[trans]

Ringkasan

Strategi perdagangan pivot multi-dimensi dengan sistem indikator Fibonacci dinamis adalah strategi perdagangan berbasis analisis teknis, yang terutama menggunakan pivot intraday, interval sentral (CPR), tingkat Fibonacci retracement, volume-weighted average (VWAP), dan rata-rata bergerak untuk mengidentifikasi peluang jual beli potensial. Strategi ini cocok untuk pedagang intraday, terutama untuk perdagangan garis pendek pada grafik K-line 3 menit.

Strategi ini menggunakan sistem titik pivot dari perhitungan harga tinggi, rendah, dan harga close out per hari, menggabungkan perdagangan rata-rata bobot ((VWAP) dan VWAP bergerak ((MVWAP) sebagai referensi resistensi dukungan dinamis. Pada saat yang sama, melalui indikator teknis seperti indeks relatif kuat (RSI), rata-rata bergerak sederhana (SMA) dan rata-rata bergerak indeks (EMA), membangun sistem keputusan perdagangan yang komprehensif.

Strategi pertama adalah mengidentifikasi garis K hijau (naik) dan merah (turun) yang memenuhi syarat, dan kemudian menilai apakah garis K tersebut menyentuh tingkat harga kunci, seperti pivot point, support, resistance, atau VWAP. Ketika garis K merah menyentuh tingkat harga kunci, ia memicu sinyal beli (CE); ketika garis K hijau menyentuh tingkat harga kunci, ia memicu sinyal jual (PE).

Prinsip Strategi

Prinsip strategi ini didasarkan pada perilaku pasar di sekitar harga yang berfluktuasi pada titik-titik dukungan dan resistensi yang penting. Keputusan perdagangan dilakukan dengan kombinasi bentuk K-line, volume transaksi, dan indikator momentum. Analisis dasar spesifiknya adalah sebagai berikut:

Mekanisme Identifikasi K-Line:

- Garis K hijau ((ke atas): harga penutupan lebih tinggi dari harga bukaan, entitas garis K setinggi setidaknya 17 poin, harga bukaan lebih rendah dari titik rendah ditambah 0.382 kali rentang garis K, dan harga penutupan lebih tinggi dari titik rendah ditambah 0.682 kali rentang garis K.

- Garis K merah ((turun): harga penutupan lebih rendah dari harga bukaan, entitas garis K setinggi setidaknya 17 poin.

Sistem perhitungan titik pusat:

- Titik pusat hari (PP): (High point + Low point + close price) / 3

- Resistansi: R1, R2, R3, R4

- Posisi pendukung: S1, S2, S3, S4

- Blok tengah (CPR): terdiri dari Bottom CPR dan Top CPR, memberikan area harga di mana pasar mungkin menyusun

Referensi dinamika harga:

- VWAP (volume-weighted average price): mencerminkan tingkat harga rata-rata setelah mempertimbangkan faktor volume

- MVWAP (mobile transaction volume weighted average price): rata-rata bergerak dari VWAP, memberikan referensi harga yang lebih halus

Sistem Indikator Bantuan:

- RSI: digunakan untuk mengukur pasar yang terlalu banyak membeli dan terlalu banyak menjual

- SMA ((50 siklus) dan EMA ((20 siklus): memberikan referensi arah tren harga

- Analisis volume transaksi: mengevaluasi tren volume transaksi melalui rata-rata volume transaksi 20 periode

Sinyal perdagangan dihasilkan:

- Ketika K-line merah yang memenuhi syarat menyentuh titik pivot, support, resistor atau VWAP/MVWAP, maka akan dihasilkan sinyal beli ((CE)

- Ketika garis K hijau yang memenuhi syarat menyentuh titik pivot, titik support, titik resistance atau VWAP / MVWAP, menghasilkan sinyal jual (PE)

Gagasan inti dari strategi ini adalah untuk menangkap potensi reversal harga di dekat titik-titik resistensi pendukung utama, memfilternya melalui bentuk garis K tertentu dan beberapa indikator teknis, meningkatkan efektivitas sinyal. Garis K yang menyentuh titik-titik pivot sering mewakili peningkatan kemungkinan pasar untuk ragu-ragu atau reversal di tingkat harga kunci ini.

Keunggulan Strategis

Dari analisis kode strategi ini, kita dapat menyimpulkan keuntungan yang signifikan sebagai berikut:

Sistem Verifikasi MultidimensiMenggabungkan berbagai indikator teknis (pivot point, VWAP, moving average, RSI) untuk memverifikasi sinyal perdagangan, mengurangi risiko sinyal palsu.

Adaptasi Pasar yang DinamisSistem pivot point intraday diperbarui setiap hari, sehingga strategi dapat beradaptasi dengan berbagai kondisi pasar dan volatilitas.

Identifikasi garis K yang akurat: Untuk memfilter peluang perdagangan yang potensial, dan meningkatkan kualitas sinyal melalui kondisi bentuk K-line yang ketat dan tingkat Fibonacci.

Fleksibilitas tampilanStrategi: memiliki tampilan yang dapat disesuaikan, hanya dalam jangka waktu yang tepat (grafik harian di bawah 15 menit) untuk menampilkan titik pivot, mengurangi kekacauan grafik.

Keunggulan Berpikir KebalikanStrategi: Mencari peluang beli saat garis K merah menyentuh posisi kunci, mencari peluang jual saat garis K hijau menyentuh posisi kunci, memanfaatkan kemungkinan pasar dalam keadaan overbought dan oversold dalam jangka pendek.

Sistem hierarki harga yang lengkap: berisi beberapa lapisan dukungan dan resistensi ((S1-S4 dan R1-R4), memberikan harga referensi yang kaya, cocok untuk lingkungan pasar dengan amplitudo fluktuasi yang berbeda.

Integrasi Pusat Wilayah (CPR)CPR menyediakan identifikasi zona potensi perhitungan pada hari itu, yang memiliki nilai referensi penting dalam perdagangan intraday.

Bantuan visualDengan banyaknya tanda dan bentuk yang ditampilkan, K-line yang memenuhi syarat dan situasi yang menyentuh harga kunci diidentifikasi secara intuitif di grafik, sehingga memudahkan para pedagang untuk mengidentifikasi dengan cepat.

Konfirmasi pengiriman: Menggabungkan analisis volume transaksi untuk menilai keterlibatan pasar melalui volume transaksi rata-rata, meningkatkan keandalan sinyal.

Cocok untuk perdagangan intradayStrategi ini dirancang untuk jangka waktu yang singkat (khususnya grafik 3 menit) dan cocok untuk pedagang intraday yang memanfaatkan fluktuasi pasar untuk melakukan perdagangan yang sering.

Keunggulan ini membuat strategi ini menjadi sistem perdagangan intraday yang komprehensif, kuat, dan fleksibel, yang sangat cocok untuk investor yang memiliki pengetahuan tentang analisis teknis dan ingin melakukan perdagangan berdasarkan perilaku harga dan tingkat harga kritis.

Risiko Strategis

Meskipun ada banyak keuntungan dari strategi ini, ada beberapa risiko potensial yang perlu diperhatikan oleh pedagang:

Sinyal terlalu berisikoKarena strategi melibatkan beberapa pivot point ((PP, R1-R4, S1-S4) dan indikator lainnya, mungkin terlalu banyak sinyal dihasilkan di pasar yang bergejolak, yang menyebabkan frekuensi perdagangan dan peningkatan biaya.

- Solusi: Pertimbangkan untuk menambahkan kondisi penyaringan tambahan, seperti batasan waktu perdagangan atau kondisi konfirmasi tren.

Perangkap perdagangan terbalikStrategi ini didasarkan pada logika terbalik ((garis K merah menyentuh posisi kunci untuk membeli, garis K hijau menyentuh posisi kunci untuk menjual), yang dapat menyebabkan kerugian berturut-turut di pasar tren yang kuat.

- Solusi: Evaluasi tren pasar secara keseluruhan sebelum menggunakan strategi, dan tambahkan filter tren untuk menghindari perdagangan mundur pada tren kuat.

Parameter SensitivitasEfektivitas strategi sangat bergantung pada parameter K-line identifikasi (jika K-line lebih tinggi dari 17 poin) dan pengaturan siklus rata-rata bergerak, yang mungkin memerlukan parameter yang berbeda dalam lingkungan pasar yang berbeda.

- Solusi: melakukan pengujian ulang terhadap berbagai varietas dan kondisi pasar, dan mengoptimalkan pengaturan parameter.

Kurangnya pengendalian kerugianKode tidak secara jelas mengatur strategi stop loss, yang dapat menyebabkan kerugian tunggal yang terlalu besar.

- Solusi: menerapkan strategi stop loss yang jelas, seperti stop loss dinamis atau stop loss dengan jumlah tetap berdasarkan ATR.

Keterbatasan strategi dalam sehariSebagai strategi intraday yang berfokus pada grafik 3 menit, tidak cocok untuk jangka menengah dan panjang, kehilangan kemungkinan peluang tren jangka panjang.

- Solusinya: Anggap strategi ini sebagai bagian dari sistem perdagangan dan gunakan strategi jangka menengah dan panjang.

Keterbatasan titik pusatDalam pasar horizontal, harga mungkin sering menyentuh beberapa titik pivot, menghasilkan sinyal kekacauan.

- Solusi: Mempertimbangkan penutupan sementara strategi atau menambahkan kondisi konfirmasi sinyal dalam market consolidation.

Kurangnya penyesuaian bobot transaksiMeskipun VWAP digunakan, strategi ini tidak secara dinamis menyesuaikan bobot sinyal berdasarkan volume transaksi.

- Solusi: Meningkatkan kondisi devaluasi volume transaksi untuk memastikan bahwa transaksi dilakukan dengan partisipasi pasar yang memadai.

Ketergantungan waktu: Hari pivot didasarkan pada data dari hari sebelumnya, dan pada awal hari perdagangan baru dapat menunjukkan kinerja yang tidak stabil karena kurangnya data yang cukup untuk hari tersebut.

- Solusi: Pertimbangkan untuk mengaktifkan kembali strategi 30-60 menit sebelum hari perdagangan untuk mendapatkan informasi pasar yang cukup.

Tantangan implementasi otomatisasiStrategi melibatkan penilaian kondisional yang beragam, yang dapat menyebabkan keterlambatan atau ketidaktentuan waktu dalam pelaksanaan otomatisasi yang sebenarnya.

- Solusi: Optimalkan sistem eksekusi, pastikan latensi rendah, atau pertimbangkan metode semi-otomatisasi yang digabungkan dengan konfirmasi manual.

Pengamatan risiko bias: Logika identifikasi garis K hijau/merah dalam kode mungkin tidak sesuai dalam pengujian ulang dengan lingkungan hard disk.

- Solusinya: melakukan pengujian simulasi yang ketat untuk memastikan bahwa strategi tetap efektif dalam lingkungan perdagangan nyata.

Mengenali dan mengelola risiko ini sangat penting untuk menerapkan strategi ini dengan sukses, dan pedagang harus melakukan penyesuaian sesuai dengan toleransi risiko dan kebiasaan perdagangan mereka.

Arah optimasi strategi

Berdasarkan analisis mendalam terhadap kode, berikut adalah arah-arah utama di mana strategi ini dapat dioptimalkan:

Parameter Identifikasi Garis K Dinamis:

- Strategi saat ini menggunakan nilai tetap (seperti K-line height minimal 17 poin) untuk mengidentifikasi K-line yang efektif, yang dapat diubah menjadi parameter dinamis berdasarkan ATR (Average True Range) untuk membuat strategi lebih sesuai dengan lingkungan fluktuasi yang berbeda.

- Alasan optimasi: Parameter tetap memiliki efek yang berbeda dalam lingkungan fluktuasi yang berbeda, sedangkan parameter dinamis dapat meningkatkan adaptasi strategi.

Sistem penyaringan tren:

- Menambahkan kerangka waktu yang lebih tinggi (seperti 15 menit atau 30 menit) untuk menilai tren, melakukan perdagangan hanya di arah tren utama atau menyesuaikan bobot sinyal.

- Alasan optimasi: Menghindari perdagangan berlawanan yang sering terjadi dalam tren yang kuat, meningkatkan rasio kemenangan dan kerugian.

Sistem penilaian kualitas sinyal:

- Untuk setiap sinyal perdagangan, membuat sistem penilaian yang komprehensif, mempertimbangkan beberapa faktor seperti: K-line intensitas, pentingnya titik pivot yang disentuh, nilai RSI, volume transaksi yang tidak biasa, dll.

- Alasan optimasi: Tidak semua sinyal memiliki kualitas yang sama, sistem penilaian dapat memfilter sinyal berkualitas rendah dan meningkatkan efisiensi perdagangan.

Integrasi Manajemen Dana:

- Sesuaikan ukuran posisi dengan kekuatan sinyal dan kondisi pasar yang dinamis, tambahkan posisi pada peluang probabilitas tinggi, dan kurangi risiko pada peluang probabilitas rendah.

- Alasan optimasi: Pengelolaan dana yang efektif sangat penting untuk keuntungan jangka panjang dan dapat secara signifikan meningkatkan kinerja strategi.

Konfirmasi multi-frame waktu:

- Sebelum menghasilkan sinyal, periksa kondisi konsistensi dari beberapa frame waktu, seperti perdagangan ketika sinyal dari grafik 3 menit dan 15 menit konsisten.

- Alasan optimasi: Pengesahan multi-frame timeframe dapat mengurangi probabilitas sinyal yang salah dan meningkatkan akurasi transaksi.

Penghentian kerusakan dan mekanisme penghentian:

- Menerapkan sistem stop loss cerdas, seperti stop loss dinamis berdasarkan volatilitas atau stop loss pada posisi struktur penting, dengan pengaturan tujuan stop otomatis.

- Alasan optimasi: Manajemen risiko yang baik sangat penting untuk menghindari penarikan besar-besaran dan melindungi keuntungan.

Filter waktu transaksi:

- Identifikasi waktu perdagangan yang efisien dan tidak efisien, dan hindari saat-saat di mana volatilitas pasar rendah atau berantakan (seperti waktu makan siang atau sebelum dan sesudah buka dan tutup pasar).

- Alasan optimasi: karena karakteristik perilaku pasar yang berbeda pada waktu yang berbeda, perdagangan selektif dapat meningkatkan efisiensi secara keseluruhan.

Adaptasi parameter indikator:

- Mengubah parameter indikator teknis yang tetap (misalnya 14 siklus RSI, 20 siklus EMA) menjadi parameter yang disesuaikan secara otomatis berdasarkan kondisi pasar.

- Alasan optimasi: Parameter indikator optimal juga harus disesuaikan dengan perubahan kondisi pasar, meningkatkan sensitivitas indikator.

Klasifikasi lingkungan pasar:

- Ditambahkan algoritma untuk secara otomatis mengidentifikasi lingkungan pasar saat ini (trend, rounding, volatilitas tinggi, dll.) dan menerapkan pengaturan parameter yang berbeda untuk lingkungan yang berbeda.

- Alasan optimasi: pengaturan parameter tunggal sulit untuk berkinerja optimal di semua lingkungan pasar, dan penyesuaian adaptasi lingkungan dapat meningkatkan stabilitas strategi secara signifikan.

Pembelajaran Mesin:

- Pertimbangkan untuk mengintegrasikan model pembelajaran mesin untuk memprediksi probabilitas keberhasilan sinyal, memfilter dan memprioritaskan sinyal perdagangan berdasarkan pengenalan pola sejarah.

- Alasan optimasi: Pembelajaran mesin dapat menemukan pola kompleks yang sulit diidentifikasi oleh manusia, meningkatkan tingkat kecerdasan strategi.

Dengan menerapkan arah optimasi di atas, strategi dapat secara signifikan meningkatkan fleksibilitas, akurasi dan profitabilitas jangka panjang, dengan mempertahankan keunggulan asli, dan lebih baik menanggapi berbagai tantangan kondisi pasar.

Meringkaskan

Strategi perdagangan pivot multi-dimensi dengan sistem indikator Fibonacci dinamis adalah sistem strategi perdagangan intraday yang komprehensif, kuat, dan terstruktur. Ini dengan cerdik menggabungkan alat analisis teknis tradisional (pivot, Fibonacci retracement, moving average) dan indikator dinamis modern (V, WAP, CPR), yang memberikan pedagang kerangka kerja perdagangan intraday yang berpotensi melalui penyaringan kondisional K-line yang ketat dan konfirmasi multi-indikator.

Keunggulan inti dari strategi ini adalah cakupan komprehensif pada tingkat harga kunci dan sensitivitas untuk menangkap potensi titik balik. Dengan menetapkan kondisi identifikasi garis K yang ketat, strategi ini dapat menyaring sejumlah besar kebisingan pasar yang tidak masuk akal dan berfokus pada peluang perdagangan dengan probabilitas tinggi.

Namun, ada juga beberapa keterbatasan strategi, seperti kemungkinan terlalu banyak sinyal, risiko perdagangan terbalik, dan tantangan pengoptimalan parameter. Untuk mengatasi masalah ini, kami telah mengusulkan beberapa arah pengoptimalan, termasuk penyesuaian parameter dinamis, konfirmasi multi-frame timeframe, manajemen dana cerdas, dan adaptasi lingkungan pasar.

Perlu dicatat bahwa strategi perdagangan apa pun bukanlah alat untuk “menghasilkan uang”, perdagangan yang sukses membutuhkan kesabaran, disiplin, dan pembelajaran terus-menerus dari pedagang selain strategi itu sendiri. Untuk strategi ini, disarankan bahwa pedagang terlebih dahulu menguji secara menyeluruh di lingkungan simulasi, membiasakan diri dengan karakteristik kinerjanya di berbagai kondisi pasar, secara bertahap menyesuaikan parameter untuk menyesuaikan dengan varietas perdagangan tertentu dan gaya pribadi, dan akhirnya membentuk sistem perdagangan yang dipersonalisasi dan berkelanjutan.

Dengan terus-menerus berlatih, umpan balik, dan optimasi, strategi perdagangan multi-dimensi hub dan sistem indikator Fibonacci yang dinamis dapat menjadi senjata yang kuat dalam kotak alat pedagang intraday, memberikan kerangka analisis teknis yang andal untuk memahami fluktuasi pasar intraday.

Overview

The Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators is a technical analysis-based trading strategy that utilizes daily pivot points, Central Pivot Range (CPR), Fibonacci retracement levels, Volume Weighted Average Price (VWAP), and moving averages to identify potential buying and selling opportunities. This strategy is particularly suitable for intraday traders, especially those focusing on 3-minute chart timeframes. The core of the strategy is determining whether candles meeting specific conditions touch key support and resistance levels, thereby triggering trading signals.

The strategy employs a pivot point system calculated from daily high, low, and close prices, combined with Volume Weighted Average Price (VWAP) and Moving VWAP (MVWAP) as dynamic support and resistance references. It also incorporates technical indicators such as the Relative Strength Index (RSI), Simple Moving Average (SMA), and Exponential Moving Average (EMA) to create a comprehensive trading decision system.

The strategy first identifies qualifying green (bullish) and red (bearish) candles, then determines if these candles touch key price levels such as pivot points, support levels, resistance levels, or VWAP. When a red candle touches a key price level, it triggers a buy signal (CE); when a green candle touches a key price level, it triggers a sell signal (PE). This contrarian approach reflects the core concept of seeking potential reversal points at key price levels.

Strategy Principles

The principles of this strategy are built on market behavior where prices fluctuate around key support and resistance levels, combined with candle patterns, volume, and momentum indicators for trading decisions. The specific principles are analyzed as follows:

Candle Identification Mechanism:

- Green Candle (Bullish): Close higher than open, candle body height at least 17 points, open lower than low plus 0.382 times candle range, close higher than low plus 0.682 times candle range.

- Red Candle (Bearish): Close lower than open, candle body height at least 17 points.

Pivot Point Calculation System:

- Daily Pivot Point (PP): (Daily High + Daily Low + Daily Close) / 3

- Resistance Levels: R1, R2, R3, R4

- Support Levels: S1, S2, S3, S4

- Central Pivot Range (CPR): Comprised of bottom CPR and top CPR, providing a price region where the market may consolidate

Dynamic Price References:

- VWAP (Volume Weighted Average Price): Reflects the average price level considering volume factors

- MVWAP (Moving Volume Weighted Average Price): Moving average of VWAP, providing a smoother price reference

Auxiliary Indicator System:

- RSI: Used to measure market overbought/oversold conditions

- SMA (50-period) and EMA (20-period): Provide price trend direction references

- Volume Analysis: Assesses volume trends through 20-period volume moving average

Trade Signal Generation:

- When qualifying red candles touch any pivot point, support level, resistance level, or VWAP/MVWAP, a buy signal (CE) is generated

- When qualifying green candles touch any pivot point, support level, resistance level, or VWAP/MVWAP, a sell signal (PE) is generated

The core idea of the strategy is to capture potential reversals near key support and resistance levels, filtered through specific candle patterns and multiple technical indicators to enhance signal validity. Candles touching pivot points often represent increased possibility of market hesitation or reversal at these key price levels.

Strategy Advantages

Deep analysis of the strategy code reveals the following significant advantages:

Multi-dimensional Verification Mechanism: Combines multiple technical indicators (pivot points, VWAP, moving averages, RSI) to validate trading signals, reducing false signal risk.

Dynamic Market Adaptation: Daily pivot point system updates daily, allowing the strategy to adapt to different market environments and volatilities.

Precise Candle Identification: Screens potential trading opportunities through strict candle pattern conditions and Fibonacci levels, improving signal quality.

Flexible Display Settings: The strategy features view adaptation functionality, only displaying pivot points in appropriate timeframes (intraday charts below 15 minutes), reducing chart clutter.

Contrarian Thinking Advantage: The strategy looks for buying opportunities when red candles touch key levels and selling opportunities when green candles touch key levels, leveraging potential short-term overbought/oversold market conditions.

Complete Price Level Hierarchy: Includes multiple layers of support and resistance (S1-S4 and R1-R4), providing rich reference prices suitable for market environments with different volatility ranges.

Integrated Central Pivot Range (CPR): CPR provides identification of potential consolidation areas for the day, which has important reference value in intraday trading.

Visual Assistance: Through rich markers and shapes, qualifying candles and instances of touching key price levels are intuitively marked on the chart, enabling traders to quickly identify them.

Volume Confirmation: Incorporates volume analysis, assessing market participation through volume moving averages, enhancing signal reliability.

Suitable for Intraday Trading: The strategy is specially designed for short timeframes (particularly 3-minute charts), suitable for intraday traders looking to capitalize on market fluctuations through frequent trading.

These advantages make this strategy a strong, adaptive intraday trading system, particularly suitable for investors with a good understanding of technical analysis who wish to trade based on price action and key price levels.

Strategy Risks

Despite its many advantages, the strategy also presents several potential risks that traders should carefully address:

Excessive Signal Risk: Due to the strategy involving multiple pivot points (PP, R1-R4, S1-S4) and other indicators, it may generate too many signals in volatile markets, leading to frequent trading and increased fees.

- Solution: Consider adding additional filtering conditions, such as trading session limitations or trend confirmation conditions.

Contrarian Trading Trap: The strategy is based on contrarian logic (buy when red candles touch key levels, sell when green candles touch key levels), which may lead to consecutive losses in strong trending markets.

- Solution: Assess the overall market trend before using the strategy, and add trend filters to avoid counter-trend trading in strong trends.

Parameter Sensitivity: Strategy effectiveness is highly dependent on candle identification parameters (e.g., candle height must exceed 17 points) and moving average period settings, which may require different parameters in different market environments.

- Solution: Backtest different instruments and market conditions to optimize parameter settings.

Lack of Stop-Loss Mechanism: No explicit stop-loss strategy is set in the code, which may lead to excessive single-trade losses.

- Solution: Implement clear stop-loss strategies, such as ATR-based dynamic stop-losses or fixed-point stop-losses.

Intraday Strategy Limitations: As a strategy focusing on 3-minute charts, it is not suitable for medium to long-term holdings, potentially missing opportunities in longer-term trends.

- Solution: View this strategy as part of a trading system, used in conjunction with medium and long-term strategies.

Pivot Point Limitations: In range-bound markets, prices may frequently touch multiple pivot points, generating confusing signals.

- Solution: Consider temporarily disabling the strategy or adding signal confirmation conditions in consolidating markets.

Lack of Volume Weight Adjustment: Although VWAP is used, the strategy does not dynamically adjust signal weights based on volume size.

- Solution: Add volume threshold conditions to ensure trading occurs with sufficient market participation.

Time Dependency: Daily pivot points are based on previous day’s data, and may perform unstably at the beginning of a new trading day due to insufficient current day data.

- Solution: Consider enabling the strategy 30-60 minutes after the trading day begins to gather sufficient market information.

Automation Implementation Challenges: The strategy involves multiple condition judgments, and may face delays or untimely execution during actual automated execution.

- Solution: Optimize execution systems to ensure low latency, or consider semi-automated methods combined with manual confirmation.

Backtest Bias Risk: The green/red candle identification logic in the code may perform inconsistently between backtesting and live trading environments.

- Solution: Conduct rigorous live simulation testing to ensure the strategy remains effective in actual trading environments.

Recognizing and managing these risks is crucial for successfully applying this strategy. Traders should make appropriate adjustments based on their risk tolerance and trading habits.

Strategy Optimization Directions

Based on deep analysis of the code, the following are key directions for optimizing this strategy:

Dynamic Candle Identification Parameters:

- The current strategy uses fixed values (such as candle height of at least 17 points) to identify effective candles. This could be changed to dynamic parameters based on ATR (Average True Range) to better adapt to different volatility environments.

- Optimization rationale: Fixed parameters perform differently in various volatility environments; dynamic parameters can improve strategy adaptability.

Trend Filtering System:

- Add trend determination from higher timeframes (such as 15-minute or 30-minute) to only execute trades in the direction of the main trend or adjust signal weights.

- Optimization rationale: Avoid frequent counter-trend trading in strong trends, improving win rate and risk-reward ratio.

Signal Quality Scoring Mechanism:

- Establish a comprehensive scoring system for each trading signal, considering multiple factors such as candle strength, importance of the pivot point touched, RSI value, volume anomalies, etc.

- Optimization rationale: Not all signals are of equal quality; a scoring system can filter out low-quality signals and improve trading efficiency.

Capital Management Integration:

- Dynamically adjust position size based on signal strength and market conditions, increasing positions on high-probability opportunities and reducing risk exposure in low-probability situations.

- Optimization rationale: Effective capital management is crucial for long-term profitability and can significantly improve strategy performance.

Multiple Timeframe Confirmation:

- Check condition consistency across multiple timeframes before generating signals, for example, trading only when 3-minute and 15-minute chart signals align.

- Optimization rationale: Multiple timeframe confirmation can reduce the probability of false signals and improve trading precision.

Stop-Loss and Take-Profit Mechanisms:

- Implement smart stop-loss systems, such as volatility-based dynamic stop-losses or key structural position stop-losses, while setting automatic take-profit targets.

- Optimization rationale: Sound risk management is crucial for avoiding significant drawdowns and protecting profits.

Trading Time Filters:

- Identify efficient and inefficient trading sessions, avoiding periods of low market volatility or chaotic periods (such as lunch hours or before and after market open and close).

- Optimization rationale: Market behavior characteristics differ across various sessions; selective trading can improve overall efficiency.

Adaptive Indicator Parameters:

- Change fixed technical indicator parameters (such as 14-period RSI, 20-period EMA) to parameters that automatically adjust based on market state.

- Optimization rationale: When market conditions change, optimal indicator parameters should also adjust accordingly, improving indicator sensitivity.

Market Environment Classification:

- Add algorithms to automatically identify the current market environment (trending, consolidating, high volatility, etc.) and apply different parameter settings for different environments.

- Optimization rationale: Single parameter settings are difficult to perform optimally in all market environments; environment-adaptive adjustments can significantly enhance strategy stability.

Machine Learning Enhancement:

- Consider integrating machine learning models to predict signal success probability, filtering and prioritizing trading signals based on historical pattern recognition.

- Optimization rationale: Machine learning can discover complex patterns difficult for humans to identify, raising the strategy’s intelligence level.

By implementing these optimization directions, the strategy can significantly improve adaptability, accuracy, and long-term profitability while maintaining its original advantages, better addressing challenges across various market conditions.

Summary

The Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators is a comprehensive, well-structured intraday trading strategy system. It cleverly combines traditional technical analysis tools (pivot points, Fibonacci retracements, moving averages) with modern dynamic indicators (VWAP, CPR). Through strict candle condition screening and multiple indicator confirmation, it provides traders with a promising intraday trading framework.

The core advantage of this strategy lies in its comprehensive coverage of key price levels and sensitive capture of potential reversal points. By setting strict candle identification conditions, the strategy can filter out a large amount of meaningless market noise and focus on high-probability trading opportunities. At the same time, the use of volume and momentum indicators further enhances signal reliability.

However, the strategy also has some limitations, such as potentially excessive signals, contrarian trading risks, and parameter optimization challenges. To address these issues, we’ve proposed several optimization directions, including dynamic parameter adjustment, multiple timeframe confirmation, intelligent capital management, and market environment adaptation. These optimizations can help traders adjust the strategy according to their own needs and market characteristics, improving overall trading effectiveness.

It’s worth noting that no trading strategy is a “magic bullet.” Successful trading depends not only on the strategy itself but also on the trader’s patience, discipline, and continuous learning. For this strategy, it’s recommended that traders first thoroughly test it in a simulated environment, familiarize themselves with its performance characteristics under different market conditions, gradually adjust parameters to adapt to specific trading instruments and personal styles, and ultimately form a personalized, sustainably profitable trading system.

Through continuous practice, feedback, and optimization, the Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators can become a powerful weapon in an intraday trader’s toolbox, providing a reliable technical analysis framework for capturing short-term market opportunities.

The strategy’s integration of traditional pivot points with modern technical tools creates a balanced approach that respects market structure while remaining responsive to intraday price movements. By focusing on key price interactions at critical levels, traders can develop a deeper understanding of market psychology and potentially improve their trading performance.

Ultimately, successful implementation will require thoughtful customization, rigorous testing, and disciplined execution. When properly applied as part of a comprehensive trading plan that includes sound risk management principles, this strategy offers a systematic method for navigating the complexities of intraday markets with greater confidence and precision.

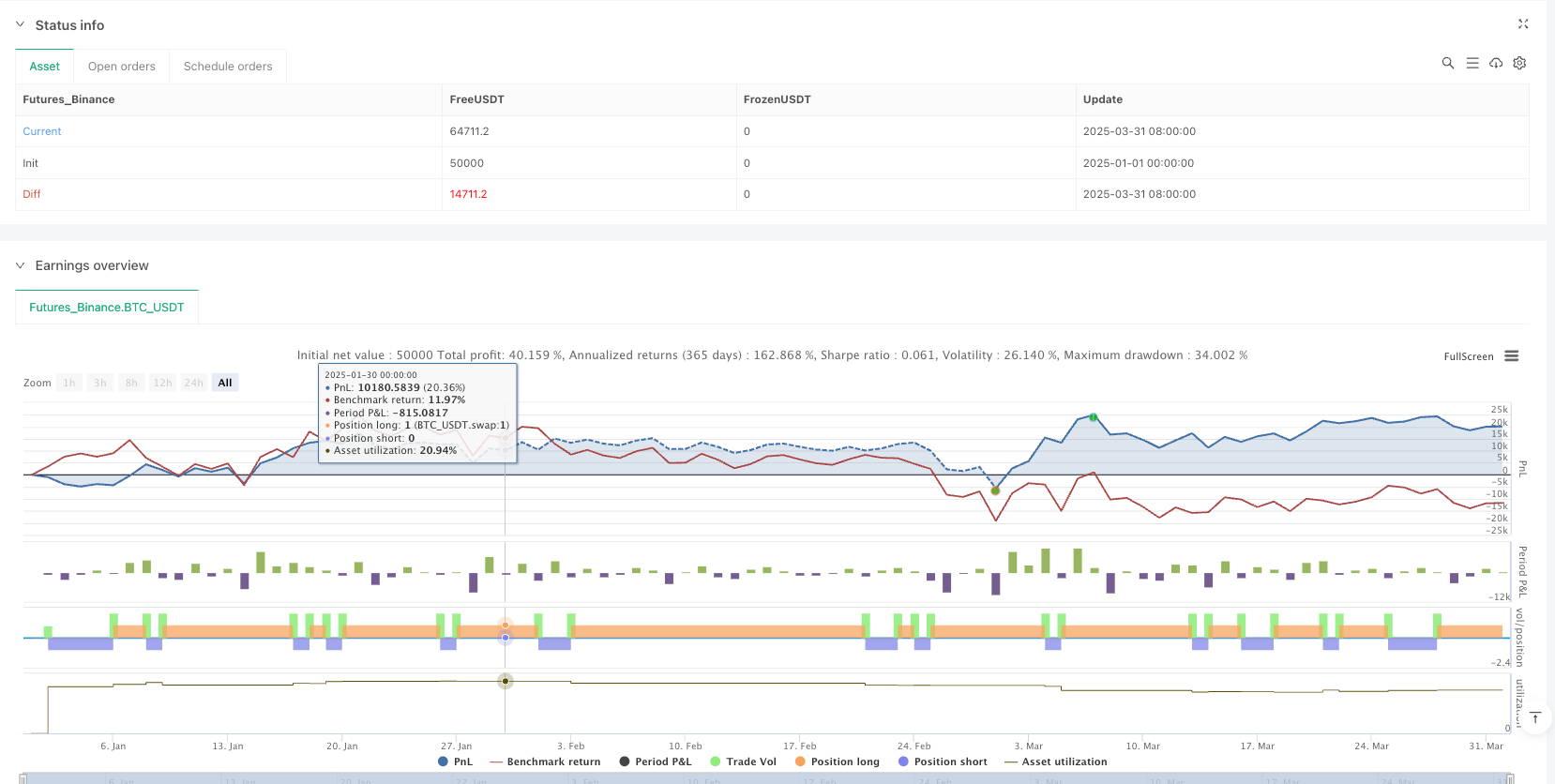

/*backtest

start: 2025-01-01 00:00:00

end: 2025-04-01 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot Point CE/PE Strategy", overlay=true)

// Identify 3-minute candles (Assuming the script is applied to a 3-minute chart)

// Calculate candle range

candleRange = high - low

// Conditions for a qualifying green candle

greenCandle = (close > open) and (candleRange >= 17) and (open < (low + 0.382 * candleRange)) and (close > (low + 0.682 * candleRange))

// Conditions for a qualifying red candle

redCandle = (close < open) and (candleRange >= 17)

// Fibonacci levels for qualifying green and red candles

green_fib_0_382 = greenCandle ? high - 0.382 * candleRange : na

green_fib_0_618 = greenCandle ? high - 0.618 * candleRange : na

red_fib_0_382 = redCandle ? low + 0.382 * candleRange : na

red_fib_0_682 = redCandle ? low + 0.682 * candleRange : na

// Daily Pivot Point Calculation

[daily_high, daily_low, daily_close] = request.security(syminfo.tickerid, "D", [high, low, close])

daily_pivot = (daily_high + daily_low + daily_close) / 3

daily_r1 = daily_pivot + (daily_pivot - daily_low)

daily_s1 = daily_pivot - (daily_high - daily_pivot)

daily_r2 = daily_pivot + (daily_high - daily_low)

daily_s2 = daily_pivot - (daily_high - daily_low)

daily_r3 = daily_high + 2 * (daily_pivot - daily_low)

daily_s3 = daily_low - 2 * (daily_high - daily_pivot)

daily_r4 = daily_high + 3 * (daily_pivot - daily_low)

daily_s4 = daily_low - 3 * (daily_high - daily_pivot)

// Updated CPR Calculation

bottom_cpr = (daily_high + daily_low) / 2

top_cpr = (daily_pivot - bottom_cpr) + daily_pivot

// VWAP and MVWAP Calculation

vwap = ta.vwap(close)

mvwap_length = input.int(20, title="MVWAP Length")

mvwap = ta.sma(vwap, mvwap_length)

// Volume Analysis

volume_ma = ta.sma(volume, 20)

plot(volume, color=color.gray, title="Volume")

plot(volume_ma, color=color.orange, title="Volume MA")

// RSI Calculation

rsi_length = input.int(14, title="RSI Length")

rsi = ta.rsi(close, rsi_length)

plot(rsi, color=color.blue, title="RSI")

// SMA and EMA Calculation

sma_length = input.int(50, title="SMA Length")

ema_length = input.int(20, title="EMA Length")

sma = ta.sma(close, sma_length)

ema = ta.ema(close, ema_length)

plot(sma, color=color.red, title="SMA")

plot(ema, color=color.green, title="EMA")

// Dynamic Visibility Condition Based on Chart Scale

show_pivot = (timeframe.isintraday and timeframe.multiplier <= 15)

// Display daily pivot points

plot(show_pivot ? daily_pivot : na, color=color.blue, title="Daily Pivot", style=plot.style_stepline)

plot(show_pivot ? daily_r1 : na, color=color.red, title="Daily R1", style=plot.style_stepline)

plot(show_pivot ? daily_r2 : na, color=color.red, title="Daily R2", style=plot.style_stepline)

plot(show_pivot ? daily_r3 : na, color=color.red, title="Daily R3", style=plot.style_stepline)

plot(show_pivot ? daily_r4 : na, color=color.red, title="Daily R4", style=plot.style_stepline)

plot(show_pivot ? daily_s1 : na, color=color.green, title="Daily S1", style=plot.style_stepline)

plot(show_pivot ? daily_s2 : na, color=color.green, title="Daily S2", style=plot.style_stepline)

plot(show_pivot ? daily_s3 : na, color=color.green, title="Daily S3", style=plot.style_stepline)

plot(show_pivot ? daily_s4 : na, color=color.green, title="Daily S4", style=plot.style_stepline)

// Display Central Pivot Range (CPR)

plot(show_pivot ? top_cpr : na, color=color.purple, title="Top CPR", style=plot.style_stepline)

plot(show_pivot ? bottom_cpr : na, color=color.orange, title="Bottom CPR", style=plot.style_stepline)

plot(vwap, color=color.fuchsia, title="VWAP")

plot(mvwap, color=color.teal, title="MVWAP")

// Mark qualifying candles

plotshape(greenCandle, title="Green Candle", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(redCandle, title="Red Candle", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Detect Green Candle Touching Pivot Points

greenTouchPivot = greenCandle and ((open <= daily_pivot and high >= daily_pivot) or

(open <= daily_r1 and high >= daily_r1) or

(open <= daily_r2 and high >= daily_r2) or

(open <= daily_r3 and high >= daily_r3) or

(open <= daily_r4 and high >= daily_r4) or

(open <= daily_s1 and high >= daily_s1) or

(open <= daily_s2 and high >= daily_s2) or

(open <= daily_s3 and high >= daily_s3) or

(open <= daily_s4 and high >= daily_s4) or (open <= vwap and high >= vwap) or (open <= mvwap and high >= mvwap))

// Detect Red Candle Touching Pivot Points

redTouchPivot = redCandle and ((low <= daily_pivot and open >= daily_pivot) or

(low <= daily_r1 and open >= daily_r1) or

(low <= daily_r2 and open >= daily_r2) or

(low <= daily_r3 and open >= daily_r3) or

(low <= daily_r4 and open >= daily_r4) or

(low <= daily_s1 and open >= daily_s1) or

(low <= daily_s2 and open >= daily_s2) or

(low <= daily_s3 and open >= daily_s3) or

(low <= daily_s4 and open >= daily_s4) or ((open >= vwap and low <= vwap) or (open >= mvwap and low <= mvwap)))

// Mark Green Candle Touching Pivot

plotshape(greenTouchPivot, title="Green Touch Pivot", location=location.abovebar, color=color.green, style=shape.triangleup, text="GTouch")

// Mark Red Candle Touching Pivot

plotshape(redTouchPivot, title="Red Touch Pivot", location=location.belowbar, color=color.red, style=shape.triangledown, text="RTouch")

// CE Entry Below Red Touch Pivot

if (redTouchPivot)

strategy.entry("CE", strategy.long)

// PE Entry Above Green Touch Pivot

if (greenTouchPivot)

strategy.entry("PE", strategy.short)