Ringkasan

Strategi perdagangan cerdas bertimbangan multi-indikator adalah sistem perdagangan kuantitatif yang komprehensif yang menghasilkan keputusan perdagangan dengan mengintegrasikan sinyal dari beberapa indikator teknis dan memberikan bobot yang berbeda. Strategi ini menggabungkan berbagai alat analisis teknis seperti MACD, RSI acak, EMA, supertrend, dan crossover rata-rata bergerak untuk membentuk kerangka perdagangan yang komprehensif. Sistem ini tidak hanya mendukung mekanisme stop loss dan stop loss bertingkat, tetapi juga dapat menyesuaikan parameter perdagangan secara otomatis sesuai dengan kondisi pasar, sehingga dapat tetap beradaptasi tinggi dalam berbagai lingkungan pasar.

Prinsip Strategi

Inti dari strategi ini adalah sistem sinyal berbobot yang menghasilkan sinyal perdagangan melalui lima substrategi yang berbeda:

Strategi MACD: Menggunakan garis MACD dan garis sinyal yang bersilang untuk menentukan arah tren pasar. Ketika MACD melewati garis sinyal menghasilkan sinyal beli, ketika melewati garis sinyal menghasilkan sinyal jual.

Strategi RSI acak: Menggabungkan keuntungan dari RSI dan indikator acak, untuk memantau keadaan pasar overbought dan oversold. Sinyal beli dihasilkan ketika RSI acak berada di bawah ambang batas overbought yang ditetapkan, dan sinyal jual dihasilkan ketika melebihi ambang batas overbought.

Strategi EMA untuk Membeli dan Menjual: Menggunakan EMA untuk mengidentifikasi seberapa jauh harga menyimpang dari nilai rata-rata, menghasilkan sinyal beli ketika RSI berada di bawah batas oversold yang ditetapkan, menghasilkan sinyal jual ketika melebihi batas oversold.

Strategi Tren Super: Mengatur saluran harga berdasarkan perkalian ATR, untuk menentukan arah perdagangan melalui perubahan tren. Ketika indikator supertrend menghasilkan sinyal beli ketika berbalik negatif, menghasilkan sinyal jual ketika berbalik positif negatif.

Strategi Crossover Rata-rata Bergerak: Menggunakan persilangan rata-rata bergerak dari dua periode yang berbeda untuk menentukan tren pasar. Ketika garis rata-rata jangka pendek melewati garis rata-rata jangka panjang, sinyal beli dihasilkan, dan sinyal jual dihasilkan saat melewati garis rata-rata.

Strategi menghitung sinyal dari masing-masing substrategi dengan sistem bobot yang dapat disesuaikan, yang hanya akan memicu perdagangan jika jumlah yang ditimbang melebihi batas yang ditetapkan. Strategi juga mencakup mekanisme identifikasi teratas dan bawah yang berpotensi untuk menyesuaikan posisi ketika pasar mungkin berbalik.

Mekanisme konfirmasi sinyal bertingkat ini secara efektif mengurangi sinyal palsu, meningkatkan keandalan sistem perdagangan, sementara pengaturan parameter yang fleksibel memungkinkan strategi untuk beradaptasi dengan varietas perdagangan dan periode waktu yang berbeda.

Keunggulan Strategis

Sinyal konfirmasi gandaPerhitungan dengan penambahan bobot pada sinyal yang dihasilkan oleh lima indikator teknis independen, mengurangi kemungkinan kesalahan dalam satu indikator, meningkatkan kualitas dan keandalan sinyal perdagangan.

Sistem gravitasi adaptifSetiap substrategi dapat diberikan berat yang berbeda, memungkinkan pedagang untuk menyesuaikan fokus strategi mereka berdasarkan tingkat kepercayaan diri mereka terhadap berbagai indikator dan kinerja historis, meningkatkan fleksibilitas strategi.

Manajemen Risiko yang BaikStrategi ini memiliki mekanisme pengendalian risiko bertingkat, termasuk fungsi stop loss, multi-tingkat stop loss, dan penyesuaian posisi stop loss secara dinamis, untuk memastikan bahwa risiko dapat dikendalikan dengan cepat ketika terjadi perubahan pasar yang merugikan.

Mengotomatiskan identifikasi potensiDengan analisis RSI, volume perdagangan, dan pergerakan harga, strategi dapat mengidentifikasi potensi puncak dan dasar pasar, dan pada saat yang tepat, posisi terendah, mengunci keuntungan atau mengurangi kerugian.

Kustomisasi TinggiHampir semua parameter dapat disesuaikan, termasuk siklus perhitungan, bobot, persentase stop loss, dan lainnya untuk setiap indikator, memungkinkan pedagang untuk mengoptimalkan strategi sesuai dengan gaya pribadi dan kondisi pasar yang berbeda.

Penundaan bawaanStrategi ini menggunakan mekanisme konfirmasi tertunda untuk menghindari masuk ke perdagangan terlalu dini atau perdagangan berdasarkan sinyal bising, memastikan bahwa hanya sinyal yang berkelanjutan yang akan memicu perdagangan, mengurangi dampak dari fluktuasi jangka pendek.

Fungsi penyaringan waktuStrategi: Memungkinkan untuk mengatur tanggal mulai dan berakhirnya perdagangan, sehingga pedagang dapat memantau kinerja periode tertentu berdasarkan data historis, atau menghindari periode ketidakstabilan pasar yang diketahui.

Risiko Strategis

Risiko overoptimisasi parameterKarena banyaknya parameter, ada risiko over-fitting data historis, yang dapat menyebabkan strategi tidak berkinerja baik dalam perdagangan langsung. Solusinya adalah melakukan pengujian ulang pada beberapa periode waktu dan varietas, menggunakan pengaturan parameter yang relatif stabil, dan menghindari optimasi berlebihan untuk data historis tertentu.

Risiko perubahan kondisi pasarStrategi mungkin berbeda dalam pasar tren dan pasar bergolak, dan perubahan tiba-tiba dalam kondisi pasar dapat menyebabkan penurunan efektivitas strategi. Solusinya adalah dengan memperkenalkan mekanisme identifikasi lingkungan pasar, menyesuaikan parameter atau menghentikan perdagangan dalam kondisi pasar yang berbeda.

Risiko Konflik Sinyal: Menggunakan beberapa indikator pada saat yang sama dapat menghasilkan sinyal yang saling bertentangan, yang menyebabkan kebingungan dalam pengambilan keputusan. Solusinya adalah mengatur berat masing-masing indikator secara rasional, menekankan indikator yang lebih dapat diandalkan, dan memastikan pengaturan sinyal yang masuk akal untuk mengurangi kemungkinan konflik.

Risiko dari salah pengelolaan danaMeskipun strategi ini mencakup mekanisme stop loss, manajemen dana yang tidak masuk akal masih dapat menyebabkan dana cepat habis. Solusinya adalah dengan ketat mengontrol proporsi dana untuk setiap transaksi, memastikan bahwa risiko maksimum untuk setiap transaksi berada dalam batas yang dapat ditanggung.

Risiko kegagalan teknisSistem perdagangan otomatis dapat menghadapi masalah teknis seperti gangguan jaringan, keterlambatan data. Solusi adalah dengan menyiapkan mekanisme intervensi manual, memantau status operasi sistem secara teratur, dan menangani keadaan yang tidak biasa pada waktu yang tepat.

Arah optimasi strategi

Bergabung dengan Marketplace Filter: Mengembangkan indikator yang dapat mengidentifikasi apakah pasar saat ini sedang tren atau goncang, menyesuaikan bobot masing-masing substrategi sesuai dengan dinamika kondisi pasar, memperkuat strategi pelacakan tren di pasar yang sedang tren, memperkuat strategi ayunan di pasar yang bergolak.

Memperkenalkan optimasi pembelajaran mesinMenggunakan teknologi pembelajaran mesin untuk secara otomatis menyesuaikan parameter dan bobot masing-masing indikator, memungkinkan strategi untuk terus belajar dan beradaptasi berdasarkan data pasar terbaru, meningkatkan kemampuan adaptasi dinamis strategi.

Menambahkan analisis volume transaksi: Menggunakan perubahan volume transaksi sebagai sinyal konfirmasi tambahan, dan melakukan transaksi hanya dengan dukungan volume transaksi yang sesuai dengan ekspektasi, meningkatkan kredibilitas sinyal.

Mengoptimalkan algoritma identifikasi top-bottom potensial: Meningkatkan logika identifikasi top-bottom yang ada, menambahkan lebih banyak faktor konfirmasi, seperti bentuk harga, konfirmasi multi-siklus, dan lain-lain, untuk meningkatkan akurasi identifikasi.

Menambahkan indikator emosiMengintegrasikan indikator sentimen pasar, seperti indeks panik (VIX) dan rasio opsi bullish-bullish, menyesuaikan strategi perdagangan atau menghentikan perdagangan saat sentimen pasar ekstrem, dan menghindari perdagangan berlebihan pada periode fluktuasi tinggi.

Mengembangkan mekanisme Stop Loss Dinamis: Mengatur stop loss secara otomatis sesuai dengan volatilitas pasar, memperluas stop loss di pasar yang berfluktuasi tinggi, memperketat stop loss di pasar yang berfluktuasi rendah, membuat manajemen risiko lebih fleksibel dan efektif.

Pengoptimalan siklus waktu: Menambahkan fungsi analisis siklus waktu ganda, yang memerlukan periode waktu tingkat lebih tinggi dan lebih rendah untuk mengkonfirmasi sinyal secara bersamaan, mengurangi penembusan palsu dan sinyal palsu.

Meringkaskan

Strategi perdagangan cerdas bertimbangan multi-indikator membangun sistem perdagangan yang komprehensif dan fleksibel dengan mengintegrasikan berbagai alat analisis teknis dan memberikan berbagai timbangan. Strategi ini tidak hanya memiliki multiple confirmation sinyal, sistem timbangan adaptif, dan fungsi manajemen risiko yang baik, tetapi juga mencakup mekanisme identifikasi top-bottom potensial untuk otomatisasi, yang membuatnya lebih mudah beradaptasi dalam lingkungan pasar yang berubah-ubah yang kompleks.

Meskipun ada risiko potensial seperti parameter over-optimisasi, perubahan kondisi pasar dan konflik sinyal, risiko ini dapat dikendalikan secara efektif dengan pengaturan parameter yang masuk akal, identifikasi lingkungan pasar dan manajemen dana yang ketat. Arah optimasi di masa depan meliputi penambahan filter lingkungan pasar, pengenalan teknologi pembelajaran mesin, peningkatan analisis volume transaksi, dan optimalisasi algoritma identifikasi potensial.

Untuk investor yang mencari metode perdagangan yang sistematis, strategi perdagangan cerdas dengan berat multi-indikator ini memberikan kerangka kerja yang layak untuk dipertimbangkan, yang tidak hanya dapat mengurangi pengaruh faktor emosional pada keputusan perdagangan, tetapi juga dapat secara berkelanjutan mengoptimalkan kinerja perdagangan dengan cara yang didorong oleh data. Dalam menerapkan strategi ini, disarankan untuk memulai dengan pengaturan parameter yang konservatif, secara bertahap menyesuaikan dan memantau kinerja strategi dengan cermat untuk menemukan konfigurasi yang paling sesuai dengan preferensi risiko pribadi dan kondisi pasar.

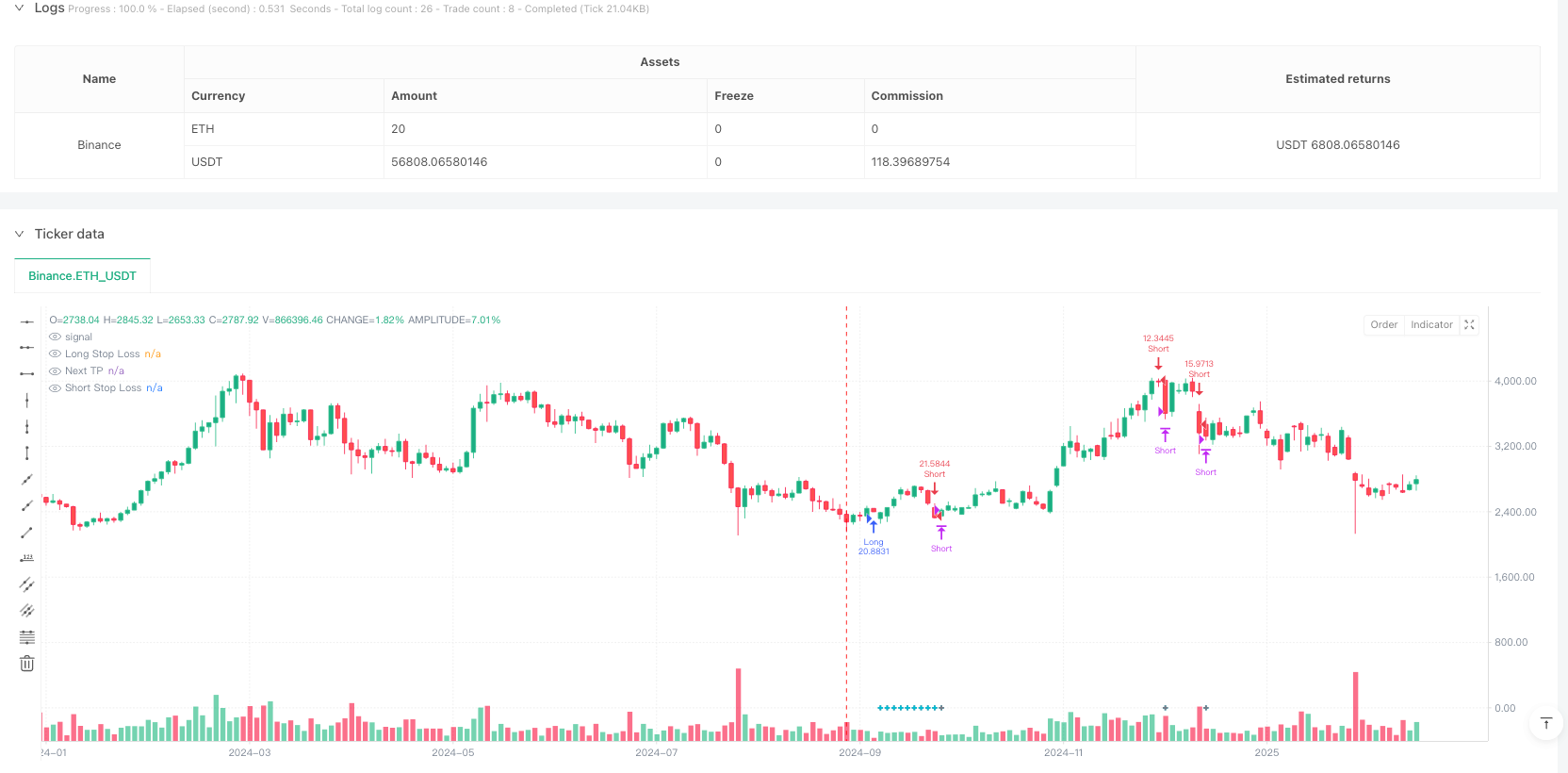

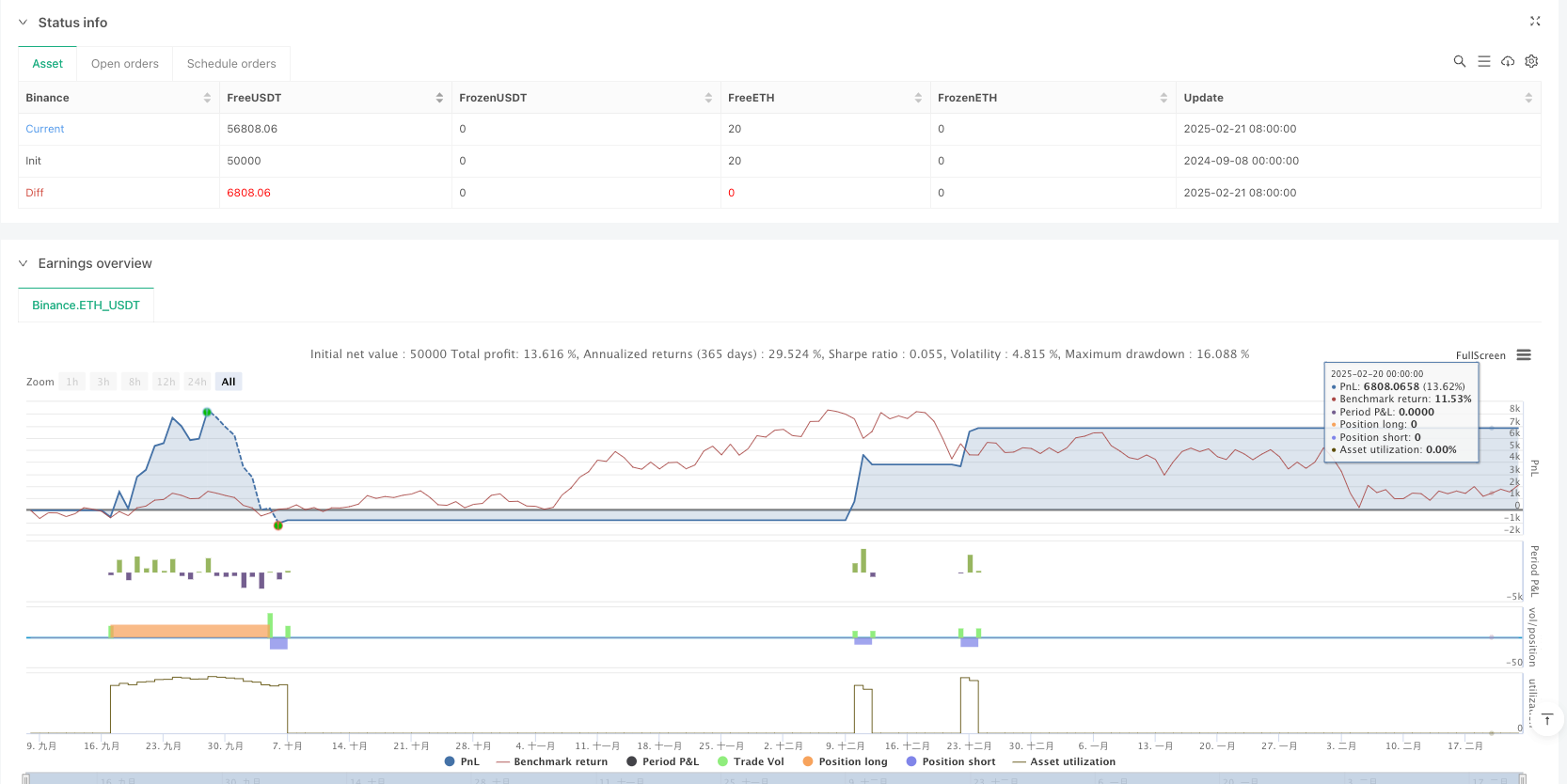

/*backtest

start: 2024-09-08 00:00:00

end: 2025-02-23 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// **********************************************************************************************************************************************************************************************************************************************************************

// Last update: 08/03/2022

// *************************************************************************************************************************************************************************************************************************************************************************

//@version=5

strategy(title='Smart trading', overlay=true, precision=2, commission_value=0.075, commission_type=strategy.commission.percent, initial_capital=1000, currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=100, slippage=1,calc_on_every_tick = false,calc_on_order_fills = true)

// *************************************************************************************************************************************************************************************************************************************************************************

// COMMENTS

// *************************************************************************************************************************************************************************************************************************************************************************

chat_id = input("-1001587924564",'Chat ID Telegram')

procent_stop = input.float(1.0,'Процент стоп')

procent_teik = input.float(4.0,'Процент TP4 ')

// *************************************************************************************************************************************************************************************************************************************************************************

// INPUTS

// *************************************************************************************************************************************************************************************************************************************************************************

// * Type trading

allow_longs = input.bool(true, 'Только лонги', group='Trading type')

allow_shorts = input.bool(true, 'Только шорты', group='Trading type')

// * Datastamp

from_day = input.int(1, 'From Day', minval=1, maxval=31, group='DataStamp')

from_month = input.int(1, 'From Month', minval=1, maxval=12, group='DataStamp')

from_year = input.int(2021, 'From Year', minval=1980, maxval=9999, group='DataStamp')

to_day = input.int(1, 'To Day', minval=1, maxval=31, group='DataStamp')

to_month = input.int(1, 'To Month', minval=1, maxval=12, group='DataStamp')

to_year = input.int(9999, 'To Year', minval=2017, maxval=9999, group='DataStamp')

// * Stop loss

stoploss = input.bool(true, 'Стоп лосс в стратегии', group='Stop loss')

movestoploss = input.string('TP-2', 'Перенос стопа', options=['None', 'Percentage', 'TP-1', 'TP-2', 'TP-3'], group='Stop loss')

movestoploss_entry = input.bool(false, 'Перенос стопа на твх', group='Stop loss')

stoploss_perc = input.float(6.0, 'Стоп лосс в %', minval=0, maxval=100, group='Stop loss') * 0.01

move_stoploss_factor = input.float(20.0, 'Фактор переноса стопа в %', group='Stop loss') * 0.01 + 1

stop_source = input.source(hl2, 'Stop Source', group='Stop loss')

// * Take profits

take_profits = input.bool(true, 'Тейк профит в стратегии', group='Take Profits')

// retrade= input.bool(false, 'Retrade', group='Take Profits')

MAX_TP = input.int(6, 'Кол-во TP', minval=1, maxval=10, group='Take Profits')

long_profit_perc = input.float(6.8, 'Long - TP в % каждый', minval=0.0, maxval=999, step=1, group='Take Profits') * 0.01

long_profit_qty = input.float(15, 'Long - TP в % от твх', minval=0.0, maxval=100, step=1, group='Take Profits')

short_profit_perc = input.float(13, 'Short - TP в % каждый', minval=0.0, maxval=999, step=1, group='Take Profits') * 0.01

short_profit_qty = input.float(10, 'Short - TP в % от твх', minval=0.0, maxval=100, step=1, group='Take Profits')

// * Delays

delay_macd = input.int(1, 'Candles delay MACD', minval=1, group='Delays')

delay_srsi = input.int(2, 'Candles delay RSI', minval=1, group='Delays')

delay_rsi = input.int(2, 'Candles delay EMA', minval=1, group='Delays')

delay_super = input.int(1, 'Candles delay Supertrend', minval=1, group='Delays')

delay_cross = input.int(1, 'Candles delay MA', minval=1, group='Delays')

delay_exit = input.int(7, 'Candles delay exit', minval=1, group='Delays')

// * Inputs Smart strategies

str_0 = input.bool(true, 'Strategy 0: Weighted Strategy', group='Weights')

weight_trigger = input.int(2, 'Smart Signal entry [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str1 = input.int(1, 'Smart Strategy 1 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str2 = input.int(1, 'Smart Strategy 2 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str3 = input.int(1, 'Smart Strategy 3 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str4 = input.int(1, 'Smart Strategy 4 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str5 = input.int(1, 'Smart Strategy 5 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

// * Inputs strategy 1: MACD

str_1 = input.bool(true, 'Strategy 1: MACD', group='Strategy 1: MACD')

MA1_period_1 = input.int(16, 'MA 1', minval=1, maxval=9999, step=1, group='Strategy 1: MACD')

MA1_type_1 = input.string('EMA', 'MA1 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 1: MACD')

MA1_source_1 = input.source(hl2, 'MA1 Source', group='Strategy 1: MACD')

MA2_period_1 = input.int(36, 'MA 2', minval=1, maxval=9999, step=1, group='Strategy 1: MACD')

MA2_type_1 = input.string('EMA', 'MA2 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 1: MACD')

MA2_source_1 = input.source(high, 'MA2 Source', group='Strategy 1: MACD')

// * Inputs strategy 2: RSI oversold/overbought

str_2 = input.bool(true, 'Strategy 2: RSI', group='Strategy 2: RSI')

long_RSI = input.float(70, 'Exit RSI Long (%)', minval=0.0, step=1, group='Strategy 2: RSI')

short_RSI = input.float(27, 'Exit RSI Short (%)', minval=0.0, step=1, group='Strategy 2: RSI')

length_RSI = input.int(14, 'RSI Length', group='Strategy 2: RSI')

length_stoch = input.int(14, 'RSI Stochastic', group='Strategy 2: RSI')

smoothK = input.int(3, 'Smooth', group='Strategy 2: RSI')

// * Inputs strategy 3: EMA oversold/overbought

str_3 = input.bool(true, 'Strategy 3: RSI', group='Strategy 3: RSI')

long_RSI2 = input.float(77, 'Exit EMA Long', minval=0.0, step=1, group='Strategy 3: RSI')

short_RSI2 = input.float(30, 'Exit EMA Short', minval=0.0, step=1, group='Strategy 3: RSI')

// * Inputs strategy 4: Supertrend

str_4 = input.bool(true, 'Strategy 4: Supertrend', group='Strategy 4: Supertrend')

periods_4 = input.int(2, 'ATR Period', group='Strategy 4: Supertrend')

source_4 = input.source(hl2, 'Source', group='Strategy 4: Supertrend')

multiplier = input.float(2.4, 'ATR Multiplier', step=0.1, group='Strategy 4: Supertrend')

change_ATR = input.bool(true, 'Change ATR Calculation Method ?', group='Strategy 4: Supertrend')

// * Inputs strategy 5: MA

str_5 = input.bool(true, 'Strategy 5: MA', group='Strategy 5: MA')

MA1_period_5 = input.int(46, 'MA 1', minval=1, maxval=9999, step=1, group='Strategy 5: MA')

MA1_type_5 = input.string('EMA', 'MA1 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 5: MA')

MA1_source_5 = input.source(close, 'MA1 Source', group='Strategy 5: MA')

MA2_period_5 = input.int(82, 'MA 2', minval=1, maxval=9999, step=1, group='Strategy 5: MA')

MA2_type_5 = input.string('EMA', 'MA2 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 5: MA')

MA2_source_5 = input.source(close, 'MA2 Source', group='Strategy 5: MA')

// * Inputs Potential TOP/BOTTOM

str_6 = input.bool(false, 'Потенциальные ордера long/short', group='Potential TOP/BOTTOM')

top_qty = input.float(30, 'Лонг закрыть (%) из оставшейся позиции', minval=0.0, maxval=100, step=1, group='Potential TOP/BOTTOM')

bottom_qty = input.float(30, 'Шорт закрыть (%) из оставшейся позиции', minval=0.0, maxval=100, step=1, group='Potential TOP/BOTTOM')

source_6_top = input.source(close, 'TP-TOP на предыдущий', group='Potential TOP/BOTTOM')

source_6_bottom = input.source(close, 'TP-BOTTOM на предыдущий', group='Potential TOP/BOTTOM')

long_trail_perc = input.float(150, 'Объем Long (%)', minval=0.0, step=1, group='Potential TOP/BOTTOM') * 0.01

short_trail_perc = input.float(150, 'Объем Short (%)', minval=0.0, step=1, group='Potential TOP/BOTTOM') * 0.01

// * Flags

FLAG_SIGNALS = input.bool(true, 'Show Buy/Sell Signals ?', group='Miscellaneous')

FLAG_SHADOWS = input.bool(true, 'Show shadows satisfied strategies ?', group='Miscellaneous')

// * Alarms

alarm_label_long = input.string('Buy', 'Label open long', group='Basic alarm system')

alarm_label_short = input.string('Sell', 'Label open short', group='Basic alarm system')

alarm_label_close_long = input.string('Close long', 'Label close long', group='Basic alarm system')

alarm_label_close_short = input.string('Close short', 'Label close short', group='Basic alarm system')

alarm_label_TP_long = input.string('TP long', 'Label Take Profit long', group='Basic alarm system')

alarm_label_TP_short = input.string('TP short', 'Label Take Profit short', group='Basic alarm system')

alarm_label_SL = input.string('SL', 'Label Stop-Loss', group='Basic alarm system')

// *************************************************************************************************************************************************************************************************************************************************************************

// ABBREVIATIONS

// *************************************************************************************************************************************************************************************************************************************************************************

// TP: Take profits

// SL: Stop-Loss

// *************************************************************************************************************************************************************************************************************************************************************************

// GLOBAL VARIABLES

// *************************************************************************************************************************************************************************************************************************************************************************

start = timestamp(from_year, from_month, from_day, 00, 00) // backtest start window

end = timestamp(to_year, to_month, to_day, 23, 59)// backtest finish window

var FLAG_FIRST = false

var price_stop_long = 0.

var price_stop_short = 0.

var profit_qty = 0. // Quantity to close per TP from open position

var profit_perc = 0. // Percentage to take profits since open position or last TP

var nextTP = 0. // Next target to take profits

var since_entry = 0 // Number of bars since open last postion

var since_close = 0 // Number of bars since close or TP/STOP last position

// * Compute profit quantity and profit percentage

if strategy.position_size > 0

profit_qty := long_profit_qty

profit_perc := long_profit_perc

else if strategy.position_size < 0

profit_qty := short_profit_qty

profit_perc := short_profit_perc

else

nextTP := 0. // Next Take Profit target (out of market)

// *************************************************************************************************************************************************************************************************************************************************************************

// FUNCTIONS

// *************************************************************************************************************************************************************************************************************************************************************************

// * MA type

// *************************************************************************************************************************************************************************************************************************************************************************

ma(MAType, MASource, MAPeriod) =>

if MAType == 'SMA'

ta.sma(MASource, MAPeriod)

else if MAType == 'EMA'

ta.ema(MASource, MAPeriod)

else if MAType == 'WMA'

ta.wma(MASource, MAPeriod)

else if MAType == 'RMA'

ta.rma(MASource, MAPeriod)

else if MAType == 'HMA'

ta.wma(2 * ta.wma(MASource, MAPeriod / 2) - ta.wma(MASource, MAPeriod), math.round(math.sqrt(MAPeriod)))

else if MAType == 'DEMA'

e = ta.ema(MASource, MAPeriod)

2 * e - ta.ema(e, MAPeriod)

else if MAType == 'TEMA'

e = ta.ema(MASource, MAPeriod)

3 * (e - ta.ema(e, MAPeriod)) + ta.ema(ta.ema(e, MAPeriod), MAPeriod)

else if MAType == 'VWMA'

ta.vwma(MASource, MAPeriod)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Number strategies

// *************************************************************************************************************************************************************************************************************************************************************************

n_strategies() =>

var result = 0.

if str_1

result := 1.

if str_2

result += 1.

if str_3

result += 1.

if str_4

result += 1.

if str_5

result += 1.

// *************************************************************************************************************************************************************************************************************************************************************************

// * Price take profit

// *************************************************************************************************************************************************************************************************************************************************************************

price_takeProfit(percentage, N) =>

if strategy.position_size > 0

strategy.position_avg_price * (1 + N * percentage)

else

strategy.position_avg_price * (1 - N * percentage)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Weigthed values

// *************************************************************************************************************************************************************************************************************************************************************************

weight_values(signal) =>

if signal

weight = 1.0

else

weight = 0.

// *************************************************************************************************************************************************************************************************************************************************************************

// * Weigthed total

// *************************************************************************************************************************************************************************************************************************************************************************

weight_total(signal1, signal2, signal3, signal4, signal5) =>

weight_str1 * weight_values(signal1) + weight_str2 * weight_values(signal2) + weight_str3 * weight_values(signal3) + weight_str4 * weight_values(signal4) + weight_str5 * weight_values(signal5)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Set alert TP message

// *************************************************************************************************************************************************************************************************************************************************************************

set_alarm_label_TP() =>

if strategy.position_size > 0

alarm_label_TP_long

else if strategy.position_size < 0

alarm_label_TP_short

// *************************************************************************************************************************************************************************************************************************************************************************

// * Color

// *************************************************************************************************************************************************************************************************************************************************************************

colors(type, value=0) =>

switch str.lower(type)

'buy'=> color.new(color.aqua, value)

'sell' => color.new(color.gray, value)

'TP' => color.new(color.aqua, value)

'SL' => color.new(color.gray, value)

'signal' => color.new(color.orange, value)

'profit' => color.new(color.teal, value)

'loss' => color.new(color.red, value)

'info' => color.new(color.white, value)

'highlights' => color.new(color.orange, value)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Bar since last entry

// *************************************************************************************************************************************************************************************************************************************************************************

bars_since_entry() =>

bar_index - strategy.opentrades.entry_bar_index(0)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Bar since close or TP/STOP

// *************************************************************************************************************************************************************************************************************************************************************************

bars_since_close() =>

ta.barssince(ta.change(strategy.closedtrades))

// *************************************************************************************************************************************************************************************************************************************************************************

// ADDITIONAL GLOBAL VARIABLES

// *************************************************************************************************************************************************************************************************************************************************************************

// * Compute time since last entry and last close/TP position

since_entry := bars_since_entry()

since_close := bars_since_close()

if strategy.opentrades == 0

since_entry := delay_exit

if strategy.closedtrades == 0

since_close := delay_exit

// *************************************************************************************************************************************************************************************************************************************************************************

// STRATEGIES

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 1: MACD

// *************************************************************************************************************************************************************************************************************************************************************************

MA1 = ma(MA1_type_1, MA1_source_1, MA1_period_1)

MA2 = ma(MA2_type_1, MA2_source_1, MA2_period_1)

MACD = MA1 - MA2

signal = ma('SMA', MACD, 9)

trend= MACD - signal

long = MACD > signal

short = MACD < signal

proportion = math.abs(MACD / signal)

// * Conditions

long_signal1 = long and long[delay_macd - 1] and not long[delay_macd]

short_signal1 = short and short[delay_macd - 1] and not short[delay_macd]

close_long1 = short and not long[delay_macd]

close_short1 = long and not short[delay_macd]

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 2: STOCH RSI

// *************************************************************************************************************************************************************************************************************************************************************************

rsi = ta.rsi(close, length_RSI)

srsi = ta.stoch(rsi, rsi, rsi, length_stoch)

k = ma('SMA', srsi, smoothK)

isRsiOB = k >= long_RSI

isRsiOS = k <= short_RSI

// * Conditions

long_signal2 = isRsiOS[delay_srsi] and not isRsiOB and since_entry >= delay_exit and since_close >= delay_exit

short_signal2 = isRsiOB[delay_srsi] and not isRsiOS and since_entry >= delay_exit and since_close >= delay_exit

close_long2 = short_signal2

close_short2 = long_signal2

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 3: RSI

// *************************************************************************************************************************************************************************************************************************************************************************

isRsiOB2 = rsi >= long_RSI2

isRsiOS2 = rsi <= short_RSI2

// * Conditions

long_signal3 = isRsiOS2[delay_rsi] and not isRsiOB2 and since_entry >= delay_exit and since_close >= delay_exit

short_signal3 = isRsiOB2[delay_rsi] and not isRsiOS2 and since_entry >= delay_exit and since_close >= delay_exit

close_long3 = short_signal3

close_short3 = long_signal3

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 4: SUPERTREND

// *************************************************************************************************************************************************************************************************************************************************************************

atr2 = ma('SMA', ta.tr, periods_4)

atr = change_ATR ? ta.atr(periods_4) : atr2

up = source_4 - multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = source_4 + multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend := 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// * Conditions

long4 = trend == 1

short4 = trend == -1

long_signal4 = trend == 1 and trend[delay_super - 1] == 1 and trend[delay_super] == -1

short_signal4 = trend == -1 and trend[delay_super - 1] == -1 and trend[delay_super] == 1

changeCond = trend != trend[1]

close_long4 = short_signal4

close_short4 = short_signal4

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 5: MA CROSS

// *************************************************************************************************************************************************************************************************************************************************************************

MA12 = ma(MA1_type_5, MA1_source_5, MA1_period_5)

MA22 = ma(MA2_type_5, MA2_source_5, MA2_period_5)

long5 = MA12 > MA22

short5 = MA12 < MA22

// * Conditions

long_signal5 = long5 and long5[delay_cross - 1] and not long5[delay_cross]

short_signal5 = short5 and short5[delay_cross - 1] and not short5[delay_cross]

close_long5 = short5 and not long5[delay_cross]

close_short5 = long5 and not short5[delay_cross]

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 6: POTENTIAL TOP/BOTTOM

// *************************************************************************************************************************************************************************************************************************************************************************

// * Combination RSI, Stoch RSI, MACD, volume, and weighted-strategy to detect potential TOP/BOTTOMS areas

volumeRSI_condition = volume[2] > volume[3] and volume[2] > volume[4] and volume[2] > volume[5]

condition_OB1 = isRsiOB2 and (isRsiOB or volume < ma('SMA', volume, 20) / 2) and volumeRSI_condition

condition_OS1 = isRsiOS2 and (isRsiOS or volume < ma('SMA', volume, 20) / 2) and volumeRSI_condition

condition_OB2 = volume[2] / volume[1] > (1.0 + long_trail_perc) and isRsiOB and volumeRSI_condition

condition_OS2 = volume[2] / volume[1] > (1.0 + short_trail_perc) and isRsiOS and volumeRSI_condition

condition_OB3 = weight_total(MACD < signal, isRsiOB, isRsiOB2, short4, short5) >= weight_trigger

condition_OS3 = weight_total(MACD > signal, isRsiOS, isRsiOS2, long4, long5) >= weight_trigger

condition_OB = (condition_OB1 or condition_OB2)

condition_OS = (condition_OS1 or condition_OS2)

condition_OB_several = condition_OB[1] and condition_OB[2] or condition_OB[1] and condition_OB[3] or condition_OB[1] and condition_OB[4] or condition_OB[1] and condition_OB[5] or condition_OB[1] and condition_OB[6] or condition_OB[1] and condition_OB[7]

condition_OS_several = condition_OS[1] and condition_OS[2] or condition_OS[1] and condition_OS[3] or condition_OS[1] and condition_OS[4] or condition_OS[1] and condition_OS[5] or condition_OS[1] and condition_OS[6] or condition_OS[1] and condition_OS[7]

// *************************************************************************************************************************************************************************************************************************************************************************

// STRATEGY ENTRIES AND EXITS

// *************************************************************************************************************************************************************************************************************************************************************************

long_SL = close - ((close / 100) * procent_stop)

long_OP = close

long_TP_1 = close + ((close / 100) * (procent_teik * 1.1))

long_TP_2 = close + ((close / 100) * (procent_teik * 1.8))

long_TP_3 = close + ((close / 100) * (procent_teik * 2.8))

long_TP_4 = close + ((close / 100) * (procent_teik * 4.5))

short_SL = close + ((close / 100) * procent_stop)

short_OP = close

short_TP_1 = close - ((close / 100) * (procent_teik * 1.1))

short_TP_2 = close - ((close / 100) * (procent_teik * 1.8))

short_TP_3 = close - ((close / 100) * (procent_teik * 2.8))

short_TP_4 = close - ((close / 100) * (procent_teik * 4.5))

if time >= start and time <= end

// ***************************************************************************************************************************************************************************

// * Set Entries

// ***************************************************************************************************************************************************************************

if str_0

if not str_1

weight_str1 := 0

if not str_2

weight_str2 := 0

if not str_3

weight_str3 := 0

if not str_4

weight_str4 := 0

if not str_5

weight_str5 := 0

if allow_shorts == true

w_total = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

if w_total >= weight_trigger

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

strategy.entry('Short', strategy.short)

if allow_longs == true

w_total = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

if w_total >= weight_trigger

strategy.entry('Long', strategy.long)

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

else

if allow_shorts == true

if str_1

strategy.entry('Short', strategy.short, when=short_signal1)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_2

strategy.entry('Short', strategy.short, when=short_signal2)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_3

strategy.entry('Short', strategy.short, when=short_signal3)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_4

strategy.entry('Short', strategy.short, when=short_signal4)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_5

strategy.entry('Short', strategy.short, when=short_signal5)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if allow_longs == true

if str_1

strategy.entry('Long', strategy.long, when=long_signal1)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_2

strategy.entry('Long', strategy.long, when=long_signal2)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_3

strategy.entry('Long', strategy.long, when=long_signal3)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_4

strategy.entry('Long', strategy.long, when=long_signal4)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_5

strategy.entry('Long', strategy.long, when=long_signal5)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

// ***************************************************************************************************************************************************************************

// * Set Take Profits

// ***************************************************************************************************************************************************************************

if strategy.position_size != 0 and take_profits and since_entry == 0

for i = 1 to MAX_TP

id = 'TP ' + str.tostring(i)

strategy.exit(id=id, limit=price_takeProfit(profit_perc, i), qty_percent=profit_qty, comment=id)

// ***************************************************************************************************************************************************************************

// * Set Stop loss

// ***************************************************************************************************************************************************************************

if strategy.position_size > 0

if since_close == 0

if high > price_takeProfit(profit_perc, 6) and MAX_TP >= 6

n = 6

nextTP := na

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 5) and MAX_TP >= 5

n = 5

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 4) and MAX_TP >= 4

n = 4

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 3) and MAX_TP >= 3

n = 3

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if high > price_takeProfit(profit_perc, 2) and MAX_TP >= 2

n = 2

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if high > price_takeProfit(profit_perc, 1) and MAX_TP >= 1

n = 1

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

if since_entry == 0

n = 0

nextTP := price_takeProfit(profit_perc, n + 1)

price_stop_long := strategy.position_avg_price * (1 - stoploss_perc)

if strategy.position_size < 0

if since_close == 0

if low < price_takeProfit(profit_perc, 6) and MAX_TP >= 6

n = 6

nextTP := na

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 5) and MAX_TP >= 5

n = 5

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 4) and MAX_TP >= 4

n = 4

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 3) and MAX_TP >= 3

n = 3

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if low < price_takeProfit(profit_perc, 2) and MAX_TP >= 2

n = 2

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if low < price_takeProfit(profit_perc, 1) and MAX_TP >= 1

n = 1

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

if since_entry == 0

n = 0

nextTP := price_takeProfit(profit_perc, n + 1)

price_stop_short := strategy.position_avg_price * (1 + stoploss_perc)

// ***************************************************************************************************************************************************************************

// * Set Exits

// ***************************************************************************************************************************************************************************

if allow_longs == true and allow_shorts == false

if str_0

w_total = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

strategy.close('Long', when=w_total>=weight_trigger, qty_percent=100, comment='SHORT')

else

if str_1

strategy.close('Long', when=close_long1, qty_percent=100, comment='SHORT')

if str_2

strategy.close('Long', when=close_long2, qty_percent=100, comment='SHORT')

if str_3

strategy.close('Long', when=close_long3, qty_percent=100, comment='SHORT')

if str_4

strategy.close('Long', when=close_long4, qty_percent=100, comment='SHORT')

if str_5

strategy.close('Long', when=close_long5, qty_percent=100, comment='SHORT')

if allow_longs == false and allow_shorts == true

if str_0

w_total = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

strategy.close('Short', when=w_total>=weight_trigger, qty_percent=100, comment='LONG')

else

if str_1

strategy.close('Short', when=close_long1, qty_percent=100, comment='LONG')

if str_2

strategy.close('Short', when=close_long2, qty_percent=100, comment='LONG')

if str_3

strategy.close('Short', when=close_long3, qty_percent=100, comment='LONG')

if str_4

strategy.close('Short', when=close_long4, qty_percent=100, comment='LONG')

if str_5

strategy.close('Short', when=close_long5, qty_percent=100, comment='LONG')

if allow_shorts == true and strategy.position_size < 0 and stoploss and since_entry > 0

strategy.close('Short', when=stop_source >= price_stop_short, qty_percent=100, comment='STOP')

if str_6

if top_qty == 100

strategy.close('Short', when=condition_OS_several, qty_percent=bottom_qty, comment='STOP')

else

strategy.exit('Short', when=condition_OS_several, limit=source_6_bottom[1], qty_percent=bottom_qty, comment='TP-B')

if allow_longs == true and strategy.position_size > 0 and stoploss and since_entry > 0

strategy.close('Long', when=stop_source <= price_stop_long, qty_percent=100, comment='STOP')

if str_6

if top_qty == 100

strategy.close('Long', when=condition_OB_several, qty_percent=top_qty, comment='STOP')

else

strategy.exit('Long', when=condition_OB_several, limit=source_6_top[1], qty_percent=top_qty, comment='TP-T')

// ***********************************************************************************************************************************************************************************************************************************************************************************

// * Data window - debugging

// *************************************************************************************************************************************************************************************************************************************************************************

price_stop = strategy.position_size > 0 ? price_stop_long : price_stop_short

// *************************************************************************************************************************************************************************************************************************************************************************

// * Buy/Sell signals

// *************************************************************************************************************************************************************************************************************************************************************************

w_total_long = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

w_total_short = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Stop loss targets

// *************************************************************************************************************************************************************************************************************************************************************************

plot(series=(strategy.position_size > 0) ? price_stop_long : na, color=color.gray, style=plot.style_cross, linewidth=2, transp=30, title="Long Stop Loss")

plot(series=(strategy.position_size < 0) ? price_stop_short : na, color=color.gray, style=plot.style_cross, linewidth=2, transp=30, title="Short Stop Loss")

// *************************************************************************************************************************************************************************************************************************************************************************

// * TP targets

// *************************************************************************************************************************************************************************************************************************************************************************

plot(strategy.position_size > 0 or strategy.position_size < 0 ? nextTP : na, color=color.aqua, style=plot.style_cross, linewidth=2, transp=30, title="Next TP")

// *************************************************************************************************************************************************************************************************************************************************************************