Strategi Pullback Sungai Tren

EMA RSI ATR CHANDELIER

Apa yang dimaksud dengan “Sungai Tren”?

Tahukah kamu? Strategi ini membayangkan lima garis rata EMA sebagai sebuah “sungai”. Seperti halnya sungai yang sebenarnya memiliki dasar dan permukaan, ketika lima garis rata itu berbaris, area yang terbentuk di antara mereka adalah “sungai tren” kita.

Ini seperti melihat arah aliran air - ke mana sungai mengalir, ke mana kita pergi.

Strategi inti: Tunggu ikan kembali ke sungai dan pasang jaring

Di mana bagian paling cerdas dari strategi ini? Tidak menaikkan harga saat harga tinggi, tetapi dengan sabar menunggu “pengetikan kembali”!

Bagaimana caranya?

- Sinyal multihead: tren ke atas + RSI≥60 + harga kembali ke sungai 40% lebih dalam + EMA cepat kembali pecah

- Sinyal kosong: tren ke bawah + RSI≤40 + Harga rebound ke river 40% tinggi + Kembali jatuh di bawah EMA cepat

Seperti halnya ikan hiu, bukan ikan yang meloncat ke bawah saat meloncat tertinggi, tetapi menunggu sampai ia berenang kembali ke perairan yang sudah dikenal!

Pengelolaan Risiko: Hanya mengambil risiko 1% dari modal setiap kali

Dan yang paling menarik dari strategi ini adalah bagaimana cara menghitung ukuran posisi secara otomatis:

- Setiap transaksi dikontrol dengan risiko 1% dari modal.

- Atur stop loss dengan indikator ATR ((2 kali ATR)

- Rasio untung rugi disetel menjadi 2: 1 ((Rugi 1 koin untuk 2 koin)

- Ada juga Chandler yang mengejar keuntungan dari stop loss protection.

Ini seperti sabuk pengaman di dalam mobil - bukan untuk menghindari kecelakaan, tapi untuk menikmati perjalanan dengan aman!

Mengapa strategi ini perlu diperhatikan?

Ini adalah salah satu dari tiga masalah utama yang dihadapi para pedagang:

- Perburuan dan pembunuhan“Saya tidak tahu apa yang terjadi, saya tidak tahu apa yang akan terjadi”.

- Tidak tahu berapa banyak.Perhitungan Posisi Otomatis, Risiko Terkontrol

- Tidak tahu kapan harus berlariAda Stop Loss, Stop Stop, dan Stop Tracking.

Strategi ini sangat cocok untuk para trader yang ingin “bertahan dan menang”. Strategi ini tidak mengejar kekayaan dalam semalam, tetapi dapat membantu Anda menghasilkan uang dalam tren!

||

🌊 What is “Trend River”? This Analogy is Brilliant!

You know what? This strategy imagines 5 EMA lines as a “river”! Just like a real river has riverbed and surface, when 5 EMAs align properly, the area between them forms our “trend river”. Key point! When the river direction is clear (bullish: fast line above, bearish: fast line below), that’s when our money-making opportunities arrive!

It’s as simple as watching water flow direction - wherever the river flows, that’s where we profit! 💰

🎯 Core Strategy: Wait for Fish to Return Before Casting the Net

What’s the smartest part of this strategy? It doesn’t chase prices during rallies, but patiently waits for “pullbacks”!

How does it work exactly?

- Long signal: Uptrend + RSI≥60 + Price pulls back to 40% river depth + Re-breaks above fast EMA

- Short signal: Downtrend + RSI≤40 + Price bounces to 40% river height + Re-breaks below fast EMA

It’s like fishing - you don’t cast when fish jump highest, but wait for them to return to familiar waters! 🎣

💡 Risk Management: Only Risk 1% Capital Each Time

Here’s the pitfall guide! The most thoughtful part of this strategy is automatic position sizing:

- Each trade risks only 1% of capital

- Uses ATR indicator for stop loss (2x ATR)

- Risk-reward ratio set at 2:1 (earn 2 to risk 1)

- Plus Chandelier trailing stop to protect profits

It’s like wearing a seatbelt while driving - not because you expect an accident, but to enjoy the ride with peace of mind! 🚗

🚀 Why is This Strategy Worth Attention?

Solves three major trader pain points:

- FOMO trading: Wait for pullbacks instead of buying tops

- Position sizing confusion: Auto-calculates position size with controlled risk

- Exit uncertainty: Has stop loss, take profit, and trailing stop

This strategy is perfect for traders who want “steady wins”. It doesn’t promise overnight riches, but helps you profit steadily in trends! Remember: In the river of trading, the most important thing isn’t swimming fastest, but swimming most steadily 🏊♀️

[/trans]

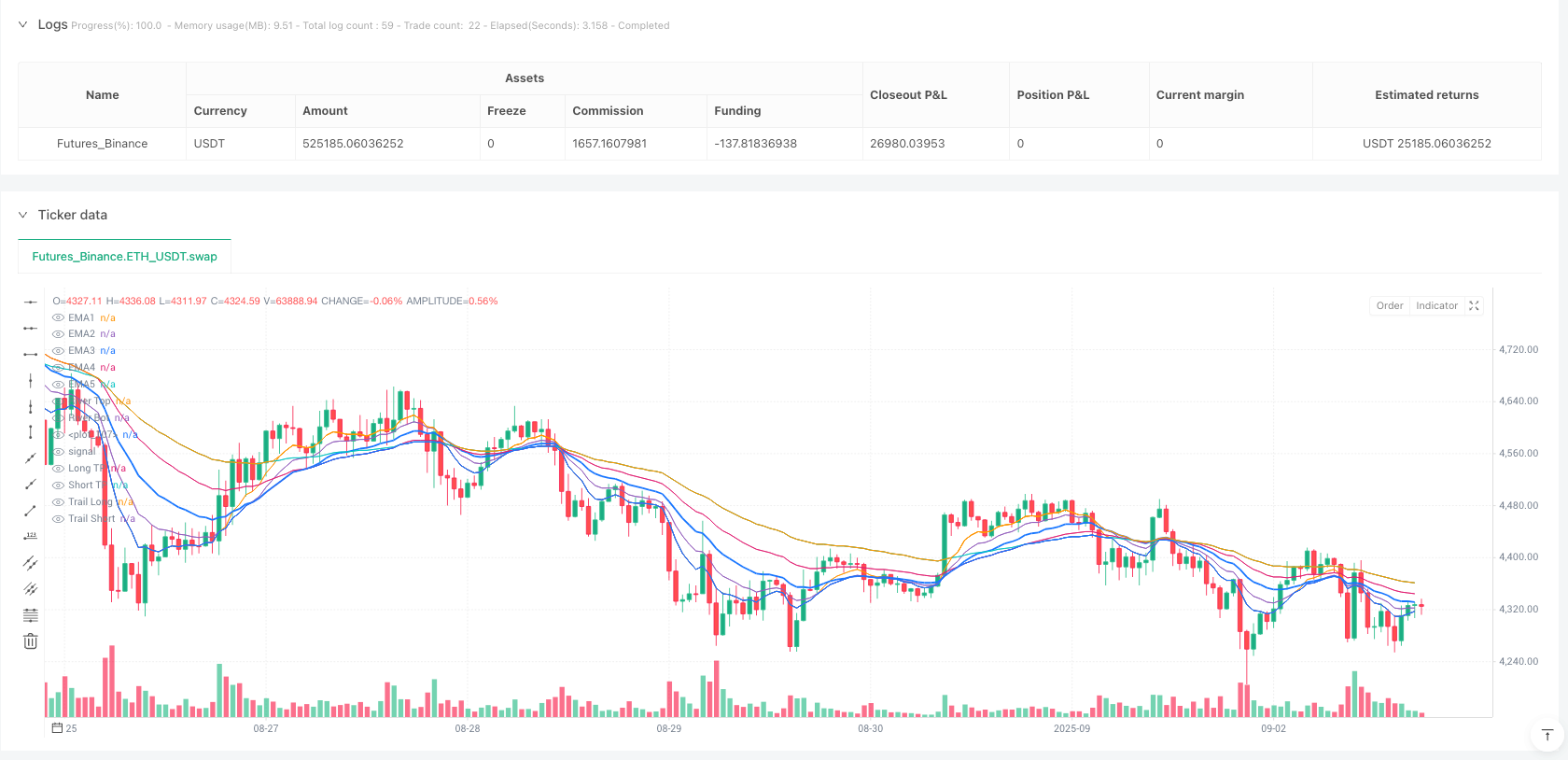

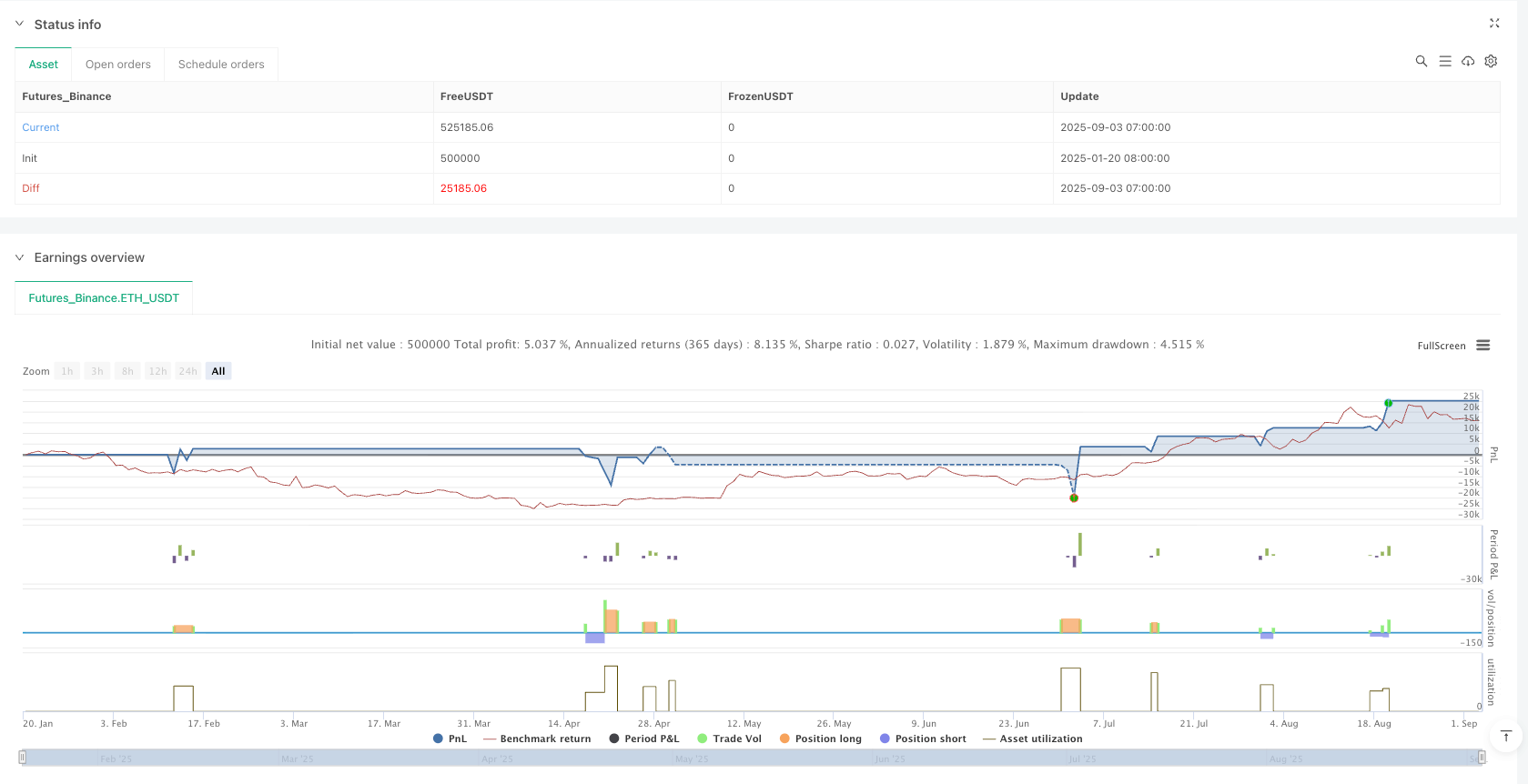

/*backtest

start: 2025-01-20 08:00:00

end: 2025-09-03 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Trend River Pullback Strategy v1",

overlay=true, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.02,

pyramiding=0, calc_on_order_fills=true, calc_on_every_tick=true, margin_long=1, margin_short=1)

// ===== Inputs

// EMA river

emaFastLen = input.int(8, "EMA1 (fast)")

ema2Len = input.int(13, "EMA2")

emaMidLen = input.int(21, "EMA3 (middle)")

ema4Len = input.int(34, "EMA4")

emaSlowLen = input.int(55, "EMA5 (slow)")

// Pullback and momentum

rsiLen = input.int(14, "RSI length")

rsiOB = input.int(60, "RSI trend threshold (long)")

rsiOS = input.int(40, "RSI trend threshold (short)")

pullbackPct = input.float(40.0, "Pullback depth % of river width", minval=0, maxval=100)

// Risk management

riskPct = input.float(1.0, "Risk per trade % of capital", step=0.1, minval=0.1)

atrLen = input.int(14, "ATR length (stop/trailing)")

atrMultSL = input.float(2.0, "ATR multiplier for stop", step=0.1)

tpRR = input.float(2.0, "Take profit R-multiple", step=0.1)

// Trailing stop

useTrail = input.bool(true, "Enable trailing stop (Chandelier)")

trailMult = input.float(3.0, "ATR multiplier for trailing", step=0.1)

// ===== Calculations

ema1 = ta.ema(close, emaFastLen)

ema2 = ta.ema(close, ema2Len)

ema3 = ta.ema(close, emaMidLen)

ema4 = ta.ema(close, ema4Len)

ema5 = ta.ema(close, emaSlowLen)

// River: top/bottom as envelope of averages

riverTop = math.max(math.max(ema1, ema2), math.max(ema3, math.max(ema4, ema5)))

riverBot = math.min(math.min(ema1, ema2), math.min(ema3, math.min(ema4, ema5)))

riverMid = (riverTop + riverBot) / 2.0

riverWidth = riverTop - riverBot

// Trend conditions: EMA alignment

bullAligned = ema1 > ema2 and ema2 > ema3 and ema3 > ema4 and ema4 > ema5

bearAligned = ema1 < ema2 and ema2 < ema3 and ema3 < ema4 and ema4 < ema5

// Momentum

rsi = ta.rsi(close, rsiLen)

// Pullback into river

pullbackLevelBull = riverTop - riverWidth * (pullbackPct/100.0)

pullbackLevelBear = riverBot + riverWidth * (pullbackPct/100.0)

pullbackOkBull = bullAligned and rsi >= rsiOB and low <= pullbackLevelBull

pullbackOkBear = bearAligned and rsi <= rsiOS and high >= pullbackLevelBear

// Entry trigger: return to momentum (fast EMA crossover)

longTrig = pullbackOkBull and ta.crossover(close, ema1)

shortTrig = pullbackOkBear and ta.crossunder(close, ema1)

// ATR for stops

atr = ta.atr(atrLen)

// ===== Position sizing by risk

capital = strategy.equity

riskMoney = capital * (riskPct/100.0)

// Preliminary stop levels

longSL = close - atrMultSL * atr

shortSL = close + atrMultSL * atr

// Tick value and size

tickValue = syminfo.pointvalue

// Avoid division by zero

slDistLong = math.max(close - longSL, syminfo.mintick)

slDistShort = math.max(shortSL - close, syminfo.mintick)

// Number of contracts/lots

qtyLong = riskMoney / (slDistLong * tickValue)

qtyShort = riskMoney / (slDistShort * tickValue)

// Limit: not less than 0

qtyLong := math.max(qtyLong, 0)

qtyShort := math.max(qtyShort, 0)

// ===== Entries

if longTrig and strategy.position_size <= 0

strategy.entry("Long", strategy.long, qty=qtyLong)

if shortTrig and strategy.position_size >= 0

strategy.entry("Short", strategy.short, qty=qtyShort)

// ===== Exits: fixed TP by R and stop

// Store entry price

var float entryPrice = na

if strategy.position_size != 0 and na(entryPrice)

entryPrice := strategy.position_avg_price

if strategy.position_size == 0

entryPrice := na

// Targets

longTP = na(entryPrice) ? na : entryPrice + tpRR * (entryPrice - longSL)

shortTP = na(entryPrice) ? na : entryPrice - tpRR * (shortSL - entryPrice)

// Trailing: Chandelier

trailLong = close - trailMult * atr

trailShort = close + trailMult * atr

// Final exit levels

useTrailLong = useTrail and strategy.position_size > 0

useTrailShort = useTrail and strategy.position_size < 0

// For long

if strategy.position_size > 0

stopL = math.max(longSL, na)

tStop = useTrailLong ? trailLong : longSL

strategy.exit("L-Exit", from_entry="Long", stop=tStop, limit=longTP)

// For short

if strategy.position_size < 0

stopS = math.min(shortSL, na)

tStopS = useTrailShort ? trailShort : shortSL

strategy.exit("S-Exit", from_entry="Short", stop=tStopS, limit=shortTP)

// ===== Visuals

plot(ema1, "EMA1", display=display.all, linewidth=1)

plot(ema2, "EMA2", display=display.all, linewidth=1)

plot(ema3, "EMA3", display=display.all, linewidth=2)

plot(ema4, "EMA4", display=display.all, linewidth=1)

plot(ema5, "EMA5", display=display.all, linewidth=1)

plot(riverTop, "River Top", style=plot.style_linebr, linewidth=1)

plot(riverBot, "River Bot", style=plot.style_linebr, linewidth=1)

fill(plot1=plot(riverTop, display=display.none), plot2=plot(riverBot, display=display.none), title="River Fill", transp=80)

plot(longTP, "Long TP", style=plot.style_linebr)

plot(shortTP, "Short TP", style=plot.style_linebr)

plot(useTrailLong ? trailLong : na, "Trail Long", style=plot.style_linebr)

plot(useTrailShort ? trailShort : na, "Trail Short", style=plot.style_linebr)

// Signal markers

plotshape(longTrig, title="Long Trigger", style=shape.triangleup, location=location.belowbar, size=size.tiny, text="L")

plotshape(shortTrig, title="Short Trigger", style=shape.triangledown, location=location.abovebar, size=size.tiny, text="S")

// ===== Alerts

alertcondition(longTrig, title="Long Signal", message="Long signal: trend aligned + pullback + momentum")

alertcondition(shortTrig, title="Short Signal", message="Short signal: trend aligned + pullback + momentum")