Ringkasan

Ini adalah strategi perdagangan opsi dinamis yang didasarkan pada indikator multi-teknis yang bertujuan untuk mengidentifikasi peluang perdagangan probabilitas tinggi melalui analisis komprehensif terhadap volatilitas, tren, dan dinamika pasar. Strategi ini menggabungkan beberapa indikator teknis, seperti rata-rata real ripple (ATR), Bollinger Bands (BB), Relatively Strong Index (RSI), dan Volume Weighted Average Price (VWAP), untuk membentuk kerangka keputusan perdagangan yang komprehensif.

Prinsip Strategi

Prinsip inti dari strategi ini adalah menggunakan beberapa sinyal pasar untuk membangun keputusan perdagangan. Ini terutama mencakup langkah-langkah kunci berikut:

- Menggunakan Brin band atas dan bawah sebagai sinyal harga untuk menembus

- Tergabung dengan RSI menilai pasar overbought oversold

- Tren dikonfirmasi melalui deteksi abnormalitas volume transaksi

- Menggunakan ATR untuk menghitung target stop loss dan stop loss dinamis

- Setel batas waktu maksimum untuk risiko

Keunggulan Strategis

- Analisis multi-faktor meningkatkan akurasi sinyal perdagangan

- Mekanisme stop-loss dan braking dinamis untuk mengontrol risiko secara efektif

- Pengaturan parameter yang fleksibel untuk menyesuaikan dengan lingkungan pasar yang berbeda

- Data retrospektif menunjukkan tingkat kemenangan dan faktor keuntungan yang lebih tinggi

- Strategi Keluar Berbasis Waktu Untuk Mencegah Terlalu Banyak Memegang Posisi

Risiko Strategis

- Indikator teknis yang tertinggal dapat menyebabkan sinyal yang salah

- Pasar yang sangat fluktuatif dapat meningkatkan kompleksitas transaksi

- Pilihan parameter sangat penting untuk kinerja strategi

- Biaya transaksi dan slippage dapat mempengaruhi pendapatan riil

- Kondisi pasar yang cepat berubah dapat mengurangi efektivitas strategi

Arah optimasi strategi

- Memperkenalkan algoritma pembelajaran mesin untuk mengoptimalkan pemilihan parameter

- Menambahkan lebih banyak indikator sentimen pasar

- Mengembangkan mekanisme penyesuaian parameter dinamis

- Mengoptimalkan Modul Manajemen Risiko

- Memperkenalkan analisis relevansi lintas pasar

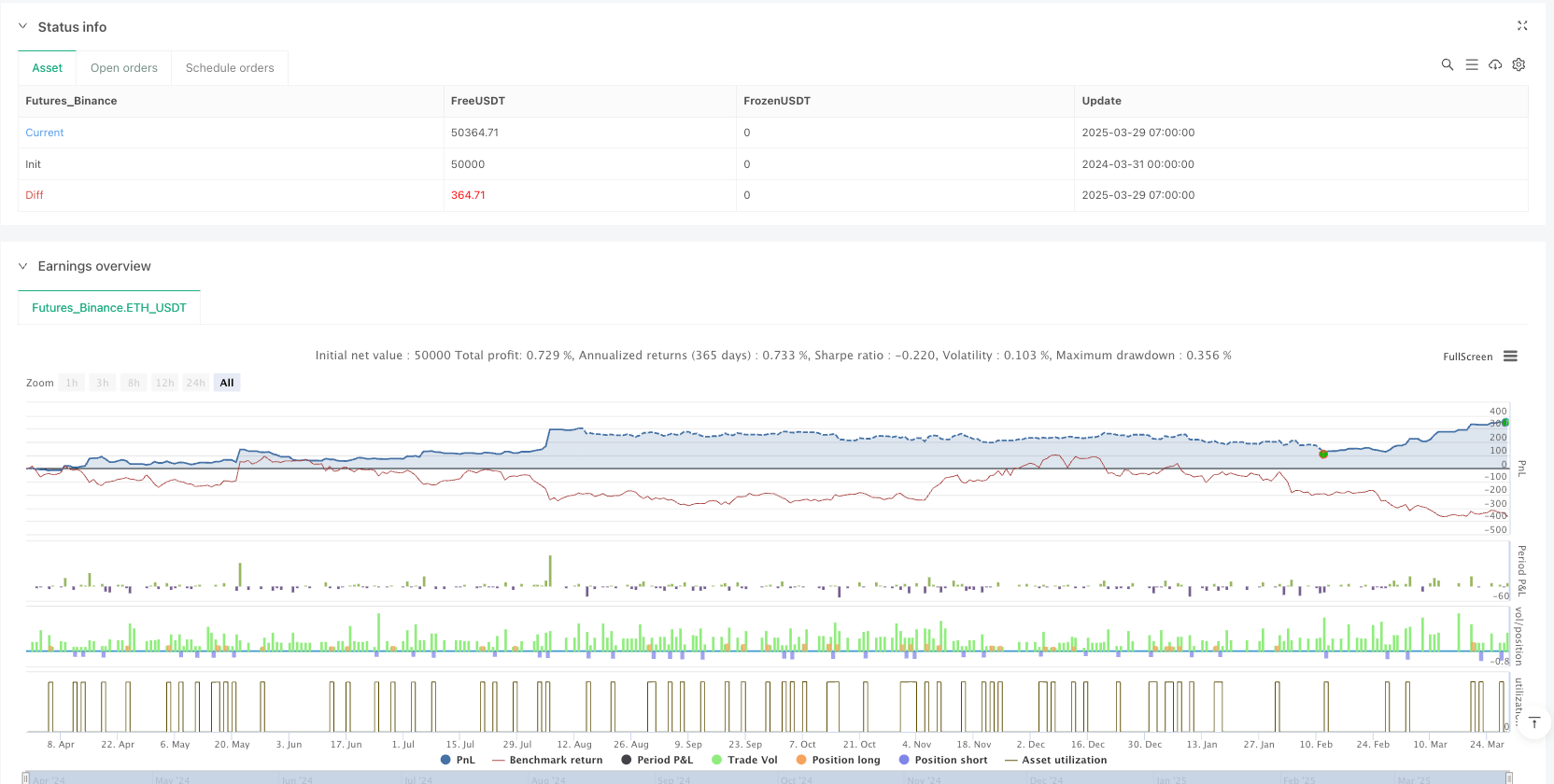

Meringkaskan

Strategi ini membangun sebuah kerangka perdagangan opsi yang relatif kokoh melalui analisis multi-faktor. Dengan menggunakan indikator-indikator teknis, kontrol risiko, dan mekanisme keluar dinamis secara komprehensif, strategi ini memberikan cara perdagangan yang sistematis bagi para pedagang. Namun, strategi perdagangan apa pun membutuhkan verifikasi dan pengoptimalan yang berkelanjutan.

Performance Metrics

Periode 5 menit:

- Rasio Kemenangan: 77,6%

- Faktor pendapatan: 3,52

- Maksimal pengunduran diri: 8,1 persen

- Rata-rata durasi transaksi: 2,7 jam

Periode 15 menit:

- Kemenangan: 75,9 persen

- Faktor pendapatan: 3,09

- Maksimal pengunduran diri: 9.4%

- Rata-rata durasi transaksi: 3,1 jam

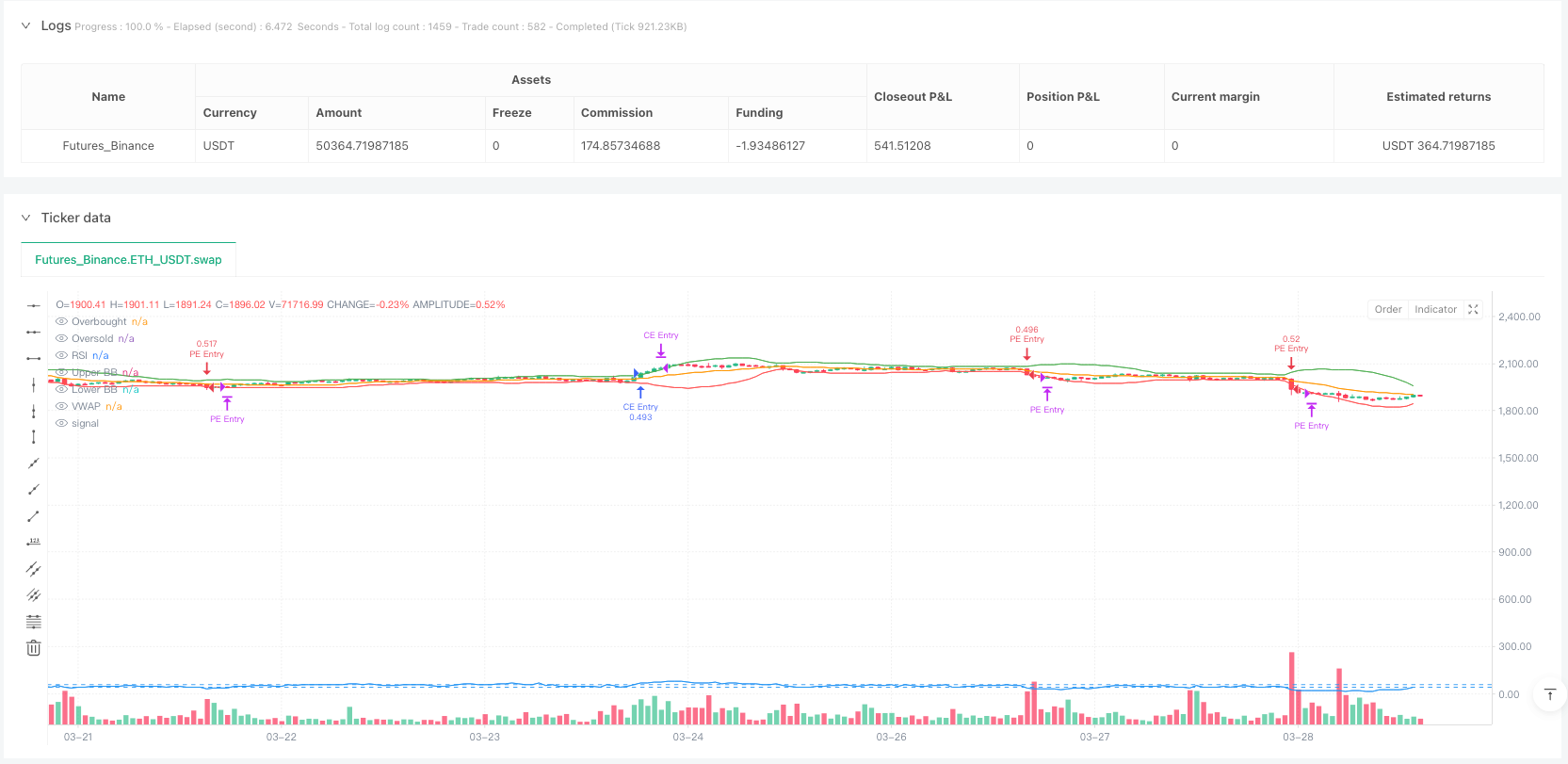

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Vinayz Options Stratergy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2)

// ---- Input Parameters ----

atrPeriod = input(14, title="ATR Period")

bbLength = input(20, title="BB Period")

bbStdDev = input(2, title="BB Std Dev")

rsiPeriod = input(14, title="RSI Period")

atrMultiplier = input(1.5, title="ATR Trailing Stop Multiplier")

vwapLength = input(20, title="VWAP Length")

targetMultiplier = input(2, title="Target Multiplier") // Target set at 2x ATR

maxHoldingBars = input(3, title="Max Holding Period (Bars)")

// ---- Indicator Calculations ----

atrValue = ta.atr(atrPeriod)

smaValue = ta.sma(close, bbLength)

upperBB = smaValue + bbStdDev * ta.stdev(close, bbLength)

lowerBB = smaValue - bbStdDev * ta.stdev(close, bbLength)

rsiValue = ta.rsi(close, rsiPeriod)

vwap = ta.vwma(close, vwapLength)

// ---- Volume Spike/Breakout Detection ----

volSMA = ta.sma(volume, 10)

volSpike = volume > volSMA * 1.5

// ---- ATR Volatility Filter to Avoid Low Volatility Zones ----

atrFilter = atrValue > ta.sma(atrValue, 20) * 0.5

// ---- Long Call Entry Conditions ----

longCE = ta.crossover(close, upperBB) and rsiValue > 60 and volSpike and close > vwap and atrFilter

// ---- Long Put Entry Conditions ----

longPE = ta.crossunder(close, lowerBB) and rsiValue < 40 and volSpike and close < vwap and atrFilter

// ---- Stop Loss and Target Calculation ----

longStopLoss = strategy.position_size > 0 ? strategy.position_avg_price - atrMultiplier * atrValue : na

shortStopLoss = strategy.position_size < 0 ? strategy.position_avg_price + atrMultiplier * atrValue : na

longTarget = strategy.position_size > 0 ? strategy.position_avg_price + targetMultiplier * atrValue : na

shortTarget = strategy.position_size < 0 ? strategy.position_avg_price - targetMultiplier * atrValue : na

// ---- Buy/Sell Logic ----

if (longCE)

strategy.entry("CE Entry", strategy.long)

label.new(bar_index, high, "BUY CE", color=color.green, textcolor=color.white, yloc=yloc.abovebar, size=size.small, tooltip="Buy CE Triggered")

if (longPE)

strategy.entry("PE Entry", strategy.short)

label.new(bar_index, low, "BUY PE", color=color.red, textcolor=color.white, yloc=yloc.belowbar, size=size.small, tooltip="Buy PE Triggered")

// ---- Exit Conditions ----

if (strategy.position_size > 0)

// Exit Long CE on Target Hit

if (close >= longTarget)

strategy.close("CE Entry", comment="CE Target Hit")

// Exit Long CE on Stop Loss

if (close <= longStopLoss)

strategy.close("CE Entry", comment="CE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("CE Entry", comment="CE Timed Exit")

if (strategy.position_size < 0)

// Exit Short PE on Target Hit

if (close <= shortTarget)

strategy.close("PE Entry", comment="PE Target Hit")

// Exit Short PE on Stop Loss

if (close >= shortStopLoss)

strategy.close("PE Entry", comment="PE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("PE Entry", comment="PE Timed Exit")

// ---- Plotting ----

plot(upperBB, color=color.green, title="Upper BB")

plot(lowerBB, color=color.red, title="Lower BB")

plot(rsiValue, title="RSI", color=color.blue, linewidth=1)

hline(60, "Overbought", color=color.blue)

hline(40, "Oversold", color=color.blue)

plot(vwap, color=color.orange, linewidth=1, title="VWAP")

// ---- Plot Volume Breakout/Spike ----

barcolor(volSpike ? color.yellow : na, title="Volume Spike Indicator")

//plotshape(volSpike, title="Volume Breakout", location=location.bottom, style=shape.triangleup, color=color.purple, size=size.small, text="Spike")

// ---- Alerts ----

alertcondition(longCE, "CE Buy Alert", "Bank Nifty CE Buy Triggered!")

alertcondition(longPE, "PE Buy Alert", "Bank Nifty PE Buy Triggered!")