2

fokus pada

366

Pengikut

Ringkasan

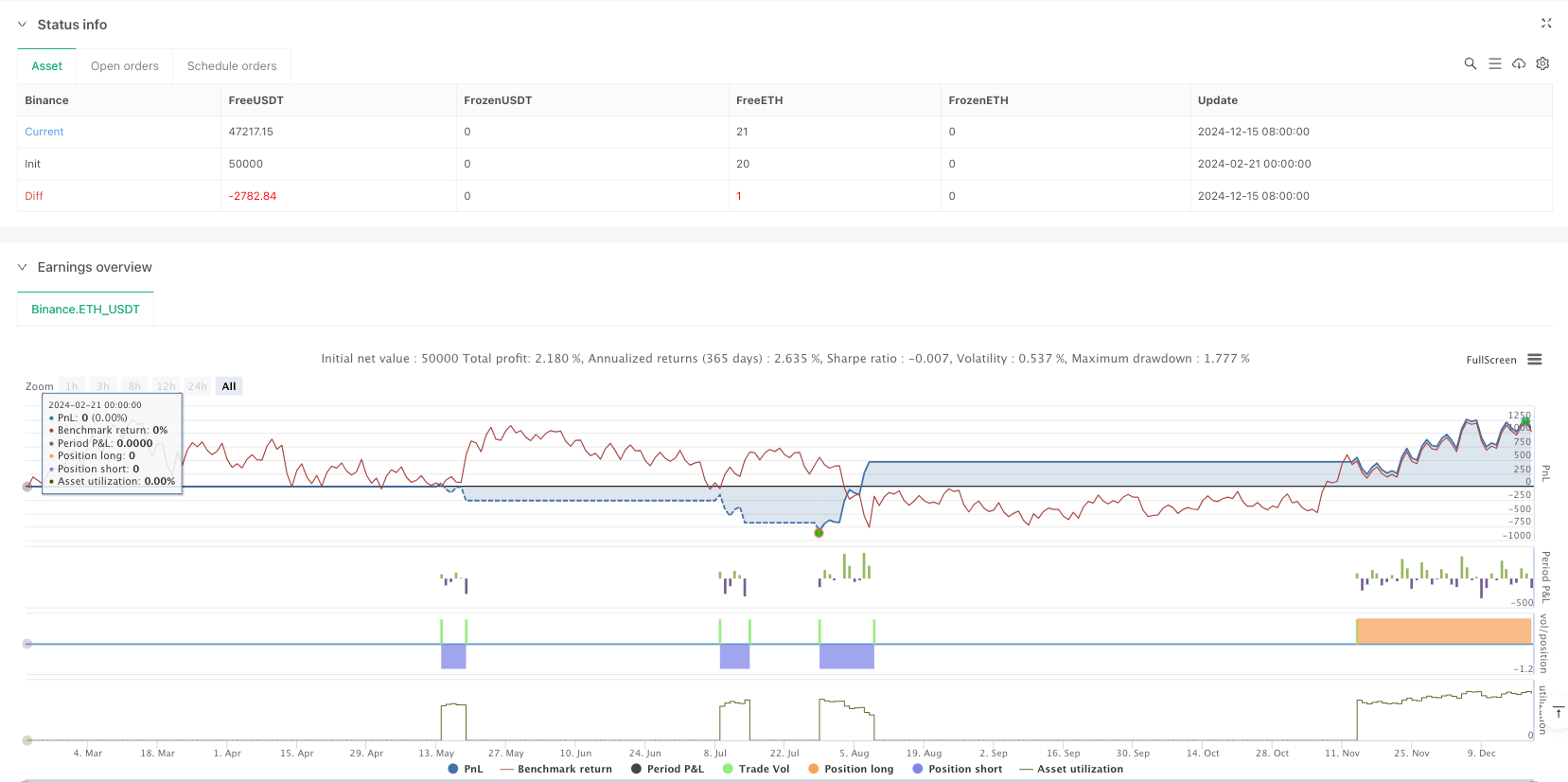

Strategi ini adalah sistem perdagangan kuantitatif yang menggabungkan crossing moving averages (MA) dan trend tracking. Ini menggunakan 15 periode SMA sebagai filter tren, sementara menggunakan crossing 9 periode dan 21 periode indeks moving averages (EMA) untuk menghasilkan sinyal perdagangan.

Prinsip Strategi

Logika inti dari strategi ini didasarkan pada elemen-elemen kunci berikut:

- Pengakuan tren: Menggunakan 15 siklus SMA sebagai indikator utama untuk menilai tren. Harga di atas 15 SMA dianggap sebagai tren naik, sebaliknya sebagai tren turun.

- Sinyal perdagangan: Sinyal perdagangan dipicu oleh persimpangan 9EMA dan 21EMA. Sinyal ganda dihasilkan ketika 9EMA melewati 21EMA dan memenuhi persyaratan lainnya. Sinyal kosong dihasilkan ketika 9EMA melewati 21EMA dan memenuhi persyaratan lainnya.

- Syarat konfirmasi: melakukan multiply membutuhkan dua garis lurus yang berurutan, dan kedua EMA berada di atas 15 SMA; melakukan shorting membutuhkan garis lurus, dan kedua EMA berada di bawah 15 SMA.

- Manajemen risiko: Sistem secara otomatis menghitung stop loss dan profit target berdasarkan entry point, dengan pengaturan rasio risiko / keuntungan 1: 4.

Keunggulan Strategis

- Trend Tracking: Menggunakan mekanisme penyaringan tren dari 15 SMA, dapat secara efektif menghindari perdagangan di posisi lateral atau berlawanan arah.

- Mekanisme pengesahan ganda: Menggabungkan kondisi ganda seperti persilangan rata-rata, pengesahan bentuk grafik dan tren, untuk mengurangi risiko sinyal palsu.

- Pengelolaan risiko yang baik: Rasio keuntungan risiko yang tetap dan pengaturan stop loss otomatis, yang menguntungkan untuk operasi yang stabil dalam jangka panjang.

- Keterangan visual yang jelas: Sistem memberikan petunjuk visual yang jelas, termasuk penandaan sinyal perdagangan dan tampilan tingkat stop loss.

Risiko Strategis

- Risiko keterlambatan: Moving Average pada dasarnya merupakan indikator keterlambatan yang mungkin tidak bereaksi tepat waktu ketika pasar berubah dengan cepat.

- Risiko terobosan palsu: sinyal silang palsu dapat dihasilkan di pasar horizontal.

- Keterbatasan rasio risiko tetap: rasio risiko dan keuntungan tetap 1:4 mungkin tidak cocok untuk semua kondisi pasar.

- Risiko kerugian beruntun: Stop loss beruntun dapat terjadi di pasar yang bergejolak.

Arah optimasi strategi

- Optimasi siklus dinamis: dapat secara otomatis menyesuaikan siklus rata-rata bergerak sesuai dengan fluktuasi pasar.

- Masukkan filter volatilitas: Tambahkan ATR atau indikator volatilitas lainnya untuk mengoptimalkan waktu masuk.

- Manajemen risiko dinamis: Tingkat risiko / keuntungan disesuaikan secara dinamis dengan kondisi pasar.

- Meningkatkan penilaian kondisi pasar: memperkenalkan indikator kekuatan tren untuk mengoptimalkan kondisi perdagangan.

Meringkaskan

Ini adalah strategi pelacakan tren yang dirancang secara rasional dan logis. Strategi ini memiliki kepraktisan yang baik dengan menggabungkan beberapa indikator teknis dan manajemen risiko yang ketat. Meskipun ada beberapa risiko yang melekat, strategi ini dapat ditingkatkan lebih lanjut dengan stabilitas dan profitabilitas melalui arah optimasi yang disarankan.

Kode Sumber Strategi

/*backtest

start: 2024-02-21 00:00:00

end: 2024-12-19 00:00:00

period: 4d

basePeriod: 4d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with 15 SMA Trend", overlay=true, margin_long=100, margin_short=100)

// Calculate Indicators

sma15 = ta.sma(close, 15)

ema9 = ta.ema(close, 9)

ema21 = ta.ema(close, 21)

// Trend Detection

uptrend = close > sma15

downtrend = close < sma15

// Crossover Conditions

goldenCross = ta.crossover(ema9, ema21)

deathCross = ta.crossunder(ema9, ema21)

// Candle Conditions

twoBullish = (close > open) and (close[1] > open[1])

bearishCandle = (close < open)

// Entry Conditions

longCondition = goldenCross and uptrend and twoBullish and (ema9 > sma15) and (ema21 > sma15)

shortCondition = deathCross and downtrend and bearishCandle and (ema9 < sma15) and (ema21 < sma15)

// Risk Management

var float longStop = na

var float longTarget = na

var float shortStop = na

var float shortTarget = na

if longCondition

longStop := low

longTarget := close + 4*(close - longStop)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long", stop=longStop, limit=longTarget)

if shortCondition

shortStop := high

shortTarget := close - 4*(shortStop - close)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short", stop=shortStop, limit=shortTarget)

// Visual Elements

plot(sma15, "15 SMA", color=color.orange)

plot(ema9, "9 EMA", color=color.blue)

plot(ema21, "21 EMA", color=color.red)

// Plot trading levels

plot(longCondition ? longStop : na, "Long Stop", color=color.red, style=plot.style_linebr)

plot(longCondition ? longTarget : na, "Long Target", color=color.green, style=plot.style_linebr)

plot(shortCondition ? shortStop : na, "Short Stop", color=color.red, style=plot.style_linebr)

plot(shortCondition ? shortTarget : na, "Short Target", color=color.green, style=plot.style_linebr)

// Signal Markers

plotshape(longCondition, "Buy", shape.triangleup, location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition, "Sell", shape.triangledown, location.abovebar, color=color.red, size=size.small)