Ringkasan

Strategi pelacakan volatilitas dinamis multi-siklus adalah sistem perdagangan garis pendek yang menggabungkan penyaring indeks bergerak cepat / lambat (EMA) dengan indeks relatif lemah (RSI). Strategi ini berfokus pada mencari peluang untuk melakukan perdagangan di dalam tren jangka pendek yang dominan, mengurangi kebisingan perdagangan melalui mekanisme konfirmasi ganda. Fitur utamanya meliputi pengendalian risiko berdasarkan rata-rata gelombang riil (ATR), penyesuaian tracking stop loss, penyesuaian stop loss berdasarkan volume perdagangan, dan penarikan profit tiga tingkat.

Prinsip Strategi

Strategi ini didasarkan pada arsitektur stack sinyal berlapis:

- Identifikasi tren: Uji arah tren mikro dengan mengkorses EMA cepat dengan EMA lambat. Ketika EMA cepat berada di atas EMA lambat, identifikasi sebagai tren bullish; sebaliknya sebagai tren bearish.

- Kekuatan motorik, kesehatan, dan waktu luangUntuk menghindari perburuan yang terlalu panjang, overtrading hanya diizinkan jika RSI berada di bawah level overbought; dan shorting hanya diizinkan jika RSI berada di atas level oversold.

- Mekanisme Konfirmasi Garis K: Memerlukan kondisi sinyal untuk membentuk beberapa garis K secara berturut-turut, untuk memfilter kebisingan pasar secara efektif.

- Trigger masuk: Pasang pesanan pasar saat garis K muncul di jendela konfirmasi selesai.

- Stop loss awalAdapun nilai transaksi yang diukur berdasarkan ATR adalah: volatility adjustment based on ATR and dynamic adjustment based on relative trading volume.

- Logika Tracking Stop Loss: Optimalisasi kombinasi dari pivot point dan ATR basis stop loss untuk profit lock.

- RSI pemantauan jangka waktu tinggiIni adalah salah satu cara yang paling efektif untuk meminimalisir risiko perdagangan negatif.

- Target laba terstrukturPada tanggal 1 Agustus, sebuah laporan dari The New York Times melaporkan bahwa:

- Pembatasan transaksiUntuk mencegah overtrading, Anda harus membatasi jumlah transaksi maksimum untuk setiap fase tren.

Inovasi utama dari strategi ini adalah penggabungan organik dari beberapa indikator teknis dengan indikator perilaku pasar (seperti volume transaksi, volatilitas) untuk membentuk sistem perdagangan yang sangat adaptif yang dapat menyesuaikan parameter secara otomatis dalam kondisi pasar yang berbeda.

Keunggulan Strategis

- AdaptifStop loss dan target position yang disesuaikan dengan ATR memungkinkan strategi untuk beradaptasi dengan kondisi pasar yang berbeda tanpa perlu sering mengoptimalkan kembali parameter.

- Manajemen Risiko BerlapisKombinasi dari stop loss awal, tracking stop loss, profit parsial, dan filter RSI multi-siklus, membentuk sistem kontrol risiko yang lengkap.

- Sistem penyaringan kebisinganRequest for confirmation of continuous K-Line (request for confirmation of continuous K-Line) secara efektif mengurangi sinyal palsu dan meningkatkan kualitas transaksi.

- Persepsi Mobilitas: Mengatur level stop loss melalui rasio volume transaksi, secara otomatis memperketat celah risiko dalam lingkungan likuiditas rendah.

- Pemantauan Kematangan Tren: Mengurangi jumlah transaksi yang diizinkan secara otomatis seiring dengan perkembangan tren, untuk menghindari over-trading di akhir tren.

- Mekanisme keuntungan yang fleksibelTahap 3: Strategi profit sharing memungkinkan untuk mengunci profit sharing ketika harga bergerak menguntungkan, sementara tetap memiliki ruang untuk naik.

- Analisis lintas siklusPemantauan RSI pada frame waktu yang lebih tinggi memberikan perspektif yang lebih luas tentang latar belakang pasar, menghindari kecanduan pada sinyal mikro ketika tren besar berbalik.

- Kesederhanaan pelaksanaanDengan integrasi PineConnector, otomatisasi strategi dapat dilakukan dengan mudah, mengurangi intervensi manusia dan dampak emosional.

Risiko Strategis

- Risiko penarikan diriMeskipun ada beberapa lapisan pengendalian risiko, dalam kondisi pasar yang ekstrim (seperti melompat, meluncur), strategi masih dapat menghadapi penarikan yang lebih besar dari yang diharapkan.

- Parameter SensitivitasBeberapa parameter penting seperti panjang EMA dan nilai RSI memiliki pengaruh yang signifikan terhadap kinerja strategi. Optimasi berlebihan dapat menyebabkan risiko overfit.

- Biaya transaksi frekuensi tinggiSebagai strategi garis pendek, frekuensi transaksi yang tinggi, biaya transaksi yang terakumulasi (diferensi, komisi) dapat secara signifikan mempengaruhi pendapatan aktual. Biaya transaksi aktual harus dipertimbangkan dalam pengembalian.

- Risiko keterlambatanPenundaan eksekusi PineConnector (sekitar 100-300 ms) dapat menyebabkan peningkatan slippage di pasar yang sangat fluktuatif. Tidak dianjurkan untuk digunakan di pasar yang sangat fluktuatif atau kurang likuid.

- Peta ulang titik pusat: Pada grafik garis super pendek di bawah garis menit, titik sumbu pusat dapat digambar ulang dalam proses pembentukan garis K secara real-time, yang mempengaruhi akurasi stop loss.

- Mengidentifikasi Keterlambatan TrenPengidentifikasian tren berdasarkan persilangan EMA memiliki keterlambatan yang melekat, dan mungkin melewatkan sebagian dari tren di awal tren.

- Risiko Leverage Terlalu TinggiJika Anda memiliki terlalu banyak posisi, maka Anda bisa mempertaruhkan terlalu banyak uang dalam satu transaksi dan cepat menghabiskan dana Anda.

Arah optimasi strategi

- Optimalisasi Pembelajaran MesinIntroduksi algoritma pembelajaran mesin yang secara dinamis menyesuaikan parameter EMA dan RSI untuk beradaptasi dengan perubahan kondisi pasar yang berbeda. Hal ini dapat mengatasi masalah ketidakcocokan parameter tetap pada tahap pasar yang berbeda.

- Klasifikasi kondisi pasarMenambahkan analisis agregat volatilitas, memisahkan pasar menjadi kondisi volatilitas tinggi, menengah, dan rendah, dan menggunakan parameter perdagangan yang berbeda untuk kondisi yang berbeda. Ini akan meningkatkan fleksibilitas strategi dalam pasar konversi.

- Mekanisme Kesepakatan Multi-IndeksTerintegrasi dengan indikator momentum dan tren lainnya (seperti MACD, Brinks, KDJ) membentuk sistem konsensus indikator, yang menghasilkan sinyal hanya jika sebagian besar indikator mencapai kesesuaian. Ini membantu mengurangi sinyal palsu.

- Filter waktu cerdasBergabung dengan analisis waktu pasar dan pola fluktuasi, menghindari waktu perdagangan yang tidak efisien dan peristiwa volatilitas tinggi yang diketahui (seperti rilis data ekonomi penting).

- Tingkat keuntungan dari bagian dinamis: Mengatur persentase dan jarak target sebagian keuntungan secara otomatis sesuai dengan volatilitas pasar dan intensitas tren, mempertahankan lebih banyak posisi dalam tren kuat, dan menghasilkan keuntungan lebih aktif dalam tren lemah

- Penarikan kontrolIntroduksi mekanisme penyesuaian diri terhadap risiko berdasarkan pola penarikan sejarah, yang secara otomatis mengurangi frekuensi perdagangan atau meningkatkan jarak stop loss saat mendeteksi tanda-tanda awal penarikan besar yang serupa dengan sejarah.

- Peningkatan data frekuensi tinggi: Mengintegrasikan data tingkat tick untuk mengoptimalkan tiket masuk, mengurangi slippage dan meningkatkan harga tiket masuk, jika kondisi memungkinkan.

- Analisis relevansi lintas pasarAnalisis linkage dengan pasar terkait, memanfaatkan hubungan terdepan-terdepan antara pasar untuk meningkatkan kualitas sinyal.

Meringkaskan

Strategi pelacakan volatilitas dinamis multi-siklus adalah sistem perdagangan short-line yang menggabungkan alat analisis teknis klasik dengan metode manajemen risiko kuantitatif modern. Dengan arsitektur stack sinyal bertingkat, yang menggabungkan identifikasi tren EMA, penyaringan momentum RSI, mekanisme konfirmasi K-line berkelanjutan, penyesuaian volatilitas ATR, dan analisis multi-siklus, strategi ini membangun kerangka keputusan perdagangan yang komprehensif.

Meskipun ada beberapa risiko yang melekat, seperti sensitivitas parameter, biaya transaksi frekuensi tinggi, dan risiko keterlambatan, risiko ini dapat dikontrol secara efektif dengan manajemen dana yang masuk akal dan pengoptimalan berkelanjutan. Arah pengoptimalan di masa depan terutama berfokus pada pengoptimalan parameter pembelajaran mesin, klasifikasi status pasar, mekanisme konsensus multi-indikator, dan manajemen risiko dinamis.

Strategi ini memberikan kerangka kerja yang terstruktur bagi para pedagang yang ingin menangkap peluang untuk membalikkan tren di pasar garis pendek, yang menyeimbangkan kebutuhan untuk menangkap peluang perdagangan dan mengendalikan risiko. Namun, seperti semua strategi perdagangan, untuk diterapkan secara nyata, harus diuji secara menyeluruh di akun simulasi dan menyesuaikan parameter sesuai dengan toleransi risiko pribadi dan ukuran modal.

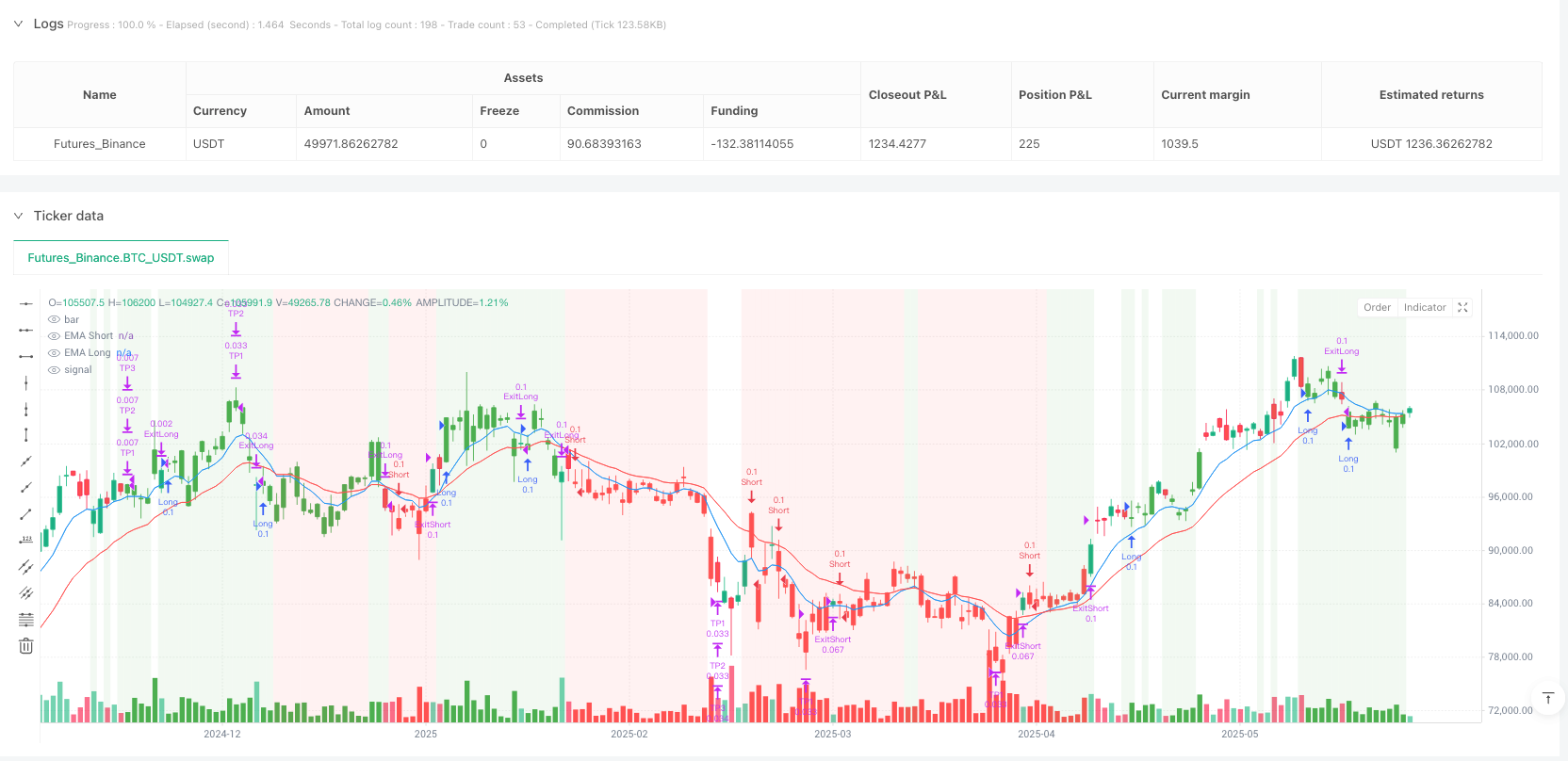

/*backtest

start: 2024-09-15 00:00:00

end: 2025-06-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@strategy_alert_message {{strategy.order.comment}}

// © AlgoSystems

strategy("Scalping Trend Power for MT5 - Updated", overlay=true, calc_on_every_tick=false)

//-------------------------------------------------------------------

// Function: confirm a condition for N consecutive bars

//-------------------------------------------------------------------

f_confirm(cond, bars) =>

_ok = true

for i = 0 to bars - 1

_ok := _ok and cond[i]

_ok

//-------------------------------------------------------------------

// Inputs: strategy parameters & PineConnector

//-------------------------------------------------------------------

lotSize = input.float(0.1, title="Lot Size")

lotMultiplier = input.float(1.0, title="Lot Multiplier", minval=0.1, step=0.1)

contractType = input.string("FX", title="Contract Type", options=["FX", "CFD", "Futures"])

// (kept for potential future use)

riskPercentage = input.float(1.0, title="Risk per Trade (%)")

riskRewardRatio = input.float(1.2, title="Risk/Reward Ratio", step=0.1)

trailingStopMultiplier = input.float(1.2, title="Trailing-Stop Multiplier", step=0.1)

emaShortLength = input.int(9, title="EMA Short Length")

emaLongLength = input.int(21, title="EMA Long Length")

rsiLength = input.int(14, title="RSI Length")

atrLength = input.int(14, title="ATR Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

higherTF = input.timeframe("30", title="Higher Time-Frame for Exit")

higherRsiOverbought = input.int(70, title="Higher-TF RSI Overbought", minval=50)

higherRsiOversold = input.int(30, title="Higher-TF RSI Oversold", minval=10)

pivotLookback = input.int(5, title="Pivot Look-Back Period", minval=2, step=1)

volumeLookback = input.int(20, title="Volume Look-Back Period", minval=5, step=1)

volumeMultiplier = input.float(1.0, title="Volume Multiplier", minval=0.1, step=0.1)

enablePartialExit = input.bool(true, title="Enable Partial Exit")

tp1ProfitMult = input.float(1.0, title="TP1 Profit Multiplier", step=0.1)

tp2ProfitMult = input.float(1.5, title="TP2 Profit Multiplier", step=0.1)

tp3ProfitMult = input.float(2.0, title="TP3 Profit Multiplier", step=0.1)

tp1ExitPercentage = input.float(33, title="TP1 Exit (%)", minval=1, maxval=100, step=1)

tp2ExitPercentage = input.float(33, title="TP2 Exit (%)", minval=1, maxval=100, step=1)

tp3ExitPercentage = input.float(34, title="TP3 Exit (%)", minval=1, maxval=100, step=1)

confirmBars = input.int(2, title="Confirmation Bars", minval=1, step=1)

baseLongTrades = 5

tradeDecreaseFactor = input.int(0, title="Trade Decrease Factor", minval=0)

maxLongTradesPerTrend = math.max(1, baseLongTrades - tradeDecreaseFactor)

activatePineConnector = input.bool(false, title="Activate PineConnector")

pineConnectorLicense = input.string("", title="PineConnector License Code")

//-------------------------------------------------------------------

// Indicator calculations

//-------------------------------------------------------------------

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

rsiValue = ta.rsi(close, rsiLength)

atrValue = ta.atr(atrLength)

// ATR-based TP & SL

dynamicTP = atrValue * riskRewardRatio

dynamicSL = atrValue * trailingStopMultiplier

rawLongSignal = emaShort > emaLong and rsiValue < rsiOverbought

rawShortSignal = emaShort < emaLong and rsiValue > rsiOversold

longSignal = f_confirm(rawLongSignal, confirmBars)

shortSignal = f_confirm(rawShortSignal, confirmBars)

//-------------------------------------------------------------------

// Dynamic ticker symbol (remove exchange prefix if any)

//-------------------------------------------------------------------

var string dynSymbol = na

if bar_index == 0

parts = str.split(syminfo.tickerid, ":")

dynSymbol := array.size(parts) > 1 ? array.get(parts, 1) : syminfo.tickerid

//-------------------------------------------------------------------

// PineConnector messages (no "lots=" or "contract=" – updated syntax)

// The value after risk= is interpreted as LOTS if EA’s VolumeType = "Lots".

//-------------------------------------------------------------------

prefix = activatePineConnector and (pineConnectorLicense != "") ? pineConnectorLicense + "," : ""

calculatedLot = lotSize * lotMultiplier // actual order volume

// ENTRY messages

riskValue = str.tostring(calculatedLot) // risk= interpreted as lots

txtBuy = prefix + "buy," + dynSymbol + ",risk=" + riskValue

txtSell = prefix + "sell," + dynSymbol + ",risk=" + riskValue

// CLOSE FULL messages

txtCloseLong = prefix + "closelong," + dynSymbol

txtCloseShort = prefix + "closeshort," + dynSymbol

// Helper to compute risk= for partial exits

f_partialRisk(pct) => str.tostring(calculatedLot * pct / 100)

// PARTIAL EXIT messages

msgTP1Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

msgTP1Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

//-------------------------------------------------------------------

// Higher-time-frame RSI request

//-------------------------------------------------------------------

higherRsi = request.security(syminfo.tickerid, higherTF, ta.rsi(close, rsiLength))

//-------------------------------------------------------------------

// State variables

//-------------------------------------------------------------------

var bool inLongTrade = false

var bool inShortTrade = false

var int longTradeCount = 0

var float trailingStopLevel = na

var bool tp1_exited = false

var bool tp2_exited = false

var bool tp3_exited = false

//-------------------------------------------------------------------

// Entry/Exit logic

//-------------------------------------------------------------------

if barstate.isconfirmed

avgVol = ta.sma(volume, volumeLookback)

volRatio = avgVol != 0 ? volume / avgVol : 1.0

adjSL = dynamicSL / (volRatio * volumeMultiplier)

pivotH = ta.pivothigh(high, pivotLookback, pivotLookback)

pivotL = ta.pivotlow(low, pivotLookback, pivotLookback)

// LONG entry

if longSignal and not inLongTrade and not inShortTrade and longTradeCount < maxLongTradesPerTrend

strategy.entry("Long", strategy.long, qty=calculatedLot, comment="Long Entry")

if activatePineConnector

alert(txtBuy, alert.freq_once_per_bar)

inLongTrade := true

inShortTrade := false

longTradeCount += 1

trailingStopLevel := low - adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// SHORT entry

if shortSignal and not inShortTrade and not inLongTrade

strategy.entry("Short", strategy.short, qty=calculatedLot, comment="Short Entry")

if activatePineConnector

alert(txtSell, alert.freq_once_per_bar)

inShortTrade := true

inLongTrade := false

trailingStopLevel := high + adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// Trailing-stop update

if inLongTrade

baseStop = close - adjSL

trailingStopLevel := (not na(pivotL) and pivotL > trailingStopLevel) ? pivotL : math.max(trailingStopLevel, baseStop)

if inShortTrade

baseStop = close + adjSL

trailingStopLevel := (not na(pivotH) and pivotH < trailingStopLevel) ? pivotH : math.min(trailingStopLevel, baseStop)

// Dynamic TPs & partial exits

if enablePartialExit and strategy.position_size != 0

avgPrice = strategy.position_avg_price

direction = strategy.position_size > 0 ? 1 : -1

tp1 = avgPrice + direction * dynamicTP * tp1ProfitMult

tp2 = avgPrice + direction * dynamicTP * tp2ProfitMult

tp3 = avgPrice + direction * dynamicTP * tp3ProfitMult

// TP1

if not tp1_exited and f_confirm(direction > 0 ? close >= tp1 : close <= tp1, confirmBars)

strategy.exit("TP1", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp1ExitPercentage, limit=tp1, comment=direction>0 ? msgTP1Long : msgTP1Short)

if activatePineConnector

alert(direction>0 ? msgTP1Long : msgTP1Short, alert.freq_once_per_bar)

tp1_exited := true

// TP2

if not tp2_exited and f_confirm(direction > 0 ? close >= tp2 : close <= tp2, confirmBars)

strategy.exit("TP2", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp2ExitPercentage, limit=tp2, comment=direction>0 ? msgTP2Long : msgTP2Short)

if activatePineConnector

alert(direction>0 ? msgTP2Long : msgTP2Short, alert.freq_once_per_bar)

tp2_exited := true

// TP3

if not tp3_exited and f_confirm(direction > 0 ? close >= tp3 : close <= tp3, confirmBars)

strategy.exit("TP3", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp3ExitPercentage, limit=tp3, comment=direction>0 ? msgTP3Long : msgTP3Short)

if activatePineConnector

alert(direction>0 ? msgTP3Long : msgTP3Short, alert.freq_once_per_bar)

tp3_exited := true

// FULL exit (trailing stop or opposite signals)

exitCondLong = inLongTrade and (close < trailingStopLevel or rsiValue > rsiOverbought or higherRsi > higherRsiOverbought)

exitCondShort = inShortTrade and (close > trailingStopLevel or rsiValue < rsiOversold or higherRsi < higherRsiOversold)

if exitCondLong and f_confirm(exitCondLong, confirmBars)

strategy.exit("ExitLong", from_entry="Long", stop=trailingStopLevel, comment=txtCloseLong)

if activatePineConnector

alert(txtCloseLong, alert.freq_once_per_bar)

inLongTrade := false

if exitCondShort and f_confirm(exitCondShort, confirmBars)

strategy.exit("ExitShort", from_entry="Short", stop=trailingStopLevel, comment=txtCloseShort)

if activatePineConnector

alert(txtCloseShort, alert.freq_once_per_bar)

inShortTrade := false

// Reset counter when the bullish trend ends

if not rawLongSignal

longTradeCount := 0

//-------------------------------------------------------------------

// Plot & styling

//-------------------------------------------------------------------

plot(emaShort, color=color.blue, linewidth=1, title="EMA Short")

plot(emaLong , color=color.red , linewidth=1, title="EMA Long")

barcolor(inLongTrade ? color.new(color.green,0) : inShortTrade ? color.new(color.red,0) : na)

bgcolor(rawLongSignal ? color.new(color.green,90) : rawShortSignal ? color.new(color.red,90) : na)

// Signal arrows disabled (user request):

// plotshape(longSignal , title="Long signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

// plotshape(shortSignal, title="Short signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//-------------------------------------------------------------------

// HOW TO USE with PineConnector (quick checklist):

// 1. Attach this script to the chart.

// 2. Click the “Alert” bell → Create Alert.

// 3. Condition: “Scalping Trend Power … (Any alert() call)” (or “Order fills only”).

// 4. Webhook URL: https://webhook.pineconnector.com

// 5. Leave the Message box empty – the script fills it.

// 6. On MT5, run the PineConnector EA on the same symbol (dynSymbol) and keep VolumeType = Lots.

// 7. Enter your License ID in the input and tick “Activate PineConnector”.

//-------------------------------------------------------------------