Ringkasan

Strategi ini didasarkan pada analisa metafisika dari sentimen pasar, dengan tiga osilator utama: osilator keengganan, osilator ketakutan, dan osilator keserakahan. Strategi ini mengintegrasikan dinamika dan indikator tren, sekaligus menggabungkan pengesahan volume untuk membangun sistem perdagangan yang lengkap. Strategi ini cocok untuk pedagang yang ingin mengidentifikasi peluang perdagangan probabilitas tinggi melalui analisis sentimen pasar.

Prinsip Strategi

Inti dari strategi ini adalah membangun tiga osilator emosi dengan menganalisis berbagai bentuk grafik:

- Oscillator Reluctance - mengukur ketidakpastian pasar melalui bentuk bintang salib dan putaran putar

- Oscillator Ketakutan - melacak emosi kosong melalui meteor, garis tegak dan bentuk menelan penurunan

- Oscillator Kecemburuan - mendeteksi emosi multi-kepala dengan sinar matahari, pita kalung, pengintai, dan tiga tentara putih

Nilai rata-rata dari ketiga osilator ini membentuk indeks sentimen bullish ((CEI)). Ketika CEI menembus berbagai titik terendah, sinyal perdagangan bullish dipicu dan dikonfirmasi oleh volume transaksi.

Keunggulan Strategis

- Analisis emosi yang sistematis - mengubah analisis subjektif menjadi indikator objektif melalui bentuk grafik kuantitatif

- Manajemen risiko yang baik - mekanisme yang mencakup periode maksimum, stop loss, dan cooling-off

- Mekanisme pemulihan yang fleksibel - ketika perdagangan mengalami kerugian, strategi akan mencoba untuk pulih dengan menembus titik keseimbangan

- Kepraktisan multi-pasar - dapat diterapkan di beberapa pasar seperti saham, forex, dan cryptocurrency

- Keandalan sinyal yang tinggi - meningkatkan akurasi dengan konfirmasi volume transaksi dan verifikasi multi-indikator teknis

Risiko Strategis

- Sensitivitas parameter - pengaturan untuk berbagai jenis threshold perlu diuji dan dioptimalkan

- Ketergantungan pada kondisi pasar - dapat memberikan sinyal yang salah dalam pasar yang bergejolak

- Risiko slippage - risiko eksekusi yang mungkin terjadi di pasar yang kurang likuid

- Risiko overtrading - perlu mengatur periode pendinginan yang masuk akal untuk menghindari perdagangan yang sering terjadi

- Risiko sistemik - kemungkinan kerugian besar dalam peristiwa pasar besar

Arah optimasi strategi

- Dynamic Thresholds - Mengatur berbagai jenis threshold secara otomatis sesuai dengan volatilitas pasar

- Klasifikasi Kondisi Pasar - Mekanisme untuk mengidentifikasi peningkatan tren dan pasar yang bergoyang

- Optimasi pembelajaran mesin - mengoptimalkan kombinasi parameter dengan algoritma pembelajaran mesin

- Peningkatan manajemen risiko - penambahan manajemen modal dan kontrol posisi

- Filter Sinyal - Mengintegrasikan lebih banyak indikator teknis untuk memfilter sinyal palsu

Meringkaskan

Ini adalah strategi inovatif yang menggabungkan analisis teknis dengan perdagangan kuantitatif. Dengan analisis emosi yang sistematis dan manajemen risiko yang ketat, strategi ini mampu memberikan sinyal perdagangan yang andal bagi para pedagang. Meskipun ada ruang untuk optimalisasi, kerangka dasar strategi ini solid dan cocok untuk pengembangan lebih lanjut dan aplikasi di pasar.

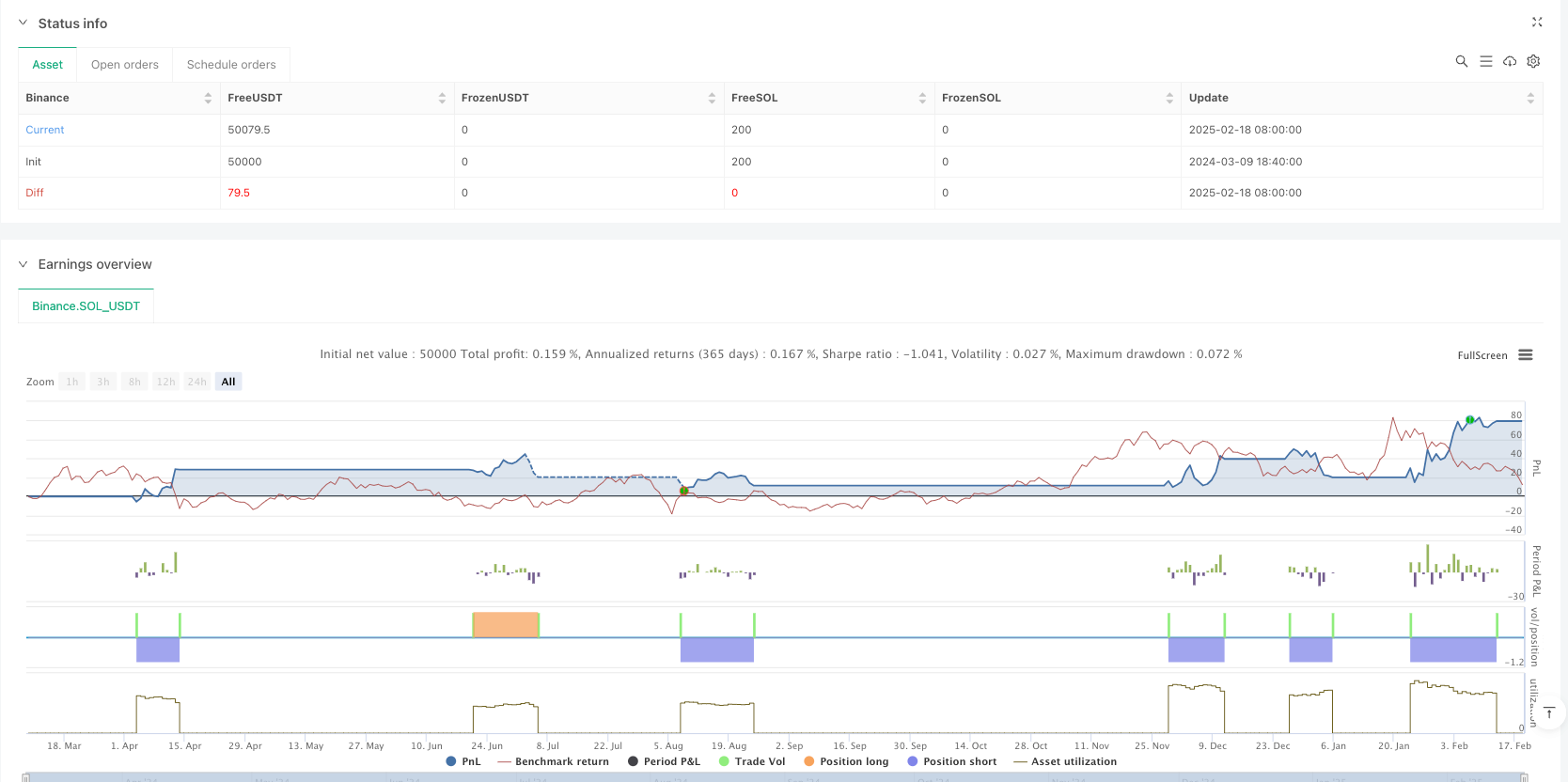

/*backtest

start: 2024-03-09 18:40:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("Candle Emotion Index Strategy", shorttitle="CEI Strategy", overlay=true)

// User Inputs

length = input.int(14, title="Lookback Period", minval=1)

dojiThreshold = input.float(0.1, title="Doji Threshold", minval=0.01, maxval=0.5)

spinningTopThreshold = input.float(0.3, title="Spinning Top Threshold", minval=0.1, maxval=0.5)

shootingStarThreshold = input.float(0.5, title="Shooting Star Threshold", minval=0.1, maxval=1.0)

hangingManThreshold = input.float(0.5, title="Hanging Man Threshold", minval=0.1, maxval=1.0)

engulfingThreshold = input.float(0.5, title="Engulfing Threshold", minval=0.1, maxval=1.0)

marubozuThreshold = input.float(0.9, title="Marubozu Threshold", minval=0.5, maxval=1.0)

hammerThreshold = input.float(0.5, title="Hammer Threshold", minval=0.1, maxval=1.0)

threeWhiteSoldiersThreshold = input.float(0.5, title="Three White Soldiers Threshold", minval=0.1, maxval=1.0)

// Volume Multiplier Input

volumeMultiplier = input.float(1.5, title="Volume Multiplier", minval=1.0)

// Cooldown Period Input

cooldownPeriod = input.int(10, title="Cooldown Period (Candles)", minval=1)

// Maximum Holding Period Inputs

maxHoldingPeriod = input.int(20, title="Maximum Holding Period (Candles)", minval=1)

lossHoldingPeriod = input.int(10, title="Loss Exit Holding Period (Candles)", minval=1)

lossThreshold = input.float(0.02, title="Loss Threshold (as % of Entry Price)", minval=0.01, maxval=1.0)

// --- Indecision Oscillator Functions ---

isDoji(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize / rangeSize < threshold

isSpinningTop(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize / rangeSize < threshold and bodySize / rangeSize >= dojiThreshold

indecisionOscillator() =>

var float dojiScore = 0.0

var float spinningTopScore = 0.0

for i = 1 to length

if isDoji(open[i], close[i], high[i], low[i], dojiThreshold)

dojiScore := dojiScore + 1.0

if isSpinningTop(open[i], close[i], high[i], low[i], spinningTopThreshold)

spinningTopScore := spinningTopScore + 1.0

dojiScore := dojiScore / length

spinningTopScore := spinningTopScore / length

(dojiScore + spinningTopScore) / 2

// --- Fear Oscillator Functions ---

isShootingStar(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

lowerWick = math.min(open, close) - low

upperWick / bodySize > threshold and lowerWick < bodySize

isHangingMan(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

lowerWick = math.min(open, close) - low

lowerWick / bodySize > threshold and upperWick < bodySize

isBearishEngulfing(open, close, openPrev, closePrev, threshold) =>

bodySize = math.abs(close - open)

prevBodySize = math.abs(closePrev - openPrev)

close < openPrev and open > closePrev and bodySize / prevBodySize > threshold

fearOscillator() =>

var float shootingStarScore = 0.0

var float hangingManScore = 0.0

var float engulfingScore = 0.0

for i = 1 to length

if isShootingStar(open[i], close[i], high[i], low[i], shootingStarThreshold)

shootingStarScore := shootingStarScore + 1.0

if isHangingMan(open[i], close[i], high[i], low[i], hangingManThreshold)

hangingManScore := hangingManScore + 1.0

if isBearishEngulfing(open[i], close[i], open[i+1], close[i+1], engulfingThreshold)

engulfingScore := engulfingScore + 1.0

shootingStarScore := shootingStarScore / length

hangingManScore := hangingManScore / length

engulfingScore := engulfingScore / length

(shootingStarScore + hangingManScore + engulfingScore) / 3

// --- Greed Oscillator Functions ---

isMarubozu(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

totalRange = high - low

bodySize / totalRange > threshold

isHammer(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

upperWick = high - math.max(open, close)

lowerWick / bodySize > threshold and upperWick < bodySize

isBullishEngulfing(open, close, openPrev, closePrev, threshold) =>

bodySize = math.abs(close - open)

prevBodySize = math.abs(closePrev - openPrev)

close > openPrev and open < closePrev and bodySize / prevBodySize > threshold

isThreeWhiteSoldiers(open, close, openPrev, closePrev, openPrev2, closePrev2, threshold) =>

close > open and closePrev > openPrev and closePrev2 > openPrev2 and close > closePrev and closePrev > closePrev2

greedOscillator() =>

var float marubozuScore = 0.0

var float hammerScore = 0.0

var float engulfingScore = 0.0

var float soldiersScore = 0.0

for i = 1 to length

if isMarubozu(open[i], close[i], high[i], low[i], marubozuThreshold)

marubozuScore := marubozuScore + 1.0

if isHammer(open[i], close[i], high[i], low[i], hammerThreshold)

hammerScore := hammerScore + 1.0

if isBullishEngulfing(open[i], close[i], open[i+1], close[i+1], engulfingThreshold)

engulfingScore := engulfingScore + 1.0

if isThreeWhiteSoldiers(open[i], close[i], open[i+1], close[i+1], open[i+2], close[i+2], threeWhiteSoldiersThreshold)

soldiersScore := soldiersScore + 1.0

marubozuScore := marubozuScore / length

hammerScore := hammerScore / length

engulfingScore := engulfingScore / length

soldiersScore := soldiersScore / length

(marubozuScore + hammerScore + engulfingScore + soldiersScore) / 4

// --- Final Calculations ---

indecision = indecisionOscillator()

fear = fearOscillator()

greed = greedOscillator()

// Calculate the average of the three oscillators

averageOscillator = (indecision + fear + greed) / 3

// --- Combined Strategy Logic ---

var float entryPriceLong = na

var float entryPriceShort = na

var int holdingPeriodLong = 0

var int holdingPeriodShort = 0

var int cooldownCounter = 0

// Buy Signal Logic for Long and Short

longBuySignal = ta.crossover(averageOscillator, 0.1)

shortBuySignal = ta.crossover(averageOscillator, 0.2)

// Calculate average volume over the lookback period

avgVolume = ta.sma(volume, length)

// Take Profit Conditions

longTakeProfitCondition = close > open and volume > avgVolume * volumeMultiplier

shortTakeProfitCondition = close < open and volume > avgVolume * volumeMultiplier

// Buy Logic for Long Positions

if longBuySignal and strategy.position_size == 0 and cooldownCounter <= 0

entryPriceLong := close

strategy.entry("Long Entry", strategy.long)

cooldownCounter := cooldownPeriod

holdingPeriodLong := 0

// Increment holding period if in a long position

if strategy.position_size > 0

holdingPeriodLong := holdingPeriodLong + 1

// Sell Logic for Long Positions

if longTakeProfitCondition and strategy.position_size > 0 and close > entryPriceLong

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodLong >= maxHoldingPeriod and strategy.position_size > 0 and close >= entryPriceLong

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodLong >= lossHoldingPeriod and strategy.position_size > 0 and close < entryPriceLong * (1 - lossThreshold)

strategy.close_all()

cooldownCounter := cooldownPeriod

// Short Logic for Short Positions

if shortBuySignal and strategy.position_size == 0 and cooldownCounter <= 0

entryPriceShort := close

strategy.entry("Short Entry", strategy.short)

cooldownCounter := cooldownPeriod

holdingPeriodShort := 0

// Increment holding period if in a short position

if strategy.position_size < 0

holdingPeriodShort := holdingPeriodShort + 1

// Cover Logic for Short Positions

if shortTakeProfitCondition and strategy.position_size < 0 and close < entryPriceShort

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodShort >= maxHoldingPeriod and strategy.position_size < 0 and close <= entryPriceShort

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodShort >= lossHoldingPeriod and strategy.position_size < 0 and close > entryPriceShort * (1 + lossThreshold)

strategy.close_all()

cooldownCounter := cooldownPeriod

// Decrement the cooldown counter each candle

if cooldownCounter > 0

cooldownCounter := cooldownCounter - 1