : _i == 4 ? 6 : _i == 3 ? 3 : _i == 2 ? 1 : 0

_m3 := _i == 9 ? 84 : _i == 8 ? 56 : _i == 7 ? 35 : _i == 6 ? 20 : _i == 5 ? 10 : _i == 4 ? 4 : _i == 3 ? 1 : 0

_m4 := _i == 9 ? 126 : _i == 8 ? 70 : _i == 7 ? 35 : _i == 6 ? 15 : _i == 5 ? 5 : _i == 4 ? 1 : 0

_m5 := _i == 9 ? 126 : _i == 8 ? 56 : _i == 7 ? 21 : _i == 6 ? 6 : _i == 5 ? 1 : 0

_m6 := _i == 9 ? 84 : _i == 8 ? 28 : _i == 7 ? 7 : _i == 6 ? 1 : 0

_m7 := _i == 9 ? 36 : _i == 8 ? 8 : _i == 7 ? 1 : 0

_m8 := _i == 9 ? 9 : _i == 8 ? 1 : 0

_m9 := _i == 9 ? 1 : 0

_f := math.pow(_a, _i) * nz(_s) + _i * _x * nz(_f[1]) - (_i >= 2 ? _m2 * math.pow(_x, 2) * nz(_f[2]) : 0) + (_i >= 3 ? _m3 * math.pow(_x, 3) * nz(_f[3]) : 0) - (_i >= 4 ? _m4 * math.pow(_x, 4) * nz(_f[4]) : 0) + (_i >= 5 ? _m5 * math.pow(_x, 5) * nz(_f[5]) : 0) - (_i >= 6 ? _m6 * math.pow(_x, 6) * nz(_f[6]) : 0) + (_i >= 7 ? _m7 * math.pow(_x, 7) * nz(_f[7]) : 0) - (_i >= 8 ? _m8 * math.pow(_x, 8) * nz(_f[8]) : 0) + (_i == 9 ? _m9 * math.pow(_x, 9) * nz(_f[9]) : 0)

f_pole(_a, _s, _i) =>

_f1 = f_filt9x(_a, _s, 1)

_f2 = _i >= 2 ? f_filt9x(_a, _s, 2) : 0.0

_f3 = _i >= 3 ? f_filt9x(_a, _s, 3) : 0.0

_f4 = _i >= 4 ? f_filt9x(_a, _s, 4) : 0.0

_f5 = _i >= 5 ? f_filt9x(_a, _s, 5) : 0.0

_f6 = _i >= 6 ? f_filt9x(_a, _s, 6) : 0.0

_f7 = _i >= 7 ? f_filt9x(_a, _s, 7) : 0.0

_f8 = _i >= 8 ? f_filt9x(_a, _s, 8) : 0.0

_f9 = _i == 9 ? f_filt9x(_a, _s, 9) : 0.0

_fn = _i == 1 ? _f1 : _i == 2 ? _f2 : _i == 3 ? _f3 : _i == 4 ? _f4 : _i == 5 ? _f5 : _i == 6 ? _f6 : _i == 7 ? _f7 : _i == 8 ? _f8 : _i == 9 ? _f9 : na

[_fn, _f1]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Gaussian Channel

int poles = input.int(4, "Poles", 1, 9, group="Gaussian Channel")

int period = input.int(144, "Sampling Period", 2, group="Gaussian Channel")

float mult = input.float(1.414, "True Range Multiplier", group="Gaussian Channel")

bool reducedLag = input.bool(false, "Reduced Lag Mode", group="Gaussian Channel")

bool fastResponse = input.bool(false, "Fast Response Mode", group="Gaussian Channel")

// Stochastic RSI

smoothK = input.int(3, "K", 1, group="Stochastic RSI")

smoothD = input.int(3, "D", 1, group="Stochastic RSI")

lengthRSI = input.int(14, "RSI Length", 1, group="Stochastic RSI")

lengthStoch = input.int(14, "Stochastic Length", 1, group="Stochastic RSI")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Calculations

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Gaussian Channel

beta = (1 - math.cos(4*math.asin(1)/period)) / (math.pow(1.414, 2/poles) - 1)

alpha = -beta + math.sqrt(math.pow(beta, 2) + 2*beta)

lag = (period - 1)/(2*poles)

src = hlc3

srcData = reducedLag ? src + (src - src[lag]) : src

trData = reducedLag ? ta.tr + (ta.tr - ta.tr[lag]) : ta.tr

[filterMain, filter1] = f_pole(alpha, srcData, poles)

[filterTRMain, filterTR1] = f_pole(alpha, trData, poles)

finalFilter = fastResponse ? (filterMain + filter1)/2 : filterMain

finalTR = fastResponse ? (filterTRMain + filterTR1)/2 : filterTRMain

hband = finalFilter + finalTR * mult

lband = finalFilter - finalTR * mult

// Stochastic RSI

rsi = ta.rsi(close, lengthRSI)

k = ta.sma(ta.stoch(rsi, rsi, rsi, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Trading Logic

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

gaussianGreen = finalFilter > finalFilter[1]

priceAbove = close > hband

stochCondition = k > 80 or k < 20

longCondition = gaussianGreen and priceAbove and stochCondition

exitCondition = ta.crossunder(close, hband)

strategy.entry("Long", strategy.long, when=longCondition)

strategy.close("Long", when=exitCondition)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Visuals

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

filterColor = finalFilter > finalFilter[1] ? #0aff68 : #ff0a5a

plot(finalFilter, "Filter", filterColor, 2)

plot(hband, "High Band", filterColor)

plot(lband, "Low Band", filterColor)

fill(plot(hband), plot(lband), color.new(filterColor, 90), "Channel Fill")