Ringkasan

Ini adalah strategi pengesahan tren Heikin-Ashi yang inovatif dan tidak digambar ulang, yang bertujuan untuk mengatasi masalah yang ada dengan strategi Heikin-Ashi dalam tampilan perdagangan tradisional. Dengan menghitung Heikin-Ashi dan mekanisme pengesahan tren ganda secara manual, strategi ini memberikan metode perdagangan yang lebih andal dan transparan.

Prinsip Strategi

Prinsip-prinsip utama dari strategi ini terdiri dari tiga langkah penting:

Perhitungan ini dilakukan secara manual tanpa menggambar ulang Haikang-Asi:

- Menggunakan rumus unik untuk menghitung harga penutupan, harga pembukaan, harga tertinggi dan harga terendah

- Memastikan data harga historis tetap stabil saat pembaruan K-line berikutnya

- Menghindari masalah perancangan ulang yang sering terjadi dalam strategi tradisional Haykansah

Beberapa tren yang dikonfirmasi:

- Permintaan untuk mengkonfirmasi arah tren

- Tanda-tanda masuk yang panjang: perlu X-root berturut-turut

- Tanda masuk kosong: perlu X-root turun terus

- Meningkatkan keandalan strategi dengan memfilter sinyal palsu melalui multiple confirmation

Model perdagangan yang fleksibel:

- Mendukung Trend Following Traditional

- Berikan opsi perdagangan untuk membalikkan tren

- Mode transaksi yang dapat disesuaikan (semua, hanya lebih, hanya kosong)

Keunggulan Strategis

- Menghilangkan masalah pemetaan ulang: data historis tetap stabil, hasil pengukuran ulang sangat konsisten dengan pelaksanaan disk

- Konfirmasi Multiple Trends: Menurunkan transaksi yang tidak perlu dengan terus-menerus memfilter sinyal palsu

- Ketinggian dapat disesuaikan:

- Fleksibel masuk dan keluar setelan batas

- Mendukung trend following dan reversal trading

- Garis K standar yang dapat disembunyikan, memberikan visibilitas yang jelas

- Cocok untuk perdagangan jangka menengah dan jangka panjang: sangat cocok untuk swing trading dan trend following

Risiko Strategis

Keterbatasan kinerja:

- Tidak cocok untuk trading scalping frekuensi tinggi

- Performa di pasar yang tidak menunjukkan tren yang jelas mungkin lebih buruk

- Parameter yang perlu disesuaikan dengan kerangka waktu yang berbeda

Pengendalian risiko potensial:

- Disarankan untuk menyiapkan mekanisme penangguhan yang tepat.

- Parameter pengoptimalan berkelanjutan dalam kondisi pasar yang berbeda

- Verifikasi silang dalam kombinasi dengan indikator teknis lainnya

Arah optimasi strategi

Pengaturan dinamis parameter:

- Mengembangkan algoritma penarikan dan penarikan terendah yang beradaptasi

- Real-time penyesuaian jumlah baterai berturut-turut berdasarkan volatilitas pasar

- Memperkenalkan algoritma pembelajaran mesin untuk mengoptimalkan pemilihan parameter

Manajemen risiko yang lebih baik:

- Manajemen Posisi Dinamis Terpadu

- Menambahkan filter relevansi

- Mengembangkan mekanisme stop loss yang lebih cerdas

Kombinasi indikator:

- Dalam kombinasi dengan indikator teknis lainnya (seperti RSI, MACD)

- Mengembangkan sistem identifikasi multi-indikator

- Meningkatkan akurasi dan keandalan sinyal

Meringkaskan

Strategi pengesahan tren peta ulang Haikang-Sisi Afrika memberikan para pedagang alat perdagangan yang lebih andal dan transparan melalui perhitungan pivot inovatif dan metode pengesahan tren ganda. Strategi ini menunjukkan potensi inovasi teknologi dalam perdagangan kuantitatif dengan menghilangkan masalah peta ulang, memfilter sinyal palsu, dan menyediakan model perdagangan yang fleksibel.

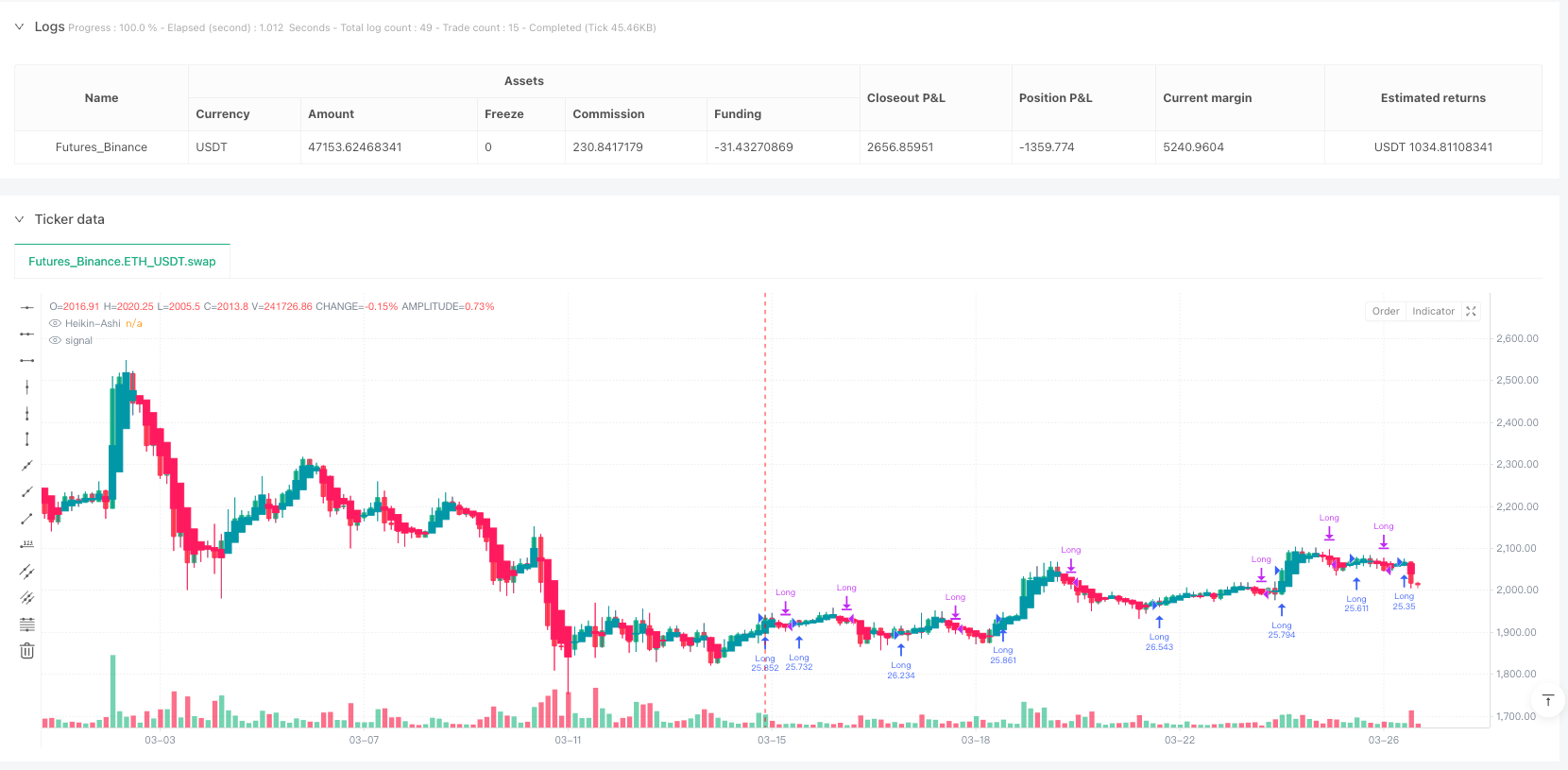

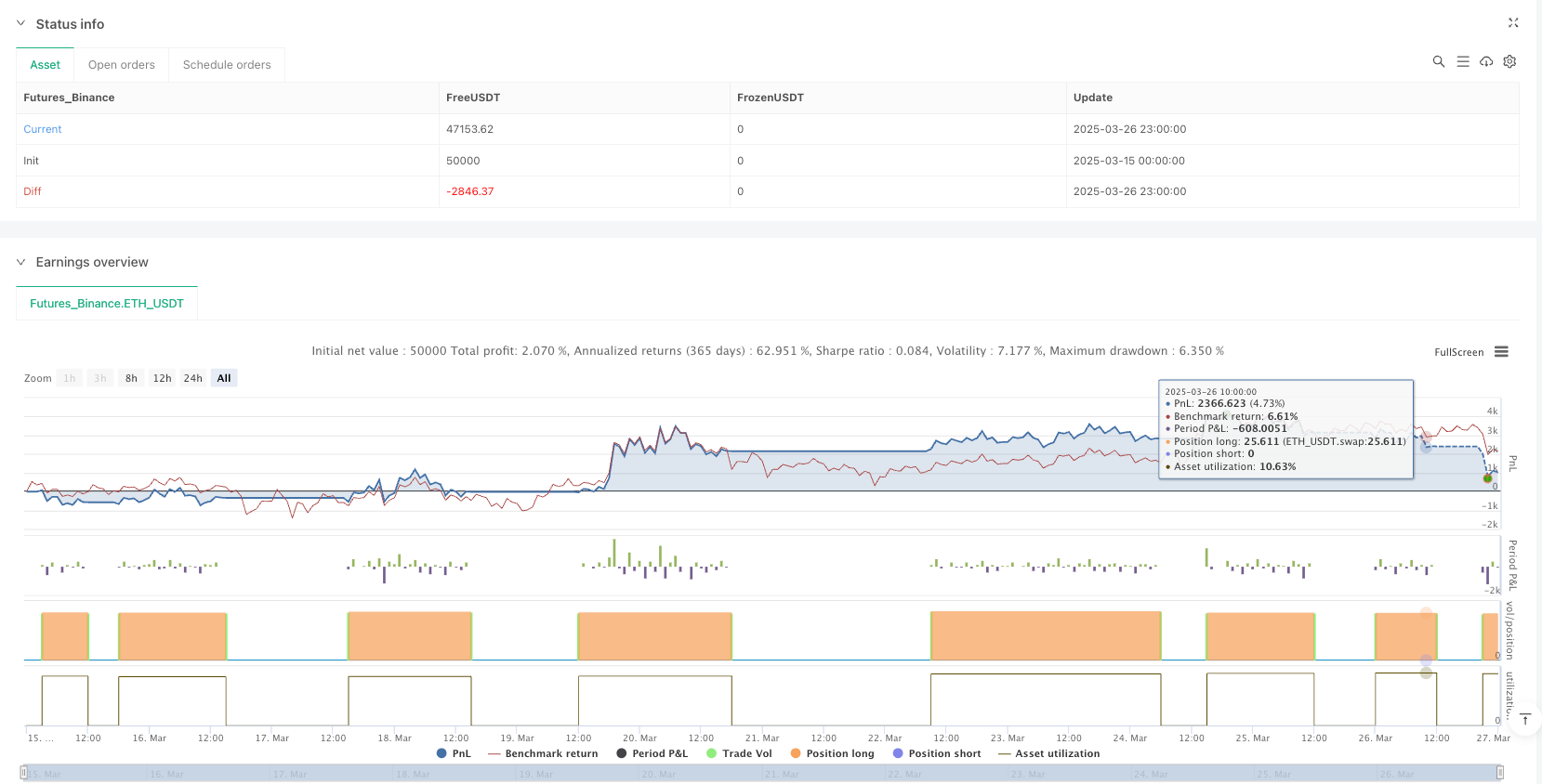

/*backtest

start: 2025-03-15 00:00:00

end: 2025-03-27 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

//© PineIndicators

strategy("Heikin-Ashi Non-Repainting Strategy [PineIndicators]", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, max_boxes_count=500, max_labels_count=500, max_lines_count=500, commission_value=0.01, process_orders_on_close=true, slippage= 2, behind_chart=false)

//====================================

// INPUTS

//====================================

// Number of consecutive candles required for entry and exit

openThreshold = input.int(title="Number of Candles for Entry", defval=2, minval=1)

exitThreshold = input.int(title="Number of Candles for Exit", defval=2, minval=1)

// Trade mode selection: "Long & Short", "Only Long", or "Only Short"

tradeMode = input.string(title="Trade Mode", defval="Only Long", options=["Long & Short", "Only Long", "Only Short"])

// Option to invert the trading logic (bullish signals become short signals, and vice versa)

invertTrades = input.bool(title="Invert Trading Logic (Long ↔ Short)", defval=false)

// Option to hide the standard candles (bodies only)

hideStandard = input.bool(title="Hide Standard Candles", defval=true)

// Heikin-Ashi transparency is fixed (0 = fully opaque)

heikinTransparency = 0

//====================================

// HIDE STANDARD CANDLES

//====================================

// Hide the body of the standard candles by setting them to 100% transparent.

// Note: The wicks of the standard candles cannot be hidden via code.

barcolor(hideStandard ? color.new(color.black, 100) : na)

//====================================

// HEIKIN-ASHI CALCULATION

//====================================

// Calculate Heikin-Ashi values manually

haClose = (open + high + low + close) / 4

var float haOpen = na

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Define colors for Heikin-Ashi candles (using fixed transparency)

bullColor = color.new(#0097a7, heikinTransparency)

bearColor = color.new(#ff195f, heikinTransparency)

//====================================

// PLOT HEIKIN-ASHI CANDLES

//====================================

// Plot the manually calculated Heikin-Ashi candles over the chart.

// The candle body, wicks, and borders will be colored based on whether the candle is bullish or bearish.

plotcandle(haOpen, haHigh, haLow, haClose, title="Heikin-Ashi",

color = haClose >= haOpen ? bullColor : bearColor,

wickcolor = haClose >= haOpen ? bullColor : bearColor,

bordercolor = haClose >= haOpen ? bullColor : bearColor,

force_overlay = true)

//====================================

// COUNT CONSECUTIVE TREND CANDLES

//====================================

// Count the number of consecutive bullish or bearish Heikin-Ashi candles.

var int bullishCount = 0

var int bearishCount = 0

if haClose > haOpen

bullishCount := bullishCount + 1

bearishCount := 0

else if haClose < haOpen

bearishCount := bearishCount + 1

bullishCount := 0

else

bullishCount := 0

bearishCount := 0

//====================================

// DEFINE ENTRY & EXIT SIGNALS

//====================================

// The signals are based on the number of consecutive trend candles.

// In normal logic: bullish candles trigger a long entry and bearish candles trigger a short entry.

// If invertTrades is enabled, the signals are swapped.

var bool longEntrySignal = false

var bool shortEntrySignal = false

var bool exitLongSignal = false

var bool exitShortSignal = false

if not invertTrades

longEntrySignal := bullishCount >= openThreshold

shortEntrySignal := bearishCount >= openThreshold

exitLongSignal := bearishCount >= exitThreshold

exitShortSignal := bullishCount >= exitThreshold

else

// Inverted logic: bullish candles trigger short entries and bearish candles trigger long entries.

longEntrySignal := bearishCount >= openThreshold

shortEntrySignal := bullishCount >= openThreshold

exitLongSignal := bullishCount >= exitThreshold

exitShortSignal := bearishCount >= exitThreshold

//====================================

// APPLY TRADE MODE RESTRICTIONS

//====================================

// If the user selects "Only Long", disable short signals (and vice versa).

if tradeMode == "Only Long"

shortEntrySignal := false

exitShortSignal := false

else if tradeMode == "Only Short"

longEntrySignal := false

exitLongSignal := false

//====================================

// TRADING STRATEGY LOGIC

//====================================

// Execute trades based on the calculated signals.

// If a long position is open:

if strategy.position_size > 0

if shortEntrySignal

strategy.close("Long", comment="Reverse Long")

strategy.entry("Short", strategy.short, comment="Enter Short")

else if exitLongSignal

strategy.close("Long", comment="Exit Long")

// If a short position is open:

if strategy.position_size < 0

if longEntrySignal

strategy.close("Short", comment="Reverse Short")

strategy.entry("Long", strategy.long, comment="Enter Long")

else if exitShortSignal

strategy.close("Short", comment="Exit Short")

// If no position is open:

if strategy.position_size == 0

if longEntrySignal

strategy.entry("Long", strategy.long, comment="Enter Long")

else if shortEntrySignal

strategy.entry("Short", strategy.short, comment="Enter Short")