Ringkasan

Strategi perdagangan struktur pasar yang berayun adalah metode perdagangan canggih yang didasarkan pada perubahan struktur pasar, penangkapan likuiditas, dan dinamika tren. Strategi ini memberikan kerangka keputusan perdagangan yang sistematis kepada pedagang dengan menganalisis karakteristik kunci dari perubahan harga, mengidentifikasi potensi peluang untuk membalikkan dan melanjutkan tren.

Prinsip Strategi

Strategi ini didasarkan pada empat indikator utama:

- Perubahan Karakter (Change of Character, CHoCH): menilai perubahan arah potensial pasar dengan mengidentifikasi titik-titik perubahan tren harga.

- Break of Structure (BOS): mengkonfirmasi dinamika tren dan arahnya.

- Inducements, IDM: menangkap jebakan likuiditas dan pergerakan dana di pasar.

- Sweeps: Mengidentifikasi Penembusan Palsu dan Mengambil Kesempatan Liquiditas

Strategi yang komprehensif menggunakan indikator analisis teknis, termasuk rata-rata real range (ATR), indeks relative strength (RSI) dan volume transaksi, untuk membangun sistem keputusan perdagangan multi-dimensi.

Keunggulan Strategis

- Manajemen risiko sistematis: Mengontrol risiko transaksi secara efektif dengan menghitung stop loss dan stop loss ATR.

- Kondisi multi-filter: Kombinasi antara CHoCH, BOS, RSI dan volume transaksi, meningkatkan akurasi sinyal.

- Manajemen posisi dinamis: menggunakan persentase hak dan kepentingan untuk mengatur posisi perdagangan, mengoptimalkan efisiensi penggunaan dana.

- Fleksibel entry dan exit mekanisme: strategi perdagangan dapat disesuaikan dengan dinamika struktur pasar.

Risiko Strategis

- Risiko terobosan palsu: Indikator struktur pasar dapat menghasilkan sinyal yang menyesatkan.

- Sensitivitas parameter: pengaturan parameter kebijakan memiliki pengaruh yang signifikan terhadap kinerja.

- Volume transaksi dan risiko likuiditas: mungkin kurang baik di pasar yang kurang likuiditas.

- Pengendalian penarikan: kemungkinan penarikan yang lebih besar di pasar yang terus tren.

Arah optimasi strategi

- Memperkenalkan algoritma pembelajaran mesin: mengoptimalkan pilihan parameter dan pengenalan sinyal.

- Menambahkan analisis multi-frame waktu: meningkatkan keandalan sinyal.

- Mengembangkan Modul Manajemen Risiko Dinamis: Mengatur Posisi Berdasarkan Volatilitas Pasar.

- Integrasi lebih banyak indikator teknis, seperti MACD, Brinband, dan lain-lain, meningkatkan filter sinyal.

Meringkaskan

Strategi perdagangan struktur pasar yang berayun adalah metode perdagangan kuantitatif yang canggih yang menyediakan pedagang dengan kerangka keputusan perdagangan yang kuat melalui analisis struktur pasar yang sistematis. Dengan pengoptimalan dan manajemen risiko yang berkelanjutan, strategi ini berpotensi untuk mendapatkan kinerja perdagangan yang stabil dalam berbagai lingkungan pasar.

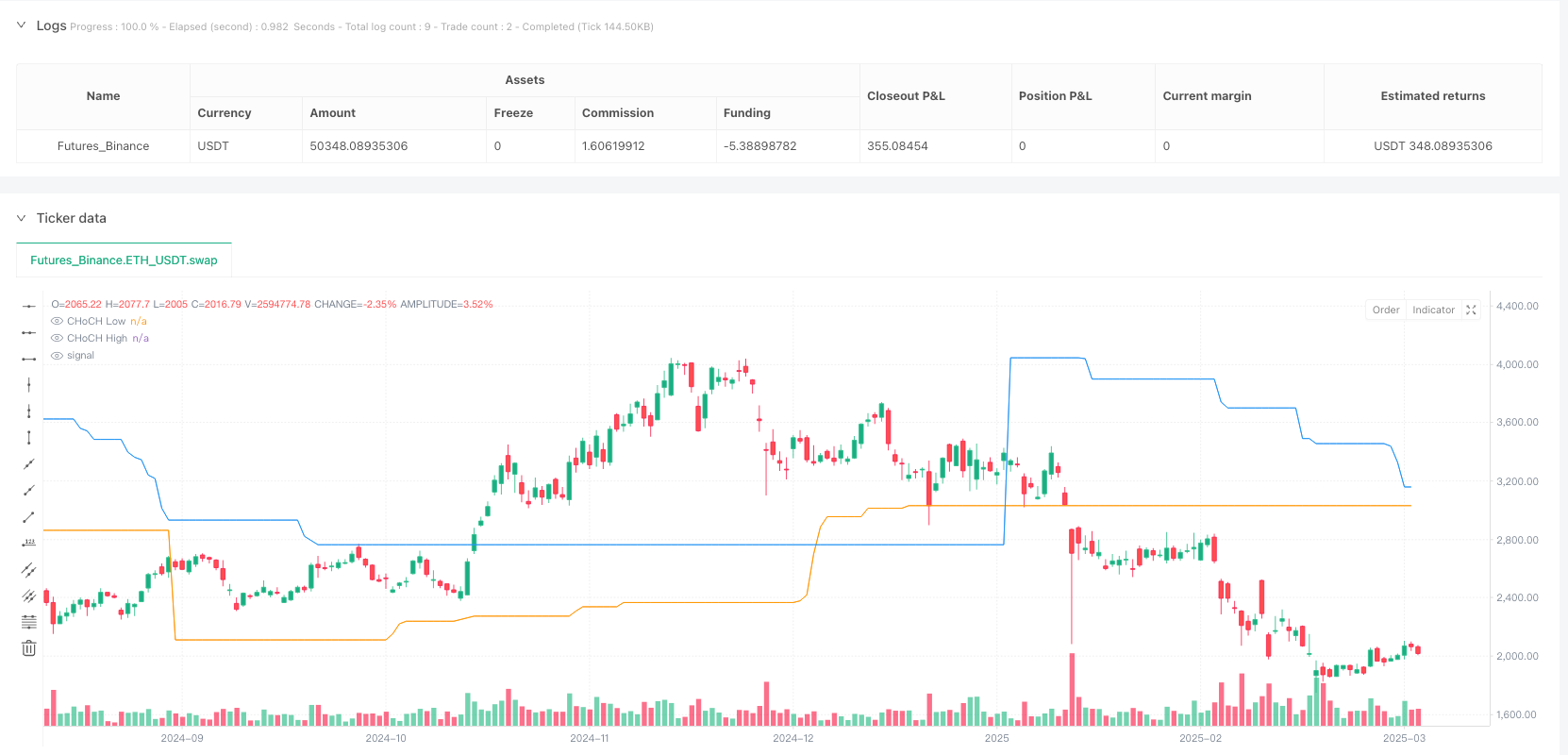

/*backtest

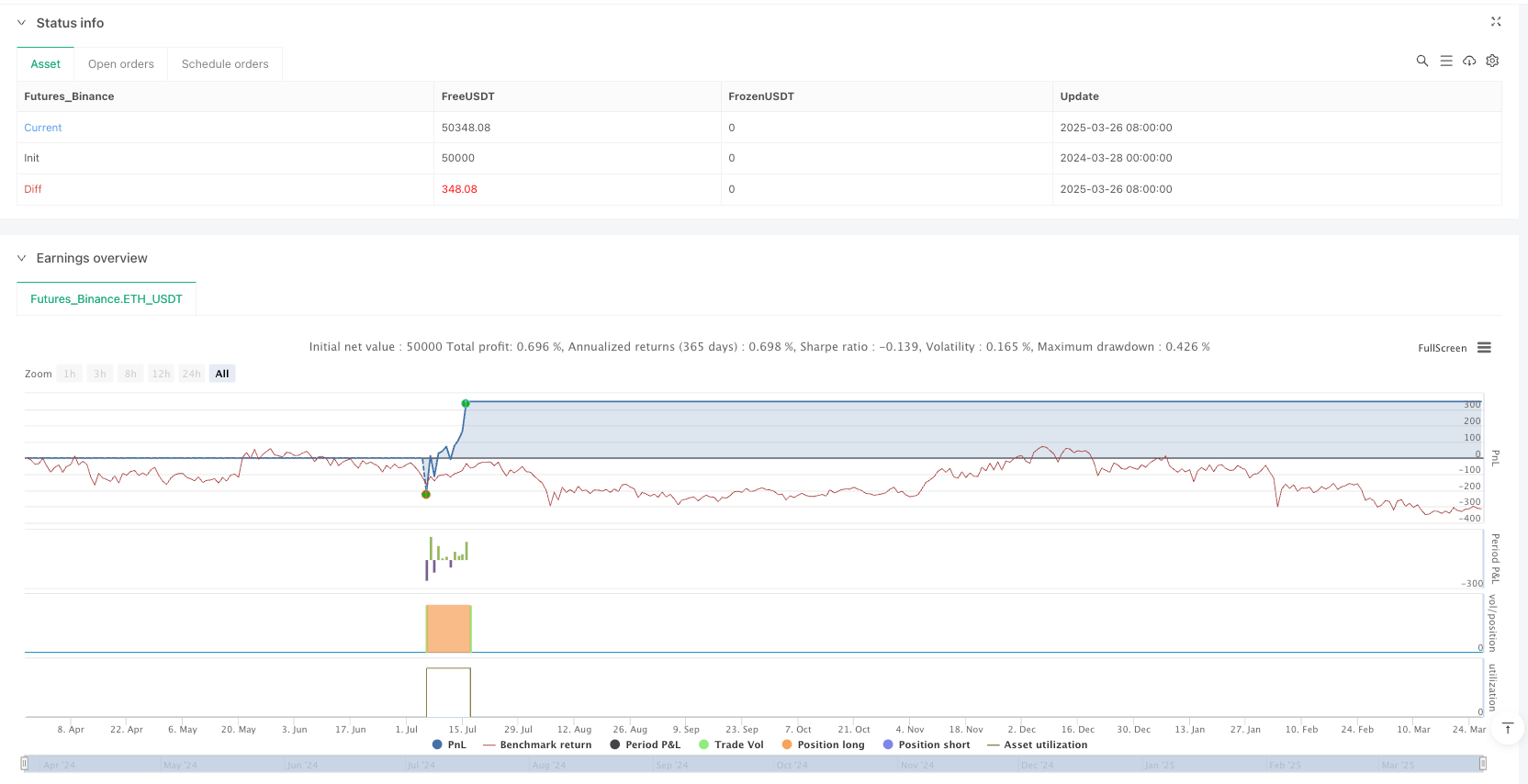

start: 2024-03-28 00:00:00

end: 2025-03-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Market Structure Swing Trading", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=5)

// === Input Parameters ===

len = input(50, "CHoCH Detection Period")

shortLen = input(3, "IDM Detection Period")

atrMultiplierSL = input(2.0, "ATR Multiplier for Stop Loss")

atrMultiplierTP = input(3.0, "ATR Multiplier for Take Profit")

rsiPeriod = input(14, "RSI Period")

rsiOverbought = input(70, "RSI Overbought Level")

rsiOversold = input(30, "RSI Oversold Level")

volThreshold = input(1.2, "Volume Multiplier Threshold")

// === ATR Calculation for SL & TP ===

atr = ta.atr(14)

stopLossLong = close - (atr * atrMultiplierSL)

takeProfitLong = close + (atr * atrMultiplierTP)

stopLossShort = close + (atr * atrMultiplierSL)

takeProfitShort = close - (atr * atrMultiplierTP)

// === RSI Filter ===

rsi = ta.rsi(close, rsiPeriod)

longConditionRSI = rsi < rsiOversold

shortConditionRSI = rsi > rsiOverbought

// === Volume Filter ===

volThresholdValue = ta.sma(volume, 20) * volThreshold

highVolume = volume > volThresholdValue

// === Market Structure Functions ===

swings(len) =>

var int topx = na

var int btmx = na

upper = ta.highest(len)

lower = ta.lowest(len)

top = high[len] > upper ? high[len] : na

btm = low[len] < lower ? low[len] : na

topx := top ? bar_index[len] : topx

btmx := btm ? bar_index[len] : btmx

[top, topx, btm, btmx]

[top, topx, btm, btmx] = swings(len)

// === CHoCH Detection ===

var float topy = na

var float btmy = na

var os = 0

var top_crossed = false

var btm_crossed = false

if top

topy := top

top_crossed := false

if btm

btmy := btm

btm_crossed := false

if close > topy and not top_crossed

os := 1

top_crossed := true

if close < btmy and not btm_crossed

os := 0

btm_crossed := true

// === Break of Structure (BOS) ===

var float max = na

var float min = na

var int max_x1 = na

var int min_x1 = na

if os != os[1]

max := high

min := low

max_x1 := bar_index

min_x1 := bar_index

bullishBOS = close > max and os == 1

bearishBOS = close < min and os == 0

// === Trade Conditions with Filters ===

longEntry = bullishBOS and longConditionRSI and highVolume

shortEntry = bearishBOS and shortConditionRSI and highVolume

// === Execute Trades ===

if longEntry

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", from_entry="Long", stop=stopLossLong, limit=takeProfitLong)

if shortEntry

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", from_entry="Short", stop=stopLossShort, limit=takeProfitShort)

// === Plotting Market Structure ===

plotshape(series=longEntry, location=location.belowbar, color=color.green, style=shape.labelup, title="BUY")

plotshape(series=shortEntry, location=location.abovebar, color=color.red, style=shape.labeldown, title="SELL")

plot(topy, color=color.blue, title="CHoCH High")

plot(btmy, color=color.orange, title="CHoCH Low")